Table of Contents

Overview

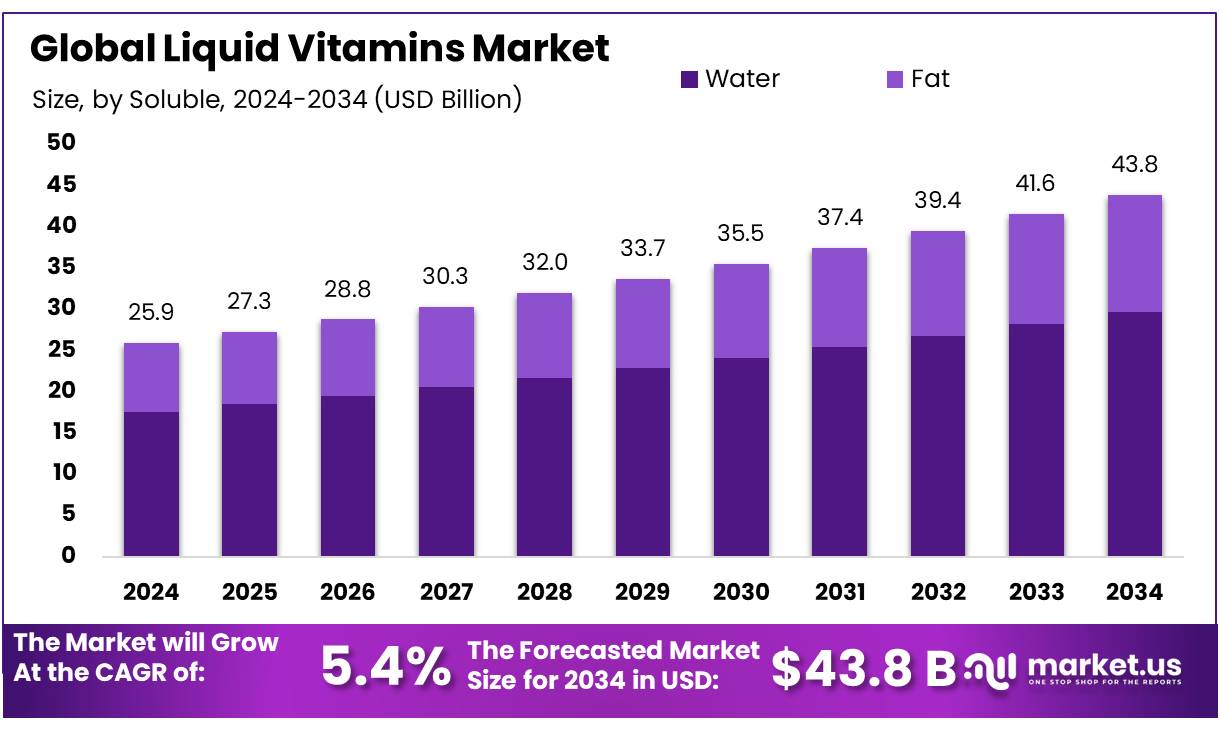

New York, NY – August 07, 2025 – The Global Liquid Vitamins Market is projected to grow from USD 25.9 billion in 2024 to USD 43.8 billion by 2034, achieving a CAGR of 5.4% during the forecast period (2025–2034). In 2024, the Asia-Pacific region led the market, commanding a 48.5% share with USD 12.5 billion in revenue.

Liquid vitamin concentrates form a niche within the dietary and nutritional supplement industry. Available in water- or oil-based formulations, these concentrates are used as standalone consumer supplements and as additives in food, beverage, and pharmaceutical products. They are categorized by solubility: water-soluble (e.g., B-complex, vitamin C) and fat-soluble (e.g., vitamins A, D, E, K), with applications in fortified beverages, health tonics, and emulsified delivery systems.

Regulatory oversight ensures product safety and compliance. In the U.S., the FDA classifies liquid vitamin concentrates as dietary supplements, requiring Supplement Facts labeling and adherence to current good manufacturing practices. In the EU, Directive 2002/46/EC, supported by EFSA guidelines, standardizes supplementation and authorizes vitamin sources in concentrated forms, facilitating market access and consumer trust.

Growing consumer focus on health has boosted demand. In 2020, U.S. dietary supplement sales reached USD 55.7 billion, with vitamin-mineral products accounting for USD 21.2 billion. Globally, supplement sales surged by 50% from 2018 to 2020, exceeding USD 220 billion in 2020, partly driven by heightened interest during the COVID-19 pandemic.

Liquid vitamins are favored for their convenience, rapid absorption, and palatability, appealing to diverse demographics, including aging populations. Clear regulatory frameworks in the U.S. and EU streamline market entry and ensure quality, fostering industry growth. Programs targeting micronutrient deficiencies, such as childhood nutrition efforts, increasingly adopt liquid vitamins for their bioavailability and ease of use.

Key Takeaways

- The Liquid Vitamins Market size is expected to be worth around USD 43.8 billion by 2034, from USD 25.9 billion in 2024, growing at a CAGR of 5.4%.

- Water held a dominant market position in the liquid vitamins market by solubility, capturing more than a 67.8% share.

- Food & beverage held a dominant market position in the liquid vitamins market by application, capturing more than a 39.4% share.

- Asia-Pacific (APAC) region emerged as the dominant force in the global liquid vitamins market, accounting for approximately 48.5% of the total market share and generating revenues close to USD 12.5 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/liquid-vitamins-market/request-sample/

Report Scope

| Market Value (2024) | USD 25.9 Billion |

| Forecast Revenue (2034) | USD 43.8 Billion |

| CAGR (2025-2034) | 5.4% |

| Segments Covered | By Soluble (Water, Fat), By Application (Food and Beverage, Pharmaceuticals, Cosmetic and Personal Care, Food Additive, Others) |

| Competitive Landscape | Adisseo, Farbest Brands, Stern Vitamin Gmbh & CO. KG, Lonza Group, ADM, Glanbia Plc, DSM, Amway, Atlantic Essentials Products Inc. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153579

Key Market Segments

Solubility Analysis

In 2024, water-soluble vitamins dominated the liquid vitamins market, holding over 67.8% of the market share. Their rapid absorption into the bloodstream makes them highly effective, driving consumer preference for vitamins like B-complex and C.

These vitamins are widely incorporated into functional beverages, health tonics, and dietary supplements, appealing to all age groups for their support of immunity, energy, and overall health. The growing demand for clean-label, easy-to-digest products has further fueled their popularity in the nutraceutical and pharmaceutical industries.

Application Analysis

The food and beverage segment held the largest share of the liquid vitamins market in 2024, accounting for over 39.4% of the market. This dominance stems from rising consumer interest in nutrient-enriched drinks, juices, and functional foods that promote immunity, energy, and wellness. Manufacturers are increasingly adding liquid vitamins, such as B12, D3, and C, to ready-to-drink products, dairy alternatives, and health shots to meet the demand for convenient nutrition.

The clean-label movement and growing focus on preventive health have driven the incorporation of vitamins into everyday consumables. In both developed and emerging markets, food and beverage companies are launching fortified products to cater to health-conscious consumers, solidifying the segment’s leading position through 2024.

Regional Analysis

In 2024, the Asia-Pacific (APAC) region emerged as the top player in the global liquid vitamins market, driven by heightened consumer awareness of preventive health, growing demand for functional foods and beverages, and rising disposable incomes in countries like China, India, Japan, and South Korea.

Urbanization and lifestyle changes have increased health concerns, such as vitamin deficiencies and immunity issues, boosting demand for liquid vitamin supplements known for their fast absorption and effectiveness. In China and India, expanding middle-class populations and the growth of e-commerce have made liquid vitamins more accessible to urban and semi-urban consumers.

Government initiatives, such as India’s POSHAN Abhiyaan (National Nutrition Mission), have further supported demand for fortified foods and supplements. In Japan, an aging population and preference for easy-to-consume formats have driven liquid vitamin use, particularly in elderly care and clinical nutrition. These factors position APAC as the market leader in 2024.

Top Use Cases

- Immune Support: Liquid vitamins, like vitamin C and zinc, are popular for boosting immunity. They absorb quickly, making them ideal for daily use in health tonics and functional drinks. Consumers prefer them for their convenience and effectiveness in supporting overall wellness, especially during cold seasons or for those with weakened immune systems.

- Sports Nutrition: Athletes and fitness enthusiasts use liquid vitamins, such as B12 and protein blends, to enhance energy, endurance, and muscle recovery. Their fast absorption suits pre- and post-workout needs, offering a convenient alternative to pills. These supplements are often added to shakes or drinks for quick consumption.

- Pediatric Health: Liquid vitamins are widely used for children who struggle with swallowing pills. Formulations with vitamins D, C, and iron support growth, immunity, and bone health. Their palatable flavors and easy dosing make them parent-friendly, ensuring kids get essential nutrients without fuss.

- Elderly Care: Older adults benefit from liquid vitamins like D3 and calcium for bone health and mobility. Their easy-to-swallow nature suits those with swallowing difficulties. Liquid formats ensure better absorption, addressing age-related nutrient deficiencies and supporting healthy aging in a convenient, digestible form.

- Prenatal Nutrition: Pregnant women use liquid vitamins, including folic acid and iron, to support fetal development and maternal health. These supplements are easy to consume, especially for those with nausea or swallowing issues, ensuring proper nutrient intake to prevent deficiencies like anemia during pregnancy.

Recent Developments

1. Adisseo

Adisseo has been focusing on liquid vitamin blends for animal nutrition, enhancing bioavailability and stability. Their Rovimix Stay-C 35 is a liquid vitamin C solution for livestock, improving immune health. Recent innovations include microencapsulation to protect vitamins from degradation.

2. Farbest Brands

Farbest Brands launched Farbest Liquid Vitamin D3, a water-dispersible form for fortified beverages and supplements. Their TruCal (liquid calcium + vitamin D) supports bone health in functional foods. They emphasize clean-label, non-GMO liquid vitamin solutions.

3. SternVitamin GmbH & Co. KG

SternVitamin introduced VitaStar Liquid, a multi-vitamin premix for beverages and gummies. Their liquid B-complex vitamins are optimized for energy drinks. Recent patents focus on heat-stable liquid vitamins for processed foods.

4. Lonza Group

Lonza expanded its Capsugel liquid-filled hard capsules for vitamins, enabling better absorption. Their VitaShure B12 liquid is a high-potency option for supplements. They also developed shelf-stable liquid vitamin E for nutraceuticals.

5. ADM (Archer Daniels Midland)

ADM’s TraditionPlus liquid vitamins include B12, D3, and E for fortified foods. Their Bio-K Plus liquid probiotics + vitamins target gut health. Recent R&D focuses on plant-based liquid vitamin delivery systems.

Conclusion

The Liquid Vitamins Market is poised for steady growth, driven by consumer demand for health-focused, convenient products and supported by robust regulatory frameworks and public health initiatives. Its applications across multiple sectors and strong regional performance, particularly in Asia-Pacific, underscore its expanding role in the global nutritional landscape.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)