Table of Contents

Overview

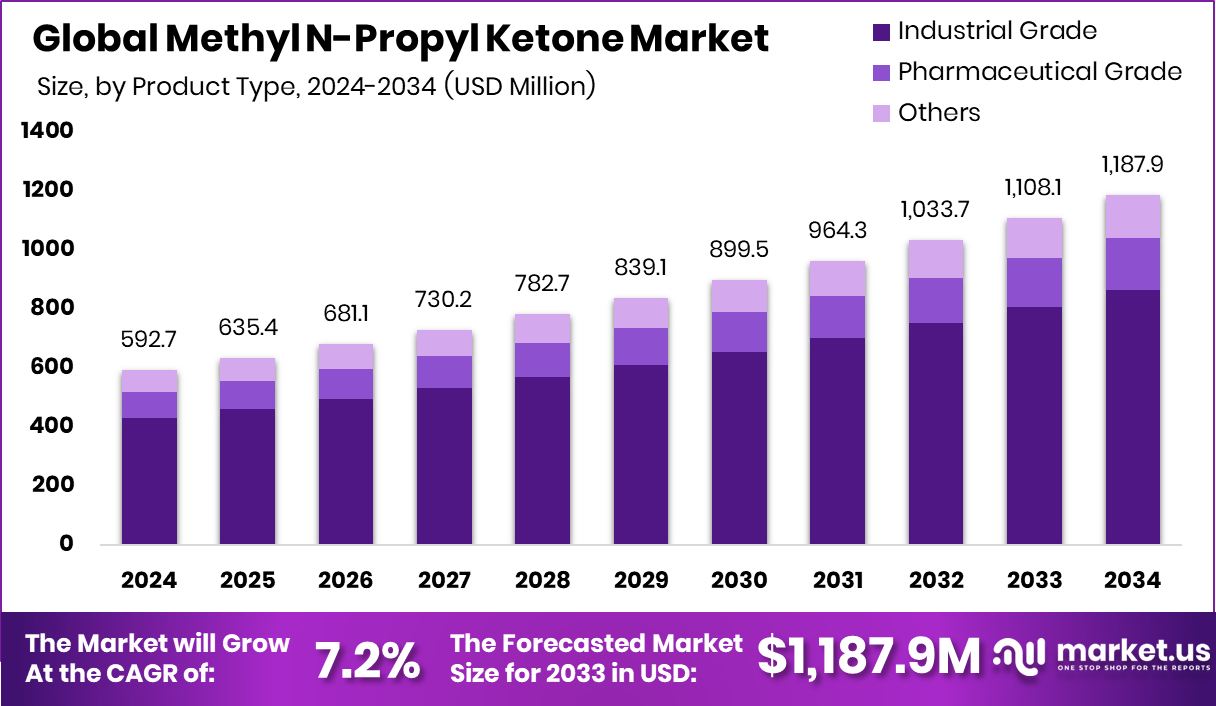

New York, NY – Nov 11, 2025 – The global Methyl N-Propyl Ketone (MPK) market is projected to reach USD 1,187.9 million by 2034 from USD 592.7 million in 2024, growing at a CAGR of 7.2%. Asia-Pacific remains dominant with a 43.9% share, valued at USD 255.8 million, driven by rapid urbanization and a thriving coatings sector.

MPK, a colorless solvent used in coatings, industrial cleaning, and inks, offers strong solvency and moderate evaporation, making it essential in automotive, electronics, and industrial maintenance. Its ability to blend with other solvents ensures compliance with regulatory and performance needs.

Market expansion is propelled by rising demand for low-VOC and high-solids coatings. Sustainable investment trends—such as Ecoat securing €21 million for low-carbon paint technologies, Distil raising $7.7 million in Series A for specialty chemicals, and UP Catalyst obtaining €18 million to advance critical raw materials—further strengthen MPK’s sustainable appeal. Its eco-friendly profile enables the replacement of hazardous solvents, boosting adoption across industrial sectors.

Additionally, Univar Solutions’ $8.1 billion acquisition underscores growing efforts to enhance chemical distribution networks, supporting solvent supply chains. As environmental regulations tighten, MPK’s role as a cleaner, safer solvent positions it for continued growth in global markets focused on green chemistry and responsible manufacturing practices.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-methyl-n-propyl-ketone-market/request-sample/

Key Takeaways

- The Global Methyl N-Propyl Ketone Market is expected to be worth around USD 1,187.9 million by 2034, up from USD 592.7 million in 2024, and is projected to grow at a CAGR of 7.2% from 2025 to 2034.

- In the Methyl N-Propyl Ketone market, industrial grade accounts for 72.7% of total consumption.

- As a solvent, methyl N-propyl ketone dominates the market with a 45.9% share.

- The paints and coatings sector is the largest end-user of methyl N-propyl ketone, holding a 44.1% share.

- The Asia Pacific accounted for a market value of USD 255.8 million, reflecting strong industrial demand.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=164415

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 592.7 Million |

| Forecast Revenue (2034) | USD 1,187.9 Million |

| CAGR (2025-2034) | 7.2% |

| Segments Covered | By Product Type (Industrial Grade, Pharmaceutical Grade, Others), By Application (Solvents, Chemical Intermediates, Pharmaceuticals, Coatings, Others), By End-User (Paints and Coatings, Pharmaceuticals, Chemicals, Personal Care, Others) |

| Competitive Landscape | Eastman Chemical Company, Celanese Corporation, ExxonMobil Chemical, Dow Chemical Company, BASF SE, Sasol Limited, Arkema Group, Solvay S.A., INEOS Group Holdings S.A., Mitsubishi Chemical Corporation |

Key Market Segments

By Product Type Analysis

In 2024, the Industrial Grade segment dominated the Methyl N-Propyl Ketone (MPK) market, capturing a 72.7% share. This grade’s strong position stems from its widespread use in coatings, inks, and industrial cleaning products, owing to its high solvency and balanced evaporation rate.

Industrial-grade MPK is particularly effective in dissolving resins such as acrylics, vinyls, and alkyds, supporting its diverse applications across automotive, electronics, and maintenance industries.

Its compliance with environmental standards and adaptability in low-VOC, high-solids coatings make it the preferred choice for sustainable manufacturing. Growing demand for cleaner solvent alternatives and environmentally responsible production continues to reinforce the dominance of industrial-grade MPK across global markets.

By Application Analysis

In 2024, the Solvents segment led the Methyl N-Propyl Ketone (MPK) market by application, securing a 45.9% share. This leadership stems from MPK’s strong solvency, quick drying, and excellent compatibility with diverse resins used in coatings, inks, and industrial cleaning.

Its effectiveness in improving formulation performance and supporting efficient drying processes has made it indispensable across manufacturing and maintenance sectors. The increasing global focus on low-VOC and eco-friendly solvent solutions has further boosted MPK’s demand, particularly in paints and coatings applications.

As industries adopt cleaner production methods, MPK’s ability to deliver high performance while minimizing environmental impact continues to strengthen its dominance in solvent-based processes.

By End-User Analysis

In 2024, the Paints and Coatings segment dominated the Methyl N-Propyl Ketone (MPK) market by end-user, accounting for a 44.1% share. This strong position is driven by MPK’s superior solvent efficiency, making it ideal for producing premium paints, varnishes, and surface coatings. Its balanced evaporation rate and strong solvency promote smooth film formation and excellent finish quality.

The industry’s growing transition toward low-VOC and high-solids formulations has further elevated MPK’s role in sustainable coating solutions. Widely used across industrial, automotive, and protective applications, MPK’s adaptability and environmental compliance continue to strengthen the dominance of the paints and coatings sector within the global MPK market.

Regional Analysis

In 2024, Asia Pacific led the Methyl N-Propyl Ketone (MPK) market with a 43.9% share, valued at USD 255.8 million. This dominance stems from rapid industrialization, expanding manufacturing sectors, and growing consumption of coatings, adhesives, and cleaning solvents across China, India, and Southeast Asia.

Strong construction activity and rising automotive production continue to boost regional demand for MPK-based industrial and maintenance applications. North America ranked next, supported by increasing use of low-VOC solvents and a mature, sustainability-focused coatings sector.

Europe retained a stable presence, emphasizing environmental compliance and advanced coating innovations. Latin America and the Middle East & Africa are witnessing steady growth due to infrastructure projects and industrial expansion, highlighting emerging opportunities for MPK adoption in developing markets.

Top Use Cases

- Solvent in coatings & resins: MPK is used as a solvent to dissolve synthetic resins such as acrylics, polyesters, cellulosics, epoxies, vinyls, and alkyds. Its strong solvency power and moderate evaporation rate make it ideal for high-solids, low-VOC coatings.

- Cleaning & surface preparation: In industries like transportation and aerospace, MPK serves as a cleaning solvent—clearing grease, oils, and prepping metal surfaces. It can substitute more hazardous solvents while meeting stricter emissions standards.

- In printing inks formulation: MPK is used in gravure and other high-speed printing ink systems as a solvent carrier for pigments and binders, aiding fast drying and consistent film formation on substrates.

- Industrial maintenance coatings: For maintenance or protective paints on metal frameworks, industrial equipment, or marine surfaces, MPK provides balanced drying, good film quality, and solvent power—making it suited for such harsh-environment coatings.

- Automotive and transport refinishing: In automobile OEM and repair/refinish coatings, MPK is used to formulate paints and varnishes due to its performance (smooth film, good solubility) and regulatory compliance for low-VOC finishes.

- Let-down solvent in high-solids systems: MPK acts as a ‘let-down’ solvent in high-solids resin systems—meaning it helps dilute and adjust resin mix for application, without overly increasing VOC or drying too fast. This allows the formulation of eco-friendly, efficient coatings.

Recent Developments

- In May 2025, Eastman partnered with beauty brand SUQQU to launch a new makeup setting-powder compact made with Eastman’s Cristal™ One copolyester. This initiative highlights Eastman’s push into more sustainable materials and coating/packaging applications.

- In January 2024, Celanese initiated a plant that captures CO₂ emissions and converts them to low-carbon methanol — a move toward cleaner chemical production.

- In November 2024, ExxonMobil announced a major investment of more than US $200 million to expand its chemical-recycling operations at its Baytown and Beaumont (Texas) sites.

Conclusion

The Methyl N-Propyl Ketone market is experiencing steady growth, supported by its versatility as a high-performance solvent in coatings, inks, and industrial cleaning applications. Its favorable evaporation rate, strong solvency, and environmental compliance make it a preferred choice across automotive, construction, and electronics sectors. The growing shift toward sustainable, low-VOC, and eco-friendly formulations is further enhancing its adoption.

Continuous innovations and investments in cleaner production technologies are also expanding MPK’s role in green chemistry. As industries prioritize efficiency and sustainability, Methyl N-Propyl Ketone remains a key component in driving performance, quality, and environmental responsibility across diverse manufacturing processes.