Table of Contents

Overview

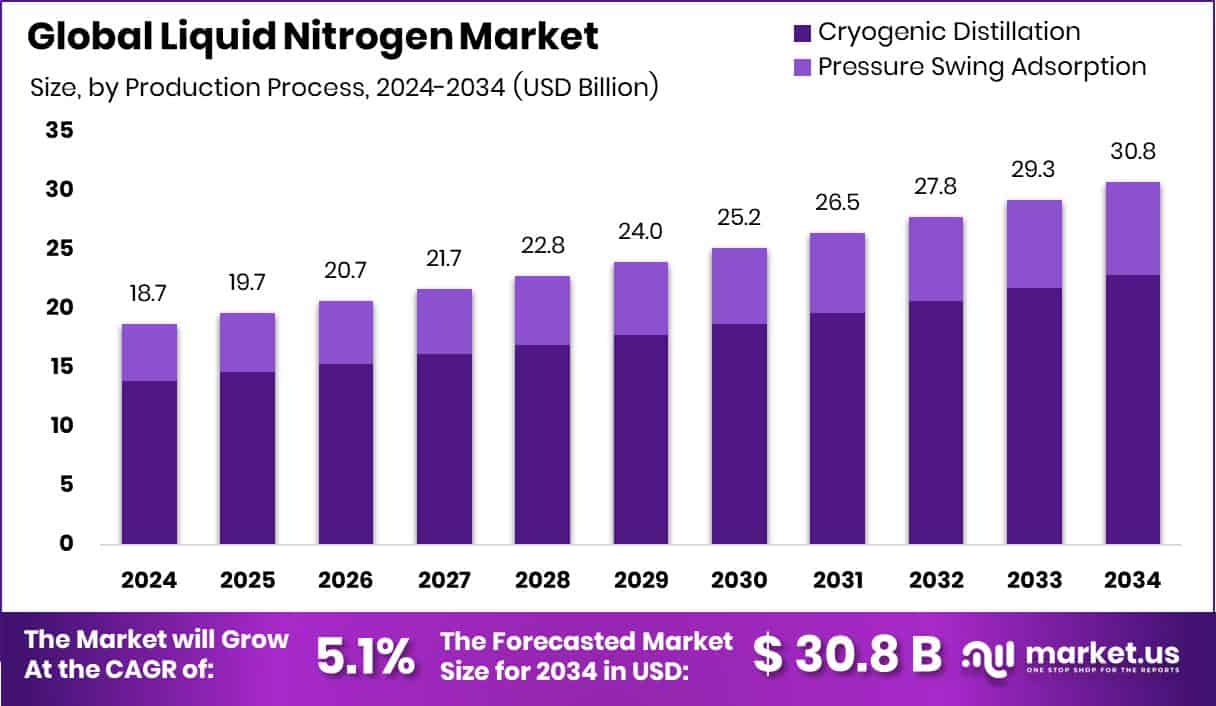

New York, NY – April 22, 2025 – The global Liquid Nitrogen Market is growing fast, driven by high demand from industries like healthcare, food & beverage, and electronics. In 2024, the market was valued at USD 18.7 billion and is expected to reach USD 30.8 billion by 2034, growing at a steady 5.1% CAGR.

Cryogenic distillation leads the liquid nitrogen market, commanding a 74.4% share in 2024. Tonnage storage dominates with a 43.4% share, driven by high-volume industries such as chemicals, metallurgy, and energy, requiring continuous supply. Coolant applications hold a 67.3% share, fueled by liquid nitrogen’s ability to achieve ultra-low temperatures rapidly. The chemical and pharmaceutical sectors account for 34.5% of liquid nitrogen use.

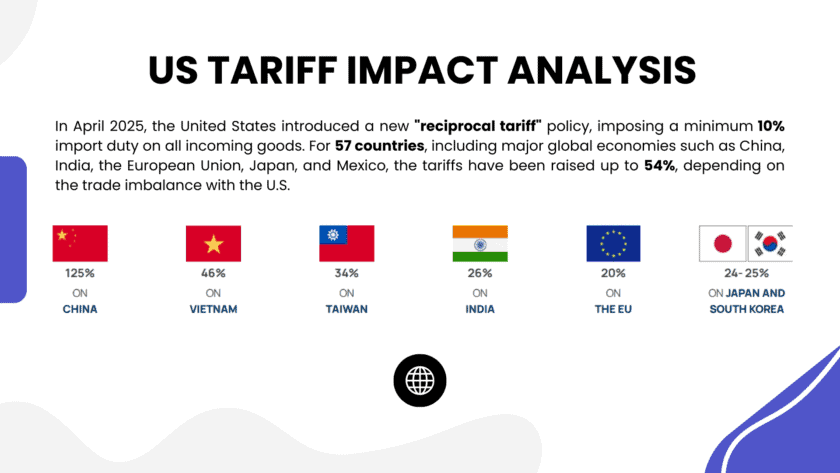

US Tariff Impact on the Liquid Nitrogen Market

Recent U.S. tariffs on imports from Canada, Mexico, and China have significant implications for the Liquid Nitrogen Market. Canada supplies over 8% of U.S. nitrogen fertilizer needs, accounting for 25% of U.S. nitrogen fertilizer imports.

➤ Get More Detailed Insights about US Tariff Impact @ – https://market.us/report/global-liquid-nitrogen-market/request-sample/

The imposition of a 25% tariff on these imports increases costs for U.S. farmers and industries reliant on nitrogen-based products. This cost increase may lead to higher prices for end-users and could potentially reduce demand. Additionally, the tariffs may disrupt supply chains and lead to retaliatory measures from trade partners, further impacting the market.

Key Takeaways

- The Global Liquid Nitrogen Market is expected to be worth around USD 30.8 billion by 2034, up from USD 18.7 billion in 2024, and grow at a CAGR of 5.1% from 2025 to 2034.

- Cryogenic distillation dominates the liquid nitrogen market, accounting for 74.40% due to high purity yields.

- Tonnage storage systems lead with 43.40%, meeting rising demand in industrial-scale liquid nitrogen applications.

- Liquid nitrogen’s coolant application dominates the market, representing 67.30% due to thermal control demand.

- Chemicals and pharmaceuticals represent 34.50% end-use share, driving steady growth in the liquid nitrogen market.

- The market in Europe is valued at USD 8.1 billion in 2024.

Analyst Viewpoint

Investing in the liquid nitrogen market offers a compelling opportunity, driven by its growing applications across diverse industries like healthcare, food processing, and electronics. The global demand for liquid nitrogen is surging, particularly in cryopreservation for medical applications, such as storing biological samples, and in food preservation, where it ensures longer shelf life without chemical additives.

The healthcare sector’s increasing reliance on cryotherapy and the food industry’s shift toward eco-friendly freezing methods are key growth drivers. The electronics industry uses liquid nitrogen for cooling during semiconductor manufacturing, a sector seeing robust growth due to rising demand for consumer electronics. Investors should be excited yet cautious, opportunities abound, but so do challenges. The market’s expansion is supported by innovations like improved cryogenic storage solutions, which enhance safety and efficiency, making liquid nitrogen more accessible for smaller businesses.

Report Scope

| Market Value (2024) | USD 18.7 Billion |

| Forecast Revenue (2034) | USD 30.8 Billion |

| CAGR (2025-2034) | 5.1% |

| Segments Covered | By Production Process (Cryogenic Distillation, Pressure Swing Adsorption), By Storage Type (Tonnage, Cylinders and Packaged Gas, Merchant Liquid/ Bulk, Others), By Application (Coolant, Refrigerant), By End-use (Chemicals and Pharmaceuticals, Healthcare, Food and Beverages, Metal Manufacturing and Construction, Rubber and Plastic, Others) |

| Competitive Landscape | Air Products and Chemicals, Inc., Linde plc, Nexair LLC, Praxair Inc., Matheson Tri-Gas, Inc., Gulf Cryo, Southern Industrial Gas Berhad, Messer Group, Nippon Sanso Holdings Corporation, Bluefors Oy, AOC México, Air Liquide S.A., CalOx Inc., Norco Inc., Dakota Gasification Company, Other Key Players |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=145878

Key Market Segments

By Production Process

- Cryogenic distillation leads the liquid nitrogen market, commanding a 74.4% share in 2024. Its dominance stems from high efficiency and the ability to produce large volumes of ultra-pure liquid nitrogen, critical for industries like electronics, healthcare, and food processing, where purity is paramount. The process’s scalability meets rising demand, particularly in developed regions with robust industrial infrastructure. Integration with air separation units (ASUs) enhances energy efficiency and cost-effectiveness for large-scale operations.

By Storage Type

- Tonnage storage dominates with a 43.4% share, driven by high-volume industries such as chemicals, metallurgy, and energy, requiring continuous supply. On-site tonnage systems ensure uninterrupted operations, minimizing transportation needs. Their reliability and cost-effectiveness suit industries like steel manufacturing, electronics, and pharmaceuticals. Automated monitoring in modern tonnage setups enhances safety and reduces waste. Growing industrial activity in Asia Pacific bolsters demand, with tonnage systems offering superior economies of scale compared to cylinders or microbulk options.

By Application

- Coolant applications hold a 67.3% share, fueled by liquid nitrogen’s ability to achieve ultra-low temperatures rapidly. It’s essential for thermal management in electronics, metal processing, food preservation, and healthcare equipment. Cryogenic freezing in the food industry extends shelf life, while healthcare relies on it for cryosurgery and biological sample storage. Electronics uses it for chip manufacturing and superconductors. Its non-flammable, inert nature ensures safety in sensitive settings.

By End-Use

- The chemical and pharmaceutical sectors account for 34.5% of liquid nitrogen use. In chemicals, it supports temperature-sensitive reactions, cryogenic grinding, and inerting volatile compounds. In pharmaceuticals, it’s vital for preserving biological samples, vaccines, and active ingredients under strict regulations. Growth in biotechnology and research labs, particularly for cell cultures and genetic materials, drives demand. The global push for biologics, advanced drug discovery, and vaccine development further increases reliance on liquid nitrogen for cryopreservation and safe production processes.

Regional Analysis

- Europe led the global liquid nitrogen market, holding a 43.6% share valued at USD 8.1 billion, fueled by strong demand in healthcare and food industries, particularly for cryopreservation and food freezing.

- North America saw significant market activity, driven by pharmaceutical advancements and industrial applications like metal manufacturing and chemical processing. The Asia Pacific region experienced robust demand growth, propelled by industrialization in China and India, especially in electronics and healthcare sectors.

- The Middle East & Africa market grew steadily, supported by increased use of oil and gas for pipeline purging and maintenance. Latin America showed gradual progress, driven by food processing and agriculture, with rising use in food preservation and transportation.

Recent Developments

1. Air Products and Chemicals, Inc.

- Air Products expanded its liquid nitrogen production capacity in Texas (2024) to meet rising demand from the semiconductor and aerospace industries. The company also invested in green hydrogen-linked nitrogen production to support sustainability goals. A new cryogenic logistics hub in Pennsylvania enhances distribution efficiency.

2. Linde plc

- Linde launched a new liquid nitrogen plant in Germany (2024) to serve Europe’s pharmaceutical and electronics sectors. The company also partnered with a major biotech firm for cryogenic storage solutions. Linde’s AI-driven supply chain optimization reduces delivery costs.

3. Nexair LLC

- Nexair introduced on-site nitrogen generation systems (2024) to help U.S. manufacturers bypass tariff-related costs. The company also expanded its Southeast U.S. distribution network, targeting food processing and metal fabrication industries.

4. Praxair Inc. (Now part of Linde)

- Praxair (under Linde) upgraded its North American cryogenic transport fleet (2024) for safer, more efficient liquid nitrogen delivery. The company also secured a long-term supply contract with a leading U.S. aerospace manufacturer.

5. Matheson Tri-Gas, Inc.

- Matheson Tri-Gas expanded its medical-grade liquid nitrogen offerings (2024), focusing on vaccine storage and biobanking. The company also opened a new production facility in Ohio to strengthen domestic supply chains.

Conclusion

The Liquid Nitrogen Market is experiencing steady growth, driven by its increasing use in healthcare, food processing, and electronics industries. This growth is supported by advancements in cryogenic technologies and the expanding demand for high-purity gases. However, challenges such as high production costs and safety concerns related to handling liquid nitrogen persist. Despite these hurdles, the market’s outlook remains positive, with opportunities emerging in developing regions and new applications across various sectors.