Table of Contents

Overview

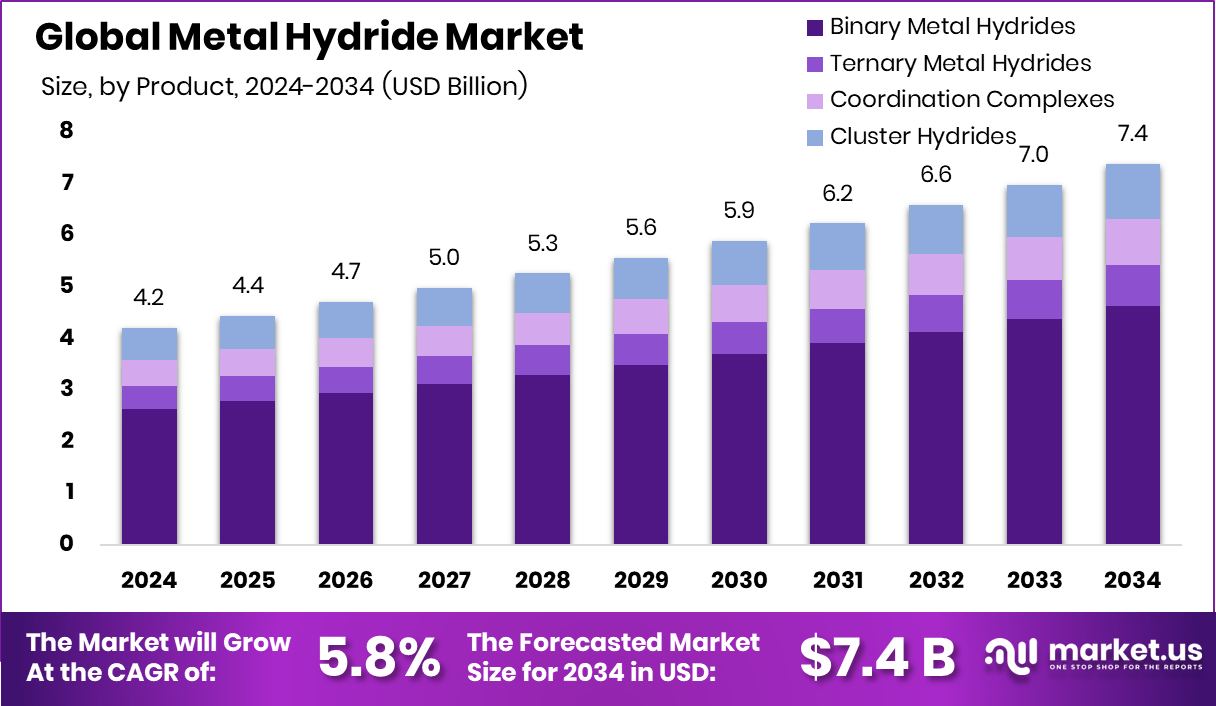

New York, NY – August 22, 2025 – The Global Metal Hydride Market was valued at USD 4.2 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2025 to 2034, reaching approximately USD 7.4 billion by 2034. This growth is driven by the increasing adoption of hydrogen as a clean energy source across various sectors, with metal hydrides playing a critical role in addressing energy storage challenges.

Metal hydrides are compounds formed when hydrogen bonds with a metal or alloy, enabling solid-state hydrogen storage. In this process, hydrogen atoms are absorbed into the metal’s structure, creating a new compound. This makes metal hydrides a promising solution for energy and industrial applications, as hydrogen offers a nearly emission-free pathway for power generation and fuel. Sectors such as heavy industry, long-distance transport, and energy storage are increasingly leveraging hydrogen to support the transition to cleaner energy systems.

Despite their potential, metal hydrides face significant challenges, including high costs, slow hydrogen absorption and release kinetics, and sensitivity to impurities like oxygen and water. In 2023, their adoption in emerging applications critical to the clean energy transition accounted for less than 1% of global hydrogen demand, even though demand grew by 40% compared. These limitations highlight the need for advancements to enhance their efficiency and affordability.

According to the International Energy Agency (IEA), global hydrogen demand reached over 97 million tonnes (Mt) in 2023 and approached 100 Mt in 2024. Renewable hydrogen demand is expected to significantly increase, reaching up to 16 petajoules (PJ) in Europe, 29 PJ in the United States, 36 PJ in China, and 22 PJ in the rest of the world. This rising demand for renewable hydrogen is a key driver for the growth of the metal hydride market, as it supports applications in energy storage and clean fuel solutions.

Key Takeaways

- The global metal hydrides market was valued at USD 4.2 billion in 2024.

- The global metal hydrides market is projected to grow at a CAGR of 5.8% and is estimated to reach USD 7.4 billion by 2034.

- In the product segment, binary metal hydrides dominate the market with around 62.7% of the total market share.

- Among the applications, metal hydrides used for hydrogen storage held the majority of revenue share in 2024 at 44.6%.

- Based on industries, the metal hydride market was led by the energy industry with a substantial market share of 41.6% in 2024.

- In 2024, the Asia Pacific was the biggest market of metal hydrides, constituting around 32.4% of the total market share, valued at approximately US$1.36 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/metal-hydride-market/request-sample/

Report Scope

| Market Value (2024) | USD 4.2 Billion |

| Forecast Revenue (2034) | USD 7.4 Billion |

| CAGR (2025-2034) | 5.8% |

| Segments Covered | By Product Type (Binary Metal Hydrides, Ternary Metal Hydrides, Coordination Complexes, Cluster Hydrides), By Applications (Hydrogen Storage, Hydrogen Compressors, Heat Pumps, Heat Storage, Batteries, Thermoboosters, Other Applications), By End-Use Industry (Energy, Automotive, Aerospace, Other Industries) |

| Competitive Landscape | American Elements, Albemarle Corporation, Ganfeng Lithium Group Co., Ltd., Santa Cruz Biotechnology Inc., Vizag Chemical, Nippon Denko Co., Ltd., Tokuyama Corporation, Triveni Chemicals, Other Key Players. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=155006

Key Market Segments

Product Type Analysis

The metal hydride market is segmented into binary metal hydrides, ternary metal hydrides, coordination complexes, and cluster hydrides. In 2024, binary metal hydrides dominated, capturing over 62% of the global market, valued at USD 2.6 billion. Their preference stems from simpler structures, ease of synthesis, and high hydrogen storage capacity. While complex hydrides like borohydrides offer higher storage potential, binary hydrides, such as magnesium and lanthanum-based compounds, provide a balanced mix of properties.

Application Analysis

The market is divided by application into hydrogen storage, hydrogen compressors, heat pumps, heat storage, batteries, thermoboosters, and others. In 2024, hydrogen storage held the largest share at 41.6%. Metal hydrides provide a safer alternative to high-pressure gas or cryogenic liquid storage. Despite potential in other applications, technical and economic challenges limit broader adoption.

End-Use Industry Analysis

The market is segmented by end-use industry into energy, automotive, aerospace, and others. In 2024, the energy sector led with a 46.4% share. Metal hydrides’ low gravimetric hydrogen density and high costs limit their use in automotive and aerospace sectors, where weight and cost are critical. However, their suitability for long-term storage makes them ideal for energy sector applications, such as grid energy storage, backup systems, and heat pumps, where weight constraints are less stringent.

Regional Analysis

In 2024, the Asia Pacific region led the global metal hydride market with a 32.4% share, valued at approximately USD 1.3 billion. This dominance is driven by strong government support, ambitious hydrogen roadmaps, and significant investments in clean energy infrastructure. China is the largest market in the region, supported by numerous projects and technological advancements.

Japan and South Korea are also key players, with major demonstration projects and government initiatives like Japan’s supply-side subsidy and South Korea’s clean hydrogen power auction system, aimed at bridging the cost gap between low-carbon hydrogen and fossil fuels. Companies like Nippon Denko and Tokuyama Corporation further drive market growth through research and development in metal hydrides.

Top Use Cases

- Hydrogen Storage for Fuel Cells: Metal hydrides store hydrogen safely at low pressures, making them ideal for fuel cell vehicles and portable power systems. They release hydrogen when heated, offering high volumetric density. Their compact nature suits small-scale applications, but weight limits broader automotive use.

- Thermal Energy Storage: Metal hydrides absorb and release heat during hydrogen uptake and release, perfect for thermal storage in renewable energy systems. They support solar plants by storing heat for nighttime use, enhancing efficiency in grid storage and industrial applications.

- Hydrogen Purification: Metal hydrides purify hydrogen by selectively absorbing it from gas mixtures. Used in industries like automotive, they offer low energy use and high extraction rates. Cooling systems improve their efficiency, making them a safe, simple solution for clean hydrogen production.

- Nickel-Metal Hydride Batteries: Metal hydrides power NiMH batteries in electronics and hybrid vehicles. They provide higher energy density than other nickel-based batteries but face competition from lighter lithium-ion batteries. Their durability and safety make them viable for specific high-demand applications.

- Hydrogen Compressors: Metal hydrides compress hydrogen by absorbing it at low pressure and releasing it at higher pressure when heated. This technology supports industrial gas supply with lower energy costs compared to mechanical compressors, ideal for stationary hydrogen systems.

Recent Developments

1. American Elements

American Elements has expanded its portfolio of advanced hydrogen storage materials, including complex metal hydrides like sodium borohydride and magnesium hydride, targeting next-generation clean energy systems. They focus on supplying R&D quantities and custom-engineered materials with high purity for aerospace and alternative fuel R&D, emphasizing their role in solid-state hydrogen storage solutions for a sustainable energy future.

2. Albemarle Corporation

While a lithium leader, Albemarle’s developments in metal hydrides are linked to lithium-ion battery innovation. Their advanced lithium compounds, like lithium borohydride, are crucial for enhancing solid-state electrolytes. This research is pivotal for increasing energy density and safety in batteries, indirectly advancing metal hydride applications in energy storage. Their focus remains on electrification and next-generation battery materials.

3. Ganfeng Lithium Group Co., Ltd.

Ganfeng Lithium is heavily investing in solid-state battery technology, where metal hydrides play a critical role. Their R&D focuses on new anode materials, including lithium hydride composites and complex hydrides, to improve battery performance and safety. This development is key to their strategy of leading next-generation energy storage solutions and expanding beyond raw materials into advanced battery components.

4. Santa Cruz Biotechnology Inc.

Santa Cruz Biotechnology (SCBT) supplies a diverse catalog of research-grade metal hydrides, such as sodium hydride and calcium hydride, primarily for chemical synthesis and pharmaceutical research. Their recent developments focus on maintaining a vast inventory of high-purity reagents to support ongoing academic and industrial R&D in catalysis and hydrogenation processes, rather than pioneering new energy storage applications.

5. Vizag Chemical

Vizag Chemical is a key global supplier of industrial-grade metal hydrides, including magnesium and sodium hydride. Their recent developments focus on scaling production and ensuring a reliable supply chain for sectors like metallurgy, chemical processing, and glass manufacturing. They emphasize high-volume distribution and competitive pricing, serving the traditional industrial market rather than cutting-edge energy R&D.

Conclusion

Metal Hydrides are versatile, offering safe, efficient solutions for hydrogen storage, thermal management, purification, batteries, and compression. Their high volumetric density and safety advantages drive adoption in energy and industrial sectors. However, challenges like weight, cost, and slow kinetics limit broader use, particularly in mobile applications. Ongoing research aims to enhance performance, boosting market potential.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)