Table of Contents

Overview

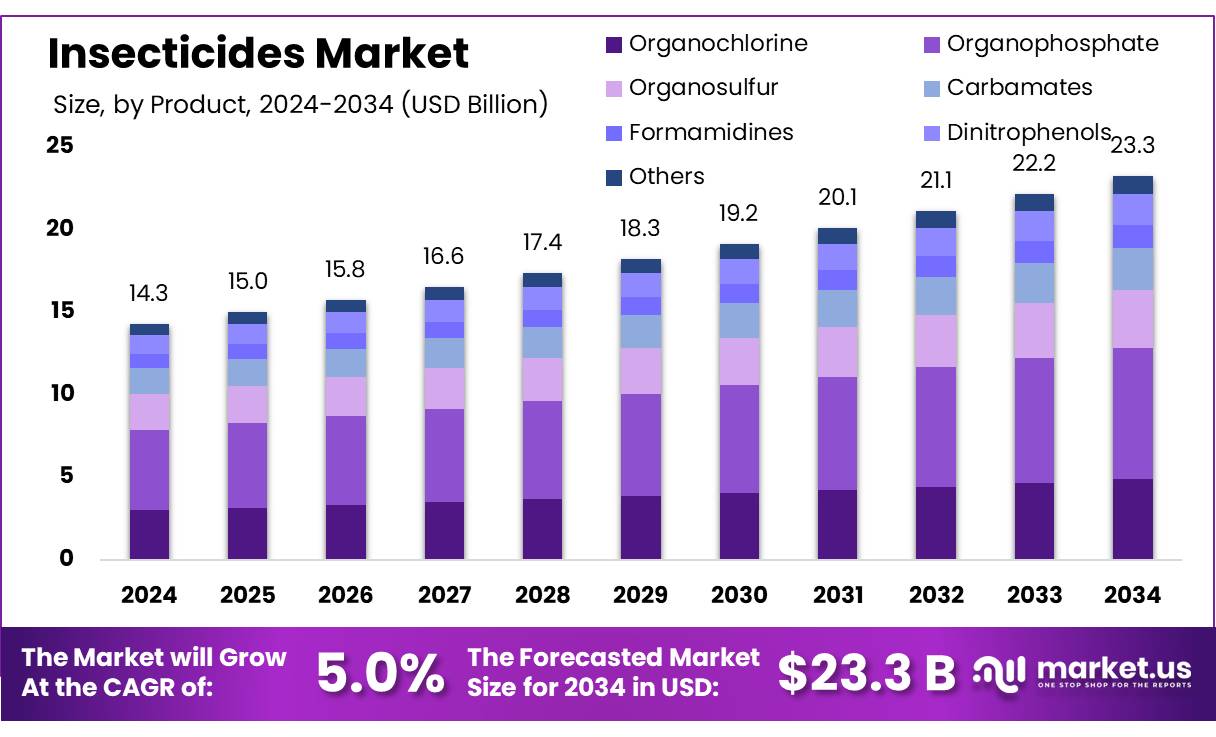

New York, NY – August 25, 2025 – The Global Insecticides Market is projected to reach USD 23.3 billion by 2034, up from USD 14.3 billion in 2024, with a CAGR of 5.0% during the 2025–2034 forecast period. In 2024, the Asia-Pacific region led the market, holding a 46.9% share and generating USD 6.7 billion in revenue.

Insecticide concentrates, including emulsifiable concentrates (EC), suspension concentrates (SC), capsule suspensions (CS), and oil-dispersion (OD) formats, are critical for crop and vector protection. These formulations offer high active-ingredient loadings, stable shelf life, and efficient field dilution. They are widely used in cash crops, staple crops, stored-grain protection, and public-health initiatives for adulticide and larvicide control.

The pesticide value chain involves active synthesis, formulation, tolling, and distribution, with increasing focus on solvent content, operator safety, and stringent stewardship. Global crop yield losses due to pests and diseases range from 20% to 40% annually, underscoring the critical role of insecticide concentrates in integrated pest management (IPM) for food security. Public-health programs also drive consistent demand.

In 2023, the WHO reported 263 million malaria cases and 597,000 deaths, with National Malaria Programmes distributing over 190 million insecticide-treated nets (ITNs), primarily in sub-Saharan Africa. Regulatory frameworks significantly shape the insecticide product mix. The EU’s Farm-to-Fork strategy targets a 50% reduction in chemical pesticide use and risk (non-binding).

Key Takeaways

- The Global Insecticides Market size is expected to be worth around USD 23.3 billion by 2034, from USD 14.3 billion in 2024, growing at a CAGR of 5.0%.

- Organophosphate held a dominant market position, capturing more than a 34.2% share.

- Systemic Insecticide held a dominant market position, capturing more than a 39.4% share.

- Synthetic held a dominant market position, capturing more than 81.8% share.

- Liquid held a dominant market position, capturing more than 71.1% share.

- Cereals & Grains held a dominant market position, capturing more than a 45.3% share.

- Asia Pacific was the dominating region in insecticides, holding a 46.9% share worth USD 6.7 Bn.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/insecticides-market/request-sample/

Report Scope

| Market Value (2024) | USD 14.3 Billion |

| Forecast Revenue (2034) | USD 23.3 Billion |

| CAGR (2025-2034) | 5.0% |

| Segments Covered | By Product (Organochlorine, Organophosphate, Organosulfur, Carbamates, Formamidines, Dinitrophenols, Others), By Type (Systemic Insecticide, Ingested Insecticide, Contact Insecticide), By Origin (Organic, Synthetic), By Formulation (Solid, Liquid, Gaseous), By Crop Type (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Others) |

| Competitive Landscape | Adama Agricultural Solutions Ltd, American Vanguard Corporation, BASF SE, Bayer CropScience AG, Corteva Agriscience, FMC Corporation, Isagro SPA, Nufarm Ltd, Syngenta AG, Sumitomo Chemical Co. Ltd, UPL Limited |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=155176

Key Market Segments

By Product Analysis

In 2024, organophosphates commanded a 34.2% market share, driven by their broad-spectrum control of chewing and sucking pests, rapid field performance, and compatibility with emulsifiable concentrates (EC), suspension concentrates (SC), and capsule suspensions (CS). These attributes align with existing distributor and spray service inventories.

Procurement teams use organophosphates as rotation partners to delay resistance in pyrethroid or newer mode-of-action (MOA) blocks, while agronomists emphasize label-driven practices like buffer zones, pre-harvest intervals (PHI), and personal protective equipment (PPE) to meet residue and drift standards.

By Type Analysis

In 2024, systemic insecticides held a 39.4% market share, favored for their ability to translocate within plants, protecting new growth and hidden pest sites unreachable by contact sprays. They excel in seed treatments, soil drenches, and drip applications, offering extended protection, fewer re-sprays, and stable yields in high-pressure seasons.

In 2025, demand will stay strong with shifts toward precision delivery (seed coatings, chemigation) and tighter stewardship on drift and operator exposure. Focus areas include cleaner formulations, improved tank-mix compatibility, and label-driven resistance management, solidifying systemics as a cornerstone of integrated pest management.

By Origin Analysis

In 2024, synthetic insecticides captured an 81.8% market share, driven by fast knockdown, consistent field performance, and broad crop and pest labels that streamline procurement. Formulators prefer synthetics for their compatibility with EC, SC, and CS concentrates, efficient distribution, and stability across storage conditions. Agronomists use synthetics as rotation anchors to manage resistance and complement biologicals during pest surges.

Despite stricter stewardship, improved nozzles, buffer practices, and operator training keep synthetics central to integrated programs. In 2025, demand will persist in cost-sensitive markets and public-health applications, with trends toward low-solvent formulations, microencapsulation for safety, and precision delivery (seed coatings, chemigation, drones) to maximize efficacy without altering proven chemistry.

By Formulation Analysis

In 2024, liquid insecticides held a 71.1% market share, preferred for their quick mixing, smooth flow through sprayers and drone rigs, and uniform leaf and canopy coverage. Retailers favor liquids for easy stocking and safer handling in EC, SC, and CS formats, minimizing downtime in field applications. Liquids perform consistently across climates and storage conditions, making them a reliable choice.

Agronomists integrate liquids into programs with MOA rotation and adjuvants for better sticking, spreading, and rainfastness, using standard equipment. In 2025, demand will remain strong, driven by cleaner labels, enhanced operator safety, and precision delivery to reduce waste while maintaining efficacy, keeping liquids the go-to for speed and convenience.

By Crop Type Analysis

In 2024, cereals and grains accounted for a 45.3% market share, driven by the vast planted areas of wheat, rice, and corn, which face persistent threats from aphids, borers, armyworms, and sucking pests across growth stages. Growers rely on seed treatments for early protection and liquid foliar sprays for in-season control, enabling flexible tank mixes and quick application during tight weather windows.

Distributors value broad labels and proven formulations compatible with sprayers and drones, ensuring low downtime and uniform coverage. Agronomists use these products as program anchors, rotating MOAs, adjusting spray intervals, and using adjuvants for better canopy penetration. In 2025, demand will hold steady with emphasis on precision application, cleaner formulations, and robust resistance management to safeguard yields in staple crops.

Regional Analysis

In 2024, Asia-Pacific dominated the insecticides market with a 46.9% share, generating USD 6.7 billion. The region’s extensive cereal and grain production, particularly rice, wheat, and corn, faces intense pest pressure from stem borers, planthoppers, aphids, and fall armyworm, driving demand for fast-acting liquid concentrates and systemic options.

A robust network of contract formulators and toll blenders in China, India, and Southeast Asia ensures a steady supply of EC, SC, and CS products, while efficient distributor channels support rapid in-season delivery. Tropical and monsoon climates necessitate frequent curative sprays, favoring formulations that mix easily, store well, and provide uniform coverage via sprayers and drones.

Public-health vector control programs add consistent institutional demand. Despite tightening stewardship, agronomists manage risks through improved nozzle calibration, buffer practices, and MOA rotation. In 2025, Asia-Pacific will maintain its lead as acreage shifts to high-value horticulture and staple cereals, with growth in precision delivery (seed treatments, drip/chemigation, drones), cost-effective synthetics, low-solvent formulations, and microencapsulation for operator safety.

Top Use Cases

- Crop Protection in Agriculture: Insecticides safeguard crops like rice, wheat, and corn from pests, boosting yields. They prevent insect damage, ensuring food security for growing populations. Farmers use sprays or seed treatments to protect fields, reducing losses and improving productivity in regions like Asia and North America.

- Public Health Pest Control: Insecticides combat disease-carrying insects like mosquitoes, reducing cases of malaria and dengue. Sprays and fogging are used in communities to control pest populations, protecting public health in urban and rural areas, especially in tropical regions with high mosquito prevalence.

- Household Insect Management: Insecticides in sprays, baits, or coils eliminate household pests like cockroaches and ants. They ensure clean, safe living spaces, with natural options like neem oil gaining popularity for eco-friendly pest control in homes across the globe.

- Integrated Pest Management (IPM): Insecticides are part of IPM strategies, combining chemical and biological methods for sustainable pest control. They target specific pests while minimizing environmental impact, used in farming to balance effectiveness with eco-conscious practices, promoting long-term crop health.

- Commercial and Industrial Applications: Insecticides protect stored grains and warehouses from pests like beetles. They ensure product quality in food processing and storage facilities, reducing economic losses. Applied through fumigation or sprays, they maintain hygiene in commercial spaces globally.

Recent Developments

1. Adama Agricultural Solutions Ltd

Adama recently launched Chroma, a novel insecticide combining two active modes of action (cyantraniliprole and abamectin) for sucking and chewing pest control in fruits and vegetables. It offers rapid knockdown and long-lasting residual activity, supporting integrated pest management (IPM) programs and addressing resistance issues. This highlights Adama’s focus on providing sustainable solutions for high-value crops.

2. American Vanguard Corporation

Through its subsidiary AMVAC, the company is expanding the use of its proprietary Simpas Application System. This precision technology is now approved for use with Aztec HC (a corn rootworm insecticide) and Cobalt Advanced (a broad-spectrum insecticide), enabling targeted, in-furrow application. This reduces the amount of insecticide needed per acre, lowering environmental impact and cost while maintaining efficacy.

3. BASF SE

BASF is heavily promoting its novel insecticide active ingredient, Axalion. This new class of insecticides controls sucking pests like aphids and whiteflies through a unique mode of action, making it a key tool for resistance management. It is designed to be soft on beneficial insects, supporting ecosystem health and IPM strategies. Global regulatory submissions are ongoing, with launches expected later this decade.

4. Bayer CropScience AG

Bayer launched Serenade insecticide, a new bio-based solution for specialty crops. Based on the active ingredient Bacillus amyloliquefaciens strain QST 713, it controls key soft-bodied insects like aphids and whiteflies. As a certified organic product, it offers a sustainable option for growers, complementing Bayer’s integrated portfolio of chemical and biological crop protection tools.

5. Corteva Agriscience

Corteva is driving the adoption of Isoclast active, the first commercial insecticide from the sulfoximine class. Featured in products like Closer and Transform, it effectively controls resistant sucking pests (aphids, psyllids, whiteflies) in various crops. Its novel mode of action is critical for IRM programs, and Corteva continues to secure new global registrations to expand its use for growers worldwide.

Conclusion

The Insecticides Market is growing due to rising food demand, urbanization, and pest-related challenges. Driven by agricultural needs and eco-friendly innovations. Sustainable solutions like biopesticides and precision application are shaping a promising future for effective, environmentally conscious pest management.