Table of Contents

Overview

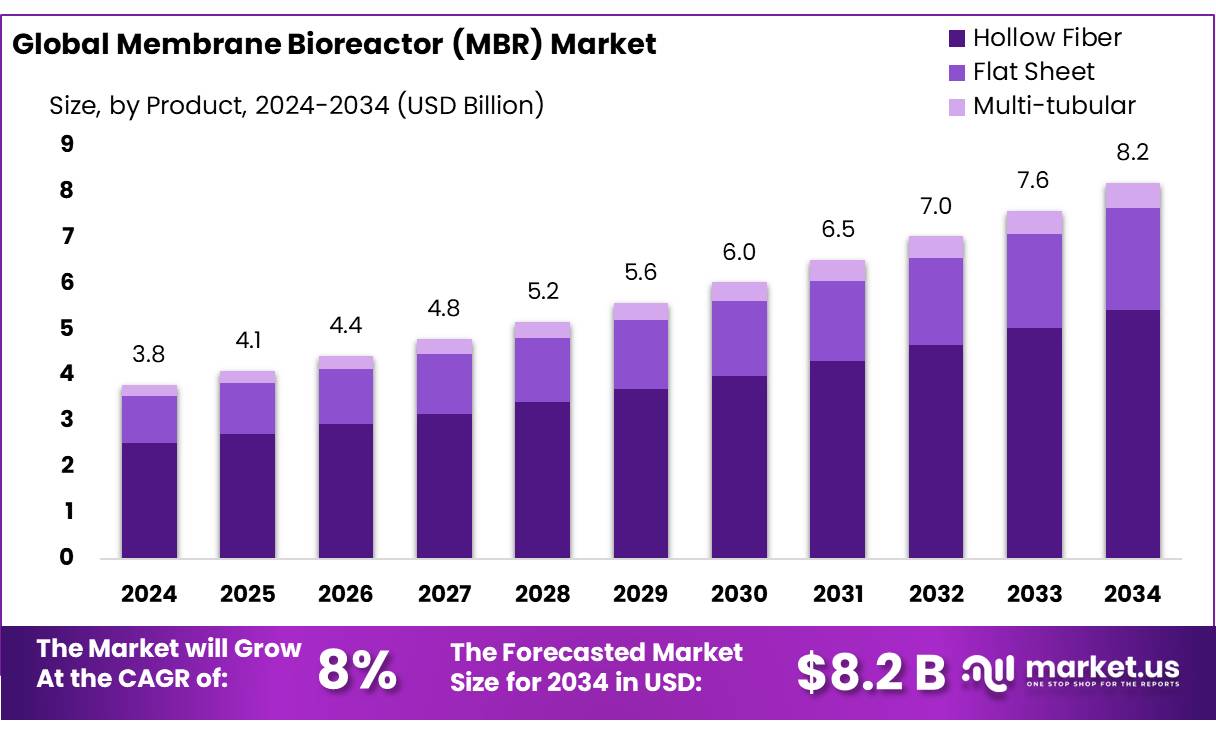

New York, NY – August 05, 2025 – The Global Membrane Bioreactor (MBR) Market is projected to grow from USD 3.8 billion in 2024 to USD 8.2 billion by 2034, with a CAGR of 8.0% during the 2025–2034 forecast period. In 2024, the Asia-Pacific region led the market, holding a 43.1% share and generating USD 1.6 billion in revenue.

MBR technology combines microfiltration or ultrafiltration with activated sludge processes, producing high-quality effluent and enabling compact wastewater treatment systems for municipal and industrial applications. Key drivers include stringent discharge regulations, rapid urbanization, and increasing water scarcity. For instance, the EU dedicates 0.8% of its energy consumption to wastewater treatment and plans to invest €90 billion to meet water and waste infrastructure needs for climate and energy goals.

Emerging opportunities lie in energy optimization and hybrid systems. Recent studies highlight MBR integration with forward osmosis, membrane distillation, and desalination, reducing energy use and improving permeate quality for wastewater reuse. Over 182 large-scale MBR systems, each treating over 5,000 m³/day, demonstrate the technology’s scalability for process water reuse and zero-liquid discharge.

Global regulatory support is strong. In India, the Delhi Jal Board’s 564 MLD sewage treatment plant, incorporating advanced MBR or similar membrane systems, is set to reduce untreated effluent in the Yamuna River. India’s 24×7 Water Supply guidelines further emphasize energy-efficient MBRs and improved sludge management. The EU’s €90 billion investment targets climate, energy, and circular economy objectives, reinforcing MBR adoption.

Key Takeaways

- Membrane Bioreactor (MBR) Market size is expected to be worth around USD 8.2 billion by 2034, from USD 3.8 billion in 2024, growing at a CAGR of 8.0%

- Hollow Fiber held a dominant market position, capturing more than a 66.2% share in the global Membrane Bioreactor (MBR) market.

- Submerged held a dominant market position, capturing more than a 67.9% share in the global Membrane Bioreactor (MBR) market.

- Industrial held a dominant market position, capturing more than a 58.5% share in the global Membrane Bioreactor (MBR) market.

- The Asia-Pacific (APAC) region emerged as the dominant force in the global Membrane Bioreactor (MBR) market, accounting for a commanding 43.1% share, equivalent to a market value of approximately USD 1.6 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-membrane-bioreactor-mbr-market/request-sample/

Report Scope

| Market Value (2024) | USD 3.8 Billion |

| Forecast Revenue (2034) | USD 8.2 Billion |

| CAGR (2025-2034) | 8.0% |

| Segments Covered | By Product (Hollow Fiber, Flat Sheet, Multi-tubular), By Configuration (Submerged, Side Stream), By Application (Industrial, Municipal, Others) |

| Competitive Landscape | General Electric, B&P Water Technologies S.r.l., CITIC Envirotech Ltd., MANN+HUMMEL Water & Fluid Solutions, Suez, Calgon Carbon Corporation, Veolia, Reynolds Culligan, Kemira, Buckman, Mitsubishi Chemical Corporation, Aquatech International LLC, Danaher Corporation, Toray Industries, Kubota Corporation |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153355

Key Market Segments

By Product Analysis

Hollow Fiber dominates with a 66.2% share in 2024, driven by its superior filtration efficiency and cost-effectiveness. Its high surface area-to-volume ratio enables efficient separation in compact systems, ideal for municipal and industrial wastewater treatment.

Hollow Fiber’s durability, ease of maintenance, and lower operational costs compared to other membrane types reinforce its market leadership. The modular design supports scalability, facilitating retrofits and capacity expansions in urban areas. With global water scarcity intensifying, demand for Hollow Fiber membranes is expected to remain robust, reflecting their balance of performance, affordability, and flexibility.

By Configuration Analysis

Submerged MBRs lead with a 67.9% share in 2024, attributed to their energy-efficient design and straightforward installation. By placing membranes directly in the bioreactor tank, Submerged MBRs eliminate high-pressure pumps, reducing costs and enhancing suitability for large-scale municipal projects.

Their compact footprint is ideal for space-constrained urban settings. As environmental regulations tighten and cities prioritize water recycling, demand for Submerged MBRs is projected to grow in 2025, driven by their cost-effectiveness, ease of integration, and ability to meet stringent water quality standards.

By Application Analysis

Industrial applications hold a 58.5% share in 2024, fueled by rising wastewater volumes from sectors like chemicals, pharmaceuticals, food processing, and textiles. Stricter global environmental regulations are pushing industries toward efficient treatment solutions like MBRs, which excel at handling high organic loads and ensuring consistent effluent quality.

Their compact design and minimal sludge production suit space-limited industrial facilities. In 2025, industrial MBR adoption is expected to increase as companies prioritize sustainable water reuse and compliance with environmental standards, addressing operational and regulatory demands.

Regional Analysis

In 2024, the Asia-Pacific (APAC) region led the global MBR market with a 43.1% share, valued at USD 1.6 billion. Rapid urbanization, population growth, industrial wastewater surges, and government investments in sustainable treatment infrastructure drive this dominance. China’s “Water Ten Plan” and ecological civilization policies enforce stringent wastewater standards, boosting MBR adoption in municipal and industrial settings.

India’s demand for modular MBR systems grows under initiatives like the Swachh Bharat Mission and Smart Cities Program, with the Ministry of Housing and Urban Affairs promoting energy-efficient wastewater solutions. Countries like Japan and South Korea also contribute significantly, addressing water scarcity and pollution through advanced MBR technologies.

Top Use Cases

- Municipal Wastewater Treatment: MBRs treat sewage from cities, producing clean water for reuse or safe discharge. Their compact design suits urban areas with limited space, and they remove contaminants like bacteria and solids effectively. High-quality effluent meets strict regulations, supporting water recycling for irrigation or industrial use, reducing strain on freshwater resources.

- Industrial Wastewater Management: MBRs handle tough wastewater from industries like food processing, pharmaceuticals, and chemicals. They efficiently remove high organic loads, ensuring compliance with environmental standards. Their ability to produce reusable water helps industries achieve zero-liquid discharge, saving costs and supporting sustainable operations in space-constrained facilities.

- Decentralized Wastewater Systems: MBRs are ideal for small communities, resorts, or remote facilities lacking access to large treatment plants. Their modular, compact design allows quick installation and operation. They deliver high-quality treated water for local reuse, like landscaping or flushing, reducing dependency on centralized infrastructure and ensuring regulatory compliance.

- Landfill Leachate Treatment: MBRs treat toxic leachate from landfills, removing harmful pollutants and producing safe effluent. Their robust filtration handles high-strength waste, preventing environmental contamination. The technology’s long solids retention time enhances treatment efficiency, making it a reliable choice for managing complex waste streams in landfill operations.

- Water Reuse and Recycling: MBRs produce crystal-clear, pathogen-free water suitable for non-potable reuse, such as irrigation, cooling, or toilet flushing. Their advanced filtration ensures high-quality effluent, supporting water-scarce regions. This reduces freshwater demand, promotes sustainability, and helps industries and municipalities meet stringent reuse standards while conserving resources.

Recent Developments

1. General Electric (GE Water)

GE Water (now part of SUEZ) has been advancing MBR systems with improved energy efficiency and smart monitoring. Their ZeeWeed MBR technology features enhanced fouling control and lower operational costs. Recent upgrades include IoT integration for real-time performance tracking. GE’s MBRs are widely used in municipal and industrial wastewater treatment.

2. B&P Water Technologies S.r.l.

B&P Water Technologies specializes in customized MBR solutions, focusing on compact and modular systems for industrial applications. Their recent developments include hybrid MBR-RO systems for water reuse and advanced membrane materials for longer lifespan. The company emphasizes cost-effective, high-performance solutions for small to medium-scale plants.

3. CITIC Envirotech Ltd.

CITIC Envirotech has expanded its MBR offerings with large-scale municipal projects in Asia. Their MEMBRIGHT MBR technology integrates low-energy membranes and automated controls. Recent projects include wastewater reuse plants in China, emphasizing sustainability and reduced carbon footprint.

4. MANN+HUMMEL Water & Fluid Solutions

MANN+HUMMEL focuses on innovative membrane materials, including their Hollow Fiber MBR systems. Recent advancements include antifouling coatings and energy-efficient aeration designs. Their MBRs are tailored for industrial wastewater, particularly in the food & beverage and pharmaceutical sectors.

5. SUEZ

SUEZ (now incorporating GE Water) leads in large-scale MBR deployments. Their LEAPmbr system reduces energy and features advanced automation. Recent projects include smart water reuse plants in Europe and the Middle East, integrating AI for optimization.

Conclusion

Membrane Bioreactor (MBR) technology is a game-changer for wastewater treatment, offering compact, efficient, and sustainable solutions for municipal and industrial needs. Its ability to produce high-quality, reusable water supports water scarcity solutions and regulatory compliance. With growing urbanization and stricter environmental standards, MBR adoption is set to rise, driving innovation and cost optimization in the global wastewater treatment market.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)