Table of Contents

Overview

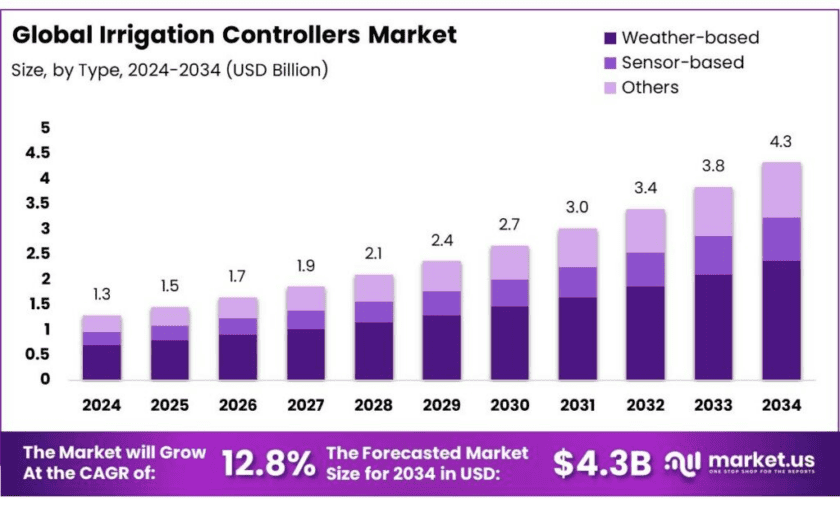

New York, NY – Oct 30, 2025 – The global irrigation controllers market is projected to reach USD 4.3 billion by 2034, increasing from USD 1.3 billion in 2024, with a strong CAGR of 12.8% during 2025–2034. In 2024, North America held the leading position, accounting for over 42.9% of total revenue, equivalent to approximately USD 0.6 billion. The market’s growth is driven by rising water scarcity concerns and the digital transformation of agricultural and landscape management practices.

Irrigation controllers have transitioned from traditional mechanical “clock” timers to smart, weather-based and soil-moisture-based systems. These advanced controllers integrate real-time weather data, soil sensors, and evapotranspiration (ET) rates to optimize irrigation schedules, significantly improving water-use efficiency. Given that agriculture consumes nearly 70% of global freshwater resources, improving irrigation precision delivers notable environmental and operational benefits for farms, municipalities, and commercial landscapes.

The industry ecosystem includes valve and solenoid manufacturers, communication module providers (such as cellular or LoRaWAN), sensor OEMs, and software platforms offering remote monitoring, alerts, and analytics. In turf and landscape applications, U.S. EPA WaterSense-certified weather-based controllers highlight potential savings: replacing standard controllers can save an average household up to 15,000 gallons annually. Nationally, this translates into approximately 390 billion gallons of water and USD 4.5 billion in cost savings each year, driving widespread municipal rebate programs and code-based adoption in residential and commercial markets.

- Government policies and public funding continue to reinforce market expansion, especially in drought-affected regions. In the U.S., the USDA announced USD 400 million (August 2024) for at least 18 irrigation districts to enhance water conservation and maintain agricultural productivity. Similarly, the WaterSMART program by the Bureau of Reclamation provided USD 3.3 million across 36 projects in late 2024 to support automation, telemetry, and controller-integrated water-efficiency systems.

In India, the Micro Irrigation Fund (MIF) managed by NABARD with an initial corpus of ₹ 5,000 crore continues to drive adoption of advanced irrigation systems. As of March 2025, projects had covered approximately 21.69 lakh hectares under the PMKSY “Per Drop More Crop” initiative. State-level reports confirm consistent expansion of micro-irrigation coverage since 2015-16. These national programs are strengthening the foundation for smart controllers and fertigation scheduling, ensuring greater returns on investment and sustainable resource utilization in greenhouse, farm, and landscape irrigation systems.

Key Takeaways

- Irrigation Controllers Market size is expected to be worth around USD 4.3 Billion by 2034, from USD 1.3 Billion in 2024, growing at a CAGR of 12.8%

- Weather-based irrigation controllers held a dominant market position, capturing more than a 54.8% share.

- Smart Controllers held a dominant market position, capturing more than a 66.6% share.

- Drip/trickle irrigation held a dominant market position, capturing more than a 59.1% share.

- Agriculture held a dominant market position, capturing more than a 67.3% share of the irrigation controllers market.

- North American greenhouse irrigation systems market holds a significant share of approximately 42.90%, valued at USD 0.6 billion in 2024.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-irrigation-controllers-market/free-sample/

Report Scope

| Market Value (2024) | USD 1.3 Bn |

| Forecast Revenue (2034) | USD 4.3 Bn |

| CAGR (2025-2034) | 12.8% |

| Segments Covered | By Type (Weather-based, Sensor-based, Others), By Product (Smart Controllers, Tap Timers, Basic Controllers), By Irrigation Type (Drip/trickle, Sprinkler, Others), By Application (Agriculture, Open Field, Controlled Environment Agriculture, Non-agriculture, Sports ground/golf course, Residential, Others) |

| Competitive Landscape | Valmont Industries, Inc., Hunter Industries, Rain Bird Corporaion, Netafim Ltd, HydroPoint Data Systems, Inc.,, Nelson Irrigation, Galcon, Smart Farm Systems, Inc., Tevatronic |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=159650

Key Market Segments

By Type Analysis – Weather-based Controllers Lead the Market with 54.8% Share in 2024

In 2024, weather-based irrigation controllers held a leading position in the market, capturing more than a 54.8% share. These controllers have gained popularity for their ability to automatically adjust irrigation schedules according to real-time weather data, including rainfall, humidity, and temperature. By utilizing weather forecasts and local environmental inputs, they optimize water usage and prevent over-irrigation, making them vital for sustainable water management in agriculture and landscaping. The rising concerns over global water scarcity and the growing adoption of smart water management technologies are major factors propelling the demand for weather-based controllers worldwide.

By Product Analysis – Smart Controllers Dominate with 66.6% Share in 2024

In 2024, smart controllers accounted for more than a 66.6% market share, dominating the irrigation controller segment. Their rapid adoption is primarily attributed to their advanced automation and integration capabilities. Smart controllers utilize data from sensors, weather forecasts, and soil moisture levels to schedule irrigation with precision. They can be remotely operated via mobile applications or cloud-based platforms, enabling users to manage irrigation anytime and anywhere. The growing emphasis on sustainable water use, coupled with the need to lower operational costs in agriculture and commercial landscaping, has significantly accelerated the deployment of smart irrigation controllers across developed and emerging regions.

By Irrigation Type Analysis – Drip/Trickle Irrigation Dominates with 59.1% Share in 2024

In 2024, drip/trickle irrigation systems dominated the irrigation controllers market with a 59.1% share. This irrigation method is highly preferred due to its precise water delivery mechanism that directs water straight to plant roots, significantly minimizing evaporation and surface runoff. Drip/trickle systems are especially beneficial in drought-prone or water-scarce regions, ensuring efficient water utilization. The method also supports improved crop productivity and minimizes disease spread by keeping foliage dry. Increasing awareness regarding water conservation and the growing shift toward sustainable farming practices have further enhanced the adoption of drip/trickle irrigation systems globally.

By Application Analysis – Agriculture Leads with 67.3% Share in 2024

In 2024, the agriculture sector held a dominant position in the irrigation controllers market, capturing more than a 67.3% share. The demand is primarily driven by the urgent need for efficient irrigation systems to tackle water scarcity and the impact of climate change on crop productivity. Advanced irrigation controllers have become essential tools for optimizing irrigation schedules, enhancing water efficiency, and improving yield outcomes. With the increasing implementation of precision farming techniques, farmers can now monitor soil moisture, weather patterns, and crop requirements in real-time, enabling more targeted irrigation. This adoption not only minimizes water wastage but also ensures healthier crops and long-term agricultural sustainability.

List of Segments

By Type

- Weather-based

- Sensor-based

- Others

By Product

- Smart Controllers

- Tap Timers

- Basic Controllers

By Irrigation Type

- Drip/trickle

- Sprinkler

- Others

By Application

- Agriculture

- Open Field

- Controlled Environment Agriculture

- Non-agriculture

- Sports ground/golf course

- Residential

- Others

Regional Analysis

In 2024, the North American Irrigation controllers market accounted for a substantial 42.90% share, valued at approximately USD 0.6 billion, highlighting the region’s dominant role in the global industry. This strong market position is driven by the region’s advanced agricultural infrastructure, increasing adoption of water-efficient irrigation technologies, and a growing focus on sustainable farming practices. The United States and Canada are the primary contributors to this growth, with both nations heavily investing in smart irrigation solutions to address water scarcity and enhance crop productivity in controlled environments.

In the United States, the implementation of smart and automated Irrigation controllers has accelerated under initiatives such as the EPA’s WaterSense program, which promotes water conservation through high-efficiency irrigation products. States like California, facing persistent drought conditions, have adopted stringent water management regulations and incentivized precision irrigation technologies that utilize real-time soil moisture, temperature, and weather data to optimize water delivery. These combined efforts have positioned North America as a leader in greenhouse irrigation innovation and efficiency.

Top Use Cases

Residential Landscape Water Savings: Installation of weather-based or soil-moisture-based irrigation controllers in residential settings can yield substantial savings in water usage. According to the U.S. Environmental Protection Agency (EPA), replacing a standard timer-based controller with a certified weather-based unit can save an average household about 7,600 gallons of water annually. In scenarios where all applicable homes adopt the technology, savings could scale to 220 billion gallons of water and around USD 2.5 billion in annual water-cost reductions nationwide.

Commercial & Large Landscapes Efficiency Gains: In larger scale landscape applications such as office parks, schools or hotels, advanced irrigation controllers deliver deeper savings. For example, a weather-based controller installed at a 372,000-square-foot site in Dallas cut irrigation use by about 12.5 million gallons and saved roughly USD 47,000 in one year — equivalent to approximately 40% reduction in water use. These outcomes highlight the value of controllers in settings where turf and planted areas account for up to 30% of water usage in maintained properties.

Agricultural/Farm Field Automation & Water-Stress Management: In agricultural contexts, controllers equipped with weather and soil-moisture feedback systems support precision irrigation scheduling that aligns with crop needs and water-availability constraints. One government study noted that advanced interruptible irrigation systems were capable of 30-40% or higher water savings in pilot scenarios. Given that agriculture uses roughly 70% of global freshwater withdrawals, these controllers play a significant role in improving resource use and enabling automation of irrigation systems for farmers.

Energy and Cost Reduction through Integrated Scheduling: Advanced irrigation controllers also deliver energy savings indirectly by reducing the amount of water pumped, treated and distributed. The EPA estimated that if 12.8 million homes switched to weather-based controllers, water utilities could reduce electricity consumption by approximately 112 million kWh per year. This shows how controller upgrades not only reduce water waste but also lower energy costs associated with irrigation systems, making them a dual benefit technology for sustainability and operational savings.

Enhancing Compliance and Rebates in Water-Stressed Regions: Controllers certified under programs such as WaterSense enable users to access rebates and meet regulatory standards tied to water conservation. For instance, the EPA indicates that widespread adoption of certified controllers could avoid up to 390 billion gallons of water and USD 4.5 billion in water-cost savings annually across U.S. homes. These data points reflect how controllers are becoming integral to utility incentive programs, drought-response planning, and smart irrigation policy frameworks.

Recent Developments

In 2024, Valmont Industries reported net sales of approximately USD 4.08 billion and net income of around USD 348.3 million. Through its agriculture segment—including the Valley® irrigation brand—the company supports connected irrigation infrastructure with over 150,000 devices deployed for water and energy optimization. As a market-research analyst would note, Valmont’s strategic focus on precision irrigation and controller-enabled automation positions it well in the expanding irrigation-controllers sector.

Hunter Industries, a leader in irrigation controllers and smart landscape systems, in 2023 released advanced controllers with Wi-Fi connectivity and cloud-based monitoring via its Hydrawise™ platform. The company’s innovations include station-level flow monitoring, real-time data integration, and compatibility with industrial automation protocols (BACnet, Modbus) for large commercial installations. As a market-research analyst would state, Hunter’s emphasis on connectivity and automation aligns with major trends in the irrigation-controllers market, placing it among the key players driving growth.

Rain Bird Corporation continues to lead in the irrigation-controllers sector by offering advanced smart and weather-based controllers designed for efficiency and connectivity. For instance, its ARC Series smart controller can reduce water usage up to 30% through automatic adjustments based on forecasted weather. While publicly disclosed full-year 2023 or 2024 revenue figures are not broken out specifically for controllers, the company continues to invest in connected, mobile-app enabled systems and partnerships (e.g., with Flume Inc. in 2023) to enhance remote monitoring and analytics capabilities.

Netafim Ltd (part of Orbia Advance Corporation’s Precision Agriculture business) is expanding into smart irrigation controllers and precision management systems. In 2023 the group generated approximately USD 8.2 billion in revenue, and in October 2024 launched “GrowSphere™,” an all-in-one digital irrigation & fertigation operating system for automated control. This strategic emphasis positions Netafim increasingly as a key player in the smart-controller segment, particularly for agricultural and commercial irrigation infrastructure.

HydroPoint Data Systems, based in Petaluma, California, specializes in smart irrigation-controller systems that integrate weather, soil-moisture and sensor data to help commercial properties reduce water waste. In recent estimates the company’s annual revenue is around USD 14.9 million for 2024. Its platform has been cited in projects that saved 30.8 million gallons of water in 2023 through WeatherTRAK controller deployments. As a market-research analyst would note, HydroPoint’s focus on cloud-connected, data-driven irrigation control positions it well in the booming irrigation-controllers segment for commercial and landscape use.

Nelson Irrigation Corporation, headquartered in Walla Walla, Washington, offers valves, automation systems and irrigation controllers tailored for agriculture and controlled-environment agriculture. The company’s website highlights its “Twig Automation” control solutions and irrigation automation focus. While a precise figure for 2023/24 revenue is not publicly published, one data source estimates the company’s annual revenue at approximately USD 50 million as of 2025. As an analyst would observe, Nelson’s specialized automation and control offerings give it niche strength within the broader irrigation-controller market, especially for growers seeking precise control and system integration.

Galcon is a leader in smart irrigation controllers, offering advanced systems like its Galileo Cloud and BT-series units tailored for agriculture, landscaping and greenhouse use. Their controllers support multi-zone programming, soil-moisture sensors and smartphone apps for remote control. For example, their indoor 6-station controller model caters directly to greenhouse operations. Although a precise 2023/24 global revenue figure is not publicly listed, their expanding pipeline in China and other markets underscores growing uptake of connected irrigation solutions.

Smart Farm Systems, Inc. specialises in cloud-based irrigation scheduling and smart controller platforms designed for farms and controlled-environment agriculture. The company emphasises real-time data integration from soil sensors and weather stations to optimize irrigation needs and reduce waste. While specific 2023 or 2024 revenue data is not publicly disclosed, the company is cited among key players innovating in the smart irrigation-controller market and aligns with broader trends of IoT adoption and precision agriculture.

Tevatronic Ltd., founded in 2012 and based in Israel, provides a smart irrigation-controller system that uses wireless soil tensiometer sensors to monitor root-zone water tension and then autonomously schedule irrigation valves. Their solution reports water and fertilizer savings up to 75%, and yield improvements of 15%-31% in pilot crops. While detailed revenue figures for 2023/2024 are not publicly disclosed, the company remains active in markets such as India, Europe and Africa and is positioned as a precision-controller specialist in the irrigation-controllers sector.

Conclusion

In conclusion, irrigation controllers have emerged as a vital technology for addressing both water scarcity and operational efficiency in agriculture and landscaping. According to the U.S. Environmental Protection Agency (EPA), replacing a traditional clock-based controller with a certified smart or weather-based model can save a typical household up to 15,000 gallons of water annually. Additionally, studies indicate that advanced controllers can reduce outdoor water use by 20–50%, depending on system design and application.