Table of Contents

Overview

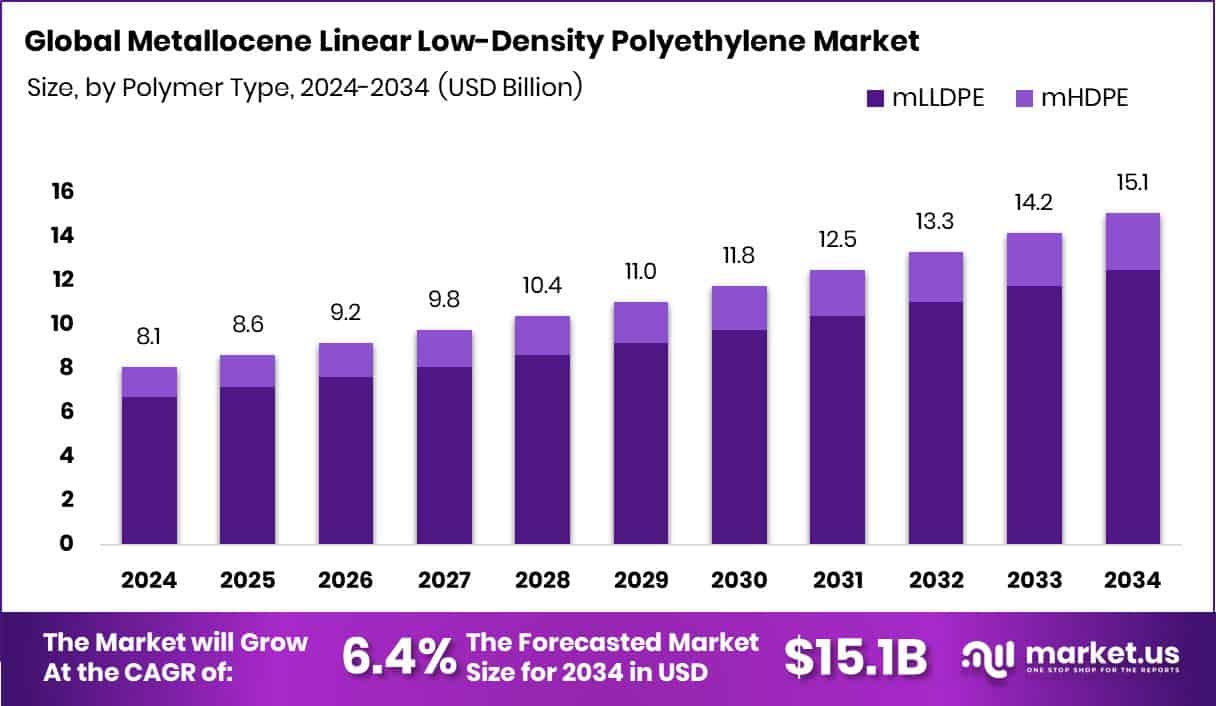

New York, NY – October 27, 2025 – The Global Metallocene Linear Low-Density Polyethylene (mLLDPE) Market is projected to reach USD 15.1 billion by 2034, rising from USD 8.1 billion in 2024 at a 6.4% CAGR. North America led with a 45.30% share (USD 3.6 billion), driven by strong industrial packaging demand. mLLDPE, made using metallocene catalysts, delivers higher tensile strength, puncture resistance, and clarity than conventional LLDPE.

Market momentum is supported by rising demand for lightweight, high-performance polymer films in packaging and emerging uses in agriculture and infrastructure. Innovation is being accelerated through £3.2 million national research funding for plastics innovation in the UK and an Rs 100 crore QIP capital raise by a packaging firm. Additionally, an £8 million site expansion by a UK packaging supplier highlights capacity growth, while a bank’s $157 million loan loss reflects broader sectoral adjustments affecting funding flows.

Opportunities center on developing ultra-low-density mLLDPE (<0.91 g/cm³) for sustainable, thinner-film packaging. Growth prospects are strong in Asia-Pacific and Latin America, supported by e-commerce expansion, flexible film adoption, and increasing downstream investment. Overall, R&D and financial infusions are enabling next-generation mLLDPE grades with improved performance and reduced environmental impact.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-metallocene-linear-low-density-polyethylene-market/

Key Takeaways

- The Global Metallocene Linear Low-Density Polyethylene Market is expected to be worth around USD 15.1 billion by 2034, up from USD 8.1 billion in 2024, and is projected to grow at a CAGR of 6.4% from 2025 to 2034.

- In 2024, mLLDPE held an 83.5% share in the Metallocene Linear Low-Density Polyethylene Market, driven by superior flexibility.

- Films accounted for a 48.2% share of the Metallocene Linear Low-Density Polyethylene Market, reflecting strong packaging sector demand.

- North America recorded a total market valuation of USD 3.6 billion during 2024.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=162508

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 8.1 Billion |

| Forecast Revenue (2034) | USD 15.1 Billion |

| CAGR (2025-2034) | 6.4% |

| Segments Covered | By Polymer Type (mLLDPE, mHDPE), By Application (Films, Sheets, Extrusion Coating, Injection Molding, Blow Molding, Wire and Cable Insulation, Others) |

| Competitive Landscape | ExxonMobil, Dow Chemical, Chevron Phillips Chemical, LyondellBasell, Borealis, SABIC, TotalEnergies, INEOS, LG Chem |

Key Market Segments

By Polymer Type Analysis

In 2024, mLLDPE dominated the By Polymer Type segment of the Metallocene Linear Low-Density Polyethylene Market with an 83.5% share. This strong position stems from its broad adoption in packaging and film manufacturing, where its high toughness, clarity, and sealing strength offer clear advantages over conventional polyethylene types. The polymer’s superior processability and uniform structure enable consistent film performance and reduced material waste.

Industries emphasizing lightweight, durable, and cost-efficient materials have increasingly chosen mLLDPE for better productivity and sustainability outcomes. Its extensive use in flexible packaging, agricultural films, and industrial wraps continues to reinforce its leadership. The preference for mLLDPE reflects a market-wide shift toward high-performance polymers that deliver both mechanical resilience and processing efficiency, cementing its dominance in 2024 across multiple end-use sectors.

By Application Analysis

In 2024, Films dominated the By Application segment of the Metallocene Linear Low-Density Polyethylene Market with a 48.2% share. This leadership reflects the extensive use of mLLDPE in manufacturing high-quality films for packaging, agriculture, and industrial applications. These films deliver exceptional tensile strength, puncture resistance, and clarity, making them highly suitable for flexible packaging, stretch wraps, and greenhouse coverings.

The segment’s strength is supported by the polymer’s excellent sealing capability and durability, which enhance product protection and shelf life. Growing demand for lightweight, cost-efficient, and high-performance packaging materials has further boosted film applications. As industries focus on sustainability and improved material performance, mLLDPE-based films have become the preferred choice across both consumer and industrial sectors, solidifying their dominance within the market in 2024.

Regional Analysis

In 2024, North America led the Metallocene Linear Low-Density Polyethylene Market, capturing a 45.30% share valued at USD 3.6 billion. This dominance stems from the region’s robust packaging, agriculture, and construction sectors, which heavily rely on high-performance mLLDPE films and materials. The widespread adoption of lightweight and durable packaging solutions across the United States and Canada underscores strong industrial demand and advanced processing capabilities.

Europe followed with steady growth supported by sustainability-driven regulations promoting efficient polymer grades, while the Asia Pacific expanded through rising manufacturing and consumer goods production. Latin America and the Middle East & Africa recorded gradual progress as infrastructure and packaging needs advanced.

Overall, North America’s commanding share in 2024 reflects its technological strength, high consumption of metallocene-based polymers, and leadership in innovation-driven industrial applications.

Top Use Cases

- Flexible food-packaging film: mLLDPE is used for films around fresh produce, snacks, or frozen goods because it offers clear, strong packaging that seals reliably. It gives better sealing performance compared with older polymers, enabling thinner films with the same protective strength.

- Stretch/shrink wrap for logistics: In wrapping pallets, furniture, or heavy items for transport, mLLDPE allows thinner gauge film while retaining puncture resistance and load-holding strength. This helps reduce resin use while maintaining protection during shipping.

- Heavy-duty bags and sacks: For industrial-grade bags (e.g., fertilizers, resins, building materials), mLLDPE gives improved drop and sealing strength, which means the bags hold up better in rough handling or stack pressures.

- Agricultural films and greenhouse covers: In agriculture, mLLDPE is used for mulch, greenhouse covers, and silage wraps because of its high clarity and resistance to puncture and tears—enabling lighter films with high performance.

- Co-extruded laminated film structures: mLLDPE is often used as one layer in multi-layer film laminates (for food or specialty packaging) because its molecular consistency gives better seal behaviour and faster packaging line performance.

- Thin-walled containers and injection molded parts: Although less common than film, specialized mLLDPE grades are used for thin-walled containers, trays, or specialty parts where high clarity and good mechanical strength are required, and down-gauging (using less material) is beneficial.

Recent Developments

- In November 2024, ExxonMobil announced it would invest over USD 200 million at its Baytown and Beaumont (Texas) sites to expand advanced recycling operations, targeting 500 million pounds/year by 2026 and a global goal of 1 billion pounds/year by 2027. This supports production of raw materials for high-performance plastics, including potentially mLLDPE grades.

- In June 2024, Dow agreed to acquire Circulus, a North American recycler of polyethylene, with an annual capacity of about 50,000 metric tons of post-consumer recycled resin. This move supports Dow’s “Transform the Waste” goal and strengthens its backend supply of recycled feedstock for high-performance PE grades.

Conclusion

The Metallocene Linear Low-Density Polyethylene market is advancing rapidly, driven by the rising need for stronger, clearer, and more sustainable packaging materials. Its superior mechanical strength, sealing ability, and flexibility make it highly preferred across packaging, agriculture, and industrial sectors. Continuous innovation in catalyst technology and polymer design enhances performance while supporting sustainability goals.

Growing recycling initiatives and the expansion of film manufacturing capacities worldwide are fostering market growth. With increasing demand for lightweight, durable materials and eco-friendly production, metallocene-based polyethylene continues to play a vital role in shaping modern packaging and high-performance film applications globally.