Table of Contents

Report Overview

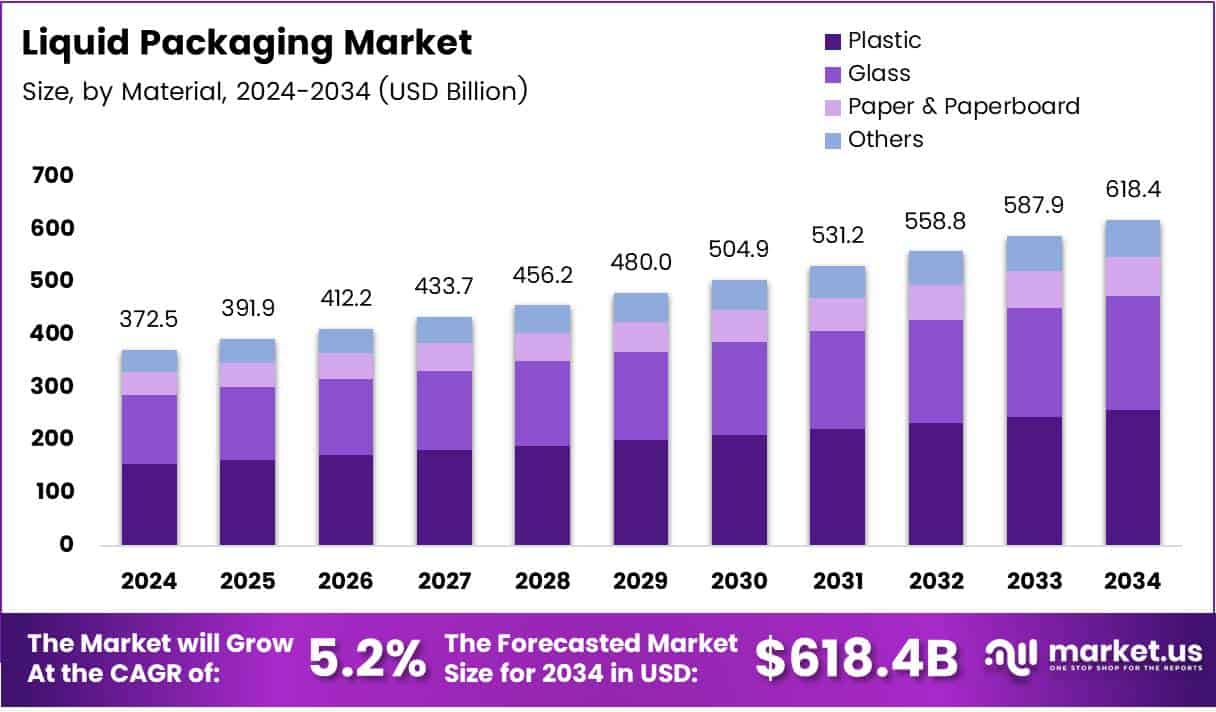

The Global Liquid Packaging Market size is expected to be worth around USD 618.4 Billion by 2034, from USD 372.5 Billion in 2024, growing at a CAGR of 5.2% during the forecast period from 2025 to 2034.

As a critical component of the packaging industry, liquid packaging ensures the safe transport, storage, and dispensing of beverages, pharmaceuticals, personal care products, and more. Evolving lifestyles, regulatory frameworks, and technological advancements are poised to accelerate innovation in this vital market.

Key growth drivers include rising demand for on-the-go consumption, ready-to-drink products, and longer shelf-life solutions. The shift toward e-commerce and user-friendly, leak-resistant packaging is prompting innovation in materials and formats like cartons, pouches, bottles, and bag-in-box systems. Sustainability is emerging as a major differentiator, with strong consumer preference for biodegradable, recyclable, and reusable materials.

Regulatory policies, including the EU’s Single-Use Plastics Directive and India’s EPR, are shaping market strategies. Moreover, government incentives and technological advancements in aseptic packaging, multilayer films, and smart packaging (e.g., QR codes and freshness indicators) are further accelerating growth.

Key Takeaways

- The global liquid packaging market is projected to reach USD 618.4 Billion by 2034, growing from USD 372.5 Billion in 2024 at a CAGR of 5.2%.

- Plastic led the material segment in 2024 with a 39.1% share due to its lightweight, cost-efficiency, and liquid compatibility.

- Rigid packaging dominated the type segment with a 58.2% market share in 2024, attributed to its durability and shelf appeal.

- The Food & Beverages segment was the top end-use category in 2024, accounting for 38.6% of the market.

- Asia Pacific held the largest regional share in 2024 at 42.5%, driven by urbanization, rising consumption, and sustainability initiatives.

Key Market Segments

Material Analysis

Plastic led with 39.1% in 2024 due to its low cost, light weight, and wide compatibility with liquids. Glass is used for premium and sensitive products, while paper-based materials are rising in eco-friendly packaging. Niche options like aluminum and bio-based materials show future potential.

Type Analysis

Rigid packaging dominated with 58.2% thanks to its strength and reliability, especially in food and healthcare. Flexible packaging is growing for single-use and portable items but still faces issues with protection and recyclability.

End Use Analysis

Food & Beverages topped with 38.6% share due to high demand for packaged drinks. Pharmaceuticals need safe and precise liquid packaging. Personal care is growing fast with innovative formats, while industrial use requires strong, compliant packaging solutions.

Drivers

The surge in demand for ready-to-drink products and processed liquid foods is a major catalyst. Over 1,200 billion liters of liquid food are consumed globally each year, creating an immense demand for reliable packaging. Consumer expectations around leak-proof, easy-to-carry, and shelf-stable formats are pushing brands toward smart packaging and multilayer films. Simultaneously, the e-commerce boom in beverages and personal care products is redefining how liquids are packaged for durability and transport.

Major Challenges

The primary restraint remains high packaging costs, especially for sustainable or advanced formats. Smaller manufacturers often face financial barriers to adopt new technologies. Moreover, plastic dependency continues to invite environmental criticism. Despite improvements in recycling systems and compostable materials, stringent regulations such as India’s Extended Producer Responsibility (EPR) and the EU’s Single-Use Plastics Directive impose added compliance costs and development constraints.

Regional Analysis

Asia Pacific holds the top position in the global liquid packaging market, contributing 42.5% of the total market share. In 2024, the region reached a market value of USD 156.4 billion. This strong performance is mainly driven by the high demand for liquid packaging solutions in industries like beverages, dairy products, and personal care.The region’s dominance is supported by rapid urbanization, which is increasing the demand for packaged liquids. Consumers in growing cities are choosing convenient, ready-to-use products more than ever. Additionally, regional governments are encouraging the use of sustainable packaging, pushing companies to invest in innovative and eco-friendly solutions.Key markets such as China, India, and countries across Southeast Asia are seeing fast growth in flexible and sustainable packaging formats.

Restraints

High Packaging Costs Pose Challenges to Market Expansion

The liquid packaging market faces notable challenges due to the high cost of materials and advanced technologies. Packaging solutions designed for enhanced durability and sustainability often involve expensive production processes, making them less accessible for small and mid-sized enterprises (SMEs).

In addition, environmental concerns regarding plastic usage remain a critical restraint. Although recyclable and biodegradable alternatives are gaining traction, the industry’s continued dependence on plastic leads to regulatory scrutiny. Stricter government policies and environmental compliance requirements are increasing operational costs and limiting market growth, especially in regions with stringent environmental regulations.

Recent Developments

In Jan 2025 — Innventure founded AeroFlexx to revolutionize the liquid packaging industry by offering a sustainable and easy-to-use solution. This innovation merges the benefits of rigid and flexible packaging to reduce plastic usage and improve efficiency.

In Apr 2025 — Reusables.com raised $3.6 million in funding to combat the $100B+ packaging waste issue. The company also launched operations at the University of California, backed by leading Canadian climate tech and B2B investors.

In Mar 2025 — VYTAL Global GmbH, a Cologne-based smart reusable packaging provider, secured €14.2 million in growth capital. The funding will accelerate its international expansion and product innovation strategy.

In Oct 2024 — New funding was allocated to develop low-cost Prefilled ApiJect Injectors for vaccines and injectables. This initiative focuses on improving access in Low- and Middle-Income Countries (LMICs) through innovative, scalable solutions.

In Apr 2025 — Toppan completed the acquisition of Sonoco’s Thermoformed & Flexibles Packaging (TFP) business. This move strengthens Toppan’s global footprint and expands its flexible packaging capabilities in North America.

Conclusion

The global liquid packaging market is on a trajectory of sustained growth, fueled by changing consumer lifestyles, technological advancements, and environmental awareness. As sustainability becomes a brand-defining factor, companies that prioritize eco-friendly innovation and digital transformation will gain a competitive edge. With robust demand across food, pharmaceuticals, and personal care segments, and a strong push from emerging markets, the decade ahead promises expansive opportunities for forward-thinking packaging providers.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)