Table of Contents

Overview

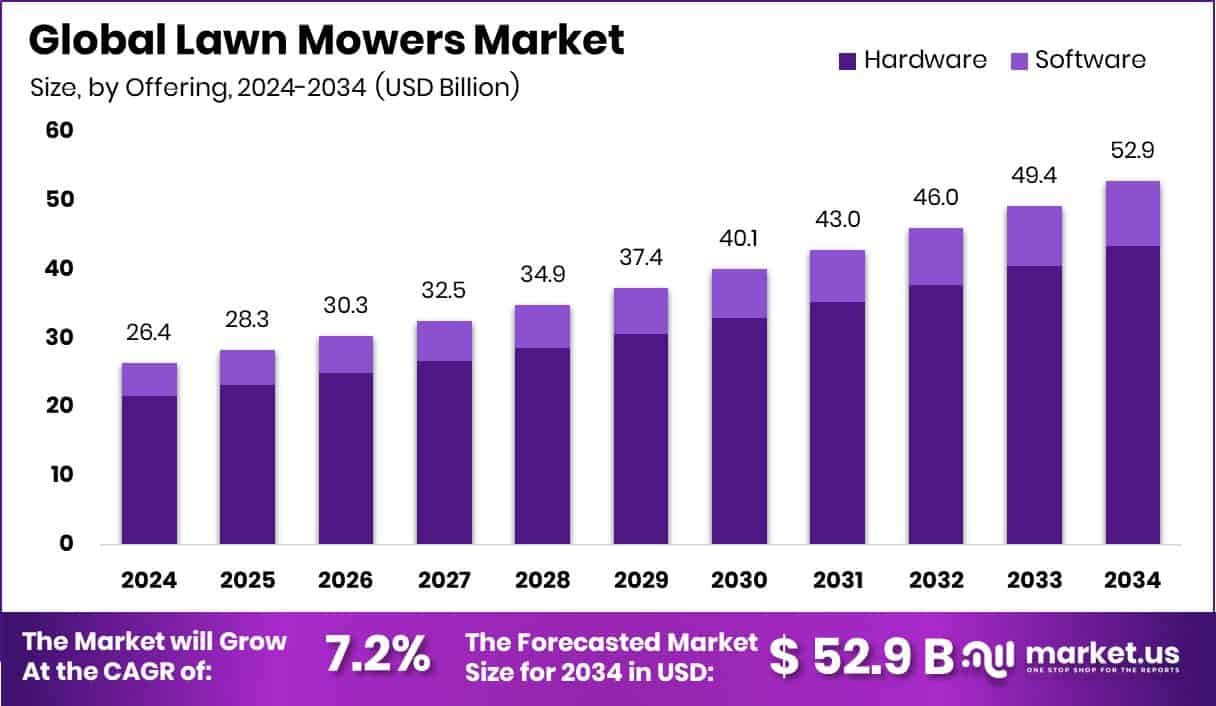

New York, NY – October 03, 2025 – The Global Lawn Mowers Market is projected to reach USD 52.9 billion by 2034, up from USD 26.4 billion in 2024, expanding at a CAGR of 7.2% between 2025 and 2034. North America leads the market with a valuation of USD 10.4 billion in 2024, accounting for a 39.7% share.

Lawn mowers are essential machines designed to trim and maintain grass in residential gardens, public parks, sports fields, and landscaped areas. Available in multiple types, including manual push models, electric variants, and fuel-powered versions, these machines cater to varying yard sizes and user needs. Beyond functionality, lawn mowers contribute to neat outdoor aesthetics, property value, and the growing landscaping culture.

The industry is witnessing dynamic developments. For instance, Greenzie raised USD 8 million to expand its autonomous mowing solutions. At the same time, Positec Group secured USD 250 million to accelerate robotic mower innovation, while a robotic mower startup led by a former Yunjing executive has already amassed close to USD 100 million in funding within three months.

Conversely, Oasa, a Chinese robotic mower manufacturer, was forced to cease operations despite previously raising USD 2.3 million. Market growth is fueled by urban housing with garden spaces, the rising popularity of home gardening, and the demand for convenient, time-saving lawn care equipment. Increasing consumer preference for automated and eco-friendly mowers further highlights the industry’s shift toward sustainable and technology-driven solutions.

Key Takeaways

- The Global Lawn Mowers Market is expected to be worth around USD 52.9 billion by 2034, up from USD 26.4 billion in 2024, and is projected to grow at a CAGR of 7.2% from 2025 to 2034.

- Hardware accounted for an 82.2% share, highlighting strong equipment-driven Lawn mower market growth.

- ICE propulsion type dominated the lawn mower market with 68.5%, reflecting consumer reliance on fuel-based models.

- Walk-behind lawn mowers secured a 47.9% share, proving their popularity among medium-sized lawn mower market users.

- The medium lawn size category contributed 56.1%, showing lawn mower market demand from average residential yard owners.

- Residential end use led with 67.7%, emphasizing household dominance in the global lawn mower market.

- North America’s 39.70% market dominance reflects rising residential lawn care demand, valued at USD 10.4 Bn.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/lawn-mowers-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 26.4 Billion |

| Forecast Revenue (2034) | USD 52.9 Billion |

| CAGR (2025-2034) | 7.2% |

| Segments Covered | By Offering (Hardware (Ultrasonic Sensors, Lift Sensors, Tilt Sensors, Motors, Microcontrollers, Batteries), Software), By Propulsion Type (Electric, ICE), By Type (Riding Lawn Mowers, Walk-behind Lawn Mowers, Robotic Lawn Mowers), By Lawn Size (Small, Medium, Large), By End Use (Residential, Commercial) |

| Competitive Landscape | American Honda Motor Co., Inc., Ariens Company, Briggs Stratton, Deere & Company, Falcon Garden Tools, Fiskars, Husqvarna Group, MTD Products, Robert Bosch GmbH, Robomow Friendly House, The Toro Company |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=157812

Key Market Segments

By Offering Analysis

Hardware dominates the lawn mowers market, holding an 82.2% global share in 2024. This reflects the critical role of tangible equipment like blades, cutting decks, motors, and drive systems in delivering efficient lawn care for residential and commercial use. The preference for advanced mower designs with features such as height adjustment, ergonomic handling, and energy-efficient engines drives this segment’s strength.

Ongoing demand for replacement parts like blades further solidifies hardware’s dominance. Innovations in lightweight materials, battery integration, and precision cutting are expected to sustain hardware’s leading position, ensuring its pivotal role in the market’s future.

By Propulsion Type Analysis

ICE propulsion lawn mowers lead with a 68.5% market share in 2024, underscoring the reliance on robust propulsion hardware like engines, transmissions, wheels, and drive assemblies. These components enhance maneuverability across diverse terrains, meeting user demand for reliable, high-performance systems.

Advances in propulsion technology, including smoother drives, better torque, and energy-efficient engines, boost adoption, while regular part replacements ensure steady revenue. With innovations in lightweight materials, noise reduction, and fuel or battery efficiency, propulsion hardware is set to maintain its dominance, driving mower performance and market growth.

By Type Analysis

Walk-behind lawn mowers capture 47.9% of market demand in 2024, favored for their affordability, ease of use, and suitability for small to medium-sized lawns. Popular among residential users, these mowers offer precision and maneuverability in tight spaces like gardens and yards. Features like adjustable cutting heights, ergonomic handles, and lightweight frames enhance their appeal, while regular maintenance needs, such as blade and wheel replacements, sustain demand. As landscaping and gardening trends grow, walk-behind mowers are expected to retain their lead, supporting the market’s growth trajectory.

By Lawn Size Analysis

Medium-sized lawns hold a 56.1% share of the global market in 2024, reflecting their prevalence among residential and commercial users. Mowers designed for medium lawns balance efficiency, cost, and ease of use, featuring adjustable cutting widths, ergonomic designs, and propulsion systems that minimize effort. Regular maintenance needs for these lawns drive consistent equipment use and replacement cycles. With urban housing, community parks, and commercial properties fueling demand, the medium lawn segment is poised to remain a key driver of the lawn mowers market.

By End Use Analysis

Residential use leads the lawn mowers market with a 67.7% share in 2024, driven by homeowners’ focus on maintaining gardens, yards, and green spaces for aesthetics and property value. Compact, user-friendly mowers with features like adjustable cutting heights and eco-friendly options cater to residential needs. Urban housing growth, suburban expansion, and a cultural emphasis on outdoor spaces sustain demand, while regular upkeep and equipment upgrades ensure consistent market activity. As residential landscaping trends continue, this segment will remain the primary force shaping the lawn mowers industry.

Regional Analysis

In 2024, North America led the Lawn Mowers Market with a 39.7% share, valued at USD 10.4 billion. This dominance stems from widespread residential lawn ownership and a cultural focus on well-kept outdoor spaces. The region’s strong landscaping industry, coupled with demand for residential and commercial property maintenance, drives growth. Favorable economic conditions and consumer investment in advanced lawn care equipment further bolster North America’s position.

Europe maintains steady growth, fueled by lifestyle gardening trends and regulations promoting electric mowers. Asia Pacific shows significant potential, driven by rapid urbanization, rising disposable incomes, and growing interest in home gardening. The Middle East & Africa and Latin America are emerging markets, with demand rising from residential and hospitality sector landscaping projects. While all regions contribute to global market growth, North America’s mature lawn culture and robust consumer base ensure its continued leadership.

Top Use Cases

- Residential Maintenance: Homeowners use push or self-propelled lawn mowers to keep small to medium yards neat and healthy. These tools cut grass evenly, collect clippings in bags to avoid weeds, or mulch them back into the soil for natural nutrients. This simple upkeep boosts curb appeal and creates inviting outdoor spaces for family relaxation without much effort.

- Commercial Landscaping: Professionals rely on ride-on or zero-turn mowers for large properties like parks and business grounds. These machines handle tough terrains quickly, ensuring precise cuts for a polished look. They save time for crews maintaining public areas, helping meet client needs for tidy landscapes that enhance property value.

- Sports Field Grooming: Golf courses and stadiums employ specialized mowers for smooth, even turf. Riding or reel types deliver fine cuts that support healthy grass growth and optimal playing conditions. Regular use prevents uneven patches, keeping fields safe and attractive for athletes and spectators year-round.

- Automated Home Gardening: Robotic mowers offer hands-free care for busy households with fenced yards. They navigate boundaries using sensors, mowing on schedules while avoiding obstacles. This tech reduces manual work, promotes consistent lawn health, and integrates with smart home systems for easy monitoring.

- Versatile Yard Attachments: Lawn tractors with riding mowers attach tools like tillers or plows for multi-season tasks. Beyond grass cutting, they aerate soil, clear snow, or vacuum leaves, turning one machine into a year-round helper. This flexibility suits homeowners expanding garden projects without buying extra equipment.

Recent Developments

1. American Honda Motor Co., Inc.

Honda is strategically exiting the North American lawn mower market, ceasing new engine and finished unit production by the end of 2023. This marks a significant shift, allowing the company to focus on core mobility businesses. Recent developments have centered on managing the wind-down, including final production runs and ensuring parts and service support for existing customers through its authorized dealer network for many years into the future.

2. Ariens Company

Ariens continues to expand its zero-turn mower lines with a focus on commercial-grade durability for homeowners. Recent launches include the updated S Series and the compact-class IKON XD, which feature enhanced comfort and improved cutting decks. The company is also investing in its electric offerings with the new Gravely EV series, providing commercial operators with a zero-emission, low-noise alternative without sacrificing the power for demanding all-day use.

3. Briggs & Stratton

Following its acquisition by private equity, Briggs & Stratton has intensified its focus on integrated battery-powered equipment. A key recent development is the launch of the “Briggs & Stratton” brand of cordless electric mowers, which utilize their modular POWERFORGE 40V battery system. This strategy positions them as a direct competitor in the homeowner battery platform market, leveraging their century of engine expertise into the electric era.

4. Deere & Company

Deere is pushing connectivity and automation with its SmartConnect technology, now standard on most ZTrak mowers, providing operators with usage data and maintenance alerts via a mobile app. A major recent development is the limited commercial release of their fully autonomous zero-turn mower, the Rogue. This mower uses onboard cameras and GPS to navigate and mow predefined areas without an operator, representing a significant leap in turf management technology.

5. Falcon Garden Tools

Falcon continues to strengthen its position in the European residential market by expanding its range of electric and robotic mowers. A key recent focus has been on the “Swift” series of cordless lawnmowers, emphasizing lightweight design, foldability for easy storage, and user-friendly features. They are also enhancing their robotic mower offerings with models featuring more precise smart navigation and app-based control to meet growing consumer demand for hands-free lawn care.

Conclusion

The Lawn mower industry is blooming with fresh opportunities, fueled by folks craving greener homes and smarter tools. Home gardening hobbies are on the rise, pushing demand for quiet, earth-friendly electric models that fit busy lives. Tech-savvy riders and hands-free robots are stealing the show in pro landscaping, while city green spaces grow with urban living. Overall, this market feels vibrant, blending ease, eco-smarts, and innovation to keep yards thriving and users smiling for years ahead.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)