Table of Contents

Overview

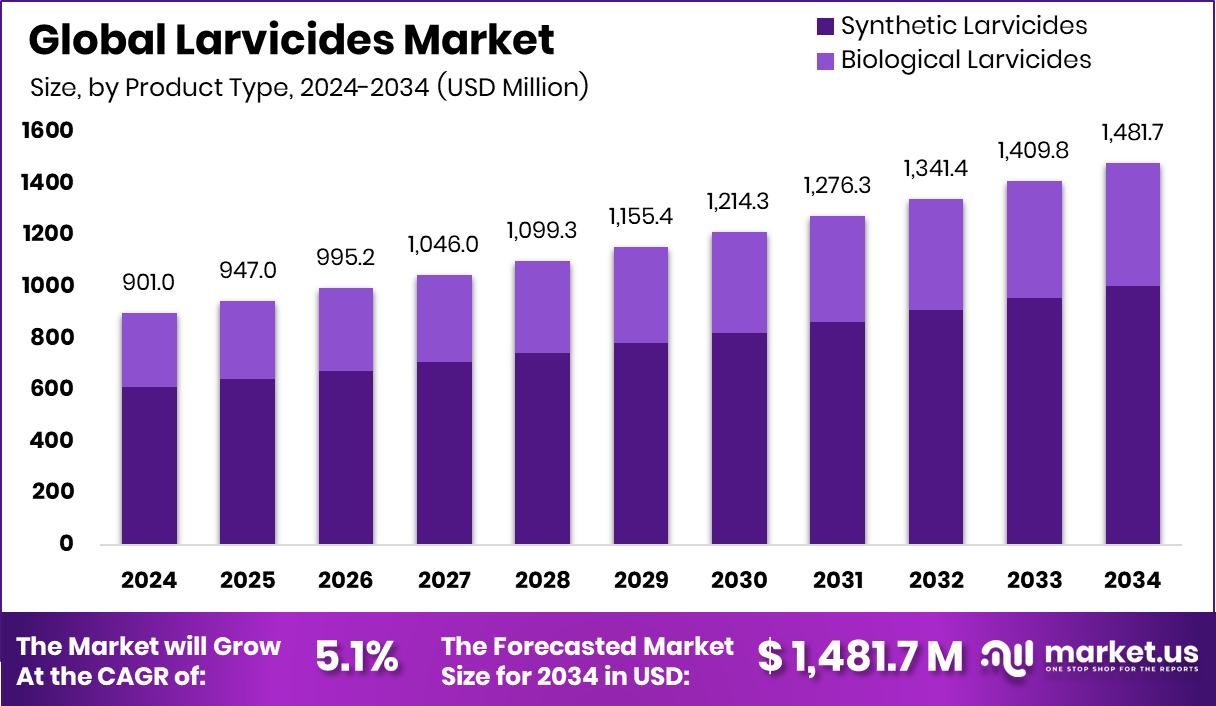

New York, NY – September 23, 2025 – The Global Larvicides Market is projected to reach approximately USD 1,481.7 million by 2034, up from USD 901.0 million in 2024, growing at a CAGR of 5.1% between 2025 and 2034. North America leads the market with a 45.8% share, recording a robust regional value of USD 412.6 million.

Larvicides are chemical or biological agents designed to eliminate the larval stages of insects, particularly mosquitoes and other disease vectors, before they develop into adults. By targeting larvae in water sources such as ponds, drains, or containers, these solutions play a crucial role in controlling the spread of illnesses like malaria, dengue, and the Zika virus. They are widely employed by public health agencies, agricultural sectors, and households to manage insect populations at their source.

The larvicides market encompasses the global production, distribution, and application of these pest-control solutions across public health, agricultural, and domestic settings. Growing awareness of vector-borne diseases has prompted governments and organizations to invest heavily in preventive measures, driving demand for larvicides in both developed and developing regions. For instance, the East African Community recently launched a malaria control initiative supported by USD 29.2 million in funding from SC Johnson.

A key growth driver for the market is the rising prevalence of mosquito-borne diseases. According to the World Health Organization, malaria accounted for over 249 million cases worldwide in 2022, underscoring the urgent need for effective larval control strategies. This persistent health challenge ensures sustained demand for larvicidal products.

Additionally, factors such as rapid urbanization, poor waste management, and increasing population density create ideal breeding conditions for mosquitoes, further boosting the requirement for larvicides. Climate change, by extending breeding seasons, also amplifies the relevance of these interventions across regions, making larvicides a critical tool in both disease prevention and public health management.

Key Takeaways

- The Global Larvicides Market is expected to be worth around USD 1,481.7 million by 2034, up from USD 901.0 million in 2024, and is projected to grow at a CAGR of 5.1% from 2025 to 2034.

- In 2024, synthetic larvicides dominated the larvicides market, holding a 67.8% share.

- Liquid formulations accounted for 41.2% of the larvicides market, reflecting ease of application.

- Chemical agents led the larvicides market, capturing 58.7% share due to proven effectiveness.

- Mosquitoes remained the prime target, representing 56.1% of the larvicides market globally.

- Non-agriculture applications dominated with a 67.3% share, highlighting public health demand in the larvicides market.

- The North America Larvicides Market, valued at USD 412.6 Mn, captured a 45.80% share.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-larvicides-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 901.0 Million |

| Forecast Revenue (2034) | USD 1,481.7 Million |

| CAGR (2025-2034) | 5.1% |

| Segments Covered | By Product Type (Synthetic Larvicides, Biological Larvicides), By Formulation (Powders, Liquids, Tablets, Dunks, Others), By Control Method (Chemical Agents, Biocontrol Agents, Insect Growth Regulators (IGR), Others), By Target Insect (Mosquitoes, Flies, Beetles, Others), By Application (Agriculture, Non-Agriculture) |

| Competitive Landscape | BASF SE, Bayer AG, Syngenta AG, Sumitomo Chemical Co., Clarke Mosquito Control Products Inc., Central Life Sciences, Gowan, UPL Ltd., FMC Corporation, Russell IPM |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=157092

Key Market Segments

By Product Type

In 2024, synthetic larvicides led the larvicides market, capturing a 67.8% share. Their dominance stems from their proven effectiveness in rapidly reducing larval populations across diverse breeding sites, making them a cornerstone of public health, agricultural, and urban pest control efforts.

Synthetic larvicides are favored for their consistent performance, extended residual activity, and cost-effectiveness compared to biological alternatives. Their widespread use is driven by the urgent need to combat mosquito-borne diseases like malaria, dengue, and Zika, particularly in high-risk regions.

By Formulation

Liquid formulations held a leading 41.2% share of the larvicides market in 2024. Their popularity is due to their ease of application and ability to evenly cover breeding sites such as ponds, drains, and stagnant water bodies. Liquid larvicides enable precise dosing, requiring minimal manpower or specialized equipment, making them ideal for both large-scale vector control programs and community-level interventions. Their rapid action and versatility in application methods—spraying, fogging, or direct pouring enhance their effectiveness across varied environments.

By Control Method

Chemical agents dominated the larvicides market in 2024 with a 56.1% share. Their widespread use is attributed to their fast-acting nature, broad coverage, and long-lasting effects, making them a go-to solution for large-scale mosquito control. Cost-effective and accessible, chemical agents are heavily utilized in government-led vector management programs targeting diseases like malaria, dengue, and Zika. Their ability to disrupt larval growth in diverse habitats, from urban drains to agricultural water bodies, drives their adoption.

By Target Insect

Mosquito control accounted for a 49.2% share of the larvicides market in 2024, reflecting the global priority to curb mosquito populations, primary vectors for diseases like malaria, dengue, Zika, and chikungunya. Public health efforts focus on larvicides to prevent larvae from maturing into disease-carrying adults, particularly in tropical and subtropical regions. Urbanization and climate change, which exacerbate mosquito breeding through stagnant water accumulation, further drive demand.

By Application

The non-agriculture segment led the larvicides market in 2024 with a 67.3% share, driven by extensive use in public health campaigns, urban sanitation, and household mosquito control. Non-agricultural applications target water storage systems, drainage networks, and urban stagnant water to prevent mosquito-borne diseases like malaria, dengue, and Zika. Rapid urbanization and inadequate sanitation in densely populated regions amplify the need for larvicides in these settings.

Regional Analysis

In 2024, North America held the largest share of the larvicides market at 45.8%, valued at USD 412.6 million. This dominance is driven by robust public health programs, advanced vector control strategies, and high awareness of mosquito-borne diseases like West Nile virus and dengue. Strong urban infrastructure and regulatory support further boost larvicide adoption.

Europe emphasizes sustainable pest management with eco-friendly formulations, while the Asia Pacific sees rapid market growth due to urbanization and diseases like malaria and chikungunya. The Middle East & Africa face persistent demand due to mosquito-friendly climates, and Latin America experiences increased adoption due to recurring disease outbreaks. North America’s leadership reflects the global shift toward proactive larval control.

Top Use Cases

- Public Health Programs: Malaria Prevention: As a market research analyst, I see larvicides playing a vital role in community health drives, where they target mosquito larvae in water pools and drains to stop diseases like malaria before they spread. This proactive step helps governments and health teams protect large populations in tropical areas, reducing illness rates and saving healthcare costs through simple, targeted applications in everyday water sources.

- Urban Mosquito Control: Dengue Outbreak Response: In busy cities facing dengue threats, larvicides offer an easy fix by treating stagnant water in gutters and containers. From my analysis, this use case shines in quick-response scenarios, allowing local authorities to spray or drop treatments that kill larvae fast, keeping neighborhoods safe without disrupting daily life or relying on costly adult mosquito chases.

- Agricultural Pest Management: Crop Protection: Farmers use larvicides in rice fields and ponds to wipe out fly and mosquito larvae that harm young plants. My research highlights how this method boosts yields by creating pest-free zones, making it a go-to for sustainable farming that cuts down on broader chemical sprays and supports steady food production in rural setups.

- Wastewater Treatment: Environmental Safeguards: In sewage systems and treatment plants, larvicides control larvae breeding in dirty water, preventing flies from becoming a nuisance. As an analyst, I note this keeps facilities clean and odor-free, aiding eco-friendly operations that align with green regulations and reducing the spread of germs to nearby communities.

- Aquaculture Facilities: Fish Farm Hygiene: Fish breeders apply larvicides to ponds to eliminate mosquito larvae without harming fish, ensuring healthy growth environments. This use case, from my market insights, helps maintain water quality and prevents disease carryover, making it essential for commercial operations that aim for high output while meeting safety standards for seafood supply.

Recent Developments

1. BASF SE

BASF is advancing integrated mosquito management with its larvicide Abate. Recent focus is on education and training programs for public health professionals, emphasizing the product’s role in preventing diseases like dengue and Zika in regions with insecticide resistance. Their efforts highlight the strategic application of larvicides as a cornerstone for effective, sustainable vector control programs.

2. Bayer AG

Bayer’s larvicide, Natular, is a cornerstone of their vector control portfolio. A key recent development is its expanded use in large-scale urban mosquito control programs. Public health initiatives increasingly rely on its spinosad-based formula, which is approved for organic use and is effective against resistant mosquito species, supporting sustainable community protection efforts without propoxur.

3. Syngenta AG

While Syngenta’s primary focus is on agricultural solutions, its public health insecticide portfolio includes larvicides like Demand Duo. Recent developments involve integrated campaigns in Asia and Africa, combining larvicide application with adulticide treatments and community education. Their approach targets the mosquito life cycle at multiple stages to combat the spread of malaria and other vector-borne diseases effectively.

4. Sumitomo Chemical Co.

Sumitomo Chemical is a key player in public health, supplying larvicides like SumiLarv 2MR to the WHO and NGOs. A major recent development is the scaling up of production and distribution of this controlled-release formulation. It is being deployed more widely in global health initiatives for its long-lasting (2-3 months) control of mosquito breeding sites, which is crucial for efficient resource use.

5. Clarke Mosquito Control Products Inc.

Clarke emphasizes practical innovation, recently focusing on the application of FourStar Briquets. These sustained-release larvicides are being widely adopted by municipal control programs for their long-lasting control in catch basins and other stagnant water sources. Their development efforts highlight ease of use and cost-effectiveness for season-long control with a single application.

Conclusion

The Larvicides landscape observes a bright path ahead for this essential tool in fighting pests at their roots. With rising worries over bug-spread illnesses and a push for kinder, greener pest options, larvicides stand out as a smart, flexible choice for health teams, farmers, and city planners alike. They blend quick results with care for nature, promising stronger community shields and thriving crops in a changing world, all while sparking fresh ideas in eco-safe formulas to meet tomorrow’s needs.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)