Table of Contents

Overview

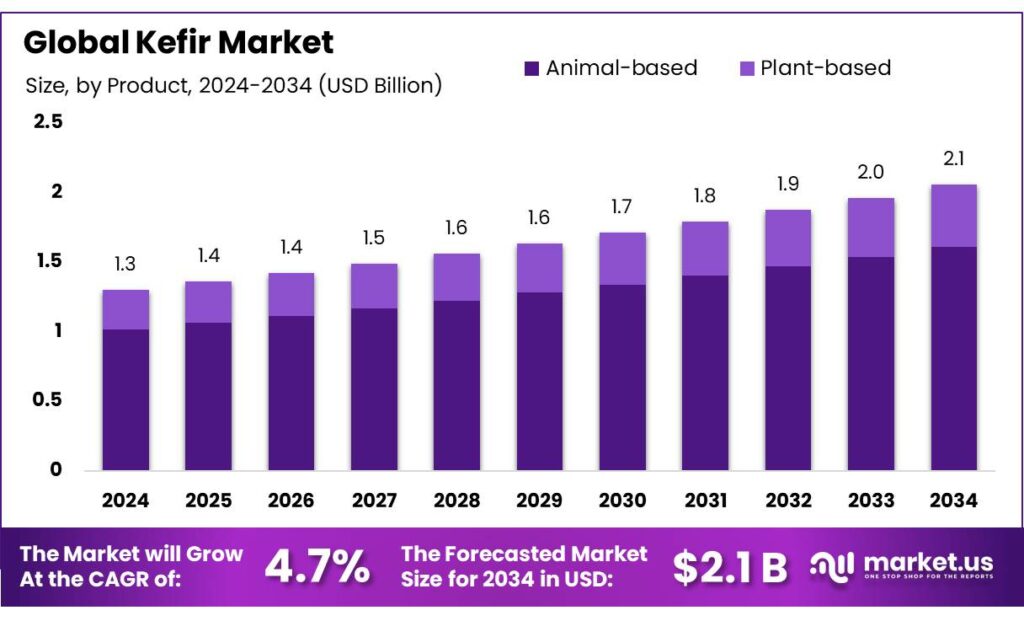

New York, NY – October 08, 2025 – The Global Kefir Market is projected to reach USD 2.1 billion by 2034, rising from USD 1.3 billion in 2024, with a CAGR of 4.7% from 2025 to 2034. Europe dominated in 2024, accounting for 43.8% of the global share and generating USD 0.5 billion in revenue.

Kefir, a fermented dairy beverage from the Caucasus region, is gaining worldwide recognition due to its probiotic richness, digestive health benefits, and nutritional value. In India, kefir represents a growing niche within the expanding functional dairy and fermented foods sector, supported by rising health awareness and demand for gut-friendly beverages.

Government-backed initiatives are reinforcing this growth. Gujarat has emerged as a vital agro-dairy hub, attracting substantial investments in milk processing and dairy value chains. Leading cooperatives like Banas Dairy support over 1,600 local cooperatives and more than 300,000 farmers, significantly enhancing the region’s dairy capacity and enabling the production of value-added products such as kefir.

Moreover, national programs such as White Revolution 2.0 aim to improve milk productivity and processing efficiency, fostering innovation in value-added dairy. The Revised National Program for Dairy Development (NPDD), approved in 2025, prioritizes infrastructure development, supply chain modernization, and quality assurance.

Complementing these, a ₹8,004 crore corpus has been allocated for dairy processing infrastructure, while the Animal Husbandry Infrastructure Development Fund (AHIDF) with a ₹15,000 crore corpus supports private investments in dairy and feed manufacturing. These combined efforts are expected to ensure a steady supply of high-quality milk, creating favorable conditions for the expansion of the kefir industry.

Key Takeaways

- Kefir Market size is expected to be worth around USD 2.1 billion by 2034, from USD 1.3 billion in 2024, growing at a CAGR of 4.7%.

- Animal-based kefir held a dominant market position, capturing more than a 78.3% share.

- Conventional kefir held a dominant market position, capturing more than a 71.5% share.

- Milk kefir held a dominant market position, capturing more than an 80.6% share.

- Flavoured kefir held a dominant market position, capturing more than a 61.2% share.

- The Food application segment held a dominant market position, capturing more than 82.7% share.

- Supermarkets and hypermarkets held a dominant market position in the kefir distribution channel, capturing more than a 37.4% share.

- Europe held a dominant position in the global kefir market, capturing more than a 43.8% share, valued at approximately USD 0.5 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-kefir-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1.3 Billion |

| Forecast Revenue (2034) | USD 2.1 Billion |

| CAGR (2025-2034) | 4.7% |

| Segments Covered | By Product (Animal-based, Plant-based), By Form (Organic, Conventional), By Product Type (Milk Kefir, Water Kefir), By Category (Flavoured, Unflavored), By Application (Food, Pharmaceutical), By Distribution Channel ( Convenience Store, Specialty Store, Supermarkets/Hypermarkets, Others) |

| Competitive Landscape | Lifeway Foods, Inc., MAPLE HILL, Green Valley, Nancy’s, The Icelandic Milk and Skyr Corporation, Forager Project, KeVita |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=157892

Key Market Segments

By Product Analysis

In 2024, animal-based kefir dominated the market, securing a 78.3% share. Its strong performance stems from its traditional heritage, nutrient-rich composition, and widespread popularity in dairy-centric regions. Made from cow, goat, or sheep milk, animal-based kefir offers a creamy texture and tangy flavor similar to yogurt. It is favored for its high protein, calcium, and vitamin content, appealing to health-conscious consumers. The probiotic benefits, supporting digestion and immunity, further drive its market dominance.

By Form Analysis

Conventional kefir led the market in 2024 with a 71.5% share, attributed to its deep-rooted tradition, nutritional value, and strong presence in dairy-loving regions. Produced from cow, goat, or sheep milk, it delivers a creamy, yogurt-like texture and tangy taste. Its rich protein, calcium, and vitamin profile, combined with probiotic benefits for gut health and immunity, makes it a top choice for health-focused consumers.

By Product Type Analysis

Milk kefir commanded an 80.6% market share in 2024, driven by its traditional appeal, robust nutritional profile, and entrenched consumption in dairy-focused regions. Sourced from cow, goat, or sheep milk, it offers a creamy texture and tangy flavor akin to yogurt. Its high levels of protein, calcium, and vitamins, along with probiotic benefits for digestion and immunity, solidify its popularity among health-conscious consumers.

By Category Analysis

Flavored kefir captured a 61.2% market share in 2024, fueled by its ability to appeal to diverse consumer tastes. Offering flavors like berry, vanilla, and citrus, it attracts a wide audience seeking tasty, health-oriented beverages. The addition of natural fruit flavors enhances both taste and nutritional value, making flavored kefir a preferred choice for health-conscious individuals.

By Application Analysis

Food applications dominated the kefir market in 2024, holding an 82.7% share, reflecting kefir’s role as a versatile functional food ingredient, especially in dairy and beverage products. Its probiotic richness, creamy texture, and tangy flavor make it ideal for smoothies, breakfast bowls, salad dressings, and dips. Growing consumer interest in gut health and probiotics has further boosted its integration into everyday diets.

By Distribution Channel Analysis

Supermarkets and hypermarkets led kefir distribution in 2024 with a 37.4% share, underscoring their role in making kefir widely accessible. These outlets offer diverse kefir products in various flavors and sizes, catering to a broad range of preferences. Strategic placement in dairy or health food aisles, along with promotional deals, enhances visibility and encourages purchases among price-sensitive consumers.

Regional Analysis

Europe dominated the global kefir market in 2024, capturing a 43.8% share, valued at approximately USD 0.5 billion. This leadership reflects Europe’s long tradition of fermented dairy consumption and growing demand for functional foods.

Countries like Russia, Germany, Poland, and the UK drive the market, where kefir is a dietary staple valued for its probiotic and health benefits. Milk-based kefir remains the top choice, with flavored variants gaining traction. Supermarkets and hypermarkets ensure broad accessibility, meeting consumer demand for convenience.

Top Use Cases

- Gut Health Support: Kefir’s probiotics help balance gut bacteria, easing digestion issues like bloating or irregularity. People drink it daily to improve overall digestive comfort and reduce discomfort from poor gut flora, making it a simple addition to routines for better daily wellness.

- Bone Strength Enhancement: With natural calcium and vitamin K2, kefir aids in maintaining strong bones. It supports daily bone health by helping absorb minerals effectively, appealing to those focused on preventing age-related weakness through easy, nutrient-rich consumption.

- Immunity Boost: The live cultures in kefir strengthen the body’s defenses against infections. Regular intake promotes a healthier immune response, helping users feel more resilient during seasonal changes or stress, as part of a proactive health lifestyle.

- Blood Sugar Management: Kefir assists in steadying blood sugar levels after meals. Its fermented nature slows sugar absorption, benefiting those watching their intake for stable energy, integrated into breakfasts or snacks for sustained daily vitality.

- Versatile Food Ingredient: Kefir blends into smoothies, dressings, or dips for a creamy texture and tang. It enhances everyday meals with probiotic perks, attracting home cooks who want flavorful, health-focused options without extra effort in preparation.

Recent Developments

Lifeway Foods, Inc.

Lifeway continues to innovate with new flavors and product lines, such as its “Bio Kefir” and “Farmstyle” low-fat kefir. They are heavily focusing on marketing their probiotic benefits for gut health and immunity. Recent efforts include expanding distribution in mainstream grocery and club stores, alongside social media campaigns targeting health-conscious consumers. Financially, they have reported consistent growth, reinforcing their position as a leader in the probiotic beverage space.

Maple Hill

A leader in organic and 100% grass-fed dairy, Maple Hill has expanded its offerings to include drinkable kefir. Their recent development centers on their regenerative agriculture practices, appealing to environmentally conscious consumers. They emphasize the superior nutritional profile of their kefir, derived from grass-fed cows. Marketing focuses on the synergy between soil health, animal welfare, and nutrient-dense products, carving a niche in the premium segment of the market.

Green Valley Creamery

Green Valley, known for its lactose-free products, has seen its kefir gain popularity. A key recent development is the expansion of its distribution network, making its kefir more accessible nationally. They continue to emphasize their lactose-free certification and the presence of live and active cultures, directly targeting consumers with dairy sensitivities. Their branding focuses on digestive wellness without compromise, leveraging the growing demand for accessible probiotic foods.

Nancy’s

Nancy’s has solidified its presence in the plant-based category with the launch of Nancy’s Oat Milk Kefir. This recent innovation caters to the growing demand for dairy-free probiotic options. The product is certified organic and uses a unique oat milk base, differentiating it from nut- or coconut-based alternatives. This expansion allows Nancy’s to compete directly in the rapidly growing plant-based probiotic sector while maintaining its core organic dairy kefir line.

The Icelandic Milk and Skyr Corporation (MS Iceland Dairies)

While famous for skyr, this company also produces traditional Icelandic kefir, “Kefir IS.” A recent development is its increased international market penetration, particularly in Europe and North America. They leverage the strong “Icelandic” brand identity associated with purity and high-quality dairy. Their marketing highlights the product’s authentic recipe and origin, aiming to attract consumers seeking authentic, foreign probiotic experiences alongside their core skyr products.

Conclusion

Kefir stands out as a versatile fermented drink, gaining traction in the functional foods sector. Its natural probiotic content aligns with rising consumer focus on gut wellness, immunity, and clean eating trends. As preferences shift toward plant-based and innovative flavors, kefir’s role in daily diets expands, offering easy ways to incorporate health benefits into modern lifestyles while driving steady market appeal.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)