Table of Contents

Overview

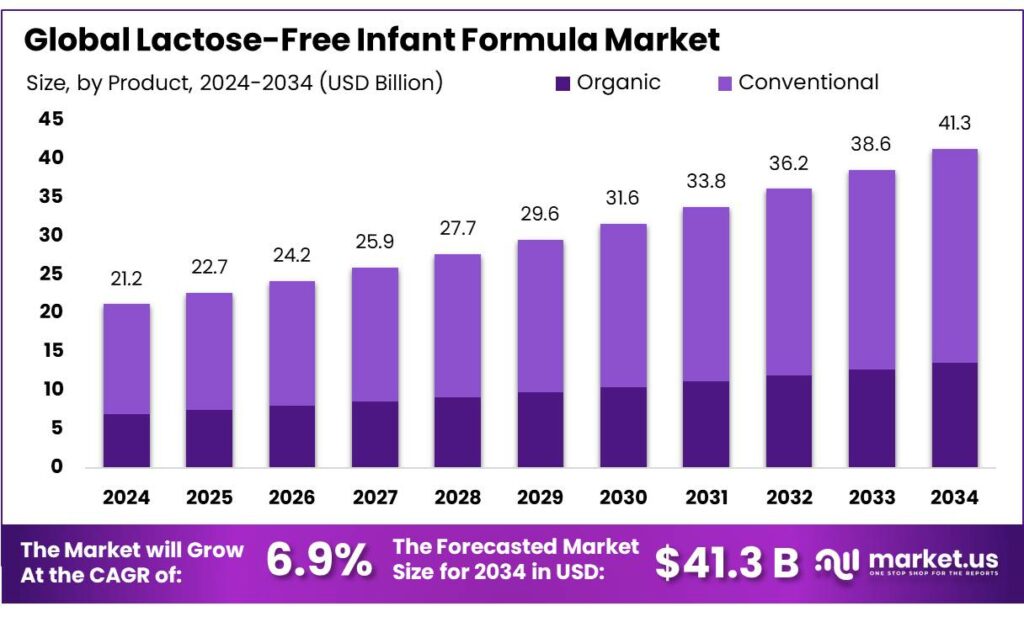

New York, NY – October 10, 2025 – The Global Lactose-Free Infant Formula Market is projected to reach USD 41.3 billion by 2034, rising from USD 21.2 billion in 2024 at a CAGR of 6.9% (2025–2034). In 2024, the Middle East & Africa led the market with a 58.9% share, generating USD 8.4 billion in revenue.

Lactose-free infant formula plays an essential role as a substitute for breast milk, offering nutrition for infants unable to digest lactose due to intolerance or milk protein sensitivity. These formulas replace lactose sugar with alternative carbohydrates, ensuring easy digestion and steady growth in infants with gastrointestinal sensitivities.

Globally, around 70% of adults experience some level of lactase non-persistence, though true congenital lactose intolerance in infants remains rare. Despite this, the growing awareness and perception of lactose sensitivity have accelerated demand for non-lactose infant nutrition. Rising parental preference for specialized formulas, especially in urban centers, has further driven the market’s expansion.

In 2023, the Food Safety and Standards Authority of India (FSSAI) proposed updates to nutrient composition tables for infant and follow-up formulas, including specific standards for lactose-free variants. For instance, manganese levels for such formulas were set between 5–400 mg per 100 g or 1–85.1 mg per 100 kcal, reflecting stricter nutrient regulation.

Globally, governments and agencies, including those in the European Union, enforce regulations such as EU Regulation 2016/127, which defines nutrient limits, labeling standards, and pesticide residue thresholds (not exceeding 0.01 mg/kg for most substances), ensuring the safety and quality of lactose-free infant formula products worldwide.

Key Takeaways

- Lactose-Free Infant Formula Market size is expected to be worth around USD 41.3 billion by 2034, from USD 21.2 billion in 2024, growing at a CAGR of 6.9%.

- Conventional held a dominant market position, capturing more than a 67.3% share in the Lactose-Free Infant Formula Market.

- Powdered Lactose-Free Formula held a dominant market position, capturing more than a 69.1% share in the Lactose-Free Infant Formula Market.

- Supermarkets & Hypermarkets held a dominant market position, capturing more than a 41.2% share in the Lactose-Free Infant Formula Market.

- Europe dominated the lactose‑free infant formula market, accounting for approximately 43.9% of the global share, amounting to an estimated USD 9.3 billion in revenue.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/lactose-free-infant-formula-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 21.2 Billion |

| Forecast Revenue (2034) | USD 41.3 Billion |

| CAGR (2025-2034) | 6.9% |

| Segments Covered | By Product (Organic, Conventional), By Product Type (Powdered Lactose-Free Formula, Ready-to-Feed Lactose-Free Formula), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online, Others) |

| Competitive Landscape | Nestlé, Nutricia, Valio Oy, Abbott, Gimme the Good Stuff, Apta Advice, Danone, Reckitt Benckiser Group PLC, Good Start, Dana Dairy Group, Abbott Laboratories Co. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=158005

Key Market Segments

By Product Analysis

In 2024, conventional lactose-free infant formula commanded a 67.3% market share in the Lactose-Free Infant Formula Market. Its dominance stems from affordability, widespread availability, and suitability for infants with mild lactose intolerance. Made with standard milk proteins but without lactose, these formulas meet the needs of most infants without requiring specialized medical oversight.

Parents favor conventional formulas for their familiar ingredients, balanced nutrition, and presence in retail and hospital settings. Demand is projected to grow steadily, driven by rising awareness, improved diagnosis of lactose intolerance in early infancy, and expanded availability in supermarkets and pharmacies across urban and semi-urban areas.

By Product Type Analysis

In 2024, powdered lactose-free formula held a 69.1% market share, attributed to its ease of storage, long shelf life, and cost-effectiveness. Parents prefer powdered formulas for their flexibility in preparation, which minimizes waste and supports portion control. Healthcare providers often recommend them for non-critical cases due to their convenience and consistent nutrient delivery.

Powdered formulas are expected to maintain their lead, particularly in regions with limited refrigeration or high cost sensitivity. Strong retail presence and compatibility with government nutrition programs further solidify this segment’s market position.

By Distribution Channel Analysis

In 2024, supermarkets and hypermarkets captured a 41.2% share of the Lactose-Free Infant Formula Market. Consumer trust in these retail chains, driven by the ability to compare brands and review labels in-store, fuels their dominance. Promotions and bundle deals enhance affordability, making specialty formulas accessible to more families.

The availability of diverse international and local brands under one roof caters to varied consumer preferences. By 2025, this channel is expected to remain strong as modern retail expands into suburban and tier-2 cities, offering convenience and reliability for infant nutrition purchases.

Regional Analysis

In 2024, Europe led the lactose-free infant formula market with a 43.9% share, generating approximately USD 9.3 billion in revenue. This leadership is driven by high consumer awareness of infant digestive health and robust supply and retail networks for specialty formulas. Stringent EU regulations on infant formula safety, nutrition, and labeling boost consumer confidence and adoption of lactose-free options.

Public health campaigns and pediatric guidance further increase demand by promoting early diagnosis of lactose intolerance. Extensive retail infrastructure, including supermarkets, hypermarkets, and pharmacy chains, ensures widespread access, particularly in Western Europe. The rapid growth of online retail also extends reach to underserved areas in Central and Eastern Europe, supporting both premium and affordable formula variants.

Top Use Cases

- Temporary Lactose Intolerance After Illness: Babies often face short-term tummy troubles like diarrhea or gas after a stomach bug, making regular milk hard to digest. Lactose-free formula steps in as a gentle switch, easing discomfort and helping little ones bounce back faster with softer stools and less fussiness during recovery.

- Congenital Lactase Deficiency: Some newborns are born without enough lactase enzyme to break down milk sugar, leading to constant bloating and crying from the start. This formula provides full nutrition without the upset, supporting steady growth and happy feeds right from day one under the doctor’s watchful eye.

- Management of Acute Gastroenteritis: During tummy infections, babies lose the ability to handle lactose temporarily, worsening dehydration and poor feeding. Switching to lactose-free options speeds up healing, cuts down on loose stools, and ensures they get key nutrients to regain strength without extra hospital trips.

- Support for Premature Infants with Sensitivities: Preemies have delicate guts that struggle with standard formulas, risking more feeding issues or slow weight gain. This tailored choice offers easy-to-absorb carbs and proteins, promoting better tolerance, healthier digestion, and milestone hits like robust growth in those early vulnerable weeks.

- Vegan or Plant-Based Family Diets: Parents raising kids on non-dairy paths seek safe nutrition that skips animal sugars while matching breast milk’s balance. Soy or hydrolyzed versions deliver essential vitamins and fats, fitting seamlessly into ethical lifestyles and keeping the baby thriving with familiar comfort and no allergy worries.

Recent Developments

1. Nestlé

Nestlé has advanced its lactose-free range under the Gerber Good Start brand, notably the ‘Extensive HA’ formula. This product is designed for cow’s milk protein sensitivity and lactose intolerance, featuring 100% whey protein hydrolysate. Their recent focus is on promoting the formula’s comfort for sensitive tummies, reducing fussiness and gas. The development is part of their broader Nurturing Health strategy to address common infant feeding challenges through specialized nutrition.

2. Nutricia

Nutricia, via its Aptamil brand, has progressed in lactose-free solutions with ‘Aptamil Lactose Free’. Recent developments emphasize their patented blend of prebiotics (scGOS/lcFOS), mimicking the prebiotic effect of human milk oligosaccharides to support a healthy gut microbiome in lactose-intolerant infants. Their research focuses on ensuring nutritional equivalence to standard formulas, providing complete nutrition while being gentle on the digestive system, a key marketing point in recent campaigns.

3. Valio Oy

Finnish dairy Valio has leveraged its patented Valio Eila lactose-free ingredient technology into infant formula. A key recent development is the use of these ingredients by manufacturers in China and Southeast Asia, creating products that avoid lactose-related discomfort while providing essential calcium absorption. Valio’s innovation lies in removing lactose at the ingredient level from milk, not just adding lactase enzyme, ensuring purity and safety for severely lactose-sensitive infants.

4. Abbott

Abbott has strengthened its Similac Sensitive line, a leading lactose-free formula. Their recent development highlights the inclusion of an immune-supporting blend with 2’-FL HMO (human milk oligosaccharide), a prebiotic previously found only in breast milk. This innovation marks a significant step beyond basic lactose-free nutrition, aiming to also support the immune system and gut health of sensitive babies, differentiating it from older lactose-free options on the market.

5. Gimme the Good Stuff

Gimme the Good Stuff’s recent development is its continuously updated database and guidance on cleaner lactose-free formulas. They have intensified scrutiny on ingredients beyond lactose, highlighting brands that are free from corn syrup, soy, and synthetic additives. Their service helps parents navigate the market to find formulas that are not only lactose-free but also align with strict standards for organic and non-GMO ingredients, reflecting growing consumer demand for purity.

Conclusion

Lactose-free infant formula as a rising star in family wellness choices. It meets the growing call for gentle, tailored feeding that soothes sensitive tummies and builds strong starts without the drama of digestive woes. With parents smarter about early signs like fussiness or wind, and doctors quick to guide swaps, this option feels like a smart, caring pick for everyday calm. Expect it to shine brighter as more families embrace customizable care that lets babies focus on joyful milestones, not mealtime battles, proving real progress in how we nurture the tiniest eaters.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)