Table of Contents

Introduction

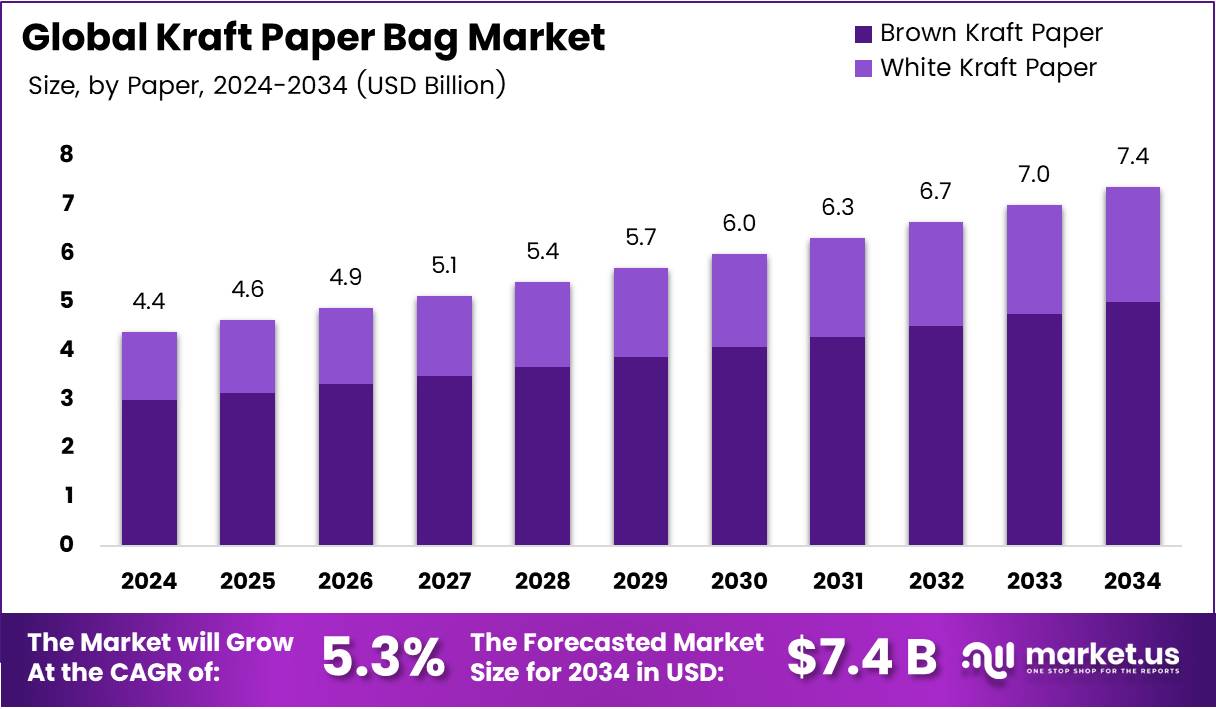

The Global Kraft Paper Bag Market is set to expand steadily, reflecting the worldwide push toward sustainable packaging. With the market projected to grow from USD 4.4 Billion in 2024 to USD 7.4 Billion by 2034 at a CAGR of 5.3%, businesses are accelerating their shift to eco-friendly alternatives.

Transitioning to kraft paper bags is fueled by regulatory bans on single-use plastics and rising consumer demand for biodegradable products. Retailers, foodservice operators, and e-commerce platforms are actively adopting kraft paper packaging as a reliable, environmentally compliant, and brand-friendly solution that supports both function and visibility.

Moreover, government incentives for recycling infrastructure and corporate ESG commitments are strengthening industry adoption. Despite cost and durability challenges, continuous innovation in product design, coatings, and printing technologies is positioning kraft paper bags as a versatile option, balancing environmental goals with business needs.

Key Takeaways

- The Kraft Paper Bag market is projected to reach USD 7.4 Billion by 2034, growing from USD 4.4 Billion in 2024 at a CAGR of 5.3%.

- In 2024, Brown Kraft Paper led the paper segment with a 67.9% share, driven by durability and eco-friendly appeal.

- Sewn Open Mouth dominated the product segment with a 23.6% share, supported by versatile sealing and wide application use.

- 2 Ply emerged as the leading thickness category with a 52.7% share, balancing cost-efficiency and strength in packaging.

- Food Service held the top spot in end-use with a 33.2% share, fueled by demand in restaurants, cafes, and food delivery.

- Asia Pacific accounted for the largest market share at 48.2%, generating USD 2.1 Billion, supported by urbanization and retail expansion.

Market Segmentation Overview

Brown Kraft Paper retained dominance in 2024 with 67.9% share, supported by its natural appearance, cost-effectiveness, and high tensile strength. It remains the preferred choice for heavy-duty packaging, while White Kraft Paper caters to premium markets requiring aesthetic appeal.

Sewn Open Mouth products held the lead at 23.6% share, gaining traction for their stitched durability and tamper-proof sealing. They remain popular in industrial and commercial settings, while Pasted Valve and Flat Bottom options expand in construction and retail packaging.

By thickness, 2 Ply kraft bags secured 52.7% share in 2024, offering an optimal blend of strength and cost. While 1 Ply serves low-weight applications, 3 Ply variants are increasingly chosen for industrial packaging where heavy loads and durability are essential.

Food Service dominated end-use with 33.2% share, driven by restaurants, cafes, and takeaway packaging needs. Retail and e-commerce applications also represent fast-expanding markets, reflecting demand for sustainable alternatives and brand-enhancing packaging.

Drivers

Rising government bans on single-use plastic bags are directly fueling market adoption. Countries across the EU, India, and the US are implementing policies to restrict plastic use, compelling businesses to adopt kraft paper bags as a compliant and eco-friendly substitute.

The rapid expansion of e-commerce is also a critical driver. Online retailers are turning to kraft bags for shipping durability and sustainability alignment, ensuring both protection during transport and positive brand positioning among eco-conscious buyers.

Use Cases

Kraft paper bags are widely used in food service, where restaurants, cafes, and delivery companies depend on biodegradable, grease-resistant packaging. Their compliance with food safety standards and customer demand for eco-conscious solutions make them the preferred choice in this sector.

Retailers leverage kraft paper bags as branding tools. With customizable designs and premium printing, brands use kraft bags not only for packaging but also as a medium for visibility and consumer engagement, supporting marketing and sustainability objectives simultaneously.

Major Challenges

The higher cost of kraft paper bags compared to plastic alternatives remains a significant barrier. Raw material reliance on wood pulp and energy-intensive production raise costs, making them less viable for price-sensitive retailers in emerging economies.

Durability issues also limit growth. Kraft bags can tear under excessive weight and lose integrity when exposed to moisture, restricting their use in groceries and other heavy-load packaging needs. This limitation reduces adoption in certain critical sectors.

Business Opportunities

Innovation in coated and laminated kraft bags offers new opportunities. Improved water resistance and durability open applications in groceries, agriculture, and logistics where traditional kraft paper bags struggled. This technological evolution strengthens market reach.

Luxury and fashion retailers present a growing premium opportunity. With sustainability now integral to brand identity, kraft paper bags with aesthetic appeal are gaining traction in high-end retail spaces, enabling higher margins and niche market expansion.

Regional Analysis

Asia Pacific leads the global kraft paper bag market, commanding 48.2% share valued at USD 2.1 Billion. Strong government bans on plastics, rapid urbanization, and retail sector growth drive its dominance, particularly in India, China, and Southeast Asia.

North America demonstrates steady growth, underpinned by rising eco-friendly product demand and regulations. With the US leading adoption, e-commerce and foodservice industries are creating consistent demand for kraft paper bags across diverse applications.

Recent Developments

- July 2025 – THC acquired Promar, a Polish manufacturer, strengthening its European footprint in sustainable packaging.

- April 2025 – Reel Paper acquired HoldOn Bags, expanding its portfolio in compostable consumer packaging.

- April 2024 – Inteplast Group acquired Brown Paper Goods, broadening its foodservice packaging offerings in North America.

- September 2024 – Novolex acquired American Twisting, boosting capabilities in specialty and customized paper packaging.

Conclusion

The Global Kraft Paper Bag Market is projected to sustain growth, expanding from USD 4.4 Billion in 2024 to USD 7.4 Billion by 2034. With regulatory backing, technological innovation, and consumer-driven sustainability trends, kraft paper bags are expected to remain central to the eco-friendly packaging shift, despite cost and durability challenges.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)