Table of Contents

Overview

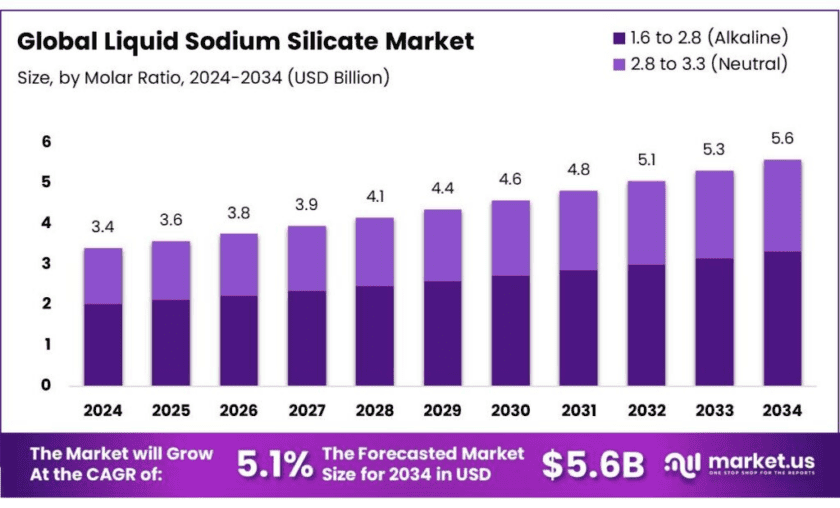

New York, NY – Nov 06, 2025 – The Global Liquid Sodium Silicate Market is projected to reach USD 5.6 billion by 2034, rising from USD 3.4 billion in 2024, at a CAGR of 5.1% between 2025 and 2034. In 2024, Asia-Pacific (APAC) dominated the market with a 44.8% share, valued at about USD 1.5 billion. Liquid sodium silicate—often called waterglass—is produced by dissolving silica (SiO₂) in sodium hydroxide (NaOH), and is essential in detergents, cement, water treatment, paper manufacturing, and refractory bonding because of its thermal stability and adhesive strength.

The European Commission recorded detergent consumption of ~6 million tonnes per year across EU-25, relying heavily on silicate builders. Likewise, FAO’s pulp-and-paper surveys confirm steady global board capacity supporting silicate adhesive demand in corrugating and packaging.

Policy also drives substitution: the U.S. EPA estimates phosphorus-control measures—culminating in the July 2010 automatic dishwasher-detergent regulation—cut about 52,000 pounds of phosphorus from wastewater discharges, accelerating the shift toward silicate-based, low-phosphate formulations.

In construction, demand is expanding through large-scale infrastructure programs. India’s Union Budget 2025-26 earmarked ₹2,87,333 crore (≈ USD 34.5 billion) for the Ministry of Road Transport and Highways, boosting cement and concrete output where liquid sodium silicate acts as a binder and sealing aid. Meanwhile, the International Energy Agency (IEA) urges the cement sector to cut CO₂ intensity by ~4% annually through 2030 to align with net-zero goals.

Key Takeaways

- Liquid Sodium Silicate Market size is expected to be worth around USD 5.6 Billion by 2034, from USD 3.4 Billion in 2024, growing at a CAGR of 5.1%.

- 1.6 to 2.8 molar ratio (alkaline) segment held a dominant market position, capturing more than a 59.3% share of the global liquid sodium silicate market.

- detergents held a dominant market position, capturing more than a 42.4% share of the global liquid sodium silicate market.

- construction held a dominant market position, capturing more than a 34.1% share of the global liquid sodium silicate market.

- Asia Pacific region held the dominant market position in the global liquid sodium silicate market, capturing more than 44.80% of the total share, valued at approximately USD 1.5 billion.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/liquid-sodium-silicate-market/free-sample/

Report Scope

| Market Value (2024) | USD 3.4 Bn |

| Forecast Revenue (2034) | USD 5.6 Bn |

| CAGR (2025-2034) | 5.1% |

| Segments Covered | By Molar Ratio (1.6 to 2.8 (Alkaline), 2.8 to 3.3 (Neutral)), By Application (Detergents, Catalysts, Pulp and Paper, Elastomers, Others), By End-use (Construction, Paper and Pulp, Petrochemical, Chemicals, Others) |

| Competitive Landscape | Solvay S.A, PQ Corporation, Evonik Industries AG, QEMETICA, BASF SE, PPG Industries, Inc, W.R. Grace & Company, Tokuyama Corporation, Sinchem Silica Gel Co, Ltd., Nippon Chemical Industrial Co., Ltd. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=159766

Key Market Segments

By Molar Ratio Analysis – 1.6 to 2.8 Molar Ratio (Alkaline) Leads with 59.3% Share

In 2024, the 1.6 to 2.8 molar ratio (alkaline) segment dominated the global liquid sodium silicate market, accounting for more than 59.3% of total revenue. This molar ratio range offers an ideal balance between alkalinity and silica content, making it widely suitable for detergent, water treatment, and cement applications. Its strong bonding, cleaning, and coagulating properties make it a key choice in diverse industrial processes. Growth in this segment is fueled by the expansion of the detergent industry—especially across Asia Pacific, where rising incomes drive household cleaning product demand.

By Application Analysis – Detergents Dominate with 42.4% Share

The detergents segment held a leading 42.4% market share in 2024, driven by the extensive use of liquid sodium silicate as a builder and cleaning enhancer in both household and industrial cleaning formulations. The compound helps soften water, break down stains, and prevent soap-scum accumulation, improving detergent performance across laundry and dishwashing categories. Rising urbanization, increasing hygiene awareness, and higher living standards are spurring detergent consumption globally, particularly in emerging economies.

By End-use Analysis – Construction Holds 34.1% Share

In 2024, the construction sector led the global liquid sodium silicate market, securing a 34.1% share. Its extensive application in cement and concrete manufacturing—where it acts as a bonding and sealing agent—significantly enhances the strength, durability, and water resistance of construction materials. Growing investments in infrastructure, urban development, and housing projects—especially across emerging economies like India and China—are propelling segment growth.

List of Segments

By Molar Ratio

- 1.6 to 2.8 (Alkaline)

- 2.8 to 3.3 (Neutral)

By Application

- Detergents

- Catalysts

- Pulp & Paper

- Elastomers

- Others

By End-use

- Construction

- Paper & Pulp

- Petrochemical

- Chemicals

- Others

Regional Analysis

Asia Pacific Dominates with 44.80% Market Share

In 2024, the Asia Pacific region emerged as the leading market for liquid sodium silicate, accounting for over 44.80% of global revenue, valued at approximately USD 1.5 billion. This leadership stems from the region’s strong industrial foundation encompassing detergent manufacturing, construction, and water treatment sectors. Major economies such as China, India, and Japan play pivotal roles, with rising applications across cement, textile, and chemical industries sustaining steady demand. The region’s commitment to industrial modernization and increased use of silicate-based materials further reinforce its market dominance.

Top Use Cases

Detergent builder in low-phosphate formulations: Liquid sodium silicate improves alkalinity, disperses soils, and inhibits corrosion in laundry and dishwashing products—key as regulations drive down phosphates. The European Commission estimates EU-25 detergent consumption at ~6 million tonnes/year, providing a large, steady base where silicates commonly appear in builder packages. In the U.S., state-level dishwasher-detergent phosphate bans that took effect in July 2010 were estimated by EPA to remove ~52,000 lb of phosphorus from wastewater annually—reinforcing substitution toward silicate-based, low-phosphate systems.

Corrugating And paper bonding adhesives: Liquid sodium silicate is widely used to glue corrugated board and as a paper-bonding adhesive due to fast tack, heat resistance, and low VOCs. Demand is underpinned by the scale of the pulp-and-paper sector: the FAO’s recurring Pulp and Paper Capacities survey documents sizable global paper and board capacity across countries and grades, indicating a robust end-market for silicate adhesives in packaging and converting lines.

Cement/concrete additives, specialty grouts And emerging low-clinker systems: In construction, liquid sodium silicate functions as a chemical binder and densifier that can improve strength, durability, and water resistance. Decarbonization targets are accelerating adoption of alternative binders and admixtures: the IEA notes cement’s direct CO₂ intensity must fall ~4% per year to 2030 to track a Net-Zero pathway, pushing interest in silicate-based systems and geopolymers. At the same time, public works sustain underlying cement demand—for example, India’s FY 2025–26 plan estimates ₹2,87,333 crore for the Road Transport & Highways ministry, which supports cement-intensive projects where silicate admixtures are used.

Water treatment: corrosion control And coagulant-aid chemistry: Utilities dose sodium silicate to control corrosion, stabilize iron/manganese, or as part of activated-silica coagulant aids. The Australian Drinking Water Guidelines indicate effectiveness at higher pH and >15–20 mg/L (as SiO₂), with start-up doses up to ~24 mg/L for 30–60 days before tapering to 4–8 mg/L maintenance. An EPA supply-chain profile similarly notes applications in corrosion control and coagulant-aid formulations used by U.S. utilities. These quantified practices highlight waterglass’s operational role in protecting distribution systems and improving clarification.

High-temperature binders for refractories And foundry molds: sodium silicate forms heat-resistant, inorganic bonds, it is used to bind refractory cements, foundry sand molds, and insulating materials where organic resins would degrade. Academic and industry literature show silicate-based systems delivering strong bonding while avoiding solvent emissions; laboratory work also demonstrates silicate inhibitors can reduce carbon-steel corrosion in aggressive environments—useful where hot-wet conditions can attack steel equipment.

Recent Developments

In 2023, Solvay completed a partial demerger that split off its “Specialty Businesses,” which included silicates and related technologies, into a separate listed company. While Solvay’s mainstream results do not list liquid sodium silicate specifically for 2024, the company has publicly referenced the silica and silicate operations being transferred to create its new entity—indicating that liquid sodium silicate production has been reorganised under the new structure.

In January 2024, PQ Corporation announced the acquisition of the specialty silicate business of the vanBaerle Group, greatly expanding its global portfolio in liquid sodium silicate and related silicate derivatives. The company’s website also notes that its liquid sodium silicates serve as a core building block for its product range, supporting applications in cleaning, construction and chemical manufacturing.

In 2024, Evonik reported group revenues of around €15.2 billion, with its specialty chemicals segment—including silicates—playing a key role. The firm highlights that its inorganic materials portfolio supplies sodium silicate for advanced paper-fillers and coating systems. Through 2023-24, Evonik has focused on sustainability and product innovation, positioning silicates as high-value ingredients in environmentally conscious applications.

In 2023, QEMETICA announced first-half revenue of PLN 2,917 billion, an 18% increase year-on-year, while its silicates business—liquid and solid sodium/potassium silicates—is described as Europe’s largest sodium silicate supplier. With about 100 employees in that segment and exports reaching Europe, Asia and North America, the company is advancing tailored silicate solutions for detergents, paper, and construction chemicals.

In 2024, BASF continued to offer its sodium silicate 37/40 product line for multiple applications including household-industrial cleaning and coatings. While the 2023 Annual Report shows group revenue of €68.9 billion and net income of €225 million for the year, specific volumes for liquid sodium silicate aren’t publicised. BASF’s involvement signals its role in supplying key silicate-based materials despite not disclosing segment-level data.

In 2024, PPG completed the sale of its silicas products business to QEMETICA for approximately USD 310 million in pre-tax proceeds. The transaction included its manufacturing units in Lake Charles, Louisiana and Delfzijl, Netherlands. In 2023 the silicas segment represented 1-2% of PPG’s total net sales. Although not exclusively liquid sodium silicate, the sale affects PPG’s exposure to silicate and related specialty chemical markets.

In 2023, W. R. Grace & Company continued to support its specialty materials segment, which includes sodium-based and silica-based products, although specific figures for liquid sodium silicate were not publicly broken out. The company disclosed its 2023 EcoVadis Silver CSR rating, placing it in the top 15 % of companies assessed, showing its commitment to sustainable chemical production.

In FY 2023, Tokuyama Corporation reported a net sales figure of ¥302.0 billion and operating profit of ¥14.3 billion. As one of Japan’s leading sodium silicate producers, the company’s product line supplies dissolved sodium silicate used in soil hardening, detergents and paper-industry additives.

In 2023, Sinchem Silica Gel Co., Ltd., based in Tengzhou, Shandong Province (China), operated as a high-tech chemical manufacturer focusing on inorganic silicon-based products including sodium silicate and silica gels. The company’s European arm reports production of over 900 tons per day of sodium silicate and related materials, supported by a workforce of around 800 employees globally. Sinchem’s broad supply chain reach underscores its position as a major player in the liquid sodium silicate market regionally and internationally.

In 2024, Nippon Chemical Industrial Co., Ltd. (Japan) offered a liquid sodium silicate grade called “Sodium Silicate 4” with chemical composition SiO₂ 23.0-25.0% and Na₂O 6.0-7.0%, featuring a molar ratio of ~3.7-3.9. This product is targeted at a range of applications including detergents, adhesives for boxboard, water treatment, and concrete hardening. Nippon’s longevity in inorganic chemicals (founded 1915) and diversified product range reinforce its capability within the sodium silicate segment.

Conclusion

In conclusion, liquid sodium silicate remains a highly versatile industrial chemical, thanks to its strong adhesive, alkaline and bonding properties. For example, its use as a builder in detergents helps facilitate grease and oil removal in laundry and dishwashing applications. Its adhesive nature also makes it ideal for applications like corrugated box manufacturing and refractory cements.

At the same time, the availability of raw materials—silica and soda ash—and the well-known process for producing it support its cost-effectiveness for large industrial volumes. As industries such as detergents, paper & packaging, construction and water treatment continue to expand globally, demand for liquid sodium silicate is likely to remain strong.

Discuss Your Needs With Our Analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)