Table of Contents

Overview

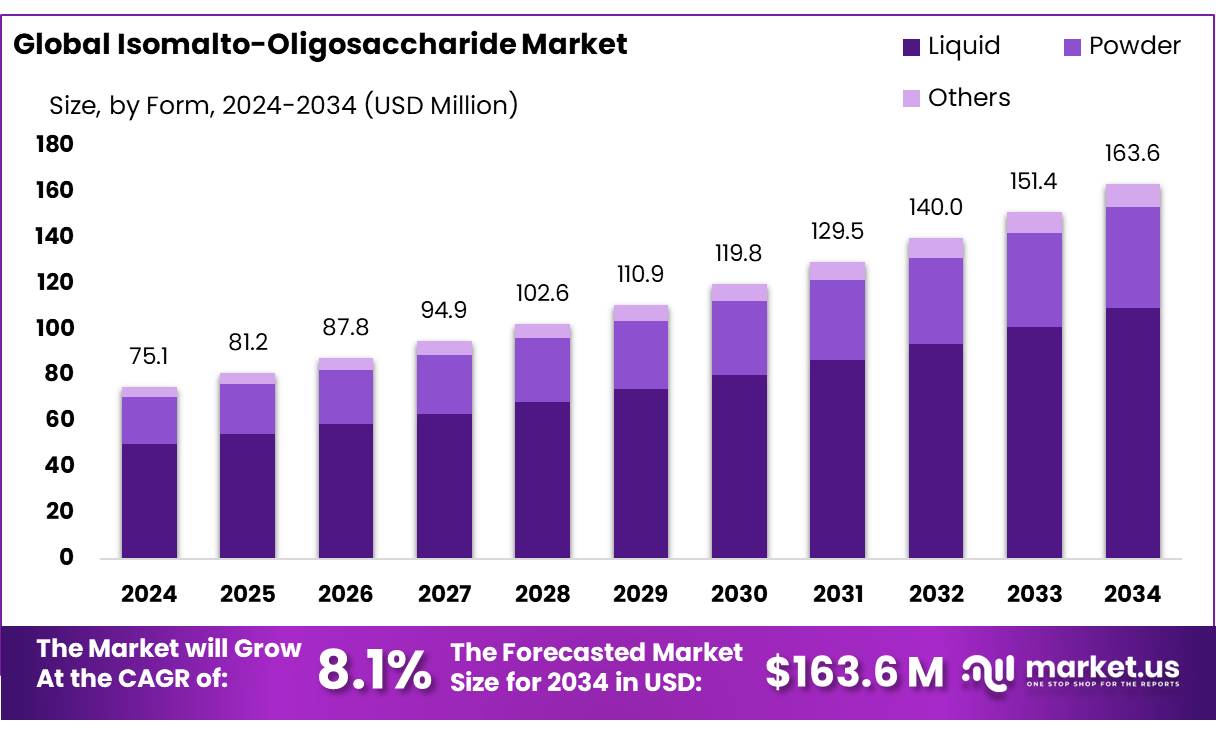

New York, NY – August 01, 2025 – The Global Isomalto-Oligosaccharide (IMO) Market is projected to grow from USD 75.1 million in 2024 to USD 163.6 million by 2034, with a CAGR of 8.1% during the 2025–2034 forecast period. In 2024, North America led the market, accounting for a 41.2% share and generating USD 30.9 million in revenue.

Isomalto-Oligosaccharides (IMOs) are short-chain glucose oligomers (degree of polymerization ≥3) derived enzymatically from starches like corn, wheat, potato, or tapioca. Functioning as prebiotic dietary fibers and low-calorie sweeteners, IMOs are recognized as safe (GRAS) in the U.S. for consumption up to 26g/day, delivering approximately 25g/day of DP3-DP9 oligosaccharides under current Good Manufacturing Practices (cGMP).

BioNeutra’s VitaFiber received U.S. FDA GRAS status in 2009, followed by approvals as a novel food ingredient by Health Canada and the EU. Growing consumer interest in digestive health, fueled by awareness of prebiotics and concerns about obesity, diabetes, and gut health, drives IMO demand. IMOs promote beneficial gut microbiota, reduce inflammation, improve lipid profiles, and support metabolic health, as supported by clinical and animal studies.

With a low glycemic index and about 50% of sucrose’s sweetness, IMOs are ideal for reducing sugar in processed foods and beverages. Regulatory endorsements, including Japan’s FOSHU framework, the EU’s novel food approval, and U.S. GRAS status, bolster market growth and validate label claims like “low-glycemic” or “prebiotic.”

In the U.S., the FDA recognizes IMO as GRAS with a recommended intake of up to 30g/day, though it is not listed as a dietary fiber. The EU approves IMO for supplements up to 30g/day under Regulation 2015/2283. Health Canada’s 2017 policy supports novel fiber sources without pre-market approval. Japan has included IMO in its FOSHU functional foods list since the early 2000s, reflecting robust regulatory support.

Key Takeaways

- Isomalto-Oligosaccharide Market size is expected to be worth around USD 163.6 Million by 2034, from USD 75.1 Million in 2024, growing at a CAGR of 8.1%.

- Liquid held a dominant market position in the Isomalto-Oligosaccharide (IMO) market by form, capturing more than a 66.8% share.

- Corn held a dominant market position in the Isomalto-Oligosaccharide (IMO) market by source, capturing more than a 54.9% share.

- Food & Beverage held a dominant market position in the Isomalto-Oligosaccharide (IMO) market by application, capturing more than a 53.4% share.

- North America held the dominant position in the Isomalto-Oligosaccharide (IMO) market by region, accounting for approximately 41.2%, equal to USD 30.9 million in market revenue.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-isomalto-oligosaccharide-market/request-sample/

Report Scope

| Market Value (2024) | USD 75.1 Million |

| Forecast Revenue (2034) | USD 163.6 Million |

| CAGR (2025-2034) | 8.1% |

| Segments Covered | By Form (Liquid, Powder, Others), By Source (Corn, Wheat, Potato, Tapioca, Others), By Application (Food and Beverage, Dietary Supplements, Animal Feed Additives, Others) |

| Competitive Landscape | Anhui Elite Industrial Co., Ltd., BioNeutra North America, COFCO Rongshi Biotechnology Co., Ltd., Guangzhou Shuangqiao Co., Ltd., Luzhou Bio-chem Technology Co., Ltd., New Francisco Biotechnology Corporation (NFBC), Nutra Food Ingredients, Orison Chemicals, Rajvi Enterprise, Bio-Tech Co., Ltd., Shandong Bailong Group Co., Ltd., Shandong Tianjiao Bio-engineering Co., Ltd., Shandong Tianmei Biotech Co., Ltd., Shijiazhuang Huachen Starch Sugar Production Co., Ltd., Xi’an Healthful Biotechnology Co., Ltd |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=152730

Key Market Segments

Form Analysis

In 2024, the liquid form of Isomalto-Oligosaccharide (IMO) commanded a 66.8% market share, leading due to its user-friendly integration into food and beverage formulations. Its high solubility, mild sweetness, and seamless blending properties make it ideal for products like energy drinks, protein shakes, yogurts, and baked goods. Liquid IMO also enhances moisture retention and shelf life, offering significant advantages in processed food production.

Source Analysis

Corn led the IMO market by source in 2024, holding a 54.9% share. Its dominance stems from the abundant supply and cost-effectiveness of corn, making it a preferred raw material. Corn starch, rich in glucose, is enzymatically transformed into IMO, delivering consistent quality and prebiotic benefits for applications in dietary supplements, energy bars, beverages, and baked goods. Well-established corn processing infrastructure in North America and Asia further solidifies its position.

Application Analysis

The food and beverage sector dominated the IMO market by application in 2024, capturing a 53.4% share. Rising demand for healthier, low-calorie sweeteners and prebiotic fibers drives their use in dairy, baked goods, energy bars, flavored drinks, and meal replacements. IMO’s ability to enhance flavor, texture, and fiber content while supporting clean-label and reduced-sugar trends makes it a go-to ingredient. Growing consumer focus on gut health and convenient nutrition further boosts its adoption in ready-to-eat and drink products.

Regional Analysis

In 2024, North America held a leading 41.2% share of the IMO market, generating USD 30.9 million in revenue. The region’s early adoption of IMO in functional foods, beverages, and dietary supplements, driven by demand for low-calorie sweeteners and prebiotic fibers, fuels its dominance.

Products like yogurts, nutritional bars, and beverages benefit from North America’s advanced food processing infrastructure and nutritional research. Strong consumer awareness of gut health and supportive regulatory frameworks for clean labeling maintain the region’s edge, despite rising competition from Asia-Pacific.

Top Use Cases

- Functional Foods: IMO is used in snacks, cereals, and nutrition bars as a low-calorie sweetener and prebiotic fiber. It enhances gut health by feeding beneficial bacteria, appealing to health-conscious consumers seeking tasty, nutritious options. Its mild sweetness and clean-label appeal make it ideal for formulating healthier processed foods.

- Dietary Supplements: IMO is added to supplements to promote digestive health and boost immunity. As a prebiotic, it supports beneficial gut bacteria, aiding digestion and nutrient absorption. Its low glycemic index makes it suitable for consumers managing diabetes or seeking wellness-focused products.

- Beverages: IMO is incorporated into drinks like juices, sports drinks, and functional beverages. It provides sweetness without spiking blood sugar, making it ideal for low-sugar or sugar-free formulations. Its prebiotic properties also add health benefits, appealing to consumers focused on gut health.

- Infant Nutrition: IMO is used in infant formulas to mimic breast milk’s prebiotic content. It supports the growth of healthy gut bacteria in babies, improving digestion and immunity. This makes it a valuable ingredient for parents seeking optimal nutrition for their infants.

- Bakery Products: IMO is used in breads, cakes, and cookies to add fiber and reduce calories. It maintains texture and sweetness while offering prebiotic benefits. This makes it popular for creating healthier baked goods that cater to consumers looking for low-sugar, gut-friendly options.

Recent Developments

1. Anhui Elite Industrial Co. Ltd.

- Anhui Elite has expanded its IMO production capacity to meet growing global demand, focusing on high-purity syrups and powders for functional foods. The company emphasizes non-GMO and organic certifications to cater to health-conscious markets. Recent investments in R&D aim to improve fermentation efficiency and reduce production costs.

2. BioNeutra North America

- BioNeutra continues to lead in IMO innovation with its VitaFiber line, promoting gut health and low-glycemic benefits. The company recently secured GRAS status for its IMO products in the U.S., enhancing market accessibility. Partnerships with food manufacturers aim to incorporate IMO into keto-friendly and diabetic-friendly products.

3. COFCO Rongshi Biotechnology Co., Ltd.

- COFCO Rongshi has launched a new IMO syrup variant with higher fiber content, targeting beverage and dairy applications. The company is expanding exports to Southeast Asia and Europe, backed by sustainable production practices. Recent collaborations with academic institutions focus on prebiotic efficacy studies.

4. Guangzhou Shuangqiao Co., Ltd.

- Shuangqiao has introduced a low-calorie IMO powder for weight management products, emphasizing clean-label trends. The company upgraded its fermentation technology to enhance yield and purity. New supply agreements with European supplement brands highlight its growing international presence.

5. Luzhou Bio-chem Technology Co., Ltd.

- Luzhou Bio-chem has developed an enzyme-enhanced IMO production process, reducing energy consumption. The company recently partnered with Chinese dairy firms to incorporate IMO into probiotic yogurts. Expansion into Middle Eastern markets is a key focus for 2024.

Conclusion

Isomalto-Oligosaccharide (IMO) is a versatile ingredient driving growth in the functional food, beverage, and supplement markets. Its low-calorie, prebiotic, and clean-label properties meet rising consumer demand for healthier, gut-friendly products. With applications in beverages, dairy, baked goods, and more, IMO’s market is set to expand as health awareness and demand for natural ingredients continue to grow globally.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)