Table of Contents

Introduction

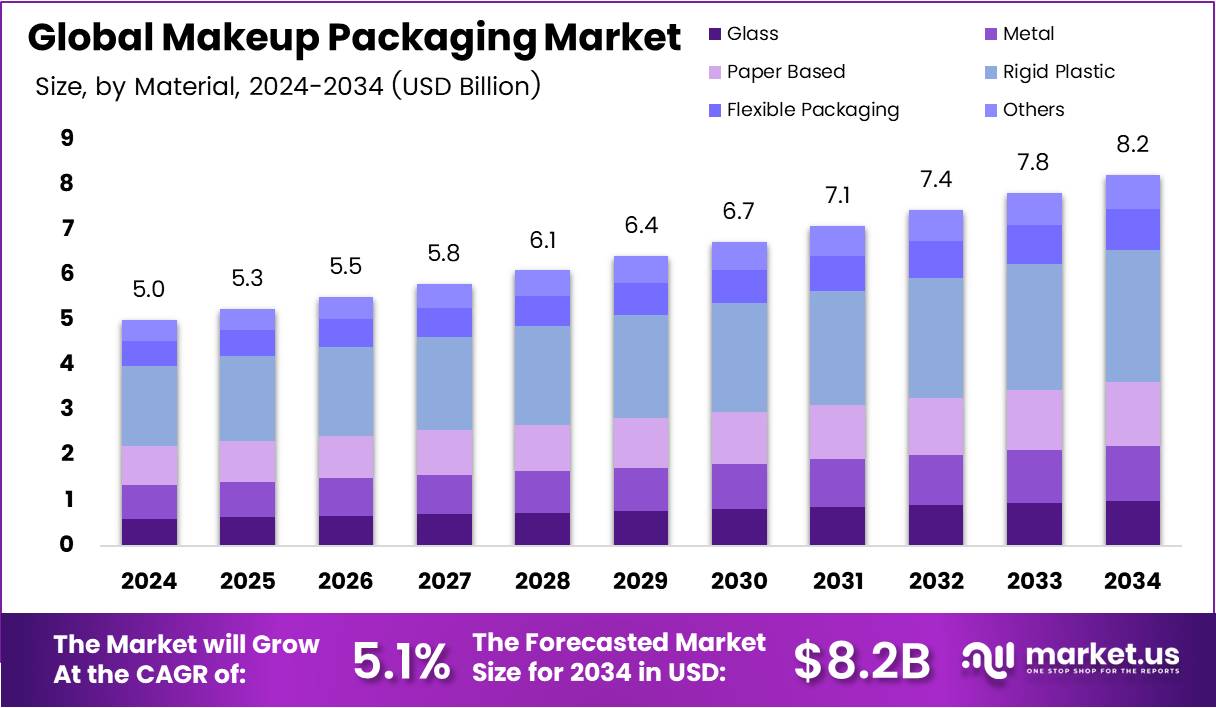

The global makeup packaging market is witnessing substantial growth, fueled by evolving consumer preferences, environmental concerns, and innovations in design and materials. Valued at USD 5.0 billion in 2024, the market is projected to reach USD 8.2 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.1% during the forecast period from 2025 to 2034.

Makeup packaging plays a critical role in enhancing both the functionality and aesthetics of beauty products, influencing consumer choices and brand loyalty. The market’s growth is driven by a rising demand for sustainability, customization, and technological advancements, making it a dynamic and highly competitive segment of the global cosmetics industry.

Key Takeaways

- The global makeup packaging market is expected to grow from USD 5.0 billion in 2024 to USD 8.2 billion by 2034, at a CAGR of 5.1% from 2025 to 2034.

- Rigid Plastic leads the material segment, accounting for 35.8% of the market share in 2024.

- The Color Cosmetics application segment holds the largest share at 29.3% in 2024.

- Bottles dominate the type segment, with a market share of 16.2% in 2024.

- The Asia Pacific region holds the largest share of 43.8%, valued at USD 2.1 billion in 2024.

Key Market Segments

By Material:

- Rigid Plastic remains the leader, holding 35.8% of the market share in 2024 due to its durability and versatility.

- Flexible Packaging is gaining popularity, especially for on-the-go and sustainable packaging solutions.

- Metal, Glass, and Paper-Based materials are also witnessing growth, driven by eco-conscious consumer preferences and the rise of premium packaging.

By Application:

- Color Cosmetics dominates, making up 29.3% of the market share in 2024, driven by innovative product designs and the expanding beauty influencer culture.

- Skin Care and Hair Care follow, with increasing demand for functional and aesthetically pleasing packaging solutions.

By Type:

- Bottles lead the packaging type segment with 16.2% of the market share in 2024, favored for their versatility and premium appeal.

- Jars and Tubes also hold substantial shares, catering to products like creams, serums, and on-the-go beauty solutions.

Drivers

- Sustainability: Increasing environmental awareness is encouraging the use of refillable, biodegradable, and recyclable materials, pushing brands to adopt eco-friendly packaging solutions.

- Technological Advancements: The integration of smart packaging features, such as QR codes and interactive labels, is enhancing consumer engagement and providing additional value.

- E-commerce: The growth of online shopping requires durable and visually appealing packaging to ensure product protection during shipping, further driving the demand for innovative designs.

- Customization: With consumers increasingly seeking personalized and unique packaging, brands are focusing on offering tailored designs to build brand loyalty and attract niche audiences.

- Emerging Markets: Rising disposable incomes in regions like Asia-Pacific and Latin America are fueling the demand for premium makeup products and, consequently, high-quality packaging solutions.

Use Cases

- Color Cosmetics: Packaging plays a significant role in cosmetics, where the visual appeal of the packaging often influences purchasing decisions. Products such as foundation, lipsticks, and eyeshadows require packaging that is both functional and aesthetically pleasing.

- Skin Care: Packaging innovations in this segment are designed to enhance the user experience, offering ease of application, portability, and protection of the delicate formulas inside.

- Hair Care and Fragrances: Packaging for these products must balance functionality with premium design. Hair care packaging focuses on convenience, while fragrance packaging emphasizes luxury and sophistication.

Major Challenges

- High Cost of Eco-Friendly Materials: Sustainable packaging options like biodegradable plastics and bamboo can be costly, making them difficult for smaller brands to implement without significantly increasing product prices.

- Regulatory Differences: Different regulations regarding packaging and labeling across regions can complicate production and increase costs for global brands.

- Supply Chain Disruptions: Shortages in raw materials and transportation issues can impact the availability and consistency of packaging materials, leading to delays in production timelines.

- Short Shelf Life of Biodegradable Materials: Some eco-friendly materials have a limited shelf life, which poses a challenge for products requiring long-term storage.

Business Opportunities

- Sustainable Packaging Solutions: Companies that innovate with biodegradable, refillable, or recyclable packaging can tap into the growing demand for eco-friendly products and build strong consumer loyalty.

- Smart Packaging: The integration of digital technologies such as augmented reality (AR) and interactive labels offers brands the chance to engage customers in new ways and provide added value.

- Customization: Offering personalized packaging options can cater to the growing trend of individualized beauty products, especially among younger consumers.

- Emerging Markets: Companies that focus on expanding into emerging markets, particularly in Asia-Pacific and Latin America, can capitalize on rising demand for premium and luxury beauty products.

Regional Analysis

The Asia Pacific region leads the global makeup packaging market, holding 43.8% of the market share in 2024 and valued at USD 2.1 billion. The region’s rapid urbanization, growing middle class, and rising awareness of premium beauty products contribute to its dominance.

In North America, the market is driven by a high level of consumer awareness, strong demand for premium beauty products, and a growing inclination toward eco-friendly packaging formats. Similarly, Europe is embracing sustainable and innovative packaging solutions, particularly in countries like France, Germany, and the UK.

Latin America is witnessing growth, with countries like Brazil and Mexico seeing increased demand for beauty products and packaging solutions. Meanwhile, the Middle East and Africa region is also growing, driven by increasing disposable incomes and rising interest in luxury cosmetics.

Recent Developments

- Berlin Packaging expanded into the beauty and cosmetics market by acquiring Cosmei, an Italian firm known for innovative packaging solutions.

- Amcor announced the use of CleanStream premium post-consumer recycled polymer for Maison Guerlain’s Aqua Allegoria hand creams, showcasing their commitment to sustainable packaging.

- Aptar Beauty’s Nomad Refill solution was recognized for Best Packaging Innovation at the 2025 Barcelona Perfumery Awards, highlighting its role in sustainable design.

- e.l.f. Cosmetics collaborated with Pagonis to co-develop inclusive packaging solutions in partnership with OBERLAND, promoting usability for all consumers.

Conclusion

The makeup packaging market is poised for significant growth, driven by sustainability, consumer demands for customization, and the integration of technological advancements. While challenges such as high material costs and regulatory differences remain, the market offers ample opportunities for innovation, especially in eco-friendly packaging solutions and emerging markets. As brands continue to prioritize aesthetics, functionality, and environmental responsibility, the makeup packaging sector will play a crucial role in shaping the future of the global beauty industry.