Table of Contents

Overview

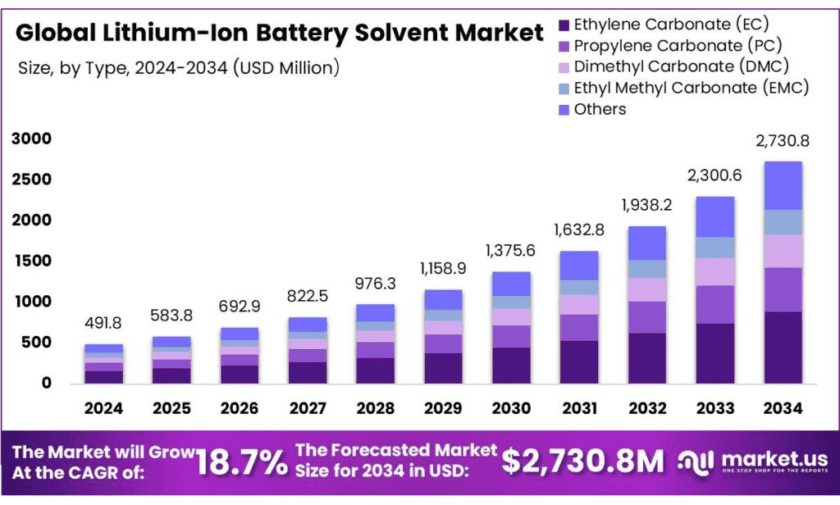

New York, NY – Oct 29, 2025 – The Global Lithium-Ion Battery Solvent Market is projected to reach USD 2,730.8 million by 2034, up from USD 491.8 million in 2024, registering a robust CAGR of 18.7% during the forecast period of 2025–2034. The market forms a crucial part of the global energy storage and electric vehicle (EV) ecosystem, as solvents play an indispensable role in the composition of lithium-ion batteries. Common solvents such as ethylene carbonate (EC), diethyl carbonate (DEC), dimethyl carbonate (DMC), and ethyl methyl carbonate (EMC) serve as vital electrolytic mediums that enable the efficient transfer of lithium ions between the anode and cathode, ensuring stable battery performance.

The market’s expansion is being significantly driven by the global transition towards electric mobility and the rising demand for renewable energy storage systems. Supportive government incentives and stringent environmental policies have accelerated the adoption of EVs worldwide.

- According to the International Energy Agency (IEA), the total number of electric vehicles on the road is projected to exceed 200 million by 2030, underscoring the increasing demand for high-performance lithium-ion batteries. Furthermore, technological advancements in renewable energy integration are amplifying the need for reliable and efficient battery solutions, further stimulating solvent consumption.

The EV segment continues to dominate the demand landscape, accounting for approximately 80% of all lithium-ion batteries produced globally between 2021 and 2030. In line with this, the global production capacity of lithium-ion batteries is anticipated to increase fivefold, reaching 5,500 GWh by 2030, reflecting the immense growth potential for associated solvent materials.

Governmental policies and infrastructure investments across major economies are also propelling the market forward. In India, the lithium-ion battery industry is expected to expand by 48% by 2030, supported by the growing penetration of EVs and renewable storage solutions. In the United States, strategic initiatives by the Department of Energy (DOE)—including funding for battery manufacturing and recycling infrastructure—are aimed at strengthening the domestic supply chain and reducing import dependency.

Key Takeaways

- Lithium-Ion Battery Solvent Market size is expected to be worth around USD 2730.8 Million by 2034, from USD 491.8 Million in 2024, growing at a CAGR of 18.7%.

- Ethylene Carbonate (EC) held a dominant market position, capturing more than a 32.4% share.

- EV held a dominant market position, capturing more than a 53.2% share of the global lithium-ion battery solvent market.

- Asia Pacific region dominated the global lithium-ion battery solvent market, capturing a 43.8% share, equivalent to USD 215.2 million.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/lithium-ion-battery-solvent-market/free-sample/

Report Scope

| Market Value (2024) | USD 491.8 Mn |

| Forecast Revenue (2034) | USD 2730.8 Mn |

| CAGR (2025-2034) | 18.7% |

| Segments Covered | By Type (Ethylene Carbonate (EC), Propylene Carbonate (PC), Dimethyl Carbonate (DMC), Ethyl Methyl Carbonate (EMC), Others), By End Use (EV, Consumer Electronics, Energy Storage, Others) |

| Competitive Landscape | UBE Corporation, OUCC, Dongwha Electrolyte, CAPCHEM, BASF SE, Mitsubishi Chemical Corporation, Zhangjiagang Guotai Huarong New Chemical Materials Co., Ltd., Huntsman International LLC, Shandong Lixing Advanced Material Co., Ltd., Lotte Chemical |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=160858

Key Market Segments

By Type Analysis – Ethylene Carbonate (EC) – 32.4% Share (2024)

In 2024, Ethylene Carbonate (EC) accounted for 32.4% of the global lithium-ion battery solvent market, establishing itself as the leading solvent type. This dominance is attributed to EC’s high chemical stability, strong dielectric constant, and superior ability to dissolve lithium salts, which collectively enhance ionic conductivity and improve the overall efficiency of lithium-ion batteries.

EC’s compatibility with other carbonate solvents such as diethyl carbonate (DEC) and dimethyl carbonate (DMC) further enhances its utility in blended solvent systems, optimizing both performance and safety in battery operations. The industrial landscape in 2025 indicates that EC will maintain its leading position due to the continued rise in EV production and increased investment in renewable energy storage solutions.

By End Use Analysis – Electric Vehicles (EV) – 53.2% Share (2024)

In 2024, the Electric Vehicle (EV) segment captured a dominant 53.2% share of the global lithium-ion battery solvent market. This strong market performance is primarily driven by the rapid global expansion of the EV industry and the rising demand for high-performance batteries that provide longer driving range, faster charging capabilities, and enhanced thermal safety.

The industrial scenario for 2025 suggests that the EV segment will continue to hold its dominant share, supported by increasing government subsidies, tax incentives, and emission reduction mandates across major automotive markets such as the United States, China, and the European Union. Moreover, the expansion of EV charging infrastructure and the shift in consumer preference towards sustainable mobility solutions are further driving the adoption of advanced lithium-ion battery solvents.

List of Segments

By Type

- Ethylene Carbonate (EC)

- Propylene Carbonate (PC)

- Dimethyl Carbonate (DMC)

- Ethyl Methyl Carbonate (EMC)

- Others

By End Use

- EV

- Consumer Electronics

- Energy Storage

- Others

Regional Analysis

Asia Pacific – 43.8% Share (2024) | Valued at USD 215.2 Million

In 2024, the Asia Pacific region led the global lithium-ion battery solvent market, accounting for a substantial 43.8% share, equivalent to a market value of USD 215.2 million. This dominance is largely driven by the region’s strong growth in electric vehicle (EV) manufacturing and renewable energy storage development. Major economies such as China, Japan, South Korea, and India have undertaken significant policy initiatives and investment programs aimed at accelerating EV adoption and expanding battery production capacity. For example, China’s large-scale EV production targets and India’s renewable energy integration initiatives have been instrumental in boosting regional demand for high-performance lithium-ion battery solvents.

The industrial landscape in Asia Pacific demonstrates a rapid enhancement in battery technology innovation and manufacturing infrastructure. The region hosts several of the world’s leading battery and chemical producers, including key manufacturers of ethylene carbonate (EC) and dimethyl carbonate (DMC)—both critical solvents for achieving superior energy density and fast-charging battery performance. Furthermore, the expanding consumer electronics market across the region continues to support steady solvent consumption, as manufacturers seek reliable and safe energy storage materials.

Top Use Cases

Electric vehicles (EV traction batteries): Solvents carry Li⁺ between electrodes and help form a stable SEI on graphite/silicon anodes. In practice, commercial EV cells use mixed-carbonate blends (e.g., EC/EMC/DMC with LiPF₆). Demand is expanding with EV sales: 17 million electric cars sold in 2024 (up >25% year-on-year), and >20% of new cars sold worldwide were electric. This scale drives large volumes of electrolyte solvents for cell filling and formation. Typical state-of-the-art electrolytes are low-salt in mixed organic solvents, with EC (SEI former) plus linear carbonates (DMC/EMC) for conductivity and viscosity control.

Utility-scale & behind-the-meter battery storage: LFP and NMC packs for grids rely on liquid electrolytes where solvent choice balances ionic conductivity, safety, and calendar life. Global battery storage deployment more than doubled in 2023, adding ~42 GW across utility-scale, behind-the-meter, and off-grid systems. For stationary storage specifically, NREL’s 2024 ATB notes LFP became the primary chemistry for stationary storage starting in 2022, still using carbonate-based liquid electrolytes. Solvent optimization supports long cycle life and wider temperature operation demanded by grid duty cycles.

Micromobility: e-bikes, scooters, delivery fleets: Mixed-carbonate electrolytes enable fast charge at moderate C-rates and acceptable cold-start in small LFP/NMC packs used by e-bikes and scooters. Electric two/three-wheelers remain the most electrified road segment: in 2024 the global e-2/3W fleet exceeded 9% electric, with ~10 million electric 2/3W sold (~15% sales share). These volumes translate into significant solvent demand for millions of compact pouch/prismatic cells used in urban delivery and shared mobility.

Consumer electronics (phones, laptops, wearables): Consumer LIBs use carbonate solvents to achieve high energy density and low impedance for thin cells. EC (for SEI) is often paired with low-viscosity DMC/EMC to keep conductivity ~10⁻² S cm⁻¹ at room temperature (typical for LiPF₆/carbonate systems). Foundational literature and analytical methods show EC, DMC, DEC as the most important LIB solvents; GC-MS analyses and reviews detail their prevalence in commercial cells. In lab and production QA, solvent composition is routinely quantified without salt removal to control performance drifts.

Fast-charging EVs and high-voltage cathodes (≥4.4–5.0 V): High-rate charging and high-voltage cathodes stress electrolytes. Solvent engineering (e.g., fluorinated carbonates and tuned linear-carbonate ratios) improves oxidative stability and suppresses gas formation. Recent peer-reviewed work demonstrates dicarbonate solvent systems enabling 5 V-class performance, while broader studies show that solvent fluorination generally raises electrolyte stability against both lithium anodes and high-voltage cathodes. Such blends are being adopted in fast-charge EV programs and high-Ni NMC cells.

Recent Developments

UBE Corporation: In 2025 the company broke ground on its U.S. plant to manufacture up to 100 000 t / yr DMC and 40 000 t / yr EMC — key lithium-ion battery electrolyte solvents — under its proprietary gas-phase nitrite process. In 2023 the firm listed its “Battery Materials – Electrolyte” business line featuring highly-purified solvents and additives for both primary and secondary Li-ion batteries.

Oriental Union Chemical Corporation (OUCC): In its 2024 annual report the company noted that its ethylene-carbonate (EC) product line, with a production capacity of ~60 000 t / yr, is targeting growth in the lithium-battery electrolyte sector for 2023-24 and beyond. The ESG report published in 2024 also emphasises increasing EC demand from LIB electrolytes.

Dongwha Electrolyte: In 2023 Dongwha Electrolyte began development of a highly-impregnating liquid electrolyte targeted for thick-electrode LFP batteries, with R&D spanning April 1 to December 31, 2023. Additionally, in 2023 the company broke ground on a US $70 million facility in Tennessee to produce more than 70,000 metric tons per year of electrolyte material for the lithium-ion battery market.

Capchem: In 2024 Capchem announced plans to invest US $350 million to build a large lithium-ion battery materials plant in Ascension Parish, Louisiana, with capacity targeting 200,000 tons of solvent and 100,000 tons of electrolyte annually. In October 2024 Capchem highlighted its role as a global supplier of integrated battery electrolyte solutions at the Battery Show North America.

Dongwha Electrolyte: In 2023, Dongwha launched an R&D project running from April 1 to December 31 focused on a highly-impregnative liquid electrolyte for high-performance LFP batteries with thick electrodes. By mid-2025 the firm announced a US-$70 million investment in a U.S. factory (capacity ~80,000 t) for lithium-ion battery electrolytes.

BASF SE: In 2023 BASF entered a partnership with Nanotech Energy to enable manufacturing of lithium-ion batteries in North America with recycled-metal cathode active materials starting in 2024. In 2024 BASF began operating a prototype battery-materials recycling refinery in Germany, supporting its broader battery-chemicals and solvent ecosystem.

Zhangjiagang Guotai Huarong New Chemical Materials Co., Ltd.: In 2023 Guotai Huarong filed a patent for a high-voltage 5 V-class lithium-ion battery electrolyte solvent system, incorporating mixed fluorinated carbonate solvents plus lithium phosphate additives to improve cycle life and safety. While specific 2023 production figures are not publicly disclosed, its earlier noted annual capacity “30,000 t/year” in electrolytes places it among the major solvent suppliers.

Huntsman International LLC: In 2023 Huntsman announced development of advanced battery materials including high-purity carbonate solvents (e.g., EC grades) tailored for EV-battery applications, aiming to strengthen its electrolyte solvent business. While 2024 exact solvent volume data isn’t specified publicly, a prior announcement (2021) referenced increased production of “ULTRAPURE™ Ethylene Carbonate” to meet EV battery demand.

Shandong Lixing Advanced Material Co., Ltd.: In 2023, Lixing launched a major project to add 110,000 metric tons/year of lithium-battery electrolyte solvent capacity with a total investment of RMB 320 million, aiming to raise its annual capacity to about 190,000 tons to become a domestic leader in five types of electronic-grade solvents.

Lotte Chemical: In 2024, Lotte Chemical reported consolidated sales of KRW 20.4304 trillion and an operating loss of KRW 894.8 billion while its “Advanced Materials” business—covering electrolyte organic solvents for lithium-ion batteries—posted KRW 1.0944 trillion in sales and an operating profit of KRW 29.7 billion.

Conclusion

In conclusion, the global market for lithium-ion battery solvents is poised for strong expansion, driven by escalating demand from electric vehicles and energy storage systems. The need for high-purity carbonate and fluorinated solvents, especially for high-voltage and fast-charging battery applications, creates clear growth pathways for solvent manufacturers with advanced formulation capabilities.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)