Table of Contents

Overview

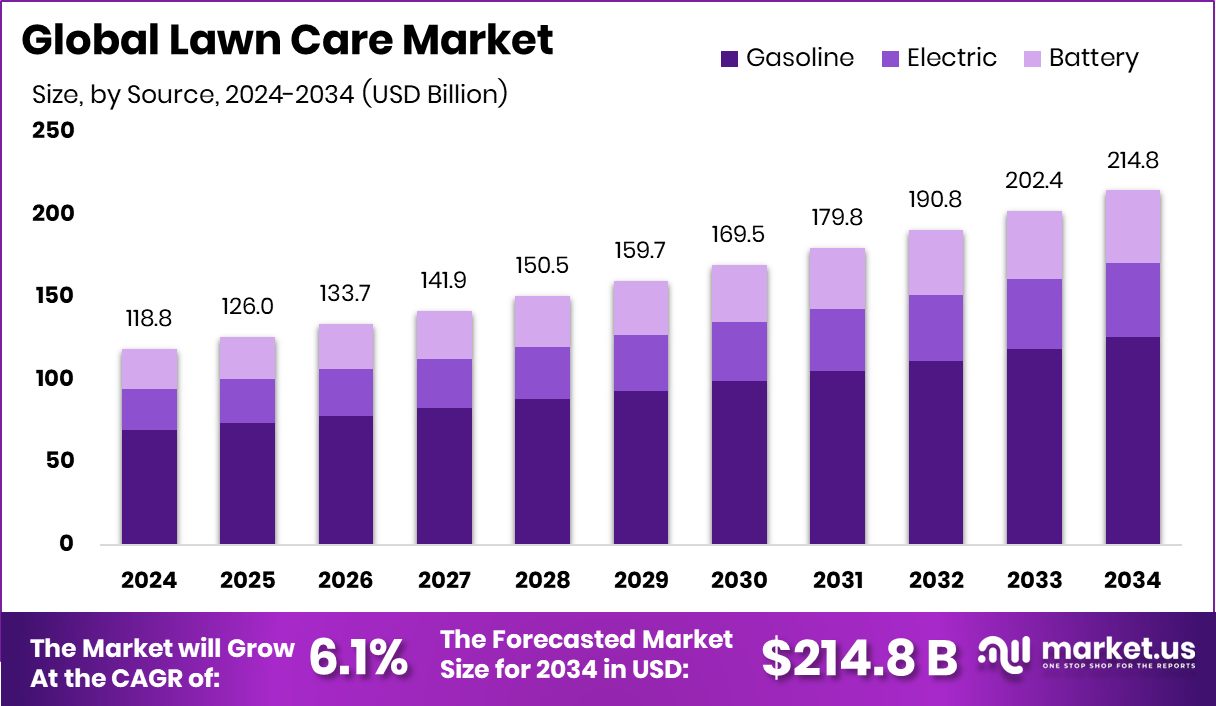

New York, NY – October 06, 2025 – The Global Lawn Care Market is projected to reach around USD 214.8 billion by 2034, up from USD 118.8 billion in 2024, growing at a CAGR of 6.1% from 2025 to 2034. North America led the market with a 45.7% share (USD 54.2 billion), supported by expanding eco-friendly lawn maintenance practices.

Lawn care involves the regular upkeep of turf and green spaces, including mowing, edging, fertilizing, watering, aeration, pest control, and seasonal clean-ups. These activities maintain the health and appearance of yards, parks, and institutional landscapes. The industry encompasses both products and services, covering equipment like mowers, trimmers, and blowers, as well as fertilizers, seeds, soil enhancers, irrigation systems, and smart eco-solutions such as battery-powered tools and automated watering.

The market caters to a diverse range of consumers, from homeowners and municipalities to schools and property managers. Rising urbanization, stricter property standards, and the push for quieter, low-emission machinery are fueling demand. Several public incentive programs are accelerating the shift toward sustainable practices.

California’s Clean Off-Road Equipment Voucher Incentive Project (CORE) provides point-of-sale discounts on zero-emission landscaping tools, helping small businesses and public agencies adopt cleaner technologies. Additionally, the South Coast AQMD program offers up to an 85% discount (up to USD 15,000) for commercial ride-on mowers, directly boosting purchases and maintenance contracts.

Government funding programs are further expanding the industry’s long-term service base. The USDA Forest Service’s Urban & Community Forestry Program, funded through the Inflation Reduction Act, supports large-scale projects in urban greening and canopy expansion—creating recurring work in mowing, irrigation, and mulching. Similarly, the EPA’s Urban Waters and Green Infrastructure grants promote the installation of rain gardens, bioswales, and open green spaces, all of which require ongoing lawn care and landscape maintenance, enhancing the market’s stability and growth outlook.

Key Takeaways

- The Global Lawn Care Market is expected to be worth around USD 214.8 billion by 2034, up from USD 118.8 billion in 2024, and is projected to grow at a CAGR of 6.1% from 2025 to 2034.

- Gasoline-powered equipment dominates the Lawn Care Market, holding a strong 58.5% share in 2024.

- Mowing services account for only 32.8%, yet remain an essential activity driving recurring Lawn Care Market demand.

- Residential properties lead the Lawn Care Market, representing 56.2% of the sector’s overall service demand.

- Riding mowers capture 31.4% in the Lawn Care Market, highlighting their efficiency and growing homeowner preference.

- Strong consumer demand in North America (45.7%, USD 54.2 Bn) highlights its lawn maintenance dominance.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/lawn-care-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 118.8 Billion |

| Forecast Revenue (2034) | USD 214.8 Billion |

| CAGR (2025-2034) | 6.1% |

| Segments Covered | By Source (Gasoline, Electric, Battery), By Service (Mowing, Trimming and Edging, Fertilization and Weed Control, Aeration and Overseeding, Pest Control, Others), By Property Type (Residential, Commercial, Municipal), By Equipment Type (Walk-Behind Mowers, Riding Mowers, Zero-Turn Mowers, Tractors, Trimmers, Edgers) |

| Competitive Landscape | Greenworks Tools, Deere Company, Echo Incorporated, Ryobi Power Tools, Makita Corporation, The Toro Company, MTD Products, Ariens Company, Scotts Miracle-Gro, Honda Motor Company |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=158224

Key Market Segments

By Source Analysis

Gasoline-powered equipment leads the Lawn Care Market, holding a 58.5% share in 2024. This dominance stems from the reliability and affordability of gasoline-driven tools like mowers, trimmers, and blowers, widely used for large-scale lawn maintenance. Despite growing concerns over emissions and noise, their durability and accessibility—particularly in areas with limited electric infrastructure—sustain their preference. Gasoline equipment remains the cornerstone of both commercial and residential lawn care, with steady demand persisting amid gradual shifts toward greener alternatives spurred by government incentives.

By Service Analysis

Mowing services dominate the Lawn Care Market, capturing a 32.8% share in 2024. As a fundamental service, mowing ensures healthy, visually appealing lawns for residential, commercial, and public properties. It supports weed control and uniform turf growth, making it the most sought-after service. The expansion of urban green spaces, parks, and institutional landscapes drives consistent demand, with mowing’s recurring nature securing stable revenue and reinforcing its role as a core lawn care service prioritized for enhancing property aesthetics.

By Property Type Analysis

Residential properties lead the Lawn Care Market, commanding a 56.2% share in 2024. This strength reflects homeowners’ focus on maintaining attractive landscapes to boost property value and neighborhood appeal. Services like mowing, fertilization, and seasonal upkeep are in high demand, fueled by suburban housing growth and community beautification initiatives. Government-backed urban greening programs further support residential lawn care, solidifying this segment as the primary driver of market growth and service expansion.

By Equipment Type Analysis

Riding mowers hold a leading 31.4% share of the Lawn Care Market’s equipment segment in 2024. Their efficiency makes them ideal for large lawns, estates, parks, and institutional grounds, where push mowers are less practical. Offering time savings, reduced physical effort, and consistent performance, riding mowers are favored by residential users with large properties and professional landscapers alike. Ongoing advancements in comfort, precision, and fuel or battery efficiency further boost their adoption, cementing their position as a key equipment choice.

Regional Analysis

North America led the global Lawn Care Market with a commanding 45.7% share, valued at USD 54.2 billion. This dominance is driven by widespread adoption of professional lawn care services, bolstered by a robust network of landscaping providers and equipment manufacturers. Strong consumer demand for attractive outdoor spaces, particularly in the U.S. and Canada, fuels steady market growth.

Government initiatives, including rebates for eco-friendly equipment like electric mowers and leaf blowers, further enhance opportunities for service providers and suppliers. Meanwhile, Europe, Asia Pacific, Latin America, and the Middle East & Africa are seeing steady growth, propelled by increasing urbanization, higher disposable incomes, and a growing cultural focus on outdoor aesthetics.

However, North America’s lead persists due to its deeper service penetration, advanced technology adoption, and supportive funding for sustainable equipment transitions. This market maturity not only underscores North America’s dominance but also serves as a model for sustainable lawn care practices globally.

Top Use Cases

- Residential Lawn Maintenance: Homeowners hire lawn care services to keep their yards neat and green through regular mowing, trimming edges, and blowing debris. This boosts curb appeal, enhances property value, and creates inviting outdoor spaces for family gatherings. Busy schedules make professional help essential for consistent upkeep without the hassle of DIY efforts.

- Commercial Property Care: Businesses use lawn care for office parks and retail spaces to maintain a professional look with fertilization, weed control, and precise landscaping. Well-kept grounds attract customers, improve brand image, and meet local standards. Services ensure year-round vibrancy, reducing liability from overgrown areas.

- Sports Field Upkeep: Athletic facilities rely on specialized lawn care for fields and courts, including aeration, seeding, and pest management to ensure safe, playable surfaces. This supports team performance and prevents injuries from uneven turf. Regular treatments promote durable grass that withstands heavy use.

- Eco-Friendly Landscaping: Environment-conscious clients opt for sustainable lawn care using organic fertilizers, native plants, and water-efficient irrigation. This reduces chemical runoff, conserves resources, and fosters biodiversity. Professionals guide transitions to low-maintenance designs that align with green living trends.

- Smart Tech Integration: Modern users adopt robotic mowers and app-controlled systems for automated lawn care, saving time and labor. These tools handle mowing, monitoring soil health, and adjusting for weather. Ideal for tech-savvy homeowners seeking efficient, hands-off maintenance solutions.

Recent Developments

1. Greenworks Tools

Greenworks continues to expand its commercial-grade battery ecosystem with the ProLine series, featuring an 82V 21-inch commercial mower. A key development is their focus on interconnected tools, including a new line of 24-inch stand-on mowers and the innovative AMP+ battery platform that powers both lawn equipment and new lifestyle products like portable power stations. This strategy aims to lock users into a versatile, gas-free ecosystem.

2. Deere Company

John Deere is aggressively integrating smart technology into its flagship mowers. Recent developments include the launch of new Z530R ZTrak mowers with enhanced Edge cutting decks and the exclusive availability of their ExactShot planting system on certain tractors. This technology uses sensors and robotics to place starter fertilizer directly onto seeds, reducing waste and showcasing Deere’s focus on precision, efficiency, and sustainability.

3. Echo Incorporated

Echo is strengthening its position in the professional market with the introduction of the ECHO-ON 56V AXIA cordless system. A major recent development is the launch of their 56V Cordless Hand-Held Blower, praised for its power-to-weight ratio. Echo is focusing on building a robust, scalable battery platform that offers performance comparable to gas, appealing directly to landscapers seeking to transition to electric without sacrificing power or runtime.

4. Ryobi Power Tools

Ryobi’s recent developments center on expanding its popular 40V battery system with more powerful and user-friendly tools. They have introduced the new 40V HP 21-in. Brushless Cordless mower, which features a quieter operation and increased runtime. Furthermore, Ryobi continues to launch new 18V ONE+ outdoor tools, emphasizing the cross-compatibility of its batteries between indoor and outdoor equipment, making it a cost-effective ecosystem for DIY homeowners.

5. Makita Corporation

Makita is pushing the limits of cordless power for the lawn care industry with its XGT 40V max system. A key recent development is the introduction of the 36V (18V X2) LXT Lawn Mower and a new 40V max XGT Brushless String Trimmer. Makita’s strategy focuses on providing commercial-grade durability and power through its expanding XGT platform, directly competing with gas-powered equipment and appealing to both pro users and serious homeowners.

Conclusion

The Lawn Care sector thrives on rising homeowner priorities for attractive outdoor areas, backed by urbanization and eco-awareness. Shifts toward sustainable methods and digital tools promise ongoing expansion, urging providers to innovate for customer demands in a competitive landscape.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)