Table of Contents

Overview

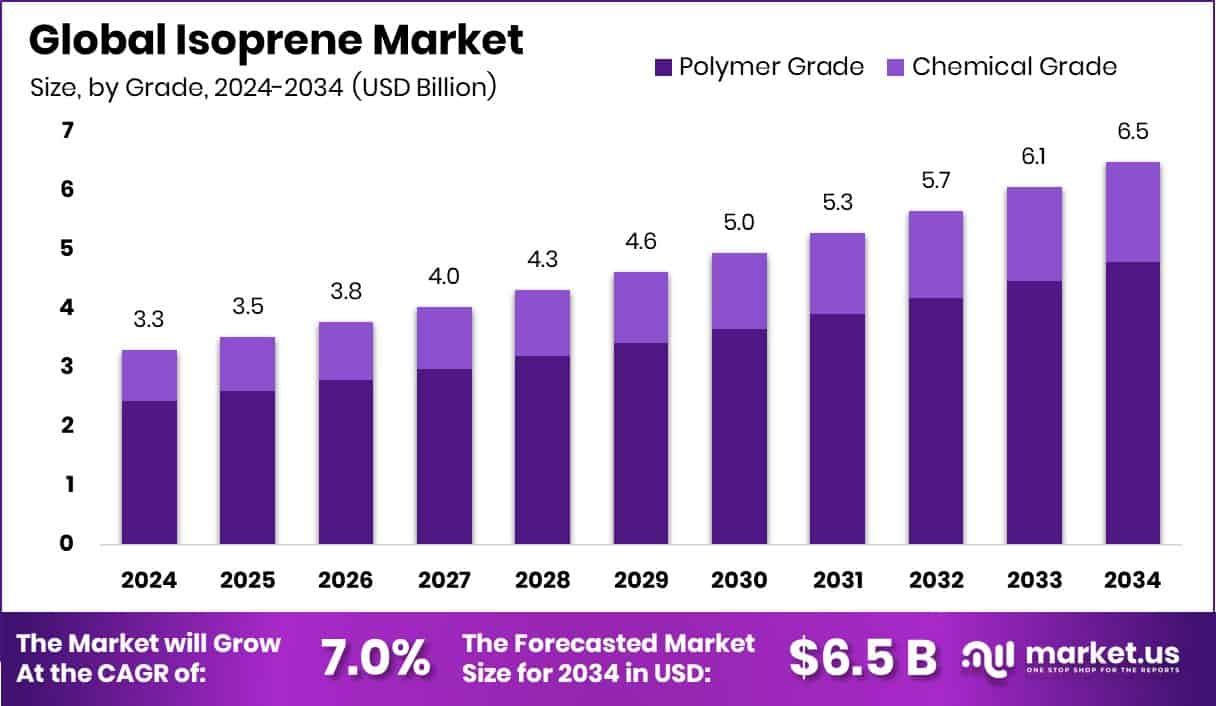

New York, NY – September 09, 2025 – The Global Isoprene Market is projected to reach USD 6.5 billion by 2034, rising from USD 3.3 billion in 2024, with a CAGR of 7.0% between 2025 and 2034. Asia Pacific leads the market with a 53.10% share, valued at USD 1.7 billion, showing rapid expansion.

Isoprene, a colorless and volatile hydrocarbon, is a key raw material for synthetic rubbers, elastomers, and specialty chemicals. It is vital in tire production, adhesives, coatings, and polymer-based products, thanks to its ability to form materials with elasticity, strength, and resistance.

Market growth is strongly driven by rising demand in the automotive and tire industry, where durable and fuel-efficient tires boost isoprene consumption. Cariflex, for instance, invested over US$350 million to build the world’s largest polyisoprene latex plant in Singapore, highlighting this trend.

Beyond automotive, applications in adhesives, coatings, and medical products also support steady growth. Isoprene-based polymers meet industrial needs for durability and flexibility, while funding initiatives such as EF Polymer’s $6.6 million raise for sustainable agriculture reinforce broader adoption across industries.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-isoprene-market/request-sample/

Key Takeaways

- The Global Isoprene Market is expected to be worth around USD 6.5 billion by 2034, up from USD 3.3 billion in 2024, and is projected to grow at a CAGR of 7.0% from 2025 to 2034.

- Polymer Grade held 73.9% in the Isoprene Market, reflecting its wide industrial usage.

- Styrene Isoprene Styrene captured a 32.6% share in the Isoprene Market, highlighting growing demand.

- Automotive dominated with 48.3% in the Isoprene Market, driven by tire and rubber applications.

- Asia Pacific’s 53.10% dominance at USD 1.7 Bn reflects strong industrial growth.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=155961

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 3.3 Billion |

| Forecast Revenue (2034) | USD 6.5 Billion |

| CAGR (2025-2034) | 7.0% |

| Segments Covered | By Grade (Polymer Grade, Chemical Grade), By Application (Styrene Isoprene Styrene, Isobutylene Isoprene, Polyisoprene, Block Co-Polymer, Others), By End-Use (Automotive, Medical, Construction, Personal Care, Others) |

| Competitive Landscape | Shell Plc, LyondellBasell Industries Holdings B.V., Kuraray Co., Ltd., ExxonMobil Corporation, Shandong Yuhuang Chemical Group Co., Ltd, Braskem, Chevron Phillips Chemical Company LLC, China Petrochemical Corporation, LOTTE Chemical Corporation |

Key Market Segments

By Grade Analysis

In 2024, Polymer Grade dominated the Isoprene Market’s By Grade segment with a 73.9% share, underscoring its central role in synthetic rubber and elastomer production. Its high purity and consistency make it the preferred choice for large-scale industrial use, particularly in the automotive sector.

Synthetic rubber from polymer-grade isoprene is vital for tire manufacturing, ensuring durability, fuel efficiency, and safety. Rising global vehicle production and the growing demand for long-lasting, high-quality tires have been key drivers of this segment’s strength.

Beyond tires, polymer grade also supports applications in adhesives, coatings, and medical equipment, reinforcing its strong market presence. Holding 73.9% of the market, it remains the backbone of the isoprene industry, with its importance set to grow as industries continue prioritizing performance and reliability

By Application Analysis

In 2024, Styrene Isoprene Styrene (SIS) led the Isoprene Market’s By Application segment with a 32.6% share, reflecting its role as a highly versatile block copolymer. Known for combining elasticity, flexibility, and durability, SIS is widely used in adhesives, sealants, coatings, and elastomeric products.

Its strong position is driven by superior adhesion and the ability to endure stress without losing strength, making it essential in pressure-sensitive adhesives, packaging, and construction. Rising global demand for advanced adhesives and sealants, along with heavy use in packaging, footwear, and healthcare, has supported this segment’s growth.

The push for lightweight, high-performance materials in modern manufacturing further strengthens SIS adoption. With a 32.6% market share, it has become a core material in the isoprene industry, and its importance is set to expand as industries prioritize adaptable and cost-effective solutions.

By End-Use Analysis

In 2024, the Automotive sector dominated the Isoprene Market’s By End-Use segment with a 48.3% share, driven by its reliance on synthetic rubber and elastomers from isoprene, especially for tire production.

Tires, central to vehicle performance, durability, and fuel efficiency, continue to anchor demand as global passenger and commercial vehicle output rises. The focus on long-lasting, fuel-efficient, and eco-friendly tires further strengthens the segment’s lead, with isoprene-based rubber meeting both performance and sustainability needs.

Beyond tires, isoprene also supports automotive adhesives, coatings, and sealing materials, enhancing safety and functionality. With a commanding 48.3% share, the automotive sector remains the backbone of isoprene demand and is set to maintain its strength as mobility grows and tire technologies advance.

Regional Analysis

In 2024, the Asia Pacific led the isoprene market with a 53.10% share, valued at USD 1.7 billion, making it the strongest regional player. This dominance is fueled by rapid industrialization, rising vehicle production, and expanded tire manufacturing in key economies such as China, India, and Japan. The growing middle-class population and higher mobility needs have further driven automotive sales, boosting demand for polymer-grade isoprene.

Supportive government initiatives for infrastructure and manufacturing have reinforced the region’s momentum, positioning Asia Pacific as both the fastest-growing and most influential market. North America and Europe remain significant, backed by advanced research, healthcare uses, and demand for high-performance elastomers.

In contrast, the Middle East & Africa and Latin America show steady progress, mainly through industrial growth and rising automotive needs. Still, with its 53.10% share, Asia Pacific stands as the defining force in global isoprene demand and supply trends.

Top Use Cases

- Vehicle Tires and Rubber Goods: Isoprene is the main building block for polyisoprene, which is used to make synthetic rubber. This rubber is highly elastic, tough, and wear-resistant—making it ideal for tires, shoe soles, hoses, belts, and other rubber items.

- Gaskets, Seals, and O-Rings: Because of its flexibility and ability to tolerate varying conditions, isoprene rubber is a common choice for making gaskets, seals, and O-rings that prevent leaks in cars, machinery, and plumbing systems.

- Medical Devices and Elastic Goods: Due to its flexibility, strength, and biocompatibility, isoprene rubber is used in medical gloves, catheters, tubing, and other health-related products.

- Engineering Components (Vibration Mounts, Gaskets, Bushings): Isoprene is valued in engineering for its resilience and durability. It’s used to make parts like bushings, anti-vibration mounts, and other components that absorb shocks and endure stress in machines.

- Sports and Outdoor Gear: Its toughness and elasticity make isoprene useful in sports gear such as resistance bands, practice goaltargets, and other resilient outdoor equipment designed to endure rough use.

- Adhesives, Coatings, and Insulating Tapes: Isoprene finds use in certain adhesives and coatings due to its stickiness and flexibility. It’s also used in making electrical-insulating tapes or cable wraps.

Recent Developments

- In October 2024, ExxonMobil rebranded its polyethylene (PE) and polypropylene (PP) materials under a new name: Signature Polymers. This fresh portfolio aims to strengthen service and collaboration with customers across its polymers business. While not directly related to isoprene, the move reflects the company’s strategy to elevate its polymer offerings.

- In May 2024, LyondellBasell began a strategic review of its European operations in both Olefins & Polyolefins and Intermediates & Derivatives. This review covers plants making key industrial chemicals—including isoprene-related intermediates—to explore options like selling, upgrading, or shutting down facilities.

- In May 2024, Shandong Yuhuang Chemical reported updates on its Liquid Polyisoprene Rubber Plant—a facility focused on producing isoprene-based rubber. This development shows the company’s active efforts to expand its isoprene-related manufacturing capabilities.

Conclusion

The isoprene market stands as a vital part of modern industry, driven by its role in producing synthetic rubber, elastomers, and specialty materials. With strong demand from the automotive sector, especially for tires, alongside growing applications in adhesives, coatings, and medical products, isoprene continues to prove its versatility and value.

Rapid industrialization in Asia Pacific and the push for high-performance, durable, and sustainable materials further strengthen its outlook. As industries increasingly focus on efficiency, safety, and innovation, isoprene’s unique properties ensure it will remain an essential raw material shaping diverse sectors for years to come.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)