Table of Contents

Overview

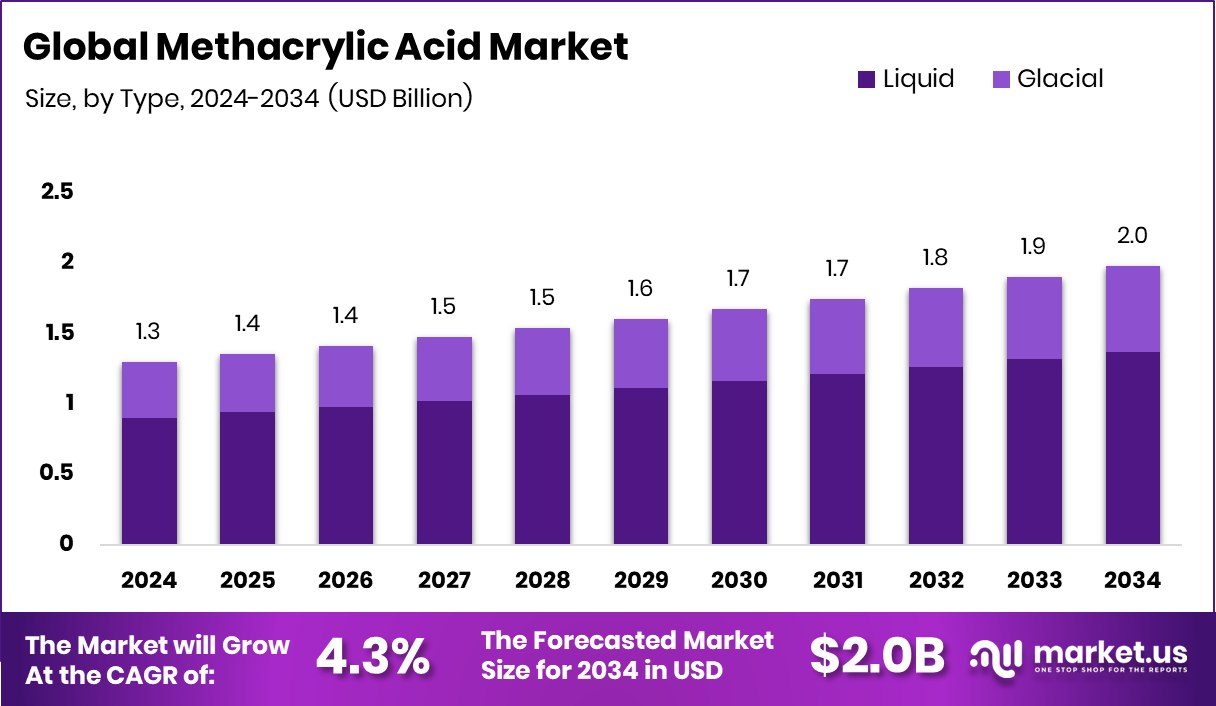

New York, NY – Nov 11, 2025 – The global methacrylic acid (MAA) market is poised to grow from approximately USD 1.3 billion in 2024 to about USD 2.0 billion by 2034, registering a compound annual growth rate of 4.3 % between 2025 and 2034. North America continues to lead the sector with a commanding share of 44.9 %, driven by robust infrastructure expansion and growing demand for sustainable coatings.

MAA—a colorless, viscous organic building block—is vital in creating acrylic and methacrylate polymers utilized in paints, adhesives, plastics, and surface coatings, where it enhances transparency, hardness, and durability. Key end-use industries such as construction, automotive, electronics, and personal care are increasingly deploying MAA-based resins and superabsorbents.

A major growth driver lies in the shift towards eco-friendly, high-performance coatings: for example, Ecoat secured €21 million to develop low-carbon paints and coatings, underscoring how sustainable innovations are boosting MAA consumption. Concurrently, industrial adhesives and protective coatings are gaining traction as industries modernise infrastructure and production processes.

Beyond that, rising infrastructure development in emerging markets, along with advances in packaging and personal-care products, is maintaining steady global demand for methacrylic-acid-based formulations. The market furthermore offers opportunities within green-chemistry solutions, circular-materials applications, and innovation-led industrial growth—evidenced by India’s JSW Group raising $790 million via bonds for material-centric acquisitions and EndureAir Systems obtaining ₹13.5 crore in funding led by an Asian Paints co-promoter to back advanced materials technology.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-methacrylic-acid-market/request-sample/

Key Takeaways

- The Global Methacrylic Acid Market is expected to be worth around USD 2.0 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 4.3% from 2025 to 2034.

- In 2024, liquid methacrylic acid dominated the market, capturing 69.3% share across applications.

- Paint applications held a 23.9% share of the methacrylic acid market, highlighting its strong formulation role.

- The construction sector accounted for a 32.8% share in the methacrylic acid market during the year.

- The North American market value reached approximately USD 0.5 billion, driven by industrial applications.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=164548

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1.3 Billion |

| Forecast Revenue (2034) | USD 2.0 Billion |

| CAGR (2025-2034) | 4.3% |

| Segments Covered | By Type (Liquid, Glacial), By Application (Paint, Adhesive, Fibre Processing Agent, Rubber Modifier, Leather Treatment, Paper Processing Agent, Lubricant Additive, Cement Mixing Agent, Others), By End Use (Construction, Automobiles, Electronics, Textile, Pharmaceutical, Others) |

| Competitive Landscape | Dow, BASF SE, Evonik Industries, Formosa Korea, KURARAY CO., LTD, LG Chem, MITSUBISHI GAS CHEMICAL COMPANY, INC, DHALOP CHEMICALS, AECOCHEM, Central Drug House |

Key Market Segments

By Type Analysis

In 2024, the liquid segment dominated the global Methacrylic Acid Market, accounting for a 69.3% share. This strong position stemmed from its widespread application in coatings, adhesives, and advanced polymer formulations. The liquid form’s excellent dispersion and blending capability make it ideal for industrial processes, particularly in paints and coatings production.

Its high compatibility with low-VOC and sustainable coating systems also supports the shift toward eco-friendly solutions in construction and manufacturing. Backed by infrastructure expansion and resin technology innovations, the liquid form remains essential in delivering durability, gloss, and adhesion performance across sectors such as automotive, electronics, and construction.

Its continued adoption underscores its importance as a core material in developing high-performance and environmentally responsible products, solidifying its leadership in the methacrylic acid landscape.

By Application Analysis

In 2024, the paint segment led the Methacrylic Acid Market by application, capturing a 23.9% share. This dominance was fueled by the growing incorporation of methacrylic acid-based formulations in producing durable, high-performance paints offering excellent adhesion, gloss, and weather resistance.

The rising global shift toward low-VOC and eco-friendly coatings across residential, commercial, and industrial construction further reinforced demand. Paint producers increasingly utilize methacrylic acid to enhance color stability and surface protection, especially in architectural and automotive coatings.

With infrastructure development and sustainability at the forefront, this segment’s leadership highlights the market’s evolution toward long-lasting, high-quality finishes. Continuous advancements in green paint technologies and expanding investments in protective and decorative coatings continue to solidify the paint segment’s crucial role in driving methacrylic acid consumption worldwide.

By End Use Analysis

In 2024, the construction segment dominated the Methacrylic Acid Market by end use, accounting for a 32.8% share. This leadership stemmed from the widespread use of methacrylic acid-based polymers and coatings in infrastructure projects, flooring, waterproofing, and surface protection applications. Known for its superior adhesion, durability, and chemical resistance, methacrylic acid plays a crucial role in enhancing concrete sealants and protective coatings for modern buildings. The sector’s expansion, driven by rapid urbanization and increasing emphasis on sustainable construction materials, further fueled demand. Builders and developers increasingly favored methacrylic acid derivatives to improve the strength and lifespan of structures while meeting green building standards. This sustained integration underscores the compound’s importance in advancing eco-efficient, long-lasting construction solutions, securing the construction industry’s dominant position in the methacrylic acid market.

Regional Analysis

In 2024, North America dominated the global Methacrylic Acid Market, securing a 44.90% share valued at approximately USD 0.5 billion. This leadership was anchored by the region’s advanced manufacturing base and the rising use of high-performance coatings and adhesives in the construction and automotive industries.

Supportive government initiatives promoting sustainable infrastructure and energy-efficient materials further boosted methacrylic acid adoption. Europe followed, driven by strict environmental norms and increasing demand for low-VOC paints and coatings. The Asia Pacific region recorded steady expansion, fueled by industrial growth, construction projects, and strong consumer goods production.

Latin America and the Middle East & Africa also progressed gradually with growing urbanization and industrialization. Overall, the market reflects a diverse regional balance, where North America continues to lead through innovation and sustainability, while Asia Pacific emerges as a key growth hub shaping future methacrylic acid demand globally.

Top Use Cases

- High-performance coatings: MAA is used in paints and surface coatings to improve how well the coating sticks, how glossy it looks, and how it withstands weather and chemicals. For example, coatings with MAA show better adhesion on metal, plastic, and glass and are more durable in outdoor applications.

- Pressure-sensitive adhesives: Copolymers that include MAA help in making adhesives that stick reliably to low-energy surfaces like polyethylene or polypropylene. These adhesives are used in automotive, electronics, and packaging, where strong bonding is needed.

- Plastic modifiers and toughened polymers: MAA is used in plastic sheets or molded/-extruded products as a modifier to improve hardness, clarity, weather-resistance, and compatibility in polymer blends. It helps make plastics more robust and stable

- Superabsorbent and hydrogel materials: Polymers containing MAA (e.g., poly(methacrylic acid) copolymers) are used to make hydrogels that absorb large amounts of water or fluid. These can find use in absorbent hygiene products or specialty materials.

- Plastic waste recycling compatibilizers: In recycling mixed plastics (like PET bottles blended with PE bags), copolymers incorporating methacrylic acid units act as compatibilizers: a small percentage (≈3 wt %) of poly(ethylene-co-methacrylic acid) improved the mechanical strength of the recycled blend by a large margin.

- Biomedical and functional coatings: MAA-based polymers are being explored in biomedical contexts: for example, grafted coatings made from poly(methacrylic acid) show tunable wettability and biocompatibility, indicating uses in medical devices or cell culture surfaces.

Recent Developments

- In June 2025, an agreement was announced to sell its 50% interest in DowAksa Advanced Composites Holdings BV (the joint venture in composites with Aksa Akrilik) for roughly USD 125 million enterprise value.

- In May 2024, BASF India announced that it would increase production capacity for its Ultramid® polyamide (PA) and Ultradur® PBT compounding plants in Panoli (Gujarat) and Thane (Maharashtra). Also, a new Polyurethane Technical Development Center was to be inaugurated on 28 May in Mumbai to support applications in transportation, construction, footwear, appliances, and furniture.

Conclusion

The Methacrylic Acid market is evolving with growing emphasis on sustainability, innovation, and performance-driven applications. Industries such as construction, automotive, and electronics increasingly rely on methacrylic acid-based polymers for durable, weather-resistant, and eco-friendly solutions. Advancements in coatings, adhesives, and resin technologies continue to enhance product quality and environmental efficiency.

Moreover, global initiatives toward low-VOC materials and bio-based formulations are reshaping production methods. With expanding infrastructure projects, rising consumer demand for high-quality finishes, and investment in green chemistry, methacrylic acid remains a key material in the transition toward more efficient and sustainable industrial and consumer applications worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)