Table of Contents

Overview

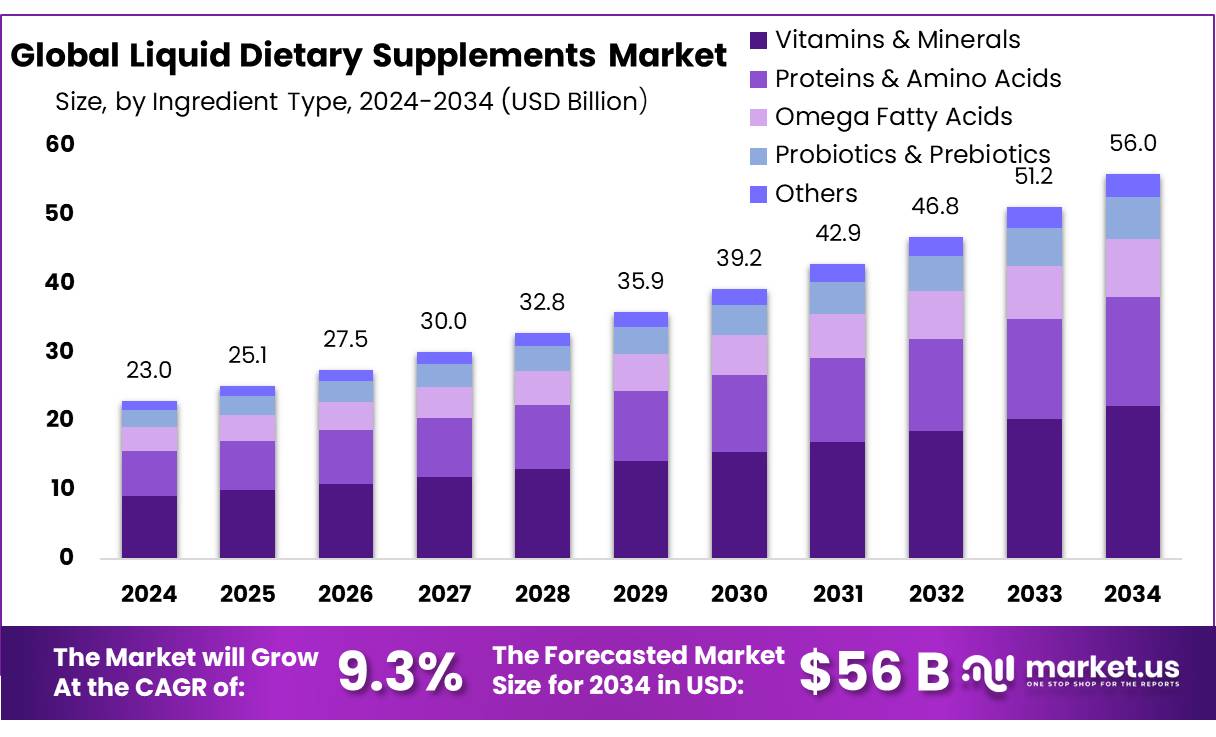

New York, NY – September 15, 2025 – The Global Liquid Dietary Supplements Market is poised for significant growth, with its value projected to reach approximately USD 56.0 billion by 2034, up from USD 23.0 billion in 2024, reflecting a robust compound annual growth rate (CAGR) of 9.3% during the forecast period from 2025 to 2034. In 2024, North America emerged as the dominant region, commanding a 35.8% market share with revenues of USD 8.2 billion.

Liquid dietary supplements, formulated in fluid form to deliver essential nutrients such as vitamins, minerals, botanicals, and omega-3 fatty acids, are gaining traction due to their ease of administration and enhanced absorption. These products are particularly appealing to individuals with swallowing difficulties, those leading busy lifestyles, or those with specific health-targeted needs, positioning liquid supplements as a vital segment within the broader nutritional supplements industry.

In the United States, dietary supplement consumption is widespread, with over half of adults 57.6% reporting use of any dietary supplement in the past 30 days during 2017–2018. Usage is particularly high among older adults, with 80.2% of women aged 60 and over incorporating supplements into their routines. While specific government data on liquid dietary supplements is limited, their role can be contextualized within the broader dietary supplements sector, which continues to grow in response to increasing health consciousness and demand for convenient nutritional solutions.

In India, government initiatives are playing a pivotal role in bolstering the nutraceutical sector, including liquid dietary supplements. Programs such as the Integrated Child Development Services (ICDS) provide supplementary nutrition to children under six, while the Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY) ensures free food grains for approximately 81.35 crore beneficiaries. Additionally, the Pradhan Mantri Bharatiya Janaushadhi Pariyojana (PMBJP) enhances access to affordable generic medicines, including Ayurvedic products, through over 9,000 outlets nationwide.

To ensure safety and efficacy, the Food Safety and Standards Authority of India (FSSAI) regulates the nutraceutical industry, issuing guidelines for the approval of health supplements, foods for special dietary use, and foods for special medical purposes. Grassroots initiatives like the Community-based Management of Acute Malnutrition (CMAM) and Village Health Sanitation Nutrition Day (VHSND) underscore India’s commitment to addressing nutritional deficiencies, further driving the demand for accessible and effective nutritional solutions like liquid dietary supplements.

Key Takeaways

- Liquid Dietary Supplements Market size is expected to be worth around USD 56.0 billion by 2034, from USD 23.0 billion in 2024, growing at a CAGR of 9.3%.

- Vitamins & Minerals held a dominant market position, capturing more than a 39.7% share of the liquid dietary supplements.

- OTC held a dominant market position, capturing more than 78.4% share of the liquid dietary supplements.

- Energy & Weight Management held a dominant market position, capturing more than a 36.9% share of the liquid dietary supplements.

- Adults held a dominant market position, capturing more than a 52.2% share of the liquid dietary supplements.

- Offline held a dominant market position, capturing more than a 69.1% share of the liquid dietary supplements.

- North America stood out as the leading region for liquid dietary supplements, accounting for a commanding 35.8% share, which translates to a market value of approximately USD 8.2 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-liquid-dietary-supplements-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 23.0 Billion |

| Forecast Revenue (2034) | USD 56.0 Billion |

| CAGR (2025-2034) | 9.3% |

| Segments Covered | By Ingredient Type (Vitamins and Minerals, Proteins and Amino Acids, Omega Fatty Acids, Probiotics and Prebiotics, Others), By Type ( OTC, Prescribed), By Application (Energy and Weight Management, Sports Nutrition, Bone and Joint Health, Cardiac Health, Anti-aging, Others, By End User (Adults, Geriatric, Children, Infants), By Distribution Channel (Offline, Online) |

| Competitive Landscape | Amway, Nestlé, Herbalife Nutrition, Nature’s Bounty, Abbott Laboratories, DuoLife S.A., Pfizer Inc., BASF, Arkopharma, Bayer |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=155502

Key Market Segments

Ingredient Type Analysis

In 2024, Vitamins & Minerals commanded a leading 39.7% share of the liquid dietary supplements market, reflecting their widespread consumer trust and preference. These essential nutrients are favored for their simplicity, familiarity, and proven benefits, supporting everything from immunity to energy and overall wellness. Their vibrant branding and long-standing reputation make them a reliable choice for health-conscious individuals.

Entering 2025, Vitamins & Minerals maintain their strong market position. Despite the rise of trendy alternatives like herbal extracts, proteins, and omega blends, these ingredients remain the cornerstone of liquid supplements. Their versatility and reliability make them a top pick for both consumers and manufacturers crafting liquid concentrate formulations.

Type Analysis

In 2024, Over-the-Counter (OTC) products held a dominant 78.4% share of the liquid dietary supplements market, underscoring their popularity. Consumers gravitate toward the accessibility and familiarity of OTC supplements, which require no prescription and offer a trusted solution for daily health needs, from vitamins to specialized blends.

As we move into 2025, OTC’s dominance persists, driven by its convenience and immediate availability. Shoppers appreciate the ease of grabbing a bottle off the shelf, while manufacturers benefit from the straightforward design and distribution of OTC products compared to prescription alternatives.

Application Analysis

In 2024, Energy & Weight Management captured a robust 36.9% share of the liquid dietary supplements market, highlighting consumer focus on vitality and fitness. These supplements appeal to those seeking quick energy boosts or support for weight control, fitting seamlessly into busy lifestyles.

Heading into 2025, this category continues to resonate with consumers juggling work, family, and health goals. Liquid supplements for energy and weight management offer a convenient, fast-acting solution, easily incorporated into morning routines, smoothies, or on-the-go schedules.

End User Analysis

In 2024, Adults accounted for a commanding 52.2% share of the liquid dietary supplements market, reflecting their role as the primary consumers. Balancing work, family, and personal health, adults turn to liquid supplements for convenient support in areas like immunity, digestion, or stress management. In 2025, adults remain the core market, valuing the ease and rapid absorption of liquid formats. Whether at home, the gym, or the office, these supplements align with the fast-paced, practical needs of adult lifestyles.

Distribution Channel Analysis

In 2024, Offline sales dominated the liquid dietary supplements market with a 69.1% share, as consumers preferred the tangible experience of in-store purchases. The ability to browse products, read labels, and consult staff provides reassurance and credibility. Offline channels maintain their lead. Shoppers continue to value the hands-on experience and immediate availability of pharmacies, health stores, and supermarkets, where they can purchase supplements without the wait of online delivery.

Regional Analysis

North America Leads with 35.8% Market Share (USD 8.2 Billion) in 2024

In 2024, North America dominated the liquid dietary supplements market, capturing a 35.8% share, equivalent to approximately USD 8.2 billion. This strong performance underscores the region’s health-conscious consumer base, robust retail network, and widespread availability through pharmacies, specialty stores, and major supermarkets.

The United States drives this dominance, commanding the majority of North America’s market. Liquid supplements, including vitamins, botanicals, and energy blends, are particularly popular among adults and seniors who prioritize convenience and fast absorption. This trend aligns with growing demographic shifts and an increasing focus on preventive nutrition among health-savvy consumers.

Top Use Cases

- Geriatric Nutrition Support: As people age, they often eat less, have weaker digestion, or have difficulty chewing/swallowing. Liquid dietary supplements give concentrated nutrients in a soft, easy-to-ingest form. They help meet daily vitamin, mineral, and protein needs for seniors, reduce the risk of malnutrition, and support strength, immune function, and recovery from illness.

- Chronic Illness & Recovery: Patients dealing with chronic diseases (e.g., cancer, kidney disease, or after surgery) can have low appetite or impaired nutrient uptake. Liquid dietary supplements provide a way to deliver high-calorie, high-protein, or vitamin/mineral blends in small volumes. They aid healing, maintain body weight, reduce the risk of complications, and speed recovery.

- Sports & Fitness Nutrition: For athletes or fitness enthusiasts, performance, muscle repair, and endurance are key. Liquid supplements enable fast absorption of proteins, amino acids, electrolytes, or botanicals. They enable convenient intake post-workout or during training. Their fluid form helps hydration, easier digestion, and flexibility compared to large solid pills or heavy shakes.

- Pediatric & Infant Supplementation: Infants, toddlers, or children who are picky eaters may miss out on essential nutrients. Liquid supplements can be formulated in friendly flavors, easy dosing, and safe consistency. They help fill nutritional gaps, prevent deficiencies, support growth and immune development, especially where solid foods are not accepted or sufficient.

- Weight Management & Meal Replacement: Some consumers want to lose weight or manage weight while ensuring they get enough nutrition. Liquid dietary supplements or ready-to-drink (RTD) shakes can act as meal replacements or partial replacements. They enable calorie control, balanced nutrient profiles, and convenience for people with busy lives, or those wanting to avoid overeating.

Recent Developments

1. Amway

Amway has expanded its Nutrilite brand with plant-powered liquid supplements, emphasizing sustainability and traceability. Their recent Nutrilite Organic Vitamin B Double Care launch focuses on energy support, sourced from organic quinoa sprouts and buckwheat. This aligns with the growing demand for clean-label, plant-based nutrition in an easily absorbable liquid format.

2. Nestlé

Through its health science division, Nestlé is innovating in medical nutrition with liquid supplements like Resource 2.0, a high-protein, clear liquid drink for patients with altered taste preferences or needing malnutrition support. They are leveraging nutritional science to develop specialized formulations that address very specific clinical dietary needs and improve patient compliance.

3. Herbalife Nutrition

Herbalife is targeting the active lifestyle market with its Herbalife24 line. A caffeine-free liquid dietary supplement co-created with Cristiano Ronaldo. Designed for focus and hydration, it reflects the trend of celebrity-endorsed, performance-oriented nutrition products that are convenient and quick to consume.

4. Nature’s Bounty

Nature’s Bounty has focused on enhancing its liquid vitamin D3 offerings, a core product category. Recent developments include new high-potency formulations and flavor improvements to increase palatability and consumer adherence. Their emphasis remains on providing essential nutrients in a highly bioavailable liquid form, catering to widespread vitamin D deficiency concerns.

5. Abbott Laboratories

Abbott continues to lead in science-backed nutritional products, recently introducing PediaSure SideKicks Clear. This is a clear liquid nutritional drink designed for children who refuse traditional milky shakes, providing a new option for parents concerned about picky eaters and nutrient gaps. It addresses compliance challenges with a patient-centric formulation.

Conclusion

The market for liquid dietary supplements is expanding strongly due to growing health awareness, aging populations, and demand for convenient, effective nutrient delivery. Liquid forms offer advantages in absorption, ease of use, and flexibility over tablets or pills. Key trends include demand for personalized nutrition, ready-to-drink formats, and natural ingredients. Companies that focus on safety, transparency, flavor, and tailored formulas are likely to win in this competitive, fast-growing sector.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)