Table of Contents

Overview

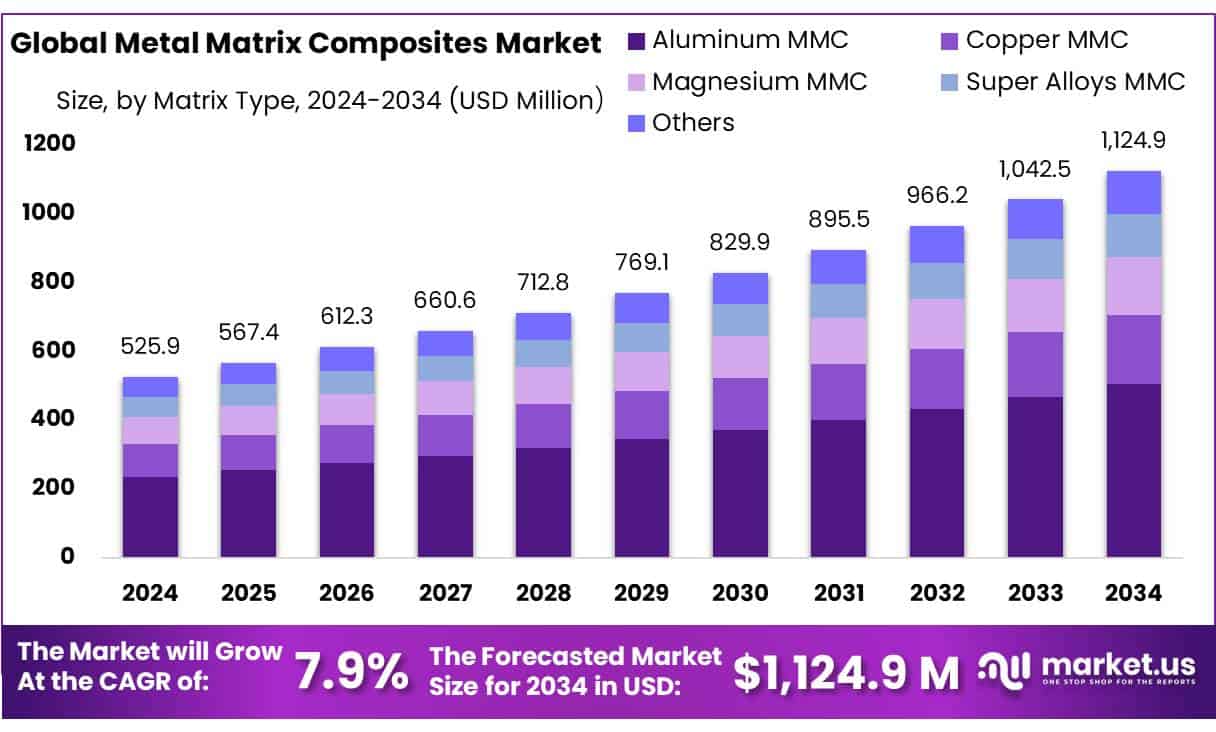

New York, NY – June 23, 2025 – The global metal matrix composites (MMC) market is forecast to surge from approximately USD 525.9 million in 2024 to around USD 1,124.9 million by 2034, registering a compound annual growth rate (CAGR) of 7.9% between 2025 and 2034. Demand is being driven by industries seeking lightweight yet high-performance materials—particularly aerospace, automotive, and defense—where fuel efficiency, strength, and thermal resistance are critical. MMCs are gaining popularity due to their superior stiffness, ductility, and thermal conductivity compared to traditional alloys.

Market opportunities lie in growing applications in electronics and thermal-management systems, as well as advancements in powder metallurgy and casting processes. Expansion is supported by increased R&D activity and government incentives, especially in emerging regions building advanced manufacturing capacities. As more manufacturers adopt MMCs for structural and thermal applications, the market’s appeal broadens, paving the way for new material systems, process optimization, and industrial scaling in both mature and developing economies.

In 2024, the global metal matrix composites (MMC) market was led by aluminum-based MMCs, which held a dominant 44.9% share due to their lightweight, high-strength properties and growing use in automotive, aerospace, and electronics applications. By reinforcement type, discontinuous reinforcements captured 51.4% of the market, favored for their cost-efficiency, ease of processing, and compatibility with mass-production methods like casting and powder metallurgy.

Silicon carbide emerged as the leading reinforcement material with a 45.6% share, driven by its superior hardness, thermal stability, and effectiveness in enhancing wear resistance and dimensional performance. The automotive and transportation sector led end-use applications, accounting for 44.3% of market share, as manufacturers increasingly rely on MMCs for lightweight, fuel-efficient components in both traditional and electric vehicles.

How Growth is Impacting the Economy

The rising demand for metal matrix composites is contributing to economic advancement across multiple industrial segments. Increased adoption in automotive and aerospace manufacturing is creating new job opportunities in advanced materials processing, machining, and component design. The expansion of Metal Matrix Composites supports the development of lightweight vehicles, reducing fuel consumption and emissions, which in turn drives cost savings across transportation networks. As OEMs invest in materials that improve thermal management and mechanical endurance, demand for skilled labor, high-performance ceramics, and precision casting increases.

Moreover, investments in R&D and specialized machinery for Metal Matrix Composites production stimulate regional manufacturing ecosystems and technology transfer. Export markets for Metal Matrix Composites are expanding, particularly in Asia-Pacific and North America, encouraging bilateral trade of high-tech components. Governments and private stakeholders are allocating resources toward lightweight material innovation, which aligns with global sustainability goals and promotes industrial competitiveness. Overall, Metal Matrix Composites growth is reinforcing economic diversification, innovation capacity, and clean manufacturing practices.

Businesses in the Metal Matrix Composites sector should focus on optimizing production methods such as powder metallurgy, squeeze casting, and additive manufacturing to reduce costs and improve scalability. Diversifying material offerings—especially with silicon carbide and alumina reinforcements—can address industry-specific performance demands. Collaborating with automotive and aerospace OEMs for customized applications will help drive adoption.

Investments in recycling and sustainable sourcing of reinforcement materials can enhance environmental compliance and appeal to eco-conscious clients. Additionally, expanding technical capabilities and certifications will build trust in high-precision sectors like defense and electronics. Market penetration in emerging economies should also be prioritized through strategic alliances and regional manufacturing hubs.

Key Takeaways

- Metal Matrix Composites Market size is expected to be worth around USD 1124.9 Million by 2034, from USD 525.9 Million in 2024, growing at a CAGR of 7.9%.

- Aluminum MMC held a dominant market position, capturing more than a 44.9% share in the global metal matrix composites market.

- Discontinuous held a dominant market position, capturing more than a 51.4% share in the global metal matrix composites market.

- Silicon Carbide held a dominant market position, capturing more than a 45.6% share in the metal matrix composites market.

- Automotive & Transportation held a dominant market position, capturing more than a 44.3% share in the global metal matrix composites market.

- North America led the global Metal Matrix Composites (MMC) market, capturing a substantial 42.9% share, equivalent to approximately USD 225.6 million.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/metal-matrix-composites-market/free-sample/

Experts Review

The present landscape of the Metal Matrix Composites market shows strong momentum, supported by increasing material performance requirements across mobility, defense, and thermal management systems. Analysts view the shift toward electric vehicles, lightweight aircraft, and compact electronics as key demand drivers.

Aluminum Metal Matrix Composites and silicon carbide reinforcements are expected to lead product innovation due to their favorable mechanical and thermal properties. In the future, adoption will accelerate as industries seek substitutes for heavier alloys, aiming to meet sustainability and fuel efficiency targets. With rising investments in R&D and manufacturing scale-up, the market is well-positioned for continued growth and application diversification through 2034.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=151023

Key Market Segments

By Matrix Type

- Aluminum MMC

- Copper MMC

- Magnesium MMC

- Super Alloys MMC

- Others

By Reinforcement Type

- Continuous

- Discontinuous

- Particles

By Reinforcement Material

- Alumina

- Silicon Carbide

- Carbon Fiber

- Others

By End-Use

- Automotive & Transportation

- Aerospace & Defense

- Electrical & Electronics

- Others

Regional Analysis

In 2024, North America held a leading position in the global Metal Matrix Composites (MMC) market, accounting for 42.9% of the total share, valued at approximately USD 225.6 million. This dominance is mainly driven by robust demand from the aerospace, automotive, and electronics sectors across the United States and Canada. MMCs are widely used in critical aerospace components such as aircraft brakes, landing gear, and spacecraft parts, while in the automotive industry, their application in brake rotors, pistons, and lightweight EV structures continues to expand in response to the growing push for vehicle efficiency and performance.

Top Use Cases

- Automotive Brake Rotors & Powertrain Components: Aluminum MMCs reinforced with silicon carbide are used in brake rotors, driveshafts, pistons, and cylinder liners to reduce weight, improve wear resistance, and enhance thermal performance. These benefits support fuel efficiency and longer component life in both combustion engine and electric vehicles.

- Aerospace Structural & Engine Parts: MMCs are employed in aerospace for critical applications like landing gear, engine components, and structural mounts. Their high strength-to-weight ratio, thermal stability, and resistance to corrosion and fatigue make them ideal for harsh flight environments, contributing to lighter, more efficient aircraft with improved fuel efficiency.

- Electronic Thermal Management & Substrates: Alloys like AlSiC are used as heat sinks and substrate materials in high-power electronic devices, power modules, and semiconductor packages. Their excellent thermal conductivity and controlled expansion enable efficient heat dissipation and reliability in advanced electronics like automotive power electronics and telecommunications.

- High-Performance Cutting Tools & Machine Parts: Tungsten carbide MMCs and cobalt matrix composites are utilized in cutting tools, wear plates, and high-speed machinery parts. They provide exceptional hardness, wear resistance, and strength under thermal and mechanical stress, extending tool life and maintaining precision in industrial settings.

- Defense, Missiles & Space Systems: MMCs reinforced with ceramics are used in military-grade armor, missile systems, and spacecraft components requiring high performance under extreme conditions. These composites offer tailored stiffness, temperature resistance, and durability—essential for mission-critical defense and space applications.

Recent Developments

3M has deepened its innovation in MMCs through a strategic partnership with Alvant, leveraging Alvant’s Advanced Liquid Pressure Forming (ALPF) technology along with 3M’s advanced materials to produce lightweight, high-performance MMC components. The collaboration aims to enhance applications in electric machines, motors, and generators, focusing on recyclability and cost efficiency—paving the way for broader adoption of MMCs in sustainable industrial systems.

ADMA Products Inc. continues to refine its titanium-based MMCs through powder metallurgy, embedding ceramic reinforcements such as TiC, SiC, and TiB within Ti‑6Al‑4V alloys. These advanced composites deliver enhanced stiffness, wear resistance, creep strength, and work-hardening performance, supporting cost-effective production of high-performance components for aerospace, defense, and medical use.

Ceram Tec has improved its ceramic-reinforced MMC manufacturing via proprietary cost-control techniques. The company now offers lightweight MMC components produced more economically and with faster machining—targeting automotive, e-mobility, electronics, and industrial markets. This enhancement reinforces Ceram Tec’s leadership in high-performance MMC solutions.

CPS Technologies has earned two notable SBIR contracts in 2024–25. First, it received U.S. Army funding to develop tungsten-alloy MMCs via binder-jet additive manufacturing—potentially substituting depleted uranium in munitions. It also secured a U.S. DOE Phase II award to scale modular radiation shielding MMC designs. A new supply contract valued at $13.3 million further supports commercial expansion of its AlSiC composite products.

Denka continues to grow its aluminum-SiC composite line with DENKA ALSINK—known for low thermal expansion and high conductivity—making it a strong alternative to copper and ceramics in semiconductor, optical, and electronic packaging applications. The product is gaining traction in high-tech material sectors.

Materion remains listed among major MMC manufacturers. However, no new MMC product releases or strategic updates were found on its site or in public records. The company’s presence in the MMC sector is confirmed, yet without recent developments.

Plansee Group reinforced its market position by acquiring Mi‑Tech Tungsten Metals in 2022. While this broadens its MMC expertise across refractory metals, no specific MMC updates were found in its recent announcements beyond its established product scope.

Conclusion

The global metal matrix composites market is expanding steadily, fueled by the rising need for high-performance, lightweight materials in critical industries. With strong adoption across automotive, aerospace, and electronics, metal matrix composites are transforming modern manufacturing by enhancing product efficiency, durability, and thermal management.

Businesses that innovate in processing technologies and align with sustainability trends will capture long-term value. As demand rises and regional capabilities grow, metal matrix composites are set to play a vital role in the future of advanced industrial materials.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)