Table of Contents

Report Overview

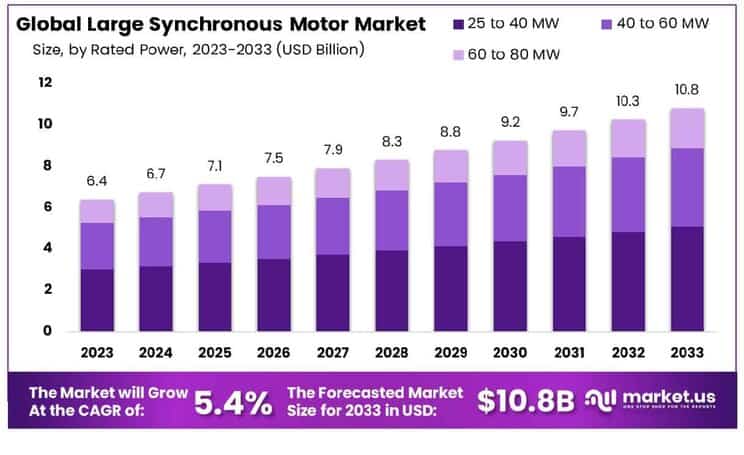

New York, NY – Jan. 29, 2025- The Global Large Synchronous Motor Market is projected to reach USD 10.8 billion by 2033, up from USD 6.4 billion in 2023, expanding at a CAGR of 5.40% from 2024 to 2033.

The Large Synchronous Motor (LSM) market refers to the industry segment dedicated to the production, sale, and application of high-power synchronous motors typically exceeding several megawatts. These motors are crucial in heavy industries, such as oil and gas, mining, and power generation, due to their high efficiency, precision, and ability to operate at constant speed, irrespective of load fluctuations.

The LSM market is experiencing growth, driven by several factors including increasing demand for energy-efficient systems, rising industrial automation, and the ongoing expansion of renewable energy infrastructure, which requires large-scale synchronous motors for grid stabilization and high-power applications.

The demand for LSMs is also buoyed by advancements in motor technology, such as improvements in materials and control systems, leading to enhanced performance and reliability. Additionally, opportunities abound in emerging markets where industrialization and infrastructure development are accelerating, offering substantial potential for LSM deployment in critical sectors, thereby driving market expansion in the coming years.

Fundamental Insights

- The Global Large Synchronous Motor Market is projected to reach approximately USD 10.8 billion by 2033, up from USD 6.4 billion in 2023, growing at a Compound Annual Growth Rate (CAGR) of 5.40% during the forecast period from 2024 to 2033.

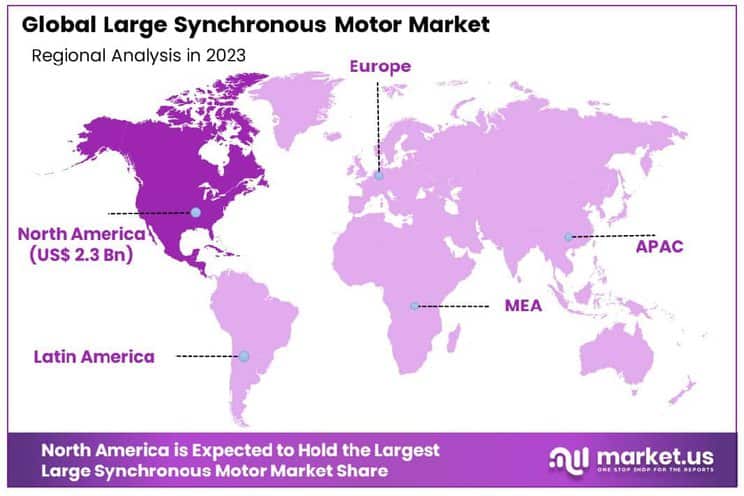

- North America leads the market, holding a dominant share of 36% in the Global Large Synchronous Motor Market.

- The market segment for motors with a rated power between 25 to 40 MW holds a significant share of 47%.

- Compressors are the leading application sector, capturing 32% of the market share.

- The oil and gas industry accounts for 24% of the end-user market, indicating a focused demand in this sector.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 6.4 Billion |

| Forecast Revenue (2033) | USD 10.8 Billion |

| CAGR (2024-2033) | 5.40% |

| Segments Covered | By Rated Power(25 to 40 MW, 40 to 60 MW, 60 to 80 MW), By Application(Compressor, Pump, Fans, Extruder, Mixers, Conveyors or Belts, Other Applications), By End User(Oil & Gas, Metal & Mining, Paper & Pulp, Chemicals & Petrochemicals, Automotive, Others) |

| Competitive Landscape | ABB, Toshiba Mitsubishi-Electric, General Electric, Industrial Systems, Corporation, Toshiba Corporation, Hyundai Electric & Energy Systems Co., Ltd, VEM Group, Rockwell Automation, Siemens AG, Ndec Corporation, Emerson Electric, Other Key Players |

Key Segments Analysis

In 2023, the Large Synchronous Motor Market was primarily segmented by rated power into three categories: 25 to 40 MW, 40 to 60 MW, and 60 to 80 MW. The 25 to 40 MW segment dominated with a 47% market share, thanks to its optimal balance of power output and efficiency, making it ideal for various industrial applications. The 40 to 60 MW segment, while significant, faced competition from the more versatile 25 to 40 MW motors, leading to a more fragmented market. The 60 to 80 MW segment, catering to niche, high-power applications, held a smaller share due to its limited number of use cases.

In 2023, the Large Synchronous Motor Market was driven by various application segments, with Compressors leading, holding a dominant 32% market share due to their crucial role in industrial processes like pneumatic tools, refrigeration, and gas compression. Following closely were the Pump and Fans segments, essential for fluid movement and ventilation. Other significant categories included Extruders and Mixers, vital for the plastics, metals, food, and pharmaceuticals industries, as well as Conveyors or Belts, key to material handling and automation in manufacturing and logistics. The “Other Applications” segment also contributed to the market, reflecting the broad versatility of large synchronous motors across industries.

In 2023, the Large Synchronous Motor Market was notably shaped by end-user sectors, with Oil & Gas leading, capturing over 24% of the market due to the sector’s need for efficiency, reliability, and performance in harsh conditions. The Metal & Mining sector followed, driven by the demand for high torque and speed control in heavy-duty applications. The Paper & Pulp and Chemicals & Petrochemicals industries also contributed significantly, relying on the motors for efficiency, durability, and precision. The Automotive sector’s adoption reflected a trend toward more energy-efficient manufacturing processes, while the “Others” category highlighted the motors’ wide-ranging applicability across various industries.

Emerging Trends

- Increased Automation in Industrial Applications: Industrial automation is driving the need for high-performance synchronous motors in factories and processing plants.

- Integration with Smart Grids: The demand for motors that can connect with smart grids is growing, enabling more efficient power management and performance optimization.

- Growing Demand for Energy-Efficient Solutions: Synchronous motors, known for their energy efficiency, are becoming increasingly popular as industries aim to reduce energy consumption and minimize operational costs.

- Technological Advancements: Innovations in motor design, such as the development of permanent magnet synchronous motors (PMSMs), are enhancing motor performance and reducing energy losses.

- Customization for Specific Applications: Manufacturers are focusing on developing motors with custom features tailored to specific industrial requirements, such as motors with variable speed control or specialized insulation materials.

Top Use Cases

- Power Generation: Large synchronous motors are integral to power plants, driving generators to produce electricity.

- Heavy Mining Equipment: These motors are widely used in large-scale mining operations for applications such as crushers and conveyors.

- Pumps and Compressors: In water treatment, HVAC systems, and oil & gas industries, large synchronous motors are employed to power large pumps and compressors that handle high volumes.

- Rolling Mills: Steel manufacturing often utilizes synchronous motors to drive rolling mills that require precise control of speed and torque.

- Cement Plants: Large synchronous motors are used in cement production for applications such as driving rotary kilns and ball mills.

Major Challenges

- High Initial Cost: Large synchronous motors are expensive to manufacture and install, which can deter small and medium enterprises from adopting the technology.

- Complex Maintenance Requirements: These motors often require regular maintenance and skilled technicians, which can result in high operational costs for industries.

- Limited Availability of Skilled Labor: The demand for experienced engineers and technicians capable of maintaining and operating these motors is a challenge in some regions.

- Technological Compatibility: Integrating large synchronous motors into existing systems with outdated infrastructure can be challenging and expensive.

- Environmental Concerns: Disposal and recycling of large electric motors can pose environmental challenges due to the materials used in manufacturing and the size of these machines.

Top Opportunities

- Emerging Economies in Asia-Pacific: The growing industrialization in countries like China and India presents a significant opportunity for market expansion.

- Increased Focus on Renewable Energy: As the demand for renewable energy grows, synchronous motors will find increased application in wind turbines and hydroelectric plants.

- Investment in Smart Motor Systems: The rise of the Internet of Things (IoT) in manufacturing is encouraging the development of motors with embedded smart sensors for better performance tracking.

- Energy Efficiency Regulations: Governments around the world are tightening energy efficiency regulations, providing an opportunity for high-efficiency synchronous motors to replace older, inefficient systems.

- Renewal and Expansion of Industrial Infrastructure: Aging infrastructure in developed countries is leading to a need for replacement and upgrading of industrial equipment, creating opportunities for the installation of modern synchronous motors.

Top Key Player Analysis

In the Global Large Synchronous Motor Market (2024+), key players like ABB, Toshiba Mitsubishi-Electric, and General Electric lead the charge with advanced, energy-efficient solutions. ABB excels in electrification and automation, while Toshiba and GE focus on energy savings and reliability for industries such as oil & gas and manufacturing. Siemens AG, Hyundai Electric, and Emerson Electric are also key contenders, offering innovative solutions with a strong emphasis on digitalization and smart technology.

Siemens, for instance, integrates smart motors to enhance operational efficiency, while Hyundai Electric provides highly reliable and efficient motors. Other important players, like Rockwell Automation, VEM Group, and Ndec Corporation, cater to niche markets, ensuring high-performance motors for specific industrial needs. The market remains competitive, with all players striving for better efficiency, cost-effectiveness, and innovation to meet growing global demand.

Top Key Player

- ABB

- Toshiba Mitsubishi-Electric

- General Electric

- Industrial Systems

- Corporation

- Toshiba Corporation

- Hyundai Electric & Energy Systems Co., Ltd

- VEM Group

- Rockwell Automation

- Siemens AG

- Ndec Corporation

- Emerson Electric

- Other Key Players

Regional Analysis

North America – Large Synchronous Motor Market with Largest Market Share of 36%

The North American region continues to dominate the global Large Synchronous Motor market, holding a substantial share of 36% in 2023, valued at approximately USD 2.3 billion. This dominance is driven by significant demand from industrial applications, including power generation, oil and gas, and heavy manufacturing sectors, all of which require high-efficiency motors. The growth of renewable energy projects, particularly wind power generation, further contributes to the expanding use of large synchronous motors in the region.

In addition, North America benefits from a well-established infrastructure and a high level of technological advancements, which support the adoption of sophisticated motor solutions. The U.S. remains the leading country in the region, while Canada and Mexico also exhibit strong market performance due to their expanding industrial bases and energy sector investments.

Recent Developments

- In 2025, Siemens introduced MACHINUM at IMTEX 2025, aiming to enhance machine tool performance and sustainability in India. This digitalization suite promises to reduce setup times by up to 20% and cut cycle times and energy usage by 18%, supporting India’s growing manufacturing sector and its export-driven market expansion. As advanced technologies become more prevalent, the Indian machine tool industry is undergoing a digital shift to meet demands for precision and customization.

- In 2023, ABB launched the IE5 SynRM Increased Safety motor, designed for use in explosive environments. This motor, part of the award-winning IE5 series, offers up to 40% lower energy losses compared to traditional IE3 motors, providing enhanced safety and energy efficiency for hazardous industries.

- In 2024, WEG acquired REIVAX, a Brazilian company specializing in control solutions for power generation. This acquisition strengthens WEG’s position in the hydroelectric, photovoltaic, wind, and cogeneration sectors, expanding their control systems business in the growing energy market.

- In 2024, Schneider Electric released its sustainability performance scores for Q2 2024 alongside its half-year financial results. This progress update highlights the company’s ongoing efforts to meet its global sustainability goals and commitments, which are integral to its strategy for long-term energy management and automation success.

- In August 2023, Nidec unveiled new smart pumping systems at WEFTEC 2023, aimed at improving water efficiency. With an emphasis on motor and control technologies, these systems address the challenges of drought and energy conservation, helping industries reduce water usage and energy consumption in critical operations.

Conclusion

The Global Large Synchronous Motor Market is poised for steady growth, with a projected increase from USD 6.4 billion in 2023 to USD 10.8 billion by 2033, driven by rising demand for energy-efficient solutions and advancements in motor technology. Key sectors like oil and gas, power generation, and heavy manufacturing continue to lead the demand, particularly in regions like North America. With emerging opportunities in renewable energy, industrial automation, and smart motor systems, the market is set to expand, despite challenges such as high initial costs and complex maintenance requirements.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)