Table of Contents

Overview

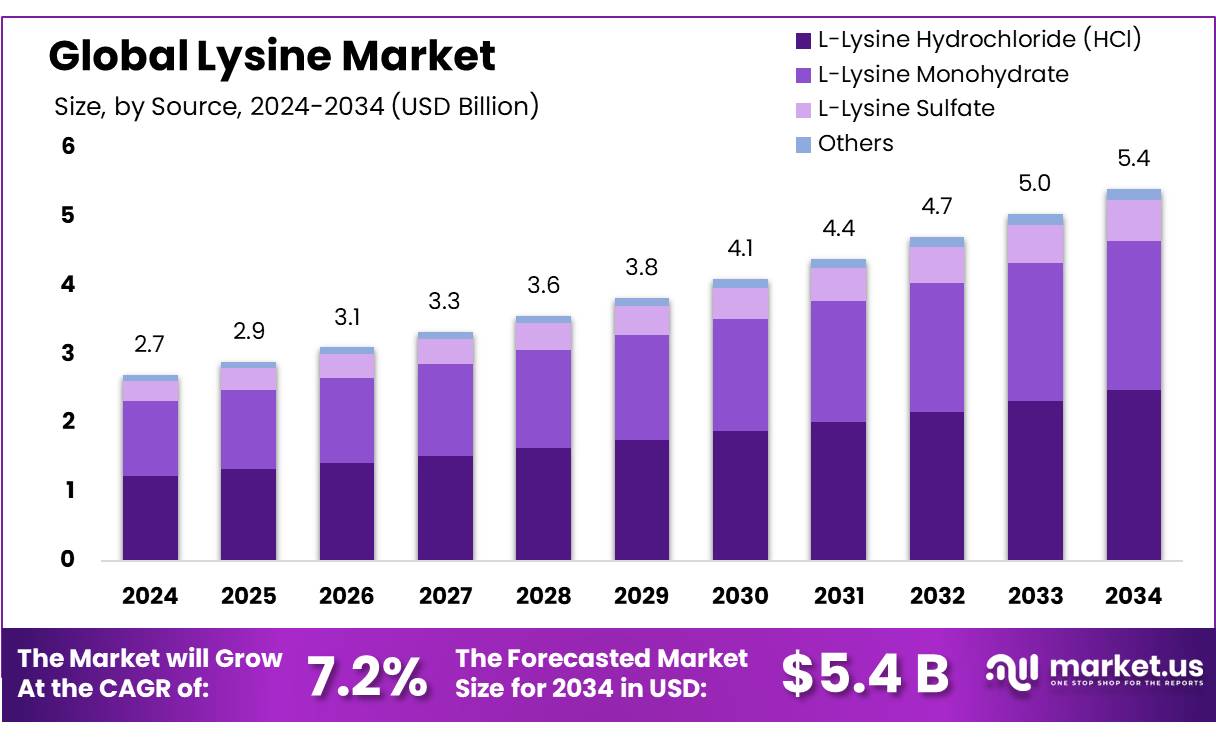

New York, NY – August 25, 2025 – The Global Lysine Market is projected to grow from USD 2.7 billion in 2024 to approximately USD 5.4 billion by 2034, achieving a CAGR of 7.2% during the forecast period from 2025 to 2034. In 2024, the Asia-Pacific region dominated the market, accounting for over 45.9% of the share, with revenues of USD 1.2 billion.

Lysine concentrates, primarily L-lysine, are vital amino acids widely used in animal nutrition, particularly in poultry and swine feed, to improve growth rates and feed efficiency. Industrial production of L-lysine has advanced significantly, with microbial fermentation utilizing engineered strains such as Corynebacterium glutamicum and Escherichia coli as the primary methods. Innovations in fermentation technologies have boosted yields, with some strains achieving concentrations exceeding 120 g/L.

The lysine industry has seen substantial progress in biotechnology and fermentation processes. The adoption of fed-batch fermentation has enabled high-efficiency production, with L-lysine concentrations surpassing 120 g/L. Additionally, genetically engineered strains have improved yield stability and reduced production costs, enhancing global market competitiveness.

Government policies have significantly influenced the lysine market. For example, the U.S. Department of Commerce launched an antidumping duty investigation into L-lysine imports from China, alleging sales at below fair value, which could harm domestic producers. Such initiatives highlight the importance of fair trade practices in sustaining a competitive lysine market.

Key Takeaways

- The Global Lysine Market size is expected to be worth around USD 5.4 billion by 2034, from USD 2.7 billion in 2024, growing at a CAGR of 7.2%.

- L-Lysine Hydrochloride (HCl) held a dominant market position, capturing more than a 45.9% share.

- Feed Grade held a dominant market position, capturing more than 81.6% share.

- Powder held a dominant market position, capturing more than a 71.3% share.

- Animal Feed held a dominant market position, capturing more than 76.2% share.

- Asia-Pacific (APAC) region stands as the global leader in lysine production, commanding approximately 45.9% of the market share in 2023, translating to an estimated market value of USD 1.2 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-lysine-market/request-sample/

Report Scope

| Market Value (2024) | USD 2.7 Billion |

| Forecast Revenue (2034) | USD 5.4 Billion |

| CAGR (2025-2034) | 7.2% |

| Segments Covered | By Type (L-Lysine Hydrochloride (HCl), L-Lysine Monohydrate, L-Lysine Sulfate, Others), By Grade (Feed Grade, Food Grade, Pharmaceutical Grade), By Form (Powder, Liquid, Granules), By Application (Animal Feed, Food and Dietary Supplements, Pharmaceuticals, Others) |

| Competitive Landscape | Global Bio-chem Technology Group Company Limited, Ajinomoto Co. Ltd., Cheil Jedang Corp, ADM, Evonik, COFCO Biochemical, Juneng Golden Corn Co. Ltd., KYOWA HAKKO BIO CO., LTD., Cargill |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=155142

Key Market Segments

By Type Analysis

In 2024, L-Lysine Hydrochloride (HCl) commanded a leading market share of over 45.9%. Its preference among integrated poultry and swine operations stems from its reliable assay, ease of handling in premix facilities, and consistent performance in least-cost feed formulations. Compared to other salts, L-Lysine HCl offers precise dosing and smooth flow through dosing and conveying systems, enhancing feed mill efficiency and minimizing waste. Its widespread availability from established fermentation facilities ensures a stable supply for large-scale nutrition programs.

By Grade Analysis

In 2024, Feed Grade lysine held a commanding market share of over 81.6%. Large poultry and swine integrators favored this grade for its cost-effective amino acid density, seamless integration into premixes and compound feed, and stability during pelleting. Its reliable handling in storage and dosing, coupled with consistent supply from established fermentation capacity, minimized reformulation risks and supported high-throughput production cycles.

By Form Analysis

In 2024, Powder lysine captured over 71.3% of the market share, favored by feed formulators for its smooth flow, precise micro-dosing, and uniform dispersion in premixes and compound feed. Its storage stability, resilience to pelleting heat, and effective blending with carriers and minerals reduced segregation risks in feed mills. Flexible packaging and reliable logistics further ensured a steady supply for poultry, swine, aquaculture, and pet feed producers.

By Application Analysis

In 2024, the Animal Feed segment led with over 76.2% market share, driven by lysine’s consistent enhancement of feed efficiency and growth in lower-protein formulations for poultry, swine, and aquaculture. Its seamless integration with premixes and compound feed, reliable flow through dosing systems, and stability during pelleting minimized reformulation risks. Robust supplier networks and dependable logistics further solidified its position as the primary application for lysine.

Regional Analysis

In 2024, the Asia-Pacific (APAC) region held a leading 45.9% market share, valued at approximately USD 1.2 billion. This dominance is driven by the region’s strong livestock sector, particularly in China, Indonesia, and South Korea, where lysine enhances animal feed efficiency and meat quality. Significant investments in fermentation technology have improved production efficiency and sustainability, with countries like China and India leading in meeting domestic and global demand through reliable supply chains.

Top Use Cases

- Animal Feed Enhancement: Lysine is widely used in poultry, swine, and aquaculture feed to boost growth and improve feed efficiency. It supports protein synthesis, helping animals gain weight faster and use feed more effectively, especially in lower-protein diets, making it a cost-effective choice for large-scale livestock operations.

- Cold Sore Management: Lysine supplements are popular for reducing the frequency and severity of cold sores caused by the herpes simplex virus. Taken daily, it may block the virus’s ability to replicate, shortening outbreak duration and offering a natural option for managing symptoms in affected individuals.

- Bone Health Support: Lysine aids calcium absorption and collagen formation, supporting bone health. It’s used in supplements to potentially reduce osteoporosis risk by strengthening bones and connective tissues, making it appealing for aging populations or those with low calcium intake seeking to maintain skeletal health.

- Anxiety and Stress Reduction: Lysine may help lower anxiety by influencing serotonin levels and reducing stress hormones like cortisol. Supplements are used to promote calmness, particularly in high-stress environments, offering a natural approach for individuals seeking mental health support without relying solely on medications.

- Wound Healing Aid: Lysine supports collagen production, which is crucial for wound healing. It’s used in creams or oral supplements to speed up recovery from injuries, surgeries, or ulcers, especially in medical settings, by promoting tissue repair and reducing infection risks in affected areas.

Recent Developments

1. Ajinomoto Co. Ltd.

Ajinomoto is expanding its lysine production capacity to meet growing global demand, particularly in animal feed. The company is investing in its Brazilian operations, recognizing the region’s significance in livestock production. This expansion is part of a broader strategy to strengthen its integrated animal nutrition solutions and secure its leading market position.

2. Cheil Jedang Corp

CJ CheilJedang is focusing on sustainability and efficiency in its lysine production. The company leverages biotechnology and fermentation expertise to optimize processes and reduce environmental impact. Recent efforts include developing more efficient microbial strains and exploring the use of alternative, sustainable raw materials for fermentation to maintain its competitive edge in the global market.

3. ADM

ADM is integrating its lysine production into its broader animal nutrition portfolio, emphasizing traceable and sustainable supply chains. The company focuses on providing tailored amino acid solutions to support animal health and farm productivity. Recent developments highlight their commitment to reducing the carbon footprint of their production processes through innovation and operational efficiencies.

4. Evonik

Evonik continues to lead in precision livestock farming with its AMINONIR service, which uses near-infrared spectroscopy to analyze feed and optimize lysine supplementation directly on farms. This recent innovation allows for real-time, data-driven decisions to improve feed efficiency and reduce nitrogen excretion, supporting more sustainable and economical animal production.

5. COFCO Biochemical

As a major player in China, COFCO Biochemical is focused on scaling its lysine output and improving cost competitiveness. Recent developments are tied to China’s self-sufficiency goals in animal feed ingredients. The company benefits from integrated production using domestic raw materials and is investing in technological upgrades to enhance yield and environmental performance at its manufacturing facilities.

Conclusion

Lysine’s versatility as an essential amino acid drives its demand across animal nutrition, human health, and wellness markets. Its role in enhancing livestock growth, managing cold sores, supporting bone health, reducing stress, and aiding wound healing highlights its broad appeal. As consumer interest in natural health solutions and efficient animal feed grows, lysine’s market potential remains strong, with opportunities for innovation in formulations and applications.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)