Table of Contents

Overview

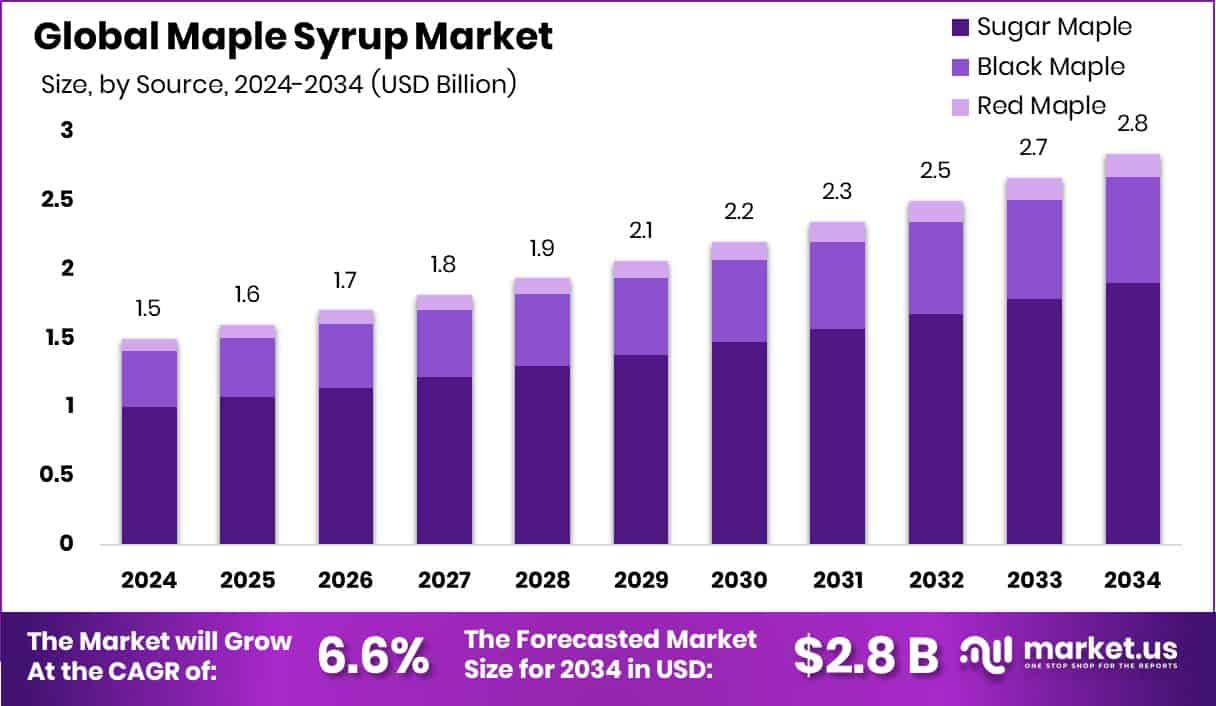

New York, NY – Oct 17, 2025 – The global Maple Syrup Market is projected to reach approximately USD 2.8 billion by 2034, rising from USD 1.5 billion in 2024, with a compound annual growth rate (CAGR) of 6.6% between 2025 and 2034. In North America, the market is valued at USD 0.6 billion, accounting for 46.30% of the global share.

Maple syrup is a natural sweetener obtained from the sap of maple trees, predominantly grown in the north eastern regions of North America. In spring, the sap is harvested and boiled to create syrup, prized for its distinctive, rich flavor. It is widely used on pancakes and waffles, as well as in baking, cooking, and gourmet recipes.

The maple syrup market encompasses the production, distribution, and sale of maple syrup. While considered a niche segment, it serves a growing audience seeking natural and organic alternatives to artificial sweeteners and refined sugar syrups.

Market growth is fueled by rising consumer demand for natural and organic products, with health-conscious individuals increasingly favoring maple syrup for its wholesome profile. Its versatility in culinary applications further enhances its appeal.

Maple syrup also fits well into various dietary preferences, including vegan and gluten-free diets, and offers notable health benefits such as antioxidants and essential minerals like zinc and manganese.

Global expansion opportunities are significant, particularly in regions with a rising appetite for natural sweeteners. Additionally, innovations in packaging and the development of flavor-infused varieties present new growth avenues, attracting consumers seeking premium and unique taste experiences.

Key Takeaways

- The global maple syrup market is projected to reach about USD 2.8 billion by 2034, up from USD 1.5 billion in 2024, registering a CAGR of 6.6% between 2025 and 2034.

- Sugar maple accounts for 67.30% of the market, making it the leading source segment.

- Conventional maple syrup holds the largest share at 69.30% in the overall market.

- Supermarkets and hypermarkets are the primary distribution channels, contributing 48.30% of sales.

- North America leads the market with a 46.30% share, valued at USD 0.6 billion.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/maple-syrup-market/free-sample/

Report Scope

| Market Value (2024) | USD 1.5 Billion |

| Forecast Revenue (2034) | USD 2.8 Billion |

| CAGR (2025-2034) | 6.6% |

| Segments Covered | By Source (Sugar Maple, Black Maple, Red Maple), By Category (Organic, Conventional), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online Sales Channels, Others) |

| Competitive Landscape | B & G Foods, Inc., The J.M. Smucker Co., Federation of Quebec Maple Syrup Producers, Les Industries Bernard et Fils Ltee, LB Maple Treat, Bascom Maple Farms Inc, Butternut Mountain Farm, Ferguson Farm Vermont Maple Syrup, Conagra Brands Inc., Coombs Family Farm |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=145147

Key Market Segments

By Source Analysis

Sugar maple accounts for 67.30% of the global maple syrup supply, making it the leading source segment in 2024. Its dominance stems from the tree’s high sap yield, superior quality, and rich, sweet flavor profile, which are highly prized in both domestic and international markets. Traditional syrup-making methods align particularly well with sugar maple sap, preserving its authentic taste and appealing to consumers seeking premium natural sweeteners. The strong demand has encouraged producers to expand sugar maple cultivation, ensuring consistent supply. With rising health awareness and a preference for sustainable products, sugar maple’s market leadership is expected to remain strong.

By Category Analysis

Conventional maple syrup leads the market with a 69.30% share in 2024. Its popularity is driven by affordability, wide availability, and suitability for everyday culinary use. Produced through more extensive farming practices and sometimes stabilized with additives, conventional maple syrup appeals to cost-conscious consumers. Strong distribution networks, including supermarkets and online platforms, further support its market presence. While organic syrup demand is growing, conventional options maintain dominance due to their balance of quality and price, ensuring continued appeal across diverse consumer segments.

By Distribution Channel Analysis

Supermarkets and hypermarkets account for 48.30% of maple syrup sales in 2024, making them the leading distribution channel. Their popularity is attributed to convenience, variety, competitive pricing, and promotional offers. Located in high-traffic areas, these outlets ensure product visibility and accessibility, while efficient supply chains maintain steady stock levels. Their scale enables favorable supplier negotiations, benefiting consumers through lower prices and special deals. This strong market position highlights supermarkets and hypermarkets as the primary retail force in the maple syrup industry.

Regional Analysis

North America leads the global maple syrup market, commanding a 46.30% share valued at USD 0.6 billion. This dominance is attributed to the abundance of maple tree forests in Canada and the north eastern United States, positioning the region as both a major producer and consumer.

In Europe, the market is experiencing steady growth, fueled by a strong preference for natural and organic foods. Maple syrup is increasingly being incorporated into traditional recipes, extending its use beyond typical breakfast dishes.

The Asia Pacific market is expanding rapidly, supported by rising health consciousness and the adoption of Western eating habits.

In the Middle East & Africa and Latin America, the market remains in its early stages but holds significant potential. Factors such as urbanization, an expanding middle class, and growing interest in global cuisines are expected to create new opportunities for maple syrup consumption in these regions.

Top Use Cases

- Breakfast Enhancer:

Consumers widely use maple syrup as a natural topping for pancakes, waffles, French toast, and porridge. Its rich sweetness and distinctive flavor make it a go-to breakfast enhancer, offering a wholesome and authentic alternative to artificial syrups. This everyday use supports strong household demand for pure maple products.

- Ingredient in Baked Goods:

Bakers and food manufacturers use maple syrup as a natural sweetener in cakes, cookies, muffins, and breads. It not only adds sweetness but also brings a warm, complex flavor profile. Driven by growing demand for clean-label and flavorful baked items, this use case helps fuel the maple syrup market’s expansion in the food industry.

- Savory Glazes & Condiments:

Maple syrup serves as a key ingredient in savory cooking used in glazes for meats and vegetables or sauces like barbecue. Its blend of sweetness and depth elevates flavor in both home kitchens and foodservice. This versatility adds value to maple syrup as a multipurpose culinary component beyond just breakfast.

- Beverage Innovation:

The beverage industry taps into maple syrup’s unique taste by incorporating it into coffee drinks (like lattes), cocktails, hot toddies, and even maple-flavored beers or liqueurs. This trend toward maple-infused beverages reflects consumer interest in natural, artisanal, and flavorful drink options, helping to diversify the market beyond traditional uses.

- Maple-Based Spreads & Confections:

Maple syrup is transformed into popular products like maple butter (a creamy spread) and maple sugar or taffy candies. These value-added confections highlight maple’s versatility and create new premium offerings. With growing interest in artisanal and gourmet products, such innovations support higher-margin opportunities in the market.

- Health & Wellness Sweetener:

As health-conscious consumers seek natural and nutrient-rich alternatives, maple syrup is increasingly used as a better-for-you sweetener. It offers antioxidants and minerals like zinc and manganese. This positioning supports its use in health-focused products such as granola, yogurt, and wellness snacks and bolsters its appeal in the organic and natural foods market.

Recent Developments

1.B & G Foods, Inc.

- In Q2 of its fiscal year, B & G Foods’ Meals segment which includes maple syrup brands like Maple Grove Farms, Spring Tree, and Vermont Maid strengthened profitability despite a slight revenue decline. Sales reached USD 104.08 million (down 3.5%), while adjusted EBITDA rose by 8% to USD 25.75 million. Improved pricing and product mix helped offset lower volumes. Additionally, analysts highlighted the continued strong performance of Spring Tree and Vermont Maid syrups within the Specialty unit.

2. The J.M. Smucker Co.

- In its fiscal fourth quarter ended April 30, 2025, The J.M. Smucker Co. reported net sales of USD 2.1 billion (a 3% year-over-year decline), while full-year net sales rose 7% to USD 8.7 billion. Key strategic moves in the period included the acquisition of Hostess Brands (completed November 2023) and divestitures of several businesses such as Voortman, Canada Condiments, Sahale Snacks, and Sweet Baked Snacks. These shifts reflect Smucker’s ongoing portfolio streamlining and growth strategy.

3. Federation of Quebec Maple Syrup Producers

- The Quebec Maple Syrup Producers reported a robust spring 2025 harvest with 224.9 million pounds of syrup produced from 55.5 million taps making it the second-largest crop on record. To meet rising demand, they authorized 7 million additional taps, boosting potential annual output by around 25 million pounds. This expansion underscores the federation’s proactive production strategy and its role in stabilizing supply for global markets.

4. LB Maple Treat

- LB Maple Treat is part of Lantic Maple, currently recognized as the world’s largest maple syrup supplier, holding about 25% of global market share. Lantic Maple was formed in 2017 by merging four family-run maple bottlers, including LB Maple Treat. The unified group exports over 50 million pounds of maple syrup to more than 58 countries.

Conclusion

The maple syrup market is witnessing strong momentum, driven by both strategic expansions and production efficiencies among key industry players. B&G Foods is optimizing profitability in its meals segment, supported by established brands like Maple Grove Farms. The J.M. Smucker Co. is reshaping its portfolio through acquisitions and divestitures to strengthen long-term growth. The Federation of Quebec Maple Syrup Producers achieved the second-largest harvest on record in 2025, while authorizing millions of additional taps to meet global demand.

Les Industries Bernard Fils is expanding its production and international presence through the acquisition of Appalaches Nature, enhancing sustainable operations. LB Maple Treat, under the Lantic Maple umbrella, maintains a dominant global position with a 25% market share and exports to over 58 countries. Collectively, these developments highlight a competitive yet collaborative market environment, where innovation, sustainability, and global expansion remain key growth drivers for the maple syrup industry.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)