Table of Contents

Overview

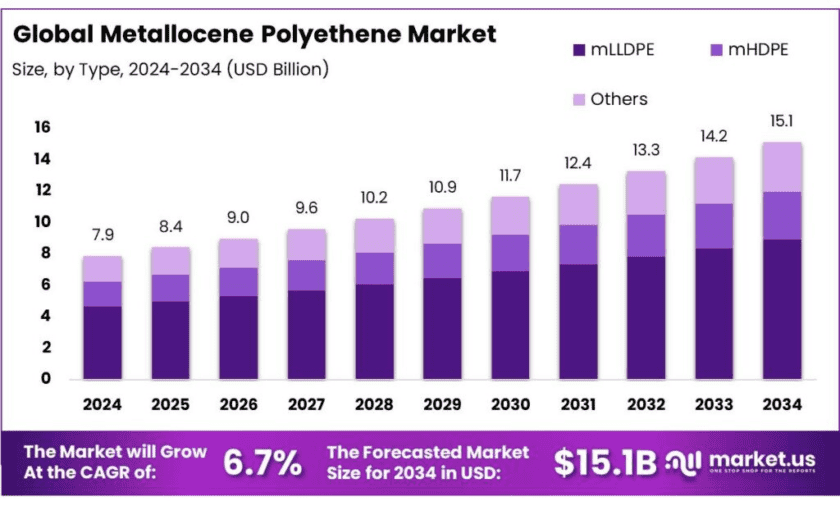

New York, NY – Oct 30, 2025 – The global Metallocene Polyethylene (mPE) market is projected to reach a valuation of USD 15.1 billion by 2034, rising from USD 7.9 billion in 2024, and is anticipated to expand at a compound annual growth rate CAGR of 6.7% between 2025 and 2034. Metallocene polyethylene refers to polyethylene grades produced using advanced metallocene single-site catalysts, offering enhanced control over molecular structure — including molecular weight distribution, comonomer incorporation, and branching — compared to traditional Ziegler–Natta catalysts.

In the broader petrochemical landscape, the International Energy Agency (IEA) projects that petrochemicals will account for over one-third of global oil-demand growth by 2030, and nearly half by 2050, highlighting the central role of polymers and advanced plastics in future energy systems. The chemical sector already represents the largest industrial energy consumer, with approximately 50% of its energy input used as feedstock rather than fuel. Furthermore, the IEA anticipates that petrochemicals, including plastics, will consume an additional 56 billion cubic meters of natural gas by 2030, reflecting steady industrial expansion.

From a policy perspective, India’s Plastic Parks Scheme, under the Department of Chemicals and Petrochemicals, provides grants covering up to 50% of project costs to support the establishment of downstream plastic manufacturing clusters, with 10 parks approved to date. Similarly, under the National Policy on Petrochemicals, 18 Centers of Excellence (CoEs) have been established with grant assistance of up to 50% of project cost to encourage innovation in polymer technology and process efficiency.

- The Indian government also allows 100% foreign direct investment (FDI) in the chemicals sector, which has attracted approximately ₹42,641 crore over the past five years, reinforcing the sector’s strategic growth potential.

Key Takeaways

- Metallocene Polyethene Market size is expected to be worth around USD 15.1 Billion by 2034, from USD 7.9 Billion in 2024, growing at a CAGR of 6.7%.

- mLLDPE held a dominant market position, capturing more than a 59.2% share of the global metallocene polyethylene market.

- Zerconocene held a dominant market position, capturing more than a 49.7% share of the global metallocene polyethylene market.

- Films held a dominant market position, capturing more than a 53.9% share of the global metallocene polyethylene market.

- Packaging held a dominant market position, capturing more than a 45.1% share of the global metallocene polyethylene market.

- Asia Pacific region held a dominant position in the global metallocene polyethylene (mPE) market, accounting for 46.9% of the market share, valued at approximately USD 3.7 billion.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/metallocene-polyethene-market/free-sample/

Report Scope

| Market Value (2024) | USD 7.9 Bn |

| Forecast Revenue (2034) | USD 15.1 Bn |

| CAGR (2025-2034) | 6.7% |

| Segments Covered | By Type (mLLDPE, mHDPE, Others), By Catalyst Type (Zerconocene, Ferrocene, Tetanocene, Others), By Application ( Films, Sheets, Injection Molding, Extrusion Coatings, Others), By End-use (Packaging, Food and Beverages, Automotive, Building and Construction, Agriculture, Healthcare, Others) |

| Competitive Landscape | Borealis AG, Braskem, Chevron Philips Chemical Company LLC, Dow Chemical Company, Exxon Mobil Corporation, INEOS Group Holdings S.A., LyondellBasell Industries N.V., LG Chem, Mitsui & Co., SABIC |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=160896

Key Market Segments

In 2024, Metallocene Linear Low-Density Polyethylene (mLLDPE) dominated the global metallocene polyethylene (mPE) market, accounting for 59.2% of the total market share. This dominance can be attributed to its superior flexibility, tensile strength, and optical clarity, which make it ideal for applications such as packaging films, stretch wraps, and agricultural films. The adoption of mLLDPE in flexible packaging was particularly strong due to its ability to produce thinner films without compromising mechanical strength, helping reduce material usage and enhance sustainability.

The year 2024 reflected a clear industry preference for mLLDPE over conventional polyethylene variants, especially in regions with rapid urbanization and growing consumer goods demand. Going forward, in 2025, this trend is expected to strengthen further as industries focus on cost-effective, high-performance polymer solutions aligned with evolving environmental and regulatory standards.

In 2024, Zerconocene catalysts held the leading position in the global metallocene polyethylene market, capturing a 49.7% market share by catalyst type. Their popularity stems from their capability to produce polymers with uniform molecular weight distribution and enhanced mechanical strength, resulting in superior product quality for use in packaging, automotive, and medical applications. Zerconocene catalysts deliver exceptional process efficiency, high polymer clarity, and consistent tensile performance, enabling large-scale manufacturers to optimize productivity while minimizing production costs.

The industrial outlook for 2024 revealed a steady shift toward Zerconocene-based polymerization systems, driven by rising demand for advanced, durable, and sustainable polyethylene materials. By 2025, this preference is expected to persist as producers emphasize high-quality, energy-efficient manufacturing and compliance with global sustainability mandates.

In 2024, Films emerged as the largest application segment in the metallocene polyethylene market, accounting for 53.9% of total demand. The segment’s leadership was supported by mPE’s superior flexibility, toughness, and sealability, which make it suitable for manufacturing packaging films, stretch wraps, and agricultural films. The high mechanical strength and clarity of mPE films have driven adoption across key industries, including food & beverage, healthcare, and consumer goods, where protective and lightweight packaging is essential.

The capacity to produce thinner films with enhanced durability and performance has enabled cost savings and reduced material consumption. As of 2025, film applications are projected to continue dominating the market, supported by the growing focus on sustainable, high-performance packaging and stricter global packaging standards.

In 2024, the Packaging segment held a commanding position in the global metallocene polyethylene market, capturing 45.1% of total market share. This dominance was driven by the rising demand for lightweight, durable, and flexible packaging solutions across sectors such as food and beverages, consumer goods, pharmaceuticals, and e-commerce. Metallocene polyethylene offers superior clarity, tensile strength, and sealability, making it ideal for use in bags, pouches, shrink wraps, and films.

In 2024, packaging manufacturers increasingly adopted mPE to extend product shelf life and reduce material waste, particularly amid tightening sustainability regulations. The outlook for 2025 indicates continued market expansion, driven by rapid growth in packaged food and e-commerce sectors in emerging economies, reinforcing packaging as the primary end-use category for metallocene polyethylene worldwide.

List of Segments

By Type

- mLLDPE

- mHDPE

- Others

By Catalyst Type

- Zerconocene

- Ferrocene

- Tetanocene

- Others

By Application

- Films

- Sheets

- Injection Molding

- Extrusion Coatings

- Others

By End-use

- Packaging

- Food and Beverages

- Automotive

- Building and Construction

- Agriculture

- Healthcare

- Others

Regional Analysis

Asia Pacific Dominates with 46.9% Share Valued at USD 3.7 Billion, Driven by Industrial Growth and Advanced Coating Demand

In 2024, the Asia Pacific region emerged as the leading market for metallocene polyethylene (mPE), capturing a 46.9% share and generating an estimated USD 3.7 billion in revenue. This dominance was primarily driven by the region’s strong industrial base, rapid expansion of manufacturing and packaging sectors, and a growing shift toward sustainable and recyclable materials.

Government-led initiatives have further accelerated the adoption of advanced polymer technologies. In China, for instance, Dushi Petrochemical achieved a milestone in December 2022 by producing metallocene polyethylene using chromium powder as a domestic catalyst, signaling progress in local catalyst development and self-sufficiency. Additionally, regional policies promoting eco-friendly packaging materials have encouraged significant investment in mPE production facilities.

Top Use Cases

Thin, tough food-packaging films (pouches, sachets, laminations): mPE helps brand owners down-gauge while keeping seal integrity and optics. A Dow ELITE™ mLLDPE film grade shows a seal initiation temperature of 95 °C, dart impact >850 g, puncture energy 168 in-lb (14 J) at 51 µm film, with haze 13% and gloss 64—useful for fast, low-temperature sealing on automated lines without sacrificing toughness. These quantified properties explain why converters adopt mPE for snack, cereal, and frozen food packaging that must resist drops and punctures yet still present well on shelf.

High-tenacity pallet stretch wrap (logistics & e-commerce): In cast stretch films, mPE can deliver high holding force at thin gauges and high line speeds. A Canada-based converter used Exceed™ Flow m1716 mPE in a nine-layer power pre-stretch film, running a 4.5 m finished width at 500 m/min; the 12 µm film achieved higher holding force and load stability at any pre-stretch level, while keeping head pressure and motor load low versus incumbent high-tenacity grades—evidence of both performance and productivity gains.

Protective air-column bags (damage-reduction, material savings): For mailers/air-column cushions, mPE enables thinner films with comparable burst and puncture performance. In trials with a Chinese converter, using Exceed™ Stiff+ m0926 and Exceed™ Flow+ m0516 in PE layers allowed 10% downgauging (from 50 µm to 45 µm) with comparable stiffness and needle-puncture and excellent burst resistance. The commercial 45 µm air-bag product reduced plastic use versus the 50–60 µm market reference and helped the supplier reach ~30% market share in its segment.

Fast, down-gauged flexible films (output & sealing efficiency): mPE grades engineered for food packaging combine low-temperature sealing with high melt strength, supporting output and thinner films. For Exceed™ XP 8784, ExxonMobil reports low seal-initiation temperature with “extreme” dart impact for package integrity plus downgauging opportunities. Processing data show maximum output 100–170 kg/h with reduced melt pressure (≈500 → 320 bar) and high motor-load efficiency; example runs include a 1 mil (25.4 µm) film on a 2.5:1 BUR with 2.68 kg/h/cm die-circumference rate—practical indicators for converters seeking throughput and energy savings.

Heavy-duty sacks with recycled content (circularity without performance loss): mPE can “boost” recycled films. In Italy, Selene’s NextBag™ heavy-duty sacks incorporated 50% post-consumer recycled (PCR) PE blended with Exceed™ XP/Exceed™ mPE and passed EUMOS 40509 pallet acceleration tests; bag-drop resistance outperformed virgin-PE references. The case demonstrates that mPE’s toughness and sealing can compensate for PCR variability, enabling high PCR percentages while keeping user machine settings stable (e.g., sealing-bar temperature and output).

Recent Developments

Borealis AG: In 2024 Borealis reported revenue of €7.85 billion and net profit of €566 million, underscoring its strong position in polyolefins. In the metallocene-polyethylene arena the company markets advanced PE grades under its Borstar® and Anteo™/BorShape™ brands, offering enhanced processability and downgauging potential. Borealis’s innovation push is visible in its 2023-priority patent applications (128 filings) and the 2025 launch of “Borstar Nextension” technology, which delivers up to double toughness compared to first-gen mPE.

Braskem S.A.: Braskem offers a metallocene-catalysed LLDPE portfolio under the FLEXUS and PROXESS product families — for example FLEXUS 9200 and FLEXUS 7212XP emphasise puncture and impact strength. The company’s mPE innovations target film, laminated and shrink-film markets; in its shrink-film solution Braskem shows the metallocene-PE component enables superior clarity and gloss. While recent full-year financials specific to mPE aren’t highlighted publicly, their product-line disclosures point to consistent emphasis in packaging applications, reinforcing their strategic commitment.

Chevron Phillips Chemical Company LLC: In 2023, Chevron Phillips reported revenue of US$14.18 billion and net income of US$1.662 billion, underpinning its strength as a major polyethylene supplier. Its Marlex® metallocene polyethylene (mPE) portfolio highlights outstanding optics, impact and puncture resistance, and enhanced sealing performance, with the company marketing metallocene, HDPE, LDPE and LLDPE grades for films and laminations.

Dow Inc. (The Dow Chemical Company): For the year ended December 31 2024, Dow published its 2024 INtersections Progress Report covering its materials science operations. In its polyethylene materials portfolio it explores novel architectures and sustainable enhancements (e.g., long-chain branched PE) intended to support film and packaging markets, which align with metallocene-polyethylene type performance demands.

Exxon Mobil Corporation: In 2023 Exxon Mobil reported full-year earnings of US $36.0 billion, with chemical products sales volume of 19,392 kt for the year. In its metallocene-polyethylene work, ExxonMobil markets its Exceed™ series (e.g., Exceed m 2018.MA) which offers extraordinary tensile, impact and puncture performance for film applications.

LyondellBasell Industries N.V.: In 2023 LyondellBasell reported net income of US $185 million for the year (Feb 2 2024 disclosure). The company’s differentiated polyethylene technology, including advanced metallocene-based polyolefin processes, was selected for a large-scale project with PetroChina Guangxi complex in July 2023. This underscores its active role in metallocene polyethylene (mPE) applications—especially in film and packaging markets where high performance PE grades are required.

LG Chem, Ltd.: LG Chem offers an m-PE product line based on its proprietary metallocene catalyst technology, marketed for applications like shipping boxes, film packaging and pipes. For the year ended December 31 2023, the company’s separate financial statements were duly audited and showed the business preparing for advanced resin segments. This positions LG Chem as a meaningful player in the metallocene polyethylene sector, focusing on high-value, specialty resin applications beyond commodity grades.

SABIC: For the full year 2024 SABIC reported revenue of SAR 139.98 billion (≈ US$37.33 billion), with polymer-product margins improving and net income from continuing operations of SAR 2.10 billion (≈ US$0.56 billion). In the metallocene-polyethylene space, SABIC offers mPE portfolio brands such as SUPEER™, COHERE™ and FORTIFY™, spanning films and flexible-packaging applications.

Conclusion

In conclusion, metallocene polyethylene (mPE) stands as a distinct advancement in the polyolefin sector. It uses metallocene catalysts to produce resins with very narrow molecular-weight distributions and uniform comonomer incorporation, resulting in higher toughness, superior optical clarity, excellent sealing, and puncture/tear resistance—even at thinner gauges.

These attributes make mPE especially well‐suited for high‐performance packaging films, down‐gauged stretch wraps, heavy‐duty sacks, and multilayer applications. On the flip side, its higher melt viscosity and process sensitivity require careful extrusion and die design to avoid melt fracture.