Table of Contents

Overview

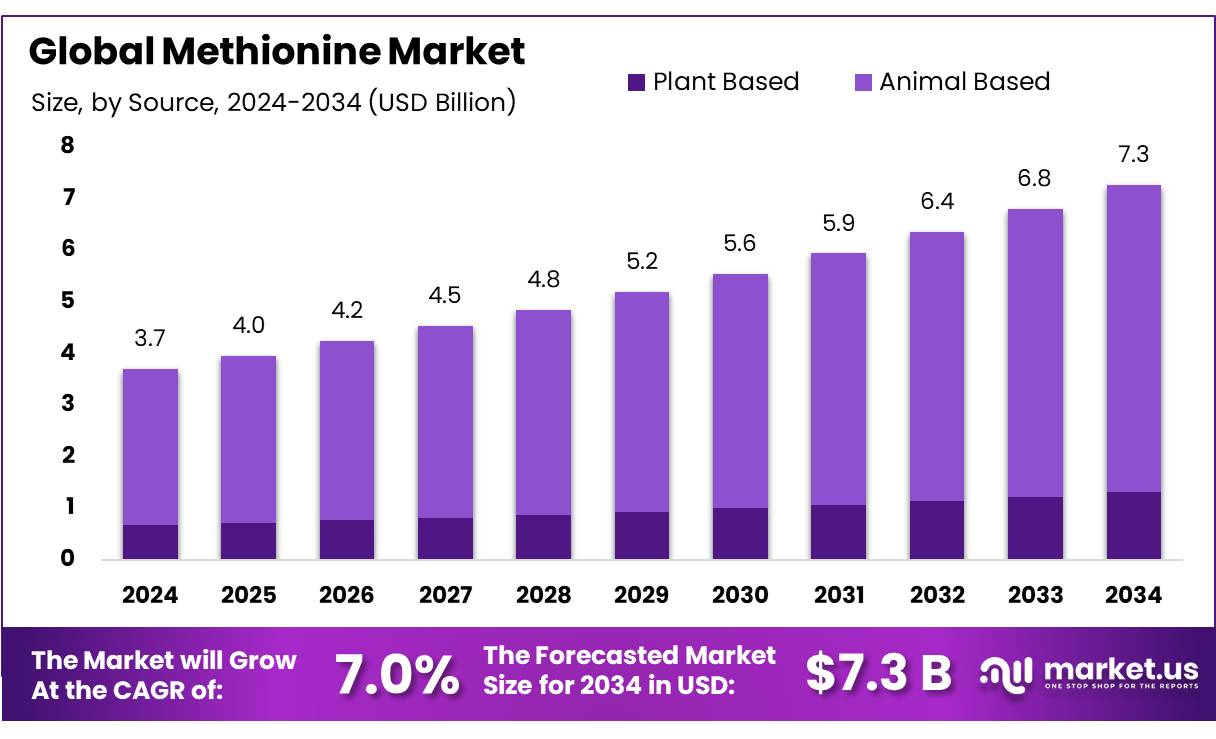

New York, NY – August 25, 2025 – The Global Methionine Market is projected to grow from USD 3.7 billion in 2024 to USD 7.3 billion by 2034, achieving a CAGR of 7.0% over the forecast period (2025–2034). In 2024, the Asia-Pacific region dominated the market, accounting for a 44.7% share and generating USD 1.6 billion in revenue.

Methionine, particularly DL-methionine and its hydroxy-analogue (MHA), is a critical amino acid used in animal feed to reduce crude protein levels while maintaining livestock performance, especially in poultry and swine. The primary production method involves petrochemical intermediates acrolein, methyl mercaptan, and hydrocyanic acid combined with ammonia and carbon dioxide via the hydantoin route, as detailed in U.S. Department of Agriculture technical documents and patents.

Rising global meat consumption, projected to increase by 47.9 million tonnes by 2034 according to the OECD-FAO Outlook, drives demand for compound feed and methionine inclusion. The United States, China, and Brazil collectively produce about 50% of global chicken meat in 2024/25, highlighting concentrated methionine demand in these regions. This drives demand for compound feed and methionine inclusion. The United States, China, and Brazil collectively produce about 50% of global chicken meat in 2024/25, highlighting concentrated methionine demand in these regions.

Asia-Pacific leads methionine consumption, with China’s feed use expected to reach 286.5 million metric tons (MMT) in MY 2024/25. India’s egg production has grown significantly, reaching 142.77 billion eggs in 2023-24, up from 78.48 billion in 2014-15, further boosting demand for methionine in poultry diets. The EU’s 2006 ban on antibiotic growth promoters has accelerated the adoption of amino-acid balancing, with methionine as the first-limiting amino acid in poultry.

Research and European feed industry data indicate that reducing dietary crude protein by 1% while supplementing essential amino acids can decrease nitrogen excretion by up to 10% in poultry and swine. A 2% reduction can lower broiler house ammonia emissions by approximately 24%, supporting compliance with EU Best Available Techniques (BAT) for intensive livestock rearing. The chemical sector, including methionine production, is energy-intensive and the third-largest source of direct industrial CO₂ emissions, per the IEA.

Key Takeaways

- Methionine Market size is expected to be worth around USD 7.3 billion by 2034, from USD 3.7 billion in 2024, growing at a CAGR of 7.0%.

- Animal-based products held a dominant market position, capturing more than 81.2% share.

- DL-Methionine held a dominant market position, capturing more than a 56.3% share.

- Animal Feed held a dominant market position, capturing more than 78.9% share.

- Asia-Pacific emerged as the clear growth engine for the global methionine market, capturing 44.7% of total revenues, valued at USD 1.6 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-methionine-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 3.7 Billion |

| Forecast Revenue (2034) | USD 7.3 Billion |

| CAGR (2025-2034) | 7.0% |

| Segments Covered | By Source (Plant-Based, Animal-Based), By Product Type (DL-Methionine, L-Methionine, Hydroxy Analogue of Methionine), By Application (Animal Feed, Food and Dietary Supplements, Pharmaceuticals, Others) |

| Competitive Landscape | Adisseo, Ajinomoto Co., Inc., AMINO GmbH, AnaSpec, CJ CHEILJEDANG CORP., DSM, Evonik Industries AG, IRIS BIOTECH GMBH, Kemin Industries, Inc., KYOWA HAKKO BIO CO., LTD. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=155120

Key Market Segments

By Source Analysis

In 2024, animal-based methionine commanded a leading market share of over 81.2%. Its dominance stems from its reliable performance in broiler, layer, and swine diets, offering consistent inclusion rates and compatibility with low-protein formulations that reduce nitrogen output.

Procurement teams favored animal-based options for their predictable dosing and seamless integration in large-scale operations, where high switching costs and established supply partnerships reinforced their preference. This familiarity also ensured stable pellet quality and amino-acid profiles across diverse feed lines.

By Product Type Analysis

In 2024, DL-Methionine secured a commanding market share of over 56.3%. Its prominence is driven by its consistent amino acid delivery across broiler, layer, swine, and aquaculture diets, enabling straightforward dosing in premixes and reliable outcomes in low-crude-protein formulations.

Nutritionists valued DL-Methionine for its compatibility with common raw materials and pellet conditions, minimizing reformulation risks and maintaining steady feed-mill throughput. Integrators relied on established supply contracts and technical support to navigate protein meal volatility, solidifying DL-Methionine as the go-to choice for baseline and high-performance diets.

By Application Analysis

In 2024, animal feed applications dominated the methionine market with a share exceeding 78.9%. This reflects its critical role in poultry, swine, and aquaculture, where methionine supports balanced amino-acid nutrition, promotes steady growth, and enhances feed conversion efficiency. Formulators favored methionine for its ability to reduce crude protein levels while maintaining performance, helping control input costs and lower nitrogen emissions.

Its seamless integration into premixes and compound feed, with predictable inclusion rates and minimal reformulation needs, made it a staple in feed mills. Large integrators sustained demand through annual contracts and technical support, ensuring consistent dosing and pellet quality across operations.

Regional Analysis

In 2024, Asia-Pacific solidified its position as the primary driver of the global methionine market, holding a 44.7% revenue share, valued at USD 1.6 billion. Feed-grade applications lead demand, accounting for over 90% of regional consumption, with poultry nutrition comprising approximately 75% of this segment.

The rapid growth of integrated poultry and aquaculture systems in China, India, Indonesia, Vietnam, and Thailand has increased the use of essential amino acids to enhance feed conversion ratios and accommodate higher stocking densities. Manufacturers are focusing on high-concentration liquid and coated methionine grades to improve handling and bioavailability for premix and compound-feed producers.

Supportive policies promoting protein self-sufficiency, ongoing advancements in commercial farming, and the expansion of quick-service restaurants and modern retail channels ensure consistent demand. While price sensitivity remains a factor, procurement strategies in Asia-Pacific increasingly prioritize supply chain stability through long-term contracts and diversified sourcing from domestic and international suppliers.

Top Use Cases

- Poultry Nutrition: Methionine is a key amino acid in poultry diets, boosting growth and feather development. It helps reduce crude protein levels in feed, improving feed conversion and lowering costs. Widely used in broiler and layer diets, it ensures healthy birds and high egg production.

- Swine Health: Methionine supports muscle growth and skin quality in pigs. It allows lower protein diets, reducing nitrogen waste and feed costs. Its inclusion in swine feed enhances weight gain and overall health, making it essential for efficient pork production.

- Aquaculture Growth: Methionine is vital for fish and shrimp, helping to replace scarce fishmeal in feeds. It promotes growth and survival rates in high-density aquaculture systems. Its use in shrimp and salmon diets supports sustainable farming by improving feed efficiency.

- Ruminant Performance: In dairy and beef cattle, methionine in rumen-protected forms boosts milk yield and growth. It supports protein synthesis, enhancing animal health and productivity. Its use in ruminant diets optimizes feed formulations for better performance and lower environmental impact.

- Pet Food Quality: Methionine Enhances Urinary Health and Antioxidant Benefits in Premium Pet Foods. It supports coat quality and overall wellness in cats and dogs. Its inclusion in pet diets meets rising consumer demand for high-quality, nutrient-rich pet nutrition.

Recent Developments

1. Adisseo

Adisseo is advancing its “Smart Factory” initiative in Nanjing, China, enhancing automation and digitalization for its methionine production. This follows their significant capacity expansion. The focus is on improving production efficiency, product quality, and sustainability to meet growing global demand and strengthen their position as a leading producer.

2. Ajinomoto Co., Inc.

Ajinomoto focuses on leveraging its fermentation technology for sustainable amino acid production. While not expanding methionine capacity directly, their recent R&D emphasizes reducing environmental impact across all operations. Their strategy involves optimizing resource efficiency and promoting the circular economy, which applies to their methionine and lysine businesses, aligning with long-term global sustainability goals.

3. AMINO GmbH

As a key distributor, AMINO GmbH’s recent developments involve strengthening its supply chain partnerships to ensure reliable methionine availability for the European market. They focus on providing technical support and tailored solutions to customers, navigating the volatile global raw material and logistics landscape to maintain a consistent supply of products like MetAMINO (Evonik) and other methionine sources.

4. AnaSpec

AnaSpec, a subsidiary of Eurofins, specializes in high-purity peptides and biochemicals. Their recent work involves providing specialty methionine derivatives and analogs for research and pharmaceutical applications. This includes products like L-Methionine sulfoxide and labeled methionine, supporting advanced life science research in areas such as protein structure/function studies and diagnostic development, not commodity feed-grade production.

5. CJ CHEILJEDANG CORP.

CJ CheilJedang is aggressively expanding its methionine footprint. A key recent development is the successful construction and operation of its new plant in Malaysia, significantly increasing its global production capacity. This strategic move positions CJ as a major competitive player, challenging established leaders by securing a large-scale, integrated supply chain to serve the Asian and international markets.

Conclusion

Methionine is a critical amino acid driving efficiency in animal nutrition across poultry, swine, aquaculture, ruminants, and pet food. Its ability to enhance growth, reduce feed costs, and support sustainability aligns with rising global demand for animal protein. As livestock and aquaculture industries expand, methionine’s role in optimizing feed formulations and animal health will fuel market growth.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)