Table of Contents

Overview

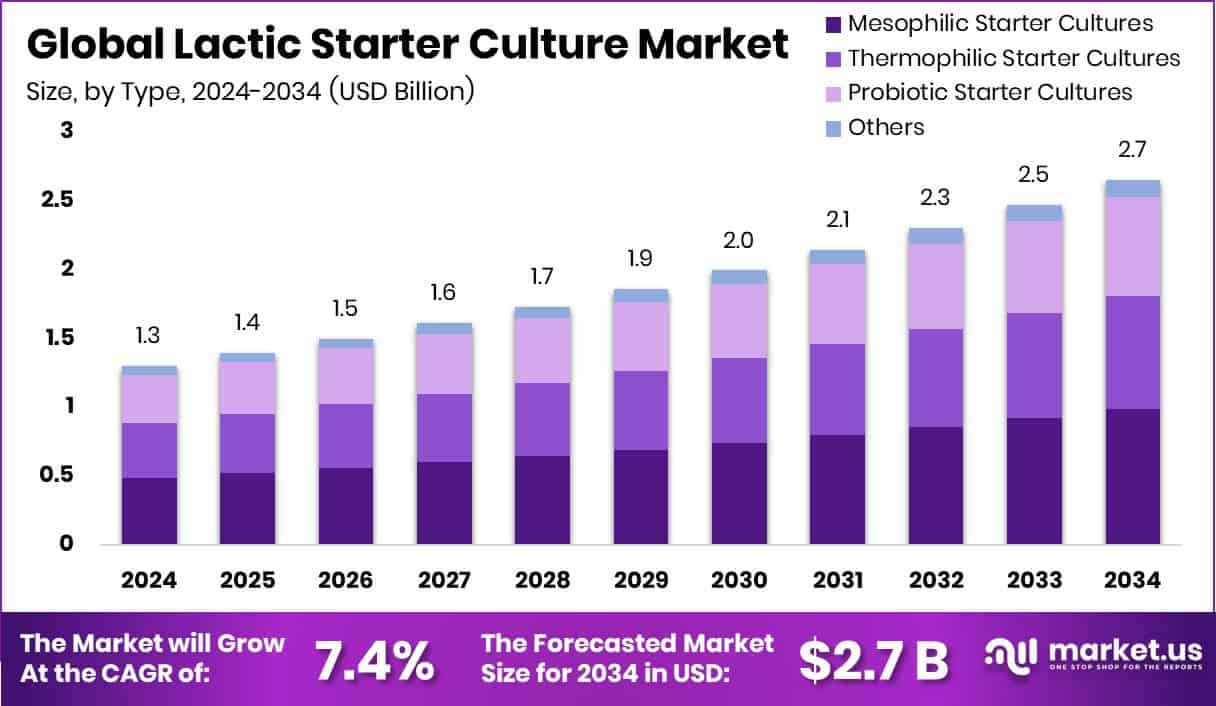

The Global Lactic Starter Culture Market is projected to reach approximately USD 2.7 billion by 2034, rising from USD 1.3 billion in 2024. The market is anticipated to grow at a compound annual growth rate (CAGR) of 7.4% between 2025 and 2034. In North America, which holds a 48.2% market share, demand continues to rise steadily, driven by a growing preference for natural fermentation techniques.

Lactic starter cultures are a group of beneficial bacteria, including Lactobacillus, Lactococcus, and Streptococcus species, primarily used in fermenting dairy and food products. These microbes convert lactose and other sugars into lactic acid, a process that not only preserves food but also improves its flavor, texture, and digestibility. Commonly found in yogurt, cheese, sour cream, and fermented beverages, these cultures are essential for enhancing food safety and extending shelf life by preventing the growth of harmful microorganisms.

The Lactic Starter Culture Market represents the global production and use of these bacterial cultures across multiple industries, including dairy, bakery, meat processing, and beverages. The market features both freeze-dried and frozen forms of cultures, available in various formats to suit the needs of industrial-scale processors and artisanal producers. Key end-users include food manufacturing units, commercial food service providers, and makers of probiotic-enriched nutritional products.

A key driver of market growth is the increasing consumer shift toward fermented and functional foods. Heightened awareness about digestive health, the appeal of natural preservation methods, and a growing preference for clean-label products are fueling the demand for lactic starter cultures in everyday food consumption.

Additionally, the rise of dairy and plant-based alternatives further supports market expansion. As interest in non-dairy yogurts, vegan cheeses, and probiotic beverages grows, so does the need for customized microbial solutions designed for plant-based fermentation. Notably, investments in the dairy-tech space such as Doodhvale Farms securing $3 million and Stellapps raising $26 million in Series C funding highlight the sector’s strong growth potential.

Key Takeaways

- The Global Lactic Starter Culture Market is projected to grow from USD 1.3 billion in 2024 to approximately USD 2.7 billion by 2034, registering a CAGR of 7.4% between 2025 and 2034.

- Mesophilic starter cultures currently hold a 37.2% market share, favored for their wide applicability across various fermentation processes.

- Freeze-dried cultures lead the market with a 49.1% share, mainly due to their extended shelf life and ease of storage.

- Dairy applications dominate the market, accounting for 56.9% of total usage, driven by sustained global demand for dairy-based products.

- North America represents a significant regional market, valued at USD 0.6 billion, supported by high levels of dairy consumption.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/lactic-starter-culture-market/free-sample/

Report Scope

| Market Value (2024) | USD 1.3 Billion |

| Forecast Revenue (2034) | USD 2.7 Billion |

| CAGR (2025-2034) | 7.4% |

| Segments Covered | By Type (Mesophilic Starter Cultures, Thermophilic Starter Cultures, Probiotic Starter Cultures, Others), By Form (Freeze-Dried, Frozen Concentrates, Liquid Cultures), By Application (Dairy Products, Bakery Products, Fermented Beverages, Meat Products, Others) |

| Competitive Landscape | Danone S.A., Chr. Hansen Holding A/S, Lallemand Inc., Sacco System S.R.L., Kerry Group plc, Lesaffre International, Meiji Holdings Co., Ltd. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153705

Key Market Segments

By Type Analysis: Mesophilic Cultures Lead with 37.2% Share : As of 2024, mesophilic starter cultures dominate the lactic starter culture market by type, holding a 37.2% share. Their leading position is largely due to their widespread use in traditional dairy fermentations such as cheese, sour cream, and cultured butter.

Operating best at moderate temperatures, mesophilic cultures are preferred for their consistent acidification, dependable performance, and ability to deliver appealing flavor profiles. Their adaptability across both artisanal and industrial settings has sustained strong demand, particularly in regions with established dairy traditions.

By Form Analysis: Freeze-Dried Cultures Dominate with 49.1% Share : In 2024, freeze-dried starter cultures held the top spot in the lactic starter culture market by form, accounting for 49.1% of the segment. This dominance is driven by their superior shelf life, ease of handling, and transport flexibility, especially in regions where cold chain logistics are limited.

Freeze-dried cultures maintain bacterial potency and functional integrity during storage, allowing quick reactivation during production. Their consistent fermentation results make them ideal for industrial-scale applications. Manufacturers favor this form due to its dosing convenience and long usability, helping minimize waste and improve operational efficiency.

By Application Analysis: Dairy Products Hold a 56.9% Market Share : Dairy products emerged as the largest application area in the lactic starter culture market in 2024, commanding a 56.9% share. This is primarily due to the essential role starter cultures play in producing cheese, yogurt, sour cream, and buttermilk products that rely on specific bacteria for flavor, texture, and preservation.

The growing demand for probiotic-rich and gut-friendly dairy foods continues to drive market growth. Lactic cultures are critical in achieving these health benefits while ensuring product safety through natural fermentation.

Regional Analysis

North America-Market Leader with 48.2% Share

In 2024, North America dominated the lactic starter culture market, holding a substantial 48.2% share valued at USD 0.6 billion. This leadership is attributed to the region’s high dairy consumption, a strong network of commercial dairy producers, and growing interest in natural fermentation methods. The rising demand for clean-label foods and increasing consumer awareness about gut health have further accelerated the adoption of lactic starter cultures across food manufacturing sectors.

Top Use Cases

Cheese Production: Starter cultures are essential in cheese-making, initiating fermentation to convert lactose into lactic acid. This process helps shape flavor, texture, and acidity, while also controlling microbial growth. Cheddar, Gouda, Brie and specialty cheeses rely on specific culture blends to achieve consistent quality and traditional characteristics in both industrial and artisanal settings.

Yogurt Manufacturing: Dairy starter cultures transform milk into creamy, tangy yogurt by fermenting lactose. Cultures including Lactobacillus and Streptococcus strains ensure the desired texture, flavour and probiotic benefits. They help producers deliver consistent quality, longer shelf life and nutrient-rich dairy snacks that align with growing consumer interest in gut health and functional foods.

Probiotic Dairy Products: Starter cultures are used to create probiotic-rich products like kefir, probiotic yogurts, and fermented milk drinks. These cultures provide live beneficial bacteria linked to improved digestion and immunity. With rising consumer awareness of gut health, food companies leverage these starter cultures to formulate products that meet functional food demand and support clean‑label positioning.

Artisanal & Specialty Dairy Items: Small-scale and gourmet producers rely on tailored starter cultures to develop unique regional cheeses, cultured cream, buttermilk and other traditional dairy specialties. Autochthonous and mesophilic strains are selected to preserve authentic flavor and texture. This niche market values precision and consistency while adhering to local heritage and clean-label standards.

Clean‑Label Preservation & Shelf‑Life Extension: Many manufacturers adopt lactic starter cultures as natural bioprotective agents to replace chemical preservatives. These cultures extend shelf life by producing lactic acid and bacteriocins that inhibit spoilage and pathogens. This approach supports consumer demand for minimally processed dairy products and simplifies compliance with clean-label and food safety standards.

Recent Developments

Danone S.A.: In October 2024, Danone rolled out its “Actimel+ Triple Actions” yogurt shot across 20 European countries. Enriched with L. casei probiotic cultures and vitamins (B6, C, D, magnesium), it targets gut health and immunity. This launch reinforces Danone’s strategy of integrating traditional lactic fermentation with functional nutrition, pushing forward the dairy starter culture market with health‑oriented innovations.

Chr. Hansen Holding A/S: In late 2023 and early 2024, Chr. Hansen completed its merger with Novozymes under the new entity Novonesis. They also launched specialized starter cultures like DVS WHITE FLORA for Mediterranean-style white cheese, and Sweety Y‑1 cultures that reduce sugar needs in yogurt while maintaining flavor and pH stability. Their FreshQ bioprotection strains help extend shelf life by inhibiting spoilage microbes naturally.

Lallemand Inc.: In September 2024, Lallemand inaugurated over 800 m² of new R&D laboratories near Toulouse at a cost of €1.7 million. These upgraded facilities focus on Specialty Cultures including lactic starter strains supporting diversification and next‑generation development. The move reflects Lallemand’s commitment to expanding its microbial portfolio and accelerating strain innovation tailored to emerging fermentation markets.

Sacco System S.R.L.: In 2024, Sacco System emphasized strengthening its artisanal and premium dairy segments by expanding R&D collaborations to deliver customized freeze‑dried lactic culture blends. Their work focuses on tailored culture solutions for cheese and yogurt makers, enabling consistent quality in niche and small-batch production. This helps enhance their presence in specialized dairy markets.

Kerry Group plc: While recent direct news on Kerry’s lactic starter cultures is limited, Kerry continues to position itself among the top-tier microbial culture providers (including lactic cultures) cited in industry‐leader reports. Through its food‐ingredients business, Kerry offers integrated fermentation solutions and dairy culture components, and remains among the key global suppliers shaping starter culture innovation.

Lesaffre International: In 2024, Lesaffre acquired Brazilian yeast producer Biorigin, expanding its global reach in microbial solutions. Its continued expansions in R&D and innovation bolstered by its Advanced Fermentations arm and collaborations with Ginkgo Bioworks subsidiary Altar strengthen its fermentation expertise. While focused broadly on yeast and probiotic solutions, the move enhances capabilities applicable to lactic starter cultures in dairy fermentation.

Meiji Holdings Co., Ltd.: Meiji has filed and published a patent (US20230363403A1 in November 2023) covering novel lactic acid bacteria starters and methods for producing fermented milk, showing active innovation in starter strain development. Additionally, in May 2024, Meiji launched its internal “Fresh Cheese Studio” brand producing high‑quality cheese curd for retail and foodservice enabling small-scale producers to use consistent dairy fermentation processes.

Conclusion

The lactic starter culture market is on a strong growth path, driven by rising demand for fermented foods, growing interest in gut health, and a shift toward clean-label, naturally preserved products. With global market value expected to nearly double from USD 1.3 billion in 2024 to around USD 2.7 billion by 2034, this sector presents promising opportunities for innovation and investment. Leading companies like Chr. Hansen, Danone, Lallemand, and Meiji are actively developing specialized cultures to improve taste, texture, and shelf life across dairy and plant-based applications.

As consumer preferences evolve, the use of freeze-dried and mesophilic cultures will continue to dominate, offering efficiency and consistent quality for manufacturers. Overall, the market’s growth is supported by technological advancements, increased awareness of functional nutrition, and rising investments across both traditional and emerging regions.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)