Table of Contents

Overview

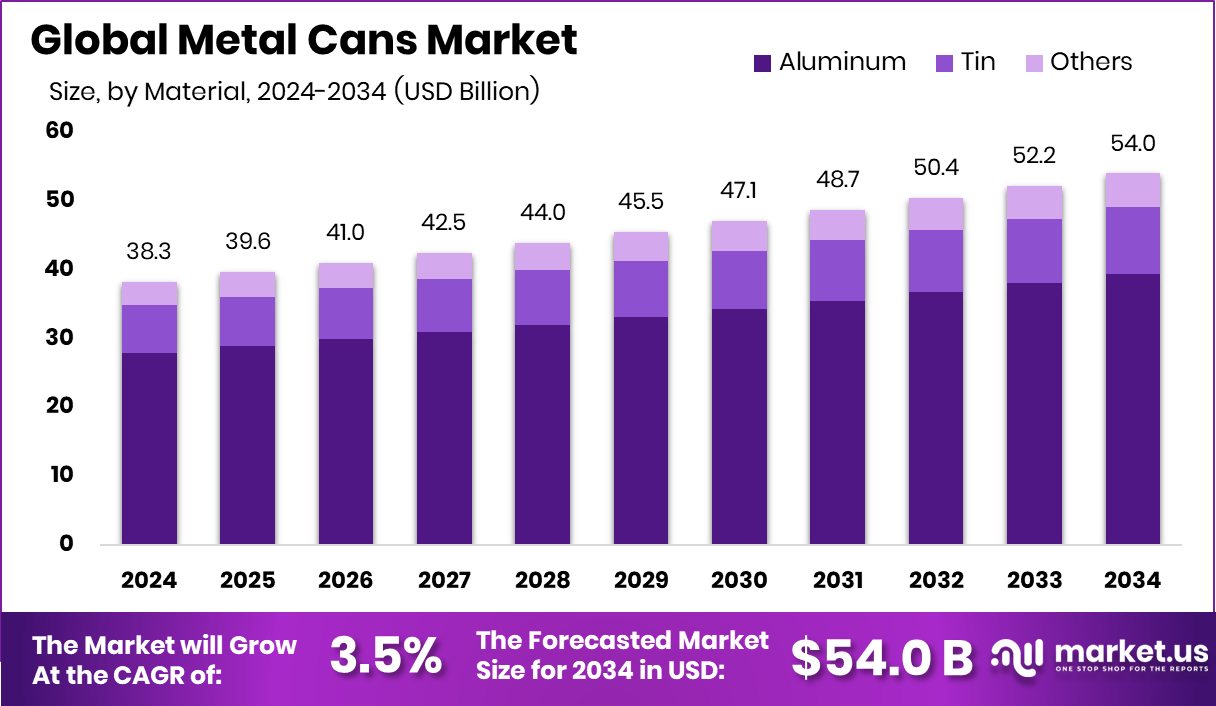

New York, NY – September 15, 2025 – The Global Metal Cans Market, valued at USD 38.3 billion in 2024, is projected to reach USD 54.0 billion by 2034, growing at a CAGR of 3.5% from 2025 to 2034. North America holds a 42.8% share, with a market value of USD 16.3 billion.

The metal cans market encompasses the global production, trade, and use of durable, recyclable containers made primarily from aluminum or steel, widely utilized for packaging food, beverages, paints, and chemicals. These cans are prized for their strength, airtight properties, and infinite recyclability, contributing to reduced environmental impact. Market growth is driven by increasing demand for ready-to-drink beverages, canned foods, and sustainable packaging solutions, fueled by urbanization, busy lifestyles, and the booming beverage sector, particularly energy drinks and carbonated sodas.

Innovations like lightweight designs and advanced printing enhance market appeal. Annually, 31 million aluminum cans are recycled through grants, underscoring the industry’s commitment to a circular economy. Major players, such as Tata Steel UK, are investing £7 million in AI-driven packaging research to boost efficiency and sustainability, while niche brands like Liquid Water raised $9 million to expand aluminum-canned water sales, catering to eco-conscious consumers.

Key Takeaways

- The Global Metal Cans Market is expected to be worth around USD 54.0 billion by 2034, up from USD 38.3 billion in 2024, and is projected to grow at a CAGR of 3.5% from 2025 to 2034.

- In the metal cans market, aluminum dominates with a 72.9% share due to its lightweight and recyclability.

- Two-piece drawn and ironed cans hold 58.1% market share, offering cost efficiency and strong structural integrity.

- Easy-open end (EOE) closures account for 67.6%, enhancing consumer convenience and driving widespread packaging adoption.

- Food and beverages lead applications with 84.2% share, fueled by growing demand for preserved and portable products.

- North America’s metal cans market reached 42.8%, USD 16.3 Bn.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-metal-cans-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 38.3 Billion |

| Forecast Revenue (2034) | USD 54.0 Billion |

| CAGR (2025-2034) | 3.5% |

| Segments Covered | By Material (Aluminum, Tin, Others), By Product (2- Piece Drawn and Ironed, 2- Piece Draw Redraw (DRD), 3- Piece), By Closure Type (Easy- Open End (EOE), Peel- off End (POE), Others), By Application (Food and beverages, Chemical, Others) |

| Competitive Landscape | Sonoco Products Company, Toyo Seikan Co., Ltd., Ball Corporation, Crown, CANPACK, Ardagh Group S.A., Hindustan Tin Works Ltd, Trivium Packaging, Silgan Containers, Ohio Art Metal Pack, LLC, Mauser Packaging Solutions |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=155331

Key Market Segments

By Material Analysis

Aluminum dominates with a 72.9% share in 2024

In 2024, aluminum accounted for 72.9% of the global metal cans market, reflecting its dominance as the preferred material. Its lightweight properties, resistance to corrosion, and exceptional recyclability make aluminum the go-to choice for food and beverage packaging. The material’s ability to form airtight seals ensures product freshness and taste, especially in carbonated drinks, energy beverages, and canned foods.

Recycling rates for aluminum exceed 65% in many regions, directly supporting global sustainability initiatives. Moreover, aluminum cans allow advanced printing and branding designs, helping manufacturers differentiate products in competitive retail markets. With technological advances in lightweight can production reducing costs while maintaining durability, aluminum is expected to retain its leadership, driven by strong demand across beverages and premium packaged foods.

By Product Analysis

2-Piece Drawn and Ironed design leads with 58.1% share

The 2-piece drawn and ironed (D&I) design held a commanding 58.1% share of the product segment in 2024. Known for its efficient production process, the format delivers seamless cans with uniform wall thickness and reduced material use, striking a balance between strength and lightness. This design is particularly valued in the high-volume beverage industry, especially for carbonated and energy drinks, where pressure resistance is critical.

Its smooth body also supports high-quality printing, enhancing branding and shelf appeal. Because it is well-suited to aluminum and fully recyclable, the 2-piece D&I format combines cost efficiency with sustainability, making it the first choice for large-scale beverage fillers globally. With rising demand for lightweight and visually attractive packaging, the segment is expected to maintain its market lead.

By Closure Type Analysis

Easy-open end closures command 67.6% share

In 2024, easy-open end (EOE) closures accounted for 67.6% of the closure type segment. EOE closures are favored for their convenience and safety, enabling consumers to access canned foods and drinks without additional tools, perfectly fitting today’s on-the-go lifestyles. They also ensure airtight protection, retaining product freshness and extending shelf life.

Their compatibility across various can sizes and adaptability to both aluminum and steel formats further reinforce their dominance. Advances in sealing technology and cost-efficient production have strengthened their appeal. As recycling goals align with consumer demand for functional, eco-friendly solutions, EOE closures are expected to sustain their leadership position across food and beverage packaging.

By Application Analysis

Food & Beverages drive 84.2% of demand

The food and beverages segment represented 84.2% of the market in 2024, underscoring its overwhelming reliance on metal cans. From carbonated soft drinks and energy beverages to canned fruits, soups, and meats, metal cans remain essential for preserving freshness, extending shelf life, and ensuring product safety. The airtight, contamination-resistant packaging allows both perishable and non-perishable products to travel globally while maintaining quality.

Rising urbanization, busier lifestyles, and demand for ready-to-eat meals and single-serve drinks are further fueling growth. The segment also benefits from consumer awareness of sustainability, as cans are fully recyclable. With strong demand in both developed and emerging economies, food and beverages are set to continue driving the bulk of metal can consumption.

Regional Analysis

North America leads with a 42.8% share, valued at USD 16.3 billion in 2024

North America emerged as the largest regional market in 2024, holding a 42.8% share worth USD 16.3 billion. The region’s dominance stems from high consumption of packaged beverages and canned foods, supported by advanced manufacturing facilities and robust recycling infrastructure. Stringent environmental regulations have accelerated the shift toward recyclable packaging, reinforcing aluminum and steel.

Europe follows closely, benefiting from strict sustainability policies and rising eco-conscious consumer demand, particularly in beverages and processed foods. Meanwhile, the Asia Pacific is experiencing rapid growth, propelled by urbanization, rising disposable incomes, and expanding retail distribution.

Latin America and the Middle East & Africa are gradually increasing adoption as consumption habits evolve. Across regions, sustainability initiatives, consumer demand for convenience, and innovations in lightweight manufacturing remain key growth drivers. North America, however, continues to set the global standard due to its strong consumer base and well-established recycling systems.

Top Use Cases

- Food Packaging: Metal cans are widely used to package food like vegetables, fruits, and ready-to-eat meals. They keep food fresh for a long time, are durable, and protect against contamination. Their recyclability makes them eco-friendly, appealing to consumers who prefer sustainable packaging options.

- Beverage Storage: Metal cans, especially aluminum, are popular for storing drinks like soda, beer, and energy drinks. They are lightweight, portable, and keep beverages fresh. Cans also allow for creative designs, making them attractive for branding and marketing purposes.

- Cosmetics and Personal Care: Metal cans are used for packaging cosmetics like deodorants, hairsprays, and shaving creams. They are sturdy, prevent leaks, and protect sensitive products from air and light. Their sleek design also enhances product appeal on store shelves.

- Paints and Chemicals: Metal cans are ideal for storing paints, varnishes, and chemicals due to their strength and resistance to corrosion. They ensure safe storage and transport, preventing leaks and maintaining product quality, which is crucial for industrial and household use.

- Pharmaceutical Packaging: Metal cans are used to package certain pharmaceuticals, like aerosol-based medicines or medical creams. They provide a sterile, secure environment, ensuring product safety and extending shelf life, which is essential for maintaining the effectiveness of medical products.

Recent Developments

1. Sonoco Products Company

Sonoco is expanding its sustainable metal packaging portfolio, focusing on aluminum beverage cans. A key development is the acquisition of Ball Corporation’s metal aerosol packaging business, significantly enhancing its personal care and food can production capabilities. This strategic move strengthens its position as a diversified global packaging provider.

2. Toyo Seikan Co., Ltd.

Toyo Seikan is innovating in ultra-lightweight and high-design steel cans to reduce environmental impact. A major focus is on developing specialized cans for the growing Ready-to-Drink (RTD) beverage market in Asia. The company also invests in advanced internal coatings to better preserve product taste and quality, meeting stringent consumer demands for performance and sustainability.

3. Ball Corporation

Ball is a leader in aluminum innovation, recently launching its lightweight, infinitely recyclable Alumi-Tek premium bottle. They are aggressively investing to expand beverage can production capacity in the UK and other global markets to meet soaring demand. Committed to circularity, their strategy emphasizes achieving 100% renewable electricity in their operations.

4. Crown Holdings, Inc.

Crown is driving innovation with its Peelfit end technology for easy-open food cans and the SuperEnd for beverage cans, using less material. They are executing a multi-year expansion plan, opening new beverage can manufacturing facilities in North America and Brazil to support growing customer demand for sustainable aluminum packaging.

5. CANPACK Group

CANPACK is significantly expanding its global footprint, with major new state-of-the-art aluminum beverage can production plants announced in the United States and Brazil. Part of the Giorgi Global Growth group, their strategy focuses on large-scale investments to increase capacity and serve multinational beverage brands, emphasizing advanced, efficient manufacturing technologies.

Conclusion

The Metal Cans Market is growing steadily due to rising demand for sustainable, durable, and recyclable packaging. With increasing consumer focus on eco-friendly solutions and the expansion of the food, beverage, and personal care industries, metal cans are becoming more popular. Innovations in lightweight designs and advanced printing technologies further boost their appeal, ensuring strong market growth.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)