Table of Contents

Overview

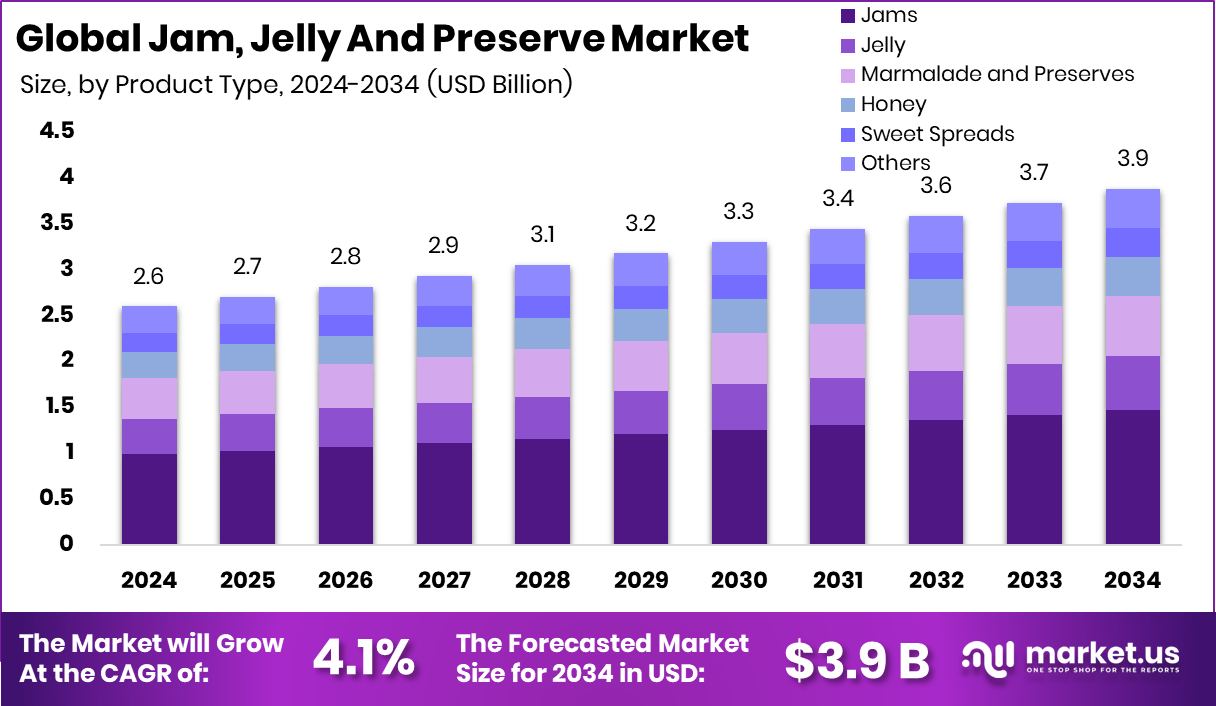

New York, NY – August 01, 2025 – The Global Jam, Jelly, and Preserve Market is projected to reach approximately USD 3.9 billion by 2034, growing from USD 2.6 billion in 2024, at a compound annual growth rate (CAGR) of 4.1% between 2025 and 2034. North America remains a key region, with consumer demand for fruit-based spreads driving the market to a value of around USD 1.1 billion.

These products, jam, jelly, and preserves, are derived from fruits combined with sugar and pectin, then cooked into thick spreads. While jam includes crushed or pureed fruit for a spoonable texture, jelly uses only fruit juice, resulting in a clear, firmer consistency. All three are widely used as spreads or condiments across households and foodservice segments.

The jam, jelly, and preserve market encompasses the manufacturing and sale of traditional and innovative fruit-based spreads, including those made with organic, low-sugar, or exotic ingredients. These products are used in households, bakeries, and the confectionery sector. Market expansion is primarily driven by growing consumer demand for healthier, clean-label, and non-GMO options with real fruit content and no artificial additives.

In recent developments, Alienkind, a fruit-based beverage startup, secured USD 1.2 million in seed funding. Similarly, Good Good, a health-focused food brand, raised USD 20 million in Series B funding, launched a no-added-sugar peanut butter, and expanded its sugar-free jam products to 3,500 Walmart locations across the United States.

Key Takeaways

- The Global Jam, Jelly And Preserve Market is expected to be worth around USD 3.9 billion by 2034, up from USD 2.6 billion in 2024, and grow at a CAGR of 4.1% from 2025 to 2034.

- Jams lead the Jam, Jelly, and Preserve Market by product type, holding a 37.9% share globally.

- Fruit and fruit juice dominate ingredient usage in the market, accounting for a significant 41.2% share.

- Strawberry flavor remains the most preferred choice among consumers, representing 33.1% of total flavor sales.

- Hypermarkets and supermarkets are the top distribution channels, contributing 48.3% to the overall market reach.

- North America dominated with a 44.80% share in the global market in 2024.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/jam-jelly-and-preserve-market/request-sample/

Report Scope

| Market Value (2024) | USD 2.6 Billion |

| Forecast Revenue (2034) | USD 3.9 Billion |

| CAGR (2025-2034) | 4.1% |

| Segments Covered | By Product Type (Jams, Jelly, Marmalade and Preserves, Honey, Sweet Spreads, Others), By Ingredient Type (Pectin, Fruit and Fruit Juice, Sweeteners, Essence, Others), By Flavor Type (Mango, Blackberry, Grape, Strawberry, Others), By Distribution Channel (Hypermarket/Supermarket, E-Commerce, Convenience Stores, Others) |

| Competitive Landscape | Andros Group, B&G Foods Inc., Bonne Maman, McCormick Company, F. Duerr & Sons Ltd, Hormel Foods, Kraft Heinz, The J.M. Smucker Company, Wilkin & Sons Ltd |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=152761

Key Market Segments

By Product Type Analysis

In 2024, jams secured a leading position in the product type segment of the jam, jelly, and preserve market, accounting for 37.9% of the total share. This dominance is primarily attributed to the strong consumer preference for fruit-based spreads with rich texture and authentic taste. Made from crushed or pureed fruits, jams offer a dense consistency that appeals to households and foodservice operators alike.

The growing shift toward natural, minimally processed foods has further fueled the demand for jams, especially those with fewer preservatives and clean-label ingredients. Urban consumers, in particular, are drawn to the convenience and versatility of ready-to-use jams, reinforcing steady market uptake. Jams are also widely available across various price points—from affordable, everyday options to premium, artisanal varieties—broadening their consumer base. Continued flavor innovations and improved packaging formats have enhanced their visibility and appeal in both modern retail and specialty outlets.

By Ingredient Type Analysis

In 2024, fruit and fruit juice emerged as the dominant ingredient type, contributing 41.2% to the total market. This segment reflects rising demand for recognizable, natural components in packaged food products. Consumers increasingly favor spreads made with real fruit and juices due to their perceived nutritional value, clean labels, and authentic taste profiles.

These ingredients are fundamental in achieving desired flavor, texture, and color in jams, jellies, and preserves, significantly influencing purchase decisions. Fruit-rich content has become a key selling point, particularly in health-conscious urban markets and premium retail segments. Manufacturers continue to innovate with seasonal and exotic fruit variants, enabling diverse flavor combinations while adhering to clean-label expectations.

By Flavor Type Analysis

In 2024, strawberry retained its position as the most favored flavor in the jam, jelly, and preserve market, capturing 33.1% of total product sales. Its universally appealing sweet-tangy taste and vibrant color make it a preferred choice across demographics and geographies. Strawberry spreads are well-integrated into daily meals, pairing seamlessly with bread, pastries, and desserts.

This versatility, combined with a strong sense of familiarity, makes the strawberry a default option for many consumers, particularly in urban areas seeking convenient and ready-to-eat foods. Its year-round availability in processed form ensures a consistent supply, while high consumer acceptance sustains demand. As traditional flavors remain relevant alongside newer options, strawberry continues to anchor flavor preferences across the segment.

By Distribution Channel Analysis

In 2024, hypermarkets and supermarkets held the largest share in the distribution channel segment, accounting for 48.3% of total market sales. Their dominance stems from extensive shelf space, high foot traffic, and the ability to offer a wide range of products and price points in a single location. These retail formats are especially influential in urban and semi-urban settings, where consumers prefer one-stop shopping experiences.

Promotions, attractive packaging, and in-store sampling further enhance customer engagement and sales conversion. With the capacity to stock both mass-market and premium fruit spreads, hypermarkets and supermarkets cater to diverse consumer preferences. Their efficient supply chains and established marketing infrastructure continue to reinforce their leadership in product distribution.

Regional Analysis

In 2024, North America dominated the global jam, jelly, and preserve market, holding a 44.8% share and reaching a market value of USD 1.1 billion. This strong position is driven by high consumption levels, demand for natural and premium spreads, and well-developed retail channels across the United States and Canada.

The region benefits from a strong preference for convenient food options and wide availability of innovative products, including clean-label and low-sugar variants. Established brand presence and consumer loyalty further support market expansion. Europe remains a stable, mature market with demand fueled by traditional breakfast habits and local fruit-based spreads.

In the Asia Pacific, urbanization, rising incomes, and dietary shifts are contributing to gradual market growth. Meanwhile, Latin America and the Middle East & Africa are emerging markets, where evolving consumer preferences and modern retail penetration are expected to unlock future growth potential.

Top Use Cases

- Breakfast Spread: Jam, jelly, or preserves serve as a classic topping on toast, bread, waffles, or pancakes. These fruit spreads are favored due to their convenience, appealing taste, and ability to deliver real fruit flavor, particularly in clean‑label, low‑sugar varieties, making them popular choices in both household and institutional settings.

- Baking & Fillings: Used in baking, these spreads act as fillings in thumbprint cookies, layer cakes, pastries, and Danish. Their rich texture and fruit profile enhance moisture and flavor, providing structural integrity as a middle layer. Artisanal and mass‑market brands often promote such applications for premium positioning.

- Yogurt & Dairy Pairing: Jam, jelly, or preserves can be stirred into yogurt, cottage cheese, or kefir, creating fruit‑infused snacks or light meals. These combinations are favored for added sweetness without refined sugar and align with increasing demand for functional, health‑oriented snack options in retail and foodservice sectors.

- Savory Sauces, Glazes & Marinades: Fruit preserves are frequently incorporated into savory cooking by transforming them into glazes or marinades for meats like chicken or pork. The sweet‑acidic balance enhances flavor complexity. This application supports product versatility beyond breakfast—especially adaptable in foodservice and ready‑to‑cook product lines.

- Drinks & Cocktails: Jams and preserves are used as flavor enhancers in beverages, including cocktails (e.g., gin & tonic, champagne spritzers), iced tea, and sparkling water. Their robust fruit flavor and natural sweetness substitute for sugar or syrup, appealing to health‑conscious consumers and premium beverage developers.

Recent Developments

1. Andros Group

- Andros Group has expanded its fruit-based spreads portfolio with new organic and reduced-sugar options, responding to health-conscious consumers. The company has also invested in sustainable packaging, aligning with its eco-friendly initiatives. Andros continues to innovate in flavor profiles, introducing exotic fruit blends.

2. B&G Foods Inc.

- B&G Foods, owner of Polaner and Mrs. Miller’s brands, launched sugar-free and keto-friendly jams to cater to dietary trends. The company also emphasized non-GMO and clean-label products. B&G has been optimizing supply chains to mitigate inflation impacts while maintaining product quality.

3. Bonne Maman

- Bonne Maman introduced limited-edition seasonal flavors, including fig-vanilla and raspberry-rose preserves. The brand remains committed to all-natural ingredients and glass jar recyclability. Bonne Maman also expanded its U.S. market presence through retail partnerships.

4. McCormick & Company

- McCormick, known for Jammin’ Jellies, has focused on global flavor innovation, such as spicy chili-infused jellies. The company is leveraging e-commerce growth with direct-to-consumer options. McCormick also highlights sustainability in sourcing and packaging.

Conclusion

Jam, jelly, and preserve products are broadly utilized across both sweet and savory culinary applications. Their versatility supports use in breakfasts, baking, dairy snacks, marinades, beverages, and gift assortments. Consumer preference for natural ingredients, fruit‑rich content, and clean‑label formulations further bolsters this category’s appeal. The market is expected to expand as innovation continues in low‑sugar, exotic flavor and packaging formats, meeting demands convenience, health, and premium experiences.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)