Table of Contents

Overview

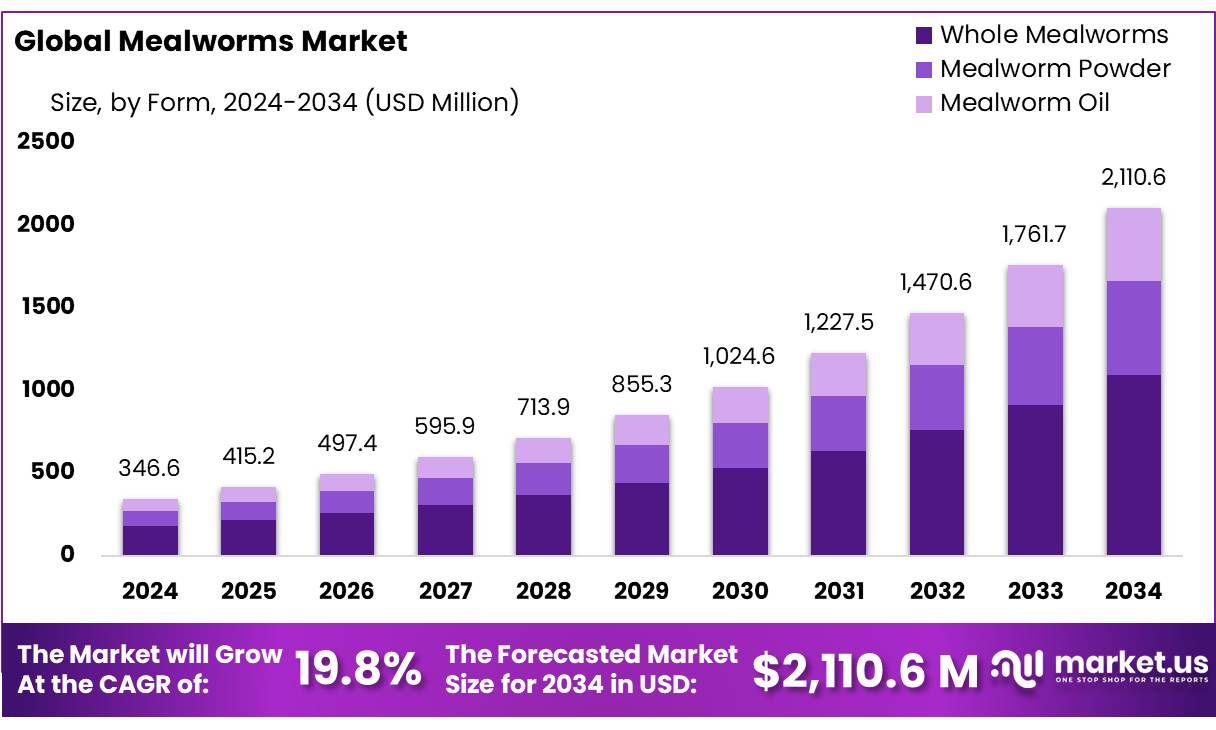

New York, NY – August 07, 2025 – The Global Mealworms Market is projected to grow from USD 346.6 million in 2024 to USD 2,110.6 million by 2034, with a CAGR of 19.8% from 2025 to 2034. In 2024, the Asia-Pacific region led the market, accounting for 47.3% of the share, equivalent to USD 163.9 million in revenue.

Mealworms, the larvae of Tenebrio molitor, are increasingly processed into concentrates like powders and protein extracts, serving as sustainable, high-value ingredients for food and feed industries. They contain 14–25g of protein per 100g of raw larvae and essential micronutrients, including potassium, iron, zinc, and oleic acids. The European Food Safety Authority (EFSA) and the EU Novel Food Regulation have approved mealworm larvae and derivatives as safe for human consumption, enabling their use in various food products.

The mealworm concentrate market is expanding rapidly due to advancements in farming technologies and rising demand for sustainable food sources. In the U.S., the National Science Foundation allocated a $2.2 million grant to establish the Center for Environmental Sustainability Through Insect Farming, which focuses on using insects like mealworms to address food shortages and promote sustainable agriculture.

Key drivers of the mealworm concentrate industry include the global push for sustainable food systems and the need to lower greenhouse gas emissions from traditional agriculture. Regulatory support is also pivotal, with the EU authorizing dried Tenebrio molitor larvae as a novel food and Singapore approving 16 insect species, including mealworms, for human consumption. Compared to traditional livestock, mealworm farming is more resource-efficient, requiring less land and water.

Producing one kilogram of fresh mealworms generates a Global Warming Potential (GWP) of 2.7 kg CO2-equivalent, primarily from feed grain production and energy use, while one kilogram of edible mealworm protein has a GWP of 14 kg CO2-equivalent, underscoring their efficiency in feed-to-protein conversion. Government initiatives further bolster the industry. The U.S. National Science Foundation’s $2.2 million grant to the Center for Environmental Sustainability Through Insect Farming supports research into mealworms and other insects as sustainable food and feed solutions to address global food security challenges.

Key Takeaways

- Mealworms Market size is expected to be worth around USD 2110.6 Million by 2034, from USD 346.6 Million in 2024, growing at a CAGR of 19.8%.

- Whole Mealworms held a dominant market position, capturing more than a 51.8% share of the global mealworms market.

- Animal Feed held a dominant market position, capturing more than a 44.1% share of the global mealworms market.

- The Asia-Pacific (APAC) region leads the global mealworms market, commanding a substantial 47.3% share, equating to approximately USD 163.9 million.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/mealworms-market/request-sample/

Report Scope

| Market Value (2024) | USD 346.6 Million |

| Forecast Revenue (2034) | USD 2110.6 Million |

| CAGR (2025-2034) | 19.8% |

| Segments Covered | By Product Type (Whole Mealworms, Mealworm Powder, Mealworm Oil), By Application (Animal Feed, Pet Food, Agriculture, Others) |

| Competitive Landscape | Ynsect, All Things Bugs, Aspire Food Group, Exo Terra, Protix, Tiny Farms, Hargol Food Tech, Entomo Farms, Better Origin, The Bug Farm |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153554

Key Market Segments

By Product Type Analysis

Whole Mealworms led the global mealworms market in 2024, securing a 51.8% share due to their growing popularity as a natural protein source. Their dominance stems from their high protein content, essential amino acids, and healthy fats, making them ideal for pet feed and animal nutrition.

Whole mealworms are favored by pet owners and small-scale farmers for their unprocessed form and ease of use, requiring minimal preparation. Their shelf stability and cost-effectiveness further enhance their appeal. As demand for sustainable, high-protein feed ingredients rises, whole mealworms are expected to maintain their market leadership.

By Application Analysis

In 2024, the Animal Feed segment held a leading 44.1% share of the global mealworms market, driven by the need for protein-rich, sustainable nutrition. Mealworms provide essential amino acids, vitamins, and healthy fats, making them a superior alternative to traditional feed sources like fishmeal and soybean meal.

Their high digestibility and low allergenic properties suit a wide range of animals, including poultry, aquaculture species, and pets. With increasing focus on sustainability, farmers and feed producers are adopting mealworms to reduce the environmental footprint of feed production. Supportive regulations in regions like Europe and North America, endorsing insect protein in animal feed, further boost this segment. The demand for eco-friendly protein sources is projected to keep Animal Feed.

Regional Analysis

The Asia-Pacific (APAC) region dominated the global mealworms market in 2024, holding a 47.3% share, equivalent to USD 163.9 million in revenue. This leadership is driven by the region’s entrenched entomophagy traditions, rapid urbanization, and growing awareness of sustainable protein sources.

Key countries like China, Thailand, and Vietnam lead in mealworm production, benefiting from advanced agricultural practices and favorable climates. China’s progress in insect farming technologies has enhanced its production capacity, while Thailand and Vietnam are scaling up operations for both domestic and export markets.

The region’s large livestock and aquaculture sectors fuel demand for mealworms as sustainable feed alternatives. Additionally, the rising popularity of plant-based and insect-based protein products among consumers supports market growth. Government initiatives, such as Thailand’s promotion of insect farming for food security and China’s investment in insect protein research, further drive the APAC market’s expansion.

Top Use Cases

- Animal Feed: Mealworms are a protein-rich, sustainable alternative to traditional animal feed like fishmeal or soybean meal. They provide essential nutrients for poultry, fish, and pets, supporting growth and health. Their low environmental impact and high digestibility make them ideal for eco-friendly farming, with growing adoption in the livestock and aquaculture industries.

- Human Consumption: Mealworms are processed into powders or snacks for human diets. Approved as safe by regulators like the EU, they’re used in protein bars, pastas, and baked goods. Their sustainability and nutritional value appeal to health-conscious and eco-friendly consumers.

- Pet Nutrition: Whole mealworms are popular in pet food for birds, reptiles, and small mammals due to their high protein and fat content. Their natural form and long shelf life make them convenient for pet owners. Demand is rising as sustainable pet food options gain traction.

- Insect Farming Technologies: Advanced mealworm farming uses automated systems to boost production efficiency. Innovations like climate-controlled facilities and optimized feed reduce costs and environmental impact. These technologies support large-scale production for food, feed, and waste management, driving market growth.

- Sustainable Protein Source: Mealworms require less land, water, and energy than traditional livestock, producing lower greenhouse gas emissions. With a Global Warming Potential of CO2-equivalent per kg, they’re an eco-friendly protein option, addressing global demand for sustainable food systems.

Recent Developments

1. Ÿnsect

- Ÿnsect has expanded its mealworm production with a new facility in the Netherlands, focusing on sustainable protein for pet food and aquaculture. The company also secured funding to scale operations globally. Ÿnsect’s mealworms are bred using vertical farming, reducing environmental impact. Their products include protein powders and oils.

2. All Things Bugs

- All Things Bugs continues to innovate in insect-based ingredients, focusing on mealworm protein for food and feed. The company has developed efficient processing methods to produce high-quality, defatted mealworm powder. Recent research highlights mealworms’ potential in addressing global protein shortages sustainably.

3. Aspire Food Group

- Aspire Food Group has automated its mealworm farming, increasing production efficiency. The company supplies mealworm protein for human food, including snacks and protein bars. Aspire also collaborates with food brands to integrate mealworm-based ingredients into mainstream products, promoting sustainable nutrition.

4. Exo Terra (Part of Protix)

- Exo Terra, now under Protix, focuses on sustainable insect farming, including mealworms for animal feed. Protix’s recent expansion includes a partnership with Tyson Foods to scale insect protein production, emphasizing mealworms’ role in reducing food waste and carbon emissions.

5. Protix

- Protix has opened the world’s largest insect protein facility in the Netherlands, producing mealworm-based feed for poultry and aquaculture. The company emphasizes a circular economy, using food waste to farm mealworms. Protix also launched a consumer brand, “Better Nature,” featuring mealworm protein products.

Conclusion

The Mealworm Market is booming due to their versatility as a sustainable protein source for animal feed, human food, pet nutrition, and more. With low environmental impact, supportive government policies, and innovations in farming, mealworms address global needs for eco-friendly nutrition. Their use in waste management and novel products further boosts their appeal, ensuring strong market growth.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)