Table of Contents

Overview

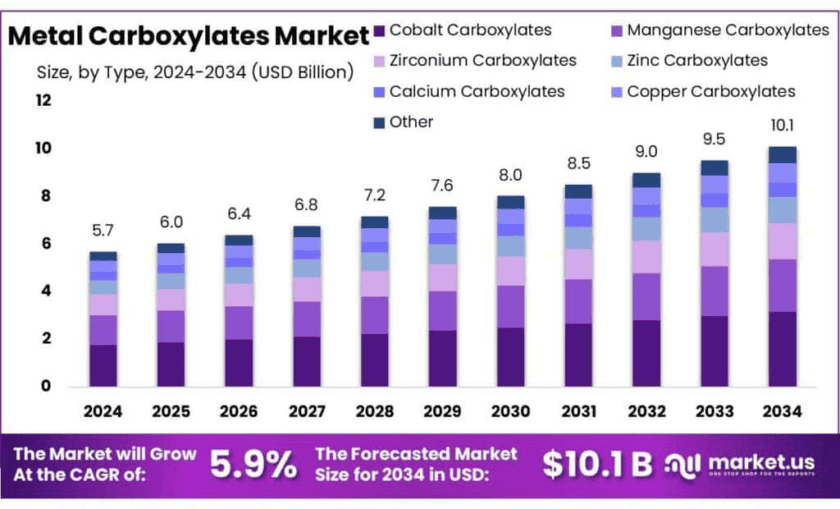

New York, NY – Nov 03, 2025 – The global Metal Carboxylates Market is projected to reach USD 10.1 billion by 2034, rising from USD 5.7 billion in 2024 at a CAGR of 5.9% (2025–2034). In 2024, the Asia Pacific region dominated the market, capturing over 43.8% share, equivalent to USD 2.4 billion in revenue.

Metal carboxylates—chemical compounds formed through reactions between metal ions and carboxylic acids—are widely used as catalysts, stabilizers, lubricants, and driers in industries such as coatings, paints, polymers, and chemical synthesis. Their strong solubility in organic solvents, excellent thermal stability, and high catalytic activity make them indispensable in polymerization, oxidation, and curing processes.

These compounds operate within mature downstream markets, including paints & coatings, printing inks, and specialty polymers—sectors that closely mirror global manufacturing and chemical industry trends. The global chemical industry generated about €5,195 billion in sales in 2023, indicating a massive demand base for additives like metal carboxylates.

In the United States, chemical shipments totaled approximately USD 639 billion in 2022, with the sector employing around 529,000 workers, demonstrating its vast economic influence and the downstream opportunities available for specialty additive manufacturers. Even a 0.1–0.5% increase in additive penetration across coatings and inks could yield substantial incremental revenue for metal carboxylate producers, given the scale of the global chemical economy.

Key Takeaways

- Metal Carboxylates Market size is expected to be worth around USD 10.1 Billion by 2034, from USD 5.7 Billion in 2024, growing at a CAGR of 5.9%.

- Cobalt Carboxylates held a dominant market position, capturing more than 31.2% of the total Metal Carboxylates market share.

- Driers and Catalysts held a dominant market position, capturing more than 62.7% of the total Metal Carboxylates market share.

- Catalysts held a dominant market position, capturing more than 46.9% of the total Metal Carboxylates market share.

- Asia Pacific is poised to dominate the global Metal Carboxylates market, capturing a significant share of 43.80%, valued at approximately USD 2.4 billion.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-metal-carboxylates-market/free-sample/

Report Scope

| Market Value (2024) | USD 5.7 Bn |

| Forecast Revenue (2034) | USD 10.1 Bn |

| CAGR (2025-2034) | 5.9% |

| Segments Covered | By Metal Type (Cobalt Carboxylates, Manganese Carboxylates, Zirconium Carboxylates, Zinc Carboxylates, Calcium Carboxylates, Copper Carboxylates, Other), By Function (Driers and Catalysts, Lubricants and Stabilizers, Corrosion Inhibitors, Others), By End-use (Catalysts, Lubricant Additives, Driers, Plastic Stabilizers, Polyester Accelerators, Fuel Additives, Others) |

| Competitive Landscape | BASF SE, Dow, Arkema Group, PMC Group, Inc., Valtris Specialty Chemicals, DIC Corporation, Ege Kimya San. ve Tic. A.S, Borchars, Umicore, NICHIA CORPORATION |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=159046

Key Market Segments

By Metal Type Analysis: In 2024, Cobalt Carboxylates emerged as the leading segment, commanding over 31.2% of the global Metal Carboxylates market share. Their dominance stems from their extensive use across coatings, catalysts, and drying agent applications, where they enhance performance and stability. The demand for cobalt-based formulations continues to rise, supported by expanding industrial and automotive coating sectors. As industries increasingly focus on durability and efficiency, cobalt carboxylates are expected to remain the preferred choice. Moving into 2025, the segment is projected to maintain steady growth, further reinforcing its role in advanced coating and catalytic technologies.

By Function Analysis: In 2024, the Driers and Catalysts segment led the market with a commanding 62.7% share. This dominance is linked to their indispensable function in coatings, paints, and inks, where they accelerate curing processes and improve overall product performance. The rise in demand for high-quality and fast-curing coatings within automotive, construction, and packaging industries has significantly boosted their usage. With the ongoing evolution of manufacturing technologies, the need for efficient drying and catalytic systems is expected to stay strong. The segment’s robust outlook for 2025 highlights its crucial role in ensuring enhanced coating performance and process efficiency.

By End-use Analysis: In 2024, the Catalysts segment dominated the Metal Carboxylates market, capturing more than 46.9% share. This leadership is attributed to their vital role in chemical, automotive, and petrochemical industries, where they drive reaction efficiency and yield optimization. The global transition towards sustainable and energy-efficient production has amplified the demand for metal-based catalysts. As industries invest in green chemistry and cleaner manufacturing technologies, metal carboxylates are expected to play an even more significant role. Entering 2025, the segment is poised for continued expansion, strengthening its position as a core enabler of sustainable industrial processes.

List of Segments

By Metal Type

- Cobalt Carboxylates

- Manganese Carboxylates

- Zirconium Carboxylates

- Zinc Carboxylates

- Calcium Carboxylates

- Copper Carboxylates

- Other

By Function

- Driers and Catalysts

- Lubricants and Stabilizers

- Corrosion Inhibitors

- Others

By End-use

- Catalysts

- Lubricant Additives

- Driers

- Plastic Stabilizers

- Polyester Accelerators

- Fuel Additives

- Others

Regional Analysis

Asia-Pacific Dominates the Cotton Yarn Market with 43.8% Share in 2024

In 2024, the Asia Pacific region is set to dominate the global Metal Carboxylates market, accounting for a substantial 43.8% share, valued at around USD 2.4 billion. This dominance is fueled by rapid industrialization, expanding manufacturing activities, and rising demand for advanced materials across key sectors such as automotive, coatings, and agriculture. Major economies like China, India, and Southeast Asian nations serve as the primary growth engines, with China emerging as the largest consumer of metal carboxylates, particularly for automotive coatings and industrial formulations.

The regional market’s expansion is further supported by stringent environmental policies promoting sustainable and high-performance materials. Japan and South Korea are witnessing increased utilization of high-grade metal carboxylates in automotive and aerospace applications, aligning with government programs focused on emission reduction and energy efficiency.

According to the Food and Agriculture Organization (FAO), Asia’s agricultural industry is projected to grow at a CAGR of 5.2%, highlighting the integral role of metal carboxylates in enhancing crop yield, soil fertility, and overall agricultural productivity.

Top Use Cases

Paints And Printing Inks: oxidative driers: Metal carboxylates of cobalt, manganese, zirconium, calcium, aluminum and others catalyze autoxidation in alkyd and drying-oil systems, cutting tack-free and through-dry times. Cobalt carboxylates are historically the most effective primary driers, while zirconium/aluminum salts act as through-driers and calcium supports pigment wetting and hardness. Formulators increasingly explore cobalt-reduced systems (manganese/iron) for EH&S reasons. Practically, this chemistry underpins a very large installed base: the U.S. paint & coatings industry alone is a $26 billion sector employing ~300,000 workers—illustrating the scale where metal-carboxylate driers are applied.

Lubricating greases: soap (metal carboxylate) thickeners: Greases are structured by metal-soap lattices—most commonly lithium stearate/12-hydroxy stearate (metal carboxylates). NLGI’s global production survey shows conventional lithium-soap greases fell from 59% of world output (2020) to 39% (2023) as supply and cost pressures shifted mix toward other thickeners (e.g., calcium sulfonate, polyurea). Still, lithium soaps remain the single largest class, underscoring the central role of metal carboxylates as rheology modifiers.

PVC stabilization: calcium/zinc metal carboxylates: Calcium-zinc (Ca/Zn) carboxylate stabilizers have grown as Europe phases out legacy additives in PVC. This shift is tightly linked to recycling targets: VinylPlus verified 737,645 t of PVC waste recycled in 2023 (EU-27+UK+NO+CH), representing 24.3% of estimated PVC waste; the program explicitly notes regulatory impacts of legacy additives on recycling flows—driving demand for lead-free stabilizer systems such as Ca/Zn carboxylates.

Polyurethane & RTV silicone: organotin (stannous) carboxylate catalysts: Stannous 2-ethylhexanoate (stannous octoate, “T-9”)—a tin(II) carboxylate—is a workhorse gel catalyst for flexible foam, coatings, sealants, and RTV silicone cure. Technical data from Evonik (DABCO®/KOSMOS® lines) document its role and the industry trend to lower-emission alternatives with similar cure profiles. These catalysts govern cream time, rise, gel/urethane balance, and tack-free, enabling high-throughput PU manufacturing.

Polyester And polycondensation: metal-carboxylate/alkoxide esterification catalysts: Metal catalysts—often titanium, zirconium, tin—in carboxylate/alkoxide forms accelerate esterification/transesterification in PET, PCL and other polyesters, lifting rates and molecular weight at lower temperatures versus purely thermal routes. Reviews in Russian Chemical Reviews and ACS Omega highlight Group-4 metal systems; reference texts note “metal ion salts… and titanium/tin alkoxides” as effective catalysts—frequently formulated from metal carboxylate precursors.

Recent Developments

In 2023, BASF’s Surface Technologies segment—which covers coatings and catalyst-related additives—reported third-party sales of €16,204 million, down from €21,283 million in 2022. Within this, the Coatings division experienced a modest 3.9 % sales increase to €4,387 million, driven by higher volumes in automotive OEM coatings. BASF’s broader additives portfolio—such as for industrial coatings—supports performance materials, including metal-carboxylate-based solutions referenced in their “Additives for Industrial Coatings” offering.

In its 2023 financial year, Dow reported full-year net sales of US $44.6 billion, down from US $56.9 billion in 2022. Its “Performance Materials & Coatings” segment—responsible for coatings additives and performance monomers—logged Q1 2023 net sales of US $2.276 billion as demand in coatings and industrial applications softened. Dow’s strategic focus remains on additive technologies that support coatings performance, thereby intersecting with the metal carboxylates value chain, though explicit segmental revenue for carboxylates is not disclosed.

Arkema Group: In 2023, Arkema reported full-year sales of approximately €9.5 billion, with EBITDA of €1.501 billion and an EBITDA margin of about 15.8%. While the company doesn’t disclose carboxylate‐specific figures, its Coating Solutions and Performance Additives segments—key for additives like metal carboxylates—remain central to its strategy. Arkema is actively investing in high-performance materials and sustainable chemistries, positioning itself to capture growth in coatings, catalysts and advanced applications.

PMC Group, Inc.: PMC Group is a global specialty chemicals company, offering a broad portfolio—including metallic stearates, specialty esters and additives across coatings, lubricants and plastics—which overlaps with metal carboxylate applications. While exact metal carboxylate revenues are not publicly broken out, sources indicate the company generated around USD 1.2 billion revenue in 2023 and is increasing its focus on sustainable and advanced additive solutions.

Valtris Specialty Chemicals is a global producer of specialty additives and precursors which play a role in formulations for coatings, lubricants and plastics—areas where metal carboxylate‐type chemistry is relevant. While the company does not publicly break out dedicated “metal carboxylates” revenue, in FY 2024 its Indian subsidiary reported operating revenue in the range of ₹ 100 crore – ₹ 150 crore (approximately USD 12–18 million) with EBITDA up around 27% year-on-year.

DIC Corporation, headquartered in Japan, lists metal carboxylates as part of its “Functional Product” portfolio alongside sulfur chemicals and surfactants. For the fiscal year ended December 31, 2023, DIC reported net sales of ¥1,038.7 billion, down 1.5% versus the prior year, and operating income of ¥17.9 billion, a sharp 54.8% decrease.

Ege Kimya San. ve Tic. A.Ş.: Established in 1955 in Turkey, Ege Kimya specialises in intermediate chemicals including metal carboxylates, zinc oxide and silicates for sectors like paints, ceramics, rubber and plastics. The company emphasises R&D and sustainable production in its 120,000 m² Adapazarı facility. While specific 2023/2024 revenue data for metal carboxylates is not publicly broken out, Ege Kimya’s product portfolio clearly lists “Metal Carboxylates” for paint driers, polyurethane catalysts and resin accelerators.

In 2023, Umicore reported full-year revenues of €3.9 billion, down from €4.2 billion in 2022. Its “Metal Carboxylates & Organics” business line is embedded within its Specialty Materials operations, positioning Umicore as a supplier of solid and liquid metal carboxylates for coatings, alkyd resins and advanced materials. From a market-analyst viewpoint, this shows Umicore is leveraging its specialty chemicals platform to serve higher-value additive markets, although revenue specific to metal carboxylates isn’t separately disclosed.

Nichia Corporation’s 2023 revenue is estimated at approximately €3.38 billion, with a workforce of about 9,353 employees. The company’s chemical business segment—covering organometallic compounds and fine chemicals—overlaps with the metal carboxylates market, especially for specialty additive use-cases. As a market research analyst, I note that while Nichia is best known for LEDs and phosphors, its chemical division provides a complementary pathway into high-performance metal carboxylates, supporting diversification beyond its core optoelectronic business.

Conclusion

In conclusion, the global metal carboxylates market stands at a critical juncture of steady growth and evolving opportunity. For industry players and stakeholders, success will hinge on aligning with emerging applications (such as eco-friendly coatings, advanced lubricants, specialty polymers) and managing supply-chain pressures (raw-material volatility and environmental compliance). In short, while the market’s core applications remain mature, incremental advances in additive penetration and performance differentiation offer tangible growth upside in the coming decade.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)