Table of Contents

Overview

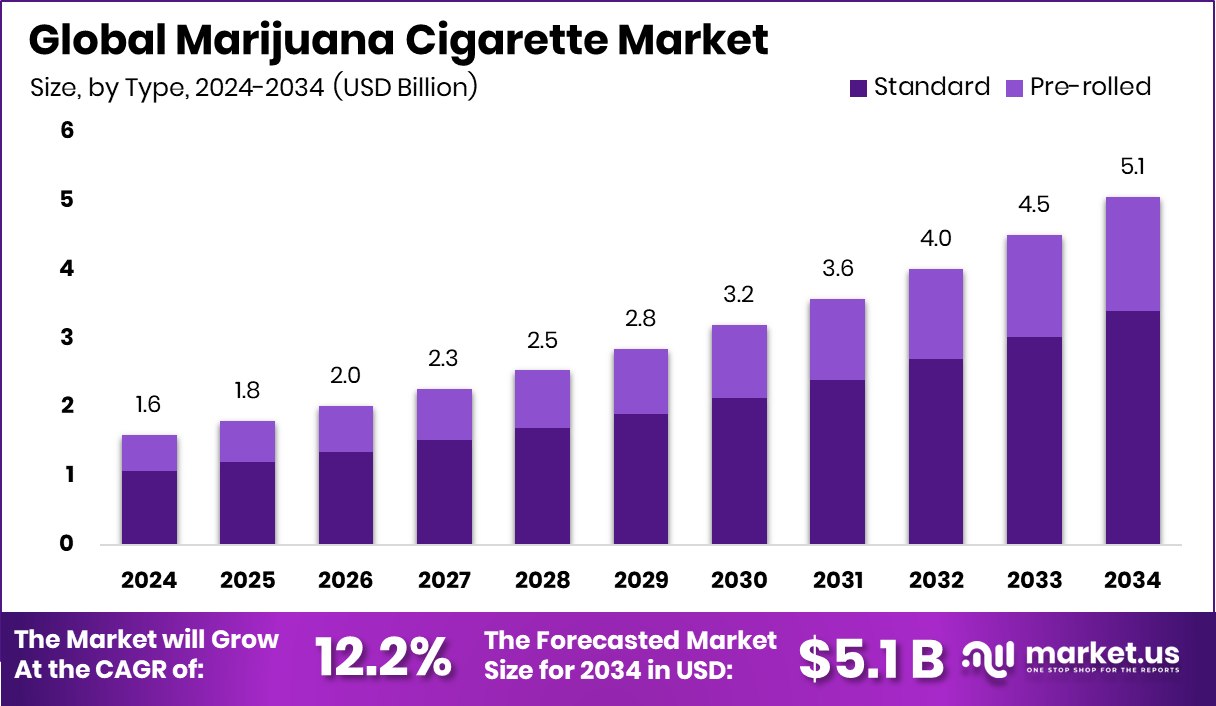

New York, NY – August 06, 2025 – The Global Marijuana Cigarette Market is projected to grow from USD 1.6 billion in 2024 to approximately USD 5.1 billion by 2034, achieving a CAGR of 12.2% from 2025 to 2034. North America holds a leading 41.7% share, valued at USD 0.6 billion in 2024.

A marijuana cigarette, often called a “joint,” consists of dried cannabis flowers and leaves rolled in paper, either hand-rolled or pre-rolled for convenience. Smoked for recreational or medicinal purposes, these cigarettes deliver psychoactive and therapeutic effects through compounds like THC and CBD.

The marijuana cigarette market encompasses the legal production, distribution, and sale of pre-rolled cannabis products, covering both medical and recreational segments based on regional laws. It includes various formats, such as hand-rolled joints, filtered pre-rolls, and infused variants.

Market growth is fueled by increasing cannabis legalization for medical and recreational use, expanding consumer access worldwide. Growing social acceptance and regulatory frameworks are shifting cannabis toward mainstream consumer goods. The demand for marijuana cigarettes is driven by their convenience and familiarity, offering a straightforward, equipment-free experience that appeals to new and casual users.

Key Takeaways

- The Global Marijuana Cigarette Market is expected to be worth around USD 5.1 billion by 2034, up from USD 1.6 billion in 2024, and is projected to grow at a CAGR of 12.2% from 2025 to 2034.

- Standard marijuana cigarettes dominate with 67.1% due to their widespread availability and user preference.

- Recreational use leads the marijuana cigarette market with 76.2% due to expanding legalization trends.

- Convenience stores account for 31.4% of sales due to accessibility and high consumer foot traffic.

- With a 41.7% share, North America leads in marijuana cigarette demand and consumption.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/marijuana-cigarette-market/request-sample/

Report Scope

| Market Value (2024) | USD 1.6 Billion |

| Forecast Revenue (2034) | USD 5.1 Billion |

| CAGR (2025-2034) | 12.2% |

| Segments Covered | By Type (Standard, Pre-rolled), By Application (Recreational, Medical Use), By Distribution Channel (Convenience Store, Supermarket, Online Sale, Others) |

| Competitive Landscape | Aphria, Aurora Cannabis, Canopy Growth, Cresco Labs, Cronos Group, Curaleaf, Green Thumb Industries, Harvest Health, MedMen, Sundial Growers, Tilray Inc., Trulieve |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153731

Key Market Segments

By Type Analysis

Standard marijuana cigarettes dominate the market, capturing a 67.1% share in 2024. Their popularity stems from consumer preference for familiar, ready-to-use cannabis products resembling traditional tobacco cigarettes. Valued for simplicity and ease of use, standard cigarettes appeal to recreational users and cannabis newcomers alike. As consumer trends favor convenient, discreet products, standard marijuana cigarettes maintain prominence in dispensaries and licensed retail, reinforcing their dominance in a diversifying market.

By Application Analysis

Recreational use commands a 76.2% share of the marijuana cigarette market in 2024, driven by growing legalization and societal acceptance of cannabis for personal and social enjoyment. Popular for their convenience and familiarity, marijuana cigarettes are a top choice for casual users and social settings like events and gatherings.

The segment’s dominance reflects robust sales volumes, supported by expanding retail infrastructure, including dispensaries and licensed outlets offering diverse standard cigarette options. This 76.2% share underscores cannabis’s shift toward a mainstream lifestyle choice, fueled by relaxed regulations and rising consumer interest in alternatives to alcohol and tobacco.

By Distribution Channel Analysis

Convenience stores hold a 31.4% share of the marijuana cigarette market in 2024, leading distribution channels due to their accessibility, widespread presence, and extended hours. High foot traffic and visibility in urban and semi-urban areas drive impulse purchases, boosting product turnover.

The inclusion of marijuana cigarettes in convenience stores reflects cannabis’s growing normalization, with these outlets serving as key points for discreet, on-the-go purchases. Their strategic locations near residential areas and transit hubs ensure a broad consumer reach, solidifying convenience stores’ pivotal role in the retail ecosystem.

Regional Analysis

North America leads the global marijuana cigarette market in 2024, with a 41.7% share valued at USD 0.6 billion. Widespread recreational cannabis legalization in the U.S. and Canada, coupled with robust retail infrastructure and consumer awareness, drives this dominance.

Europe shows gradual growth, with evolving regulations and pilot recreational programs paving the way for market expansion. Asia Pacific remains underdeveloped due to strict laws, though countries like Thailand and South Korea are exploring medical cannabis.

The Middle East & Africa face regulatory and cultural barriers, with limited activity focused on export-driven cultivation. Latin America is progressing slowly, with medical cannabis legalization laying the groundwork for future recreational markets. North America’s leadership persists, supported by favorable regulations and market maturity.

Top Use Cases

- Recreational Enjoyment: Marijuana cigarettes, or joints, are widely used for social and personal relaxation. Their convenience and familiar cigarette-like format make them popular at gatherings, festivals, or casual settings, appealing to adults seeking a legal alternative to alcohol or tobacco for leisure.

- Medical Relief: Joints are used to manage chronic pain, anxiety, and nausea, especially from chemotherapy. Their fast-acting nature delivers quick relief, making them a preferred choice for patients seeking natural remedies over pharmaceuticals, supported by growing medical cannabis acceptance.

- Convenient Consumption: Pre-rolled marijuana cigarettes offer a ready-to-use option, requiring no extra equipment. This ease attracts new users and busy consumers who value discretion and portability, driving demand in dispensaries and retail stores.

- Social Bonding: Sharing joints in social settings fosters community and connection. Their portability and ease of use make them ideal for group activities, enhancing cultural acceptance and boosting sales in regions with legal recreational cannabis.

- Micro-Dosing Trend: Low-THC or balanced THC: CBD joints cater to users seeking mild effects. These micro-dose options appeal to cautious or new consumers, promoting responsible use and expanding the market by addressing concerns about over-intoxication.

Recent Developments

1. Aphria (now part of Tilray)

Aphria, now merged with Tilray, has expanded its pre-rolled joint offerings under the “Good Supply” and “RIFF” brands, focusing on high-THC and premium-quality products. The company has introduced new strains and limited-edition pre-rolls to cater to recreational users. Tilray continues to leverage Aphria’s distribution network in Canada and Europe.

2. Aurora Cannabis

Aurora Cannabis launched “Aurora Drift”, a premium pre-rolled joint line featuring solventless hash-infused options. The company is also expanding its “Daily Special” value pre-rolls to compete in the budget segment. Aurora focuses on consistent dosing and quality, targeting both medical and recreational markets.

3. Canopy Growth

Canopy Growth’s “Tweed” and “Doja” brands have introduced new pre-roll varieties, including “Deep Space” infused joints. The company also partnered with Martha Stewart CBD for wellness-focused pre-rolls. Canopy is optimizing its supply chain to improve pre-roll freshness and potency.

4. Cresco Labs

Cresco Labs, a U.S. multi-state operator, expanded its “High Supply” pre-roll line, offering affordable, high-quality joints. The company also introduced “Floracal”, a premium cannabis brand with luxury pre-rolls. Cresco focuses on markets like Illinois, Pennsylvania, and Massachusetts.

5. Cronos Group

Cronos Group’s “Spinach” brand launched “GMO Cookies” and “Atomic Sour Grapefruit” pre-rolls, emphasizing bold flavors and high THC. The company is also exploring international markets for pre-rolled cannabis products.

Conclusion

The Marijuana Cigarette Market is thriving due to growing legalization, social acceptance, and consumer demand for convenient, familiar products. Recreational use dominates, driven by cultural shifts, while medical applications expand with research. Trends like micro-dosing and organic products reflect evolving preferences, ensuring robust growth as the market caters to diverse users and innovative offerings.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)