Table of Contents

Overview

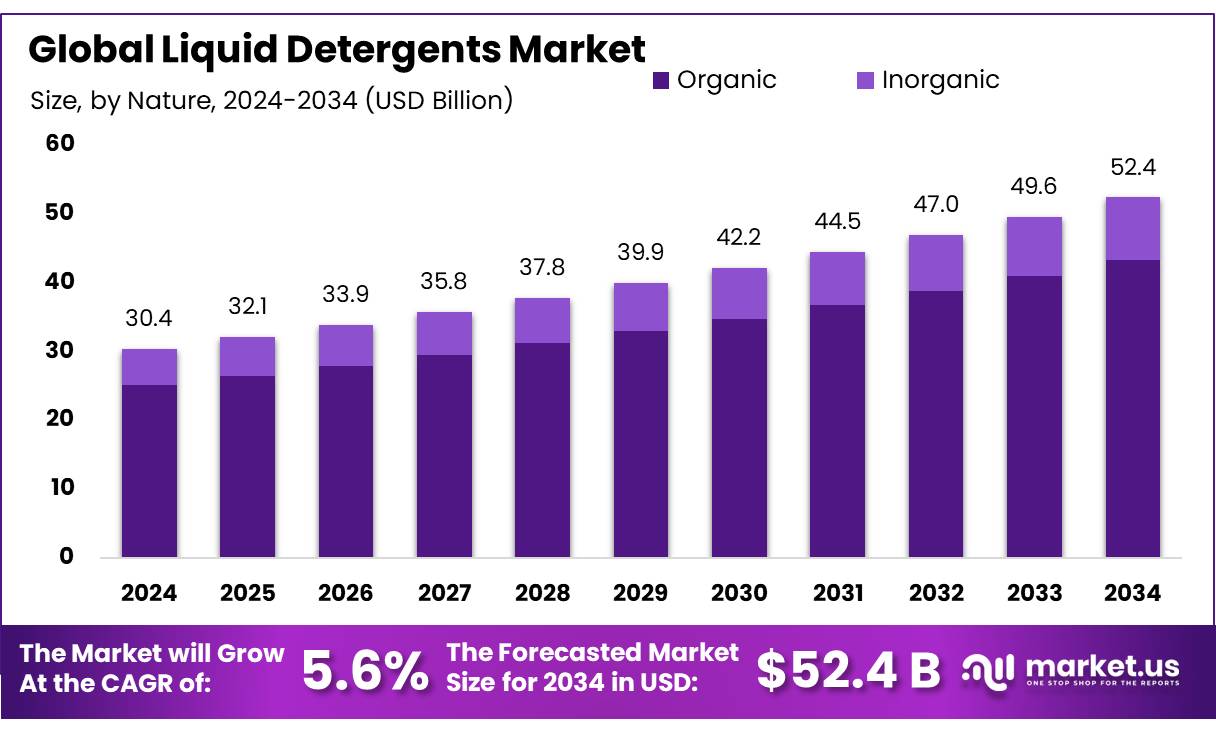

New York, NY – August 04, 2025 – The Global Liquid Detergents Market is projected to reach approximately USD 52.4 billion by 2034, rising from USD 30.4 billion in 2024. This growth reflects a compound annual growth rate (CAGR) of 5.6% from 2025 to 2034. In 2024, North America emerged as the leading region, accounting for over 41.7% of the global market and generating around USD 12.6 billion in revenue.

The liquid detergent concentrates sector has undergone substantial evolution since the 1990s, following the introduction of ultra-concentrated formulations by key players such as P&G and Henkel. According to the U.S. Environmental Protection Agency (EPA), these early innovations aimed to reduce filler content and adopt compact packaging formats, particularly to align with consumer preferences in markets like Japan and Europe.

This approach laid the foundation for today’s advanced concentrated liquid detergents, which contain higher active surfactant levels and reduced water, thereby minimizing packaging waste without compromising cleaning efficacy. Consumer trends increasingly favor liquid and concentrated detergent formats due to their ease of use, better solubility in cold water, and effectiveness.

Between November 2020 and October 2021, liquid detergents comprised 41% of all new detergent product launches in India, while powders accounted for 27%. The COVID-19 pandemic further heightened hygiene awareness, strengthening demand for liquid fabric care solutions.

In India, the surfactant segment of the chemical industry benefits from supportive government policies such as “Make in India” and “Atmanirbhar Bharat.” These initiatives allow up to 100% foreign direct investment (FDI) through the automatic route, with certain exceptions related to hazardous chemicals. These policy frameworks have encouraged both domestic production and global participation in the liquid detergent space.

Key Takeaways

- The Liquid Detergents Market size is expected to be worth around USD 52.4 billion by 2034, from USD 30.4 billion in 2024, growing at a CAGR of 5.6%.

- Organic held a dominant market position, capturing more than an 82.5% share of the global liquid detergents market.

- Household held a dominant market position, capturing more than 78.3% share of the global liquid detergents market.

- Supermarkets and Hypermarkets held a dominant market position, capturing more than a 45.5% share of the global liquid detergents market.

- North America continued to set the pace in the global liquid detergents market, contributing roughly 41.7% of worldwide revenue, equating to approximately USD 12.6 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-liquid-detergents-market/request-sample/

Report Scope

| Market Value (2024) | USD 30.4 Billion |

| Forecast Revenue (2034) | USD 52.4 Billion |

| CAGR (2025-2034) | 5.6% |

| Segments Covered | By Nature (Organic, Inorganic), By Application (Household, Industrial, And Institutional), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Departmental Stores, Online Stores, Others) |

| Competitive Landscape | Amway Corporation, S. C. Johnson & Son, Inc., Colgate-Palmolive, Church and Dwight, Henkel Company KGaA, Procter and Gamble, The Clorox Company, Kao Corporation, Godrej Consumer Products, Unilever Plc, Reckitt Benckiser Group plc |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=152809

Key Market Segments

Nature Analysis

In 2024, organic liquid detergents commanded an 82.5% share of the global market, driven by heightened consumer awareness of harmful chemicals in traditional detergents and a preference for eco-friendly, biodegradable options. Plant-based, toxin-free formulations are particularly popular among families with infants or individuals with sensitive skin, favoring fragrance- and dye-free products.

The clean-label movement, stricter environmental regulations in North America and Europe, and sustainable innovations like refill stations, compostable packaging, and concentrated formulas further solidify the dominance of organic detergents.

Application Analysis

In 2024, household applications accounted for 78.3% of the global liquid detergents market, propelled by their frequent use in laundry, dishwashing, and surface cleaning. Urban consumers, seeking convenience, prefer liquid detergents for their ease of use and precise dosing compared to powders or bars. Post-pandemic hygiene consciousness has further boosted demand, with specialized products for babies, delicate fabrics, and allergy-sensitive users expanding the household segment.

Distribution Channel Analysis

In 2024, supermarkets and hypermarkets captured a 45.5% share of the global liquid detergents market, driven by their convenience and extensive brand variety. These stores enable consumers to compare products, sizes, and prices, with promotional offers and bulk discounts encouraging purchases. The in-store shopping experience and product authenticity continue to draw urban and semi-urban consumers, making these retail channels the primary source for household cleaning products.

Regional Analysis

In 2024, North America led the global liquid detergents market, contributing 41.7% of total revenue, equivalent to USD 12.6 billion. This dominance stems from strong demand for convenient, high-performance cleaning solutions, particularly in households.

Heightened health and hygiene awareness, spurred by global health events, has driven demand for effective stain- and bacteria-removing detergents. Environmentally friendly options, such as Safer-Choice-certified liquids, have gained traction, with U.S. production reaching over 2.4 billion pounds in 2024, a 150% increase since 2021.

Top Use Cases

- Household Laundry: Liquid detergents are widely used for washing clothes at home, offering easy dosing and effective stain removal. They dissolve quickly in water, work well in both standard and high-efficiency washing machines, and cater to busy households seeking convenience and strong cleaning performance for everyday laundry needs.

- Dishwashing: Liquid detergents are popular for hand-washing dishes, cutting through grease and food residues efficiently. Their concentrated formulas require small amounts, making them cost-effective. They’re gentle on hands when formulated with skin-friendly ingredients, appealing to households prioritizing hygiene and ease during daily kitchen cleaning tasks.

- Surface Cleaning: Liquid detergents are used for cleaning household surfaces like countertops, floors, and bathrooms. Diluted with water, they remove dirt, grime, and stains effectively. Their versatility and eco-friendly options make them a go-to choice for consumers seeking multi-purpose, sustainable cleaning solutions for various home surfaces.

- Baby Clothing: Liquid detergents formulated for baby clothes are hypoallergenic, fragrance-free, and dye-free, ensuring safety for sensitive skin. They effectively clean spit-up and food stains while being gentle on delicate fabrics, making them a trusted choice for parents prioritizing health and comfort for infants.

- Delicate Fabrics: Liquid detergents are ideal for washing delicate fabrics like silk, wool, or lace, as they offer gentle cleaning without damaging fibers. Their low-foam formulas protect fabric texture and color, appealing to consumers who need specialized care for high-value or sensitive clothing items.

Recent Developments

1. Amway Corporation

Amway has expanded its SA8 Premium Bioquest Liquid Detergent line with a new plant-based, biodegradable formula, emphasizing sustainability. The detergent now features cold-water cleaning technology to reduce energy consumption. Amway also introduced refill pouches to minimize plastic waste. The product is marketed as hypoallergenic and suitable for sensitive skin.

2. S. C. Johnson & Son, Inc. (Sc Johnson)

Sc Johnson’s Windex Laundry Detergent now includes a streak-free formula for enhanced fabric care. The company also launched Nature’s Source, a plant-derived liquid detergent with 100% recycled plastic bottles. They focus on reducing water pollution by eliminating phosphates and dyes.

3. Colgate-Palmolive

Colgate-Palmolive’s Palmolive Ultra Dish & Hand Liquid Soap now doubles as a multi-surface cleaner. The company introduced antibacterial variants with essential oils for better germ protection. They also committed to 100% recyclable packaging.

4. Church & Dwight

Church & Dwight’s Arm & Hammer Plus OxiClean Liquid Detergent now features 5-in-1 odor-fighting technology. They introduced Bio-enzyme-based detergents for deep cleaning and launched smaller, concentrated doses to reduce carbon footprint.

5. Henkel Company KGaA

Henkel’s Persil ProClean Liquid Detergent now includes microplastic-free formulations. They introduced hybrid detergent sheets that dissolve in water, reducing plastic waste. Henkel also partnered with TerraCycle for bottle recycling programs.

Conclusion

Liquid detergents are a versatile, growing segment in the cleaning industry, driven by consumer demand for convenience, eco-friendliness, and specialized formulations. Their applications span household, commercial, and niche uses like baby clothing and allergy-sensitive cleaning. With innovations in sustainable packaging and biodegradable formulas, liquid detergents are poised for continued market expansion, meeting diverse consumer needs effectively.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)