Table of Contents

Overview

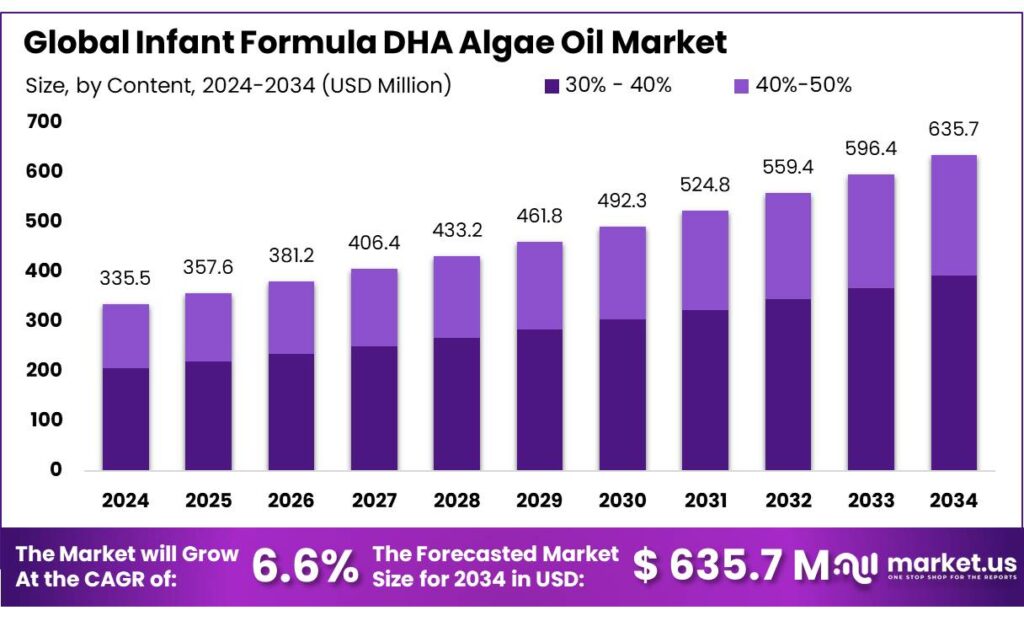

New York, NY – September 16, 2025 – The Global Infant Formula DHA Algae Oil Market is projected to grow from USD 335.5 million in 2024 to approximately USD 635.7 million by 2034, achieving a CAGR of 6.6% over the forecast period from 2025 to 2034. In 2024, North America led the market, holding a 41.7% share with a revenue of USD 17.2 billion.

The infant formula sector is witnessing significant growth due to the rising demand for DHA algae oil, fueled by parents’ preference for natural, science-backed nutritional solutions for infants. DHA, an omega-3 fatty acid, is critical for supporting infant brain and eye development, driving manufacturers to integrate algae-derived DHA into their products to gain a competitive edge.

DHA algae oil benefits from robust regulatory backing, enhancing its adoption in infant formula. The U.S. Food and Drug Administration permits DHA-rich oils in formulations providing up to 3.0 grams per day of DHA and/or EPA, reflecting thorough safety evaluations. This flexibility allows manufacturers to develop compliant, nutritionally diverse products.

The global acceptance of DHA algae oil, derived from Schizochytrium sp., facilitates international market expansion. Regulatory approvals from the U.S. FDA, Health Canada, the European Union, the Food Standards Agency of Australia, China’s Ministry of Health, and Brazil’s National Health Surveillance Agency enable manufacturers to standardize formulations and pursue global product strategies with minimal regulatory hurdles.

Key Takeaways

- Infant Formula DHA Algae Oil Market size is expected to be worth around USD 635.7 Million by 2034, from USD 335.5 Million in 2024, growing at a CAGR of 6.6%.

- 30% – 40% content held a dominant market position, capturing more than a 61.8% share in the Infant Formula DHA Algae Oil market.

- 0–3 years held a dominant market position, capturing more than a 68.3% share in the Infant Formula DHA Algae Oil market.

- North America held a commanding lead in the Infant Formula DHA Algae Oil market, capturing 41.9% of the global share, translating to approximately USD 140.5 million.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/infant-formula-dha-algae-oil-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 335.5 Million |

| Forecast Revenue (2034) | USD 635.7 Million |

| CAGR (2025-2034) | 6.6% |

| Segments Covered | By Content (30% – 40%, 40%-50%), By End Use (0-3 years old, 3-6 years old, Others) |

| Competitive Landscape | Algarithm, Cellana, Goerlich Pharma, Henry Lamotte OILS, Nordic Naturals, Polaris |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=156373

Key Market Segments

Content Analysis

30%–40% DHA Content Dominates with 61.8% Market Share in 2024

In 2024, the 30%–40% DHA content segment led the Infant Formula DHA Algae Oil market, securing a 61.8% share. This range is favored for delivering the optimal DHA concentration for infant growth and cognitive development, aligning with global nutrition guidelines and meeting parental demand for science-backed, balanced formulas. The preference for this concentration stems from its alignment with recommended DHA levels for early childhood, fostering trust among parents and caregivers.

The segment’s dominance is further supported by leading formula brands adopting algae oil as a sustainable, safe DHA source, reducing dependence on fish-based oils. This segment is projected to retain its lead, driven by ongoing endorsements from health authorities and pediatric associations emphasizing DHA’s role in brain and vision health during the first two years. Growing parental awareness continues to fuel loyalty toward products within this DHA range, sustaining demand.

End-Use Analysis

0–3 Years Segment Commands 68.3% Share in 2024

The 0–3 years age group dominated the Infant Formula DHA Algae Oil market in 2024, capturing a 68.3% share. This age range is critical for brain development, visual acuity, and cognitive function, where DHA plays a vital role. Increased parental awareness of DHA’s importance has driven demand for algae oil-based formulas, valued for their sustainability and allergen-free properties.

The segment’s strength is bolstered by trust in algae oil as a safer alternative to fish-derived DHA, particularly in regions prioritizing eco-friendly and hypoallergenic ingredients. The 0–3 years category is expected to maintain its dominance, supported by pediatric recommendations highlighting DHA’s necessity for neurological and physical development. Infant nutrition brands are reinforcing consumer confidence through targeted marketing of clinically supported, naturally sourced products.

Regional Analysis

North America Holds 41.9% Share, Valued at USD 140.5 Million in 2024

In 2024, North America led the global Infant Formula DHA Algae Oil market with a 41.9% share, generating approximately USD 140.5 million in revenue. This dominance is driven by high parental awareness of DHA’s benefits for infant brain and eye development, stringent health regulations promoting DHA fortification, and the widespread availability of premium formulas. The United States, a hub for leading infant nutrition brands, significantly contributes to the region’s market strength.

Top Use Cases

- Enhancing Brain Development: Parents use DHA algae oil in infant formulas to support quick brain growth in newborns up to three years old. This omega-3 helps build neural connections, improving memory and learning skills. As more moms and dads learn about these perks, they pick enriched formulas to give babies a smart start, especially when breastfeeding isn’t always possible.

- Boosting Eye Health: For tiny eyes still forming, DHA from algae oil in formulas aids retina growth and sharp vision. It mimics natural fats in breast milk, helping babies see colors and shapes better early on. Busy families rely on this addition to ensure clear sight development without fish oil worries like allergies or bad smells.

- Supporting Immune System Strength: Adding DHA algae oil to baby formulas helps build stronger defenses against germs. This gentle plant source fights inflammation and aids cell health, keeping little ones healthier during cold seasons. Health experts recommend it for formula-fed infants to match breast milk’s protective boost and reduce sick days.

- Vegan and Allergy-Friendly Nutrition: Families avoiding fish turn to algae-based DHA in formulas for safe, plant-powered omega-3s. It’s perfect for vegan diets or kids with seafood allergies, offering pure benefits without contaminants. This choice lets parents feed confidently, meeting growth needs while honoring eco-friendly and dietary values.

- Sustainable Choice for Eco-Conscious Parents: With overfishing concerns rising, DHA algae oil provides a green alternative for infant formulas. Grown in labs without harming oceans, it delivers key nutrients cleanly. Savvy shoppers pick it to nurture babies while protecting the planet, aligning health with sustainable living trends.

Recent Developments

1. Algarithm

Algarithm is innovating with its DHA S50 algae oil, a high-potency, single-cell organism (SCO) oil designed for infant nutrition. Their recent focus is on securing regulatory approvals in key markets like Europe and China, emphasizing its superior oxidative stability and purity. This positions their product as a reliable, sustainable source for formula manufacturers seeking clean-label ingredients.

2. Cellana

Cellana leverages its advanced ALDUO production technology to grow marine microalgae for its ReNew DHA oil. A key recent development is the scaling of its production capacity to meet growing global demand. Their focus remains on showcasing the environmental benefits of their land-based, controlled fermentation process, which ensures a contaminant-free, sustainable, and traceable DHA source for infant formula.

3. Goerlich Pharma

Goerlich Pharma provides high-purity DHA algal oils as active pharmaceutical ingredients (APIs) and excipients. Their recent development involves enhancing their product documentation and compliance dossiers to meet stringent global pharmacopoeia standards (EP, USP). This ensures their algal oil is ideally suited for pharmaceutical-grade infant nutrition products and medical formulas, where precise dosing and supreme quality are critical.

4. Henry Lamotte OILS

Henry Lamotte OILS focuses on supplying high-quality, certified organic algal DHA oil. Their recent developments include strengthening their supply chain for organic-certified (e.g., EU Organic) microalgae oil. This directly responds to the rising demand in Europe for organic infant formula options, providing manufacturers with a certified, sustainable, and plant-based DHA source that meets strict organic regulatory requirements.

5. Nordic Naturals

While known for consumer supplements, Nordic Naturals supplies algal oil to the ingredient market. Their recent development is the expansion of their product line with a concentrated, high-DHA algal oil tailored for infant formula fortification. They emphasize their third-party testing for purity and potency, leveraging their brand reputation to provide a trusted, vegan DHA source for manufacturers.

Conclusion

Infant Formula DHA Algae Oil market shines as a powerhouse ingredient. Parents worldwide crave its brain, eye, and immune perks, especially in plant-based, contaminant-free forms that echo breast milk’s goodness. While premium pricing poses hurdles in budget spots, rising awareness and green vibes push demand sky-high. Brands smartly investing here can grab a slice of this booming, baby-focused nutrition wave, blending science, sustainability, and parental peace of mind for long-term wins.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)