Table of Contents

Overview

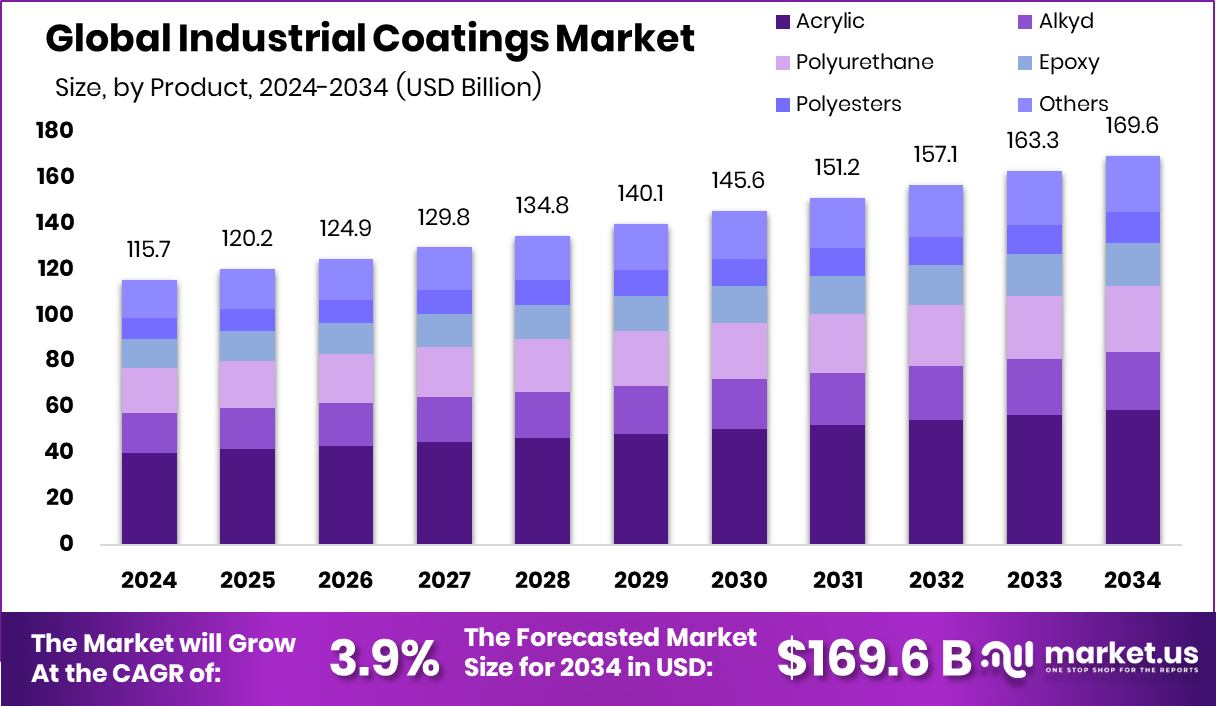

New York, NY – August 04, 2025 – The Industrial Coatings Market is projected to grow from USD 115.7 billion in 2024 to approximately USD 169.6 billion by 2034, achieving a CAGR of 3.9% from 2025 to 2034. The Asia-Pacific region, driven by rapid industrial expansion and infrastructure investments, accounts for 45.7% of the global coatings demand.

Industrial coatings are advanced paints or chemical solutions designed primarily for protection rather than aesthetics. Applied to materials like steel and concrete, they shield against corrosion, wear, fire, UV damage, and chemical exposure in demanding industrial settings. Key sectors utilizing these coatings include automotive, construction, oil & gas, marine, and manufacturing.

The industrial coatings market encompasses the global production and trade of specialized protective coatings, including epoxy, polyurethane, acrylic, and fluoropolymer types. These coatings serve critical roles in infrastructure, heavy machinery, and energy systems. Market dynamics are shaped by end-user industry trends, environmental regulations, and infrastructure investments.

The market’s expansion is fueled by surging infrastructure development and industrialization, particularly in emerging economies. Increased investments in construction, energy, and transportation projects drive demand for protective coatings to enhance asset durability. Additionally, the shift toward high-performance, eco-friendly coatings is accelerating market growth.

The focus on equipment maintenance and long-term asset protection sustains demand for industrial coatings. Industries in harsh environments, such as marine, chemical processing, and mining, depend on these coatings to minimize downtime and maintenance costs. Regulatory pressures to reduce emissions and adopt energy-efficient, low-VOC coating technologies further boost market adoption.

Key Takeaways

- The Industrial Coatings Market is expected to be worth around USD 169.6 billion by 2034, up from USD 115.7 billion in 2024, and is projected to grow at a CAGR of 3.9% from 2025 to 2034.

- Acrylic coatings hold a 34.6% share in the industrial coatings market due to durability.

- Solvent-borne technology leads the industrial coatings market with a 48.7% share, driven by performance.

- The automotive sector dominates end-use in the industrial coatings market, accounting for 28.9% market share.

- The Asia-Pacific market value reached a strong total of USD 52.8 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-industrial-coatings-market/request-sample/

Report Scope

| Market Value (2024) | USD 115.7 Billion |

| Forecast Revenue (2034) | USD 169.6 Billion |

| CAGR (2025-2034) | 3.9% |

| Segments Covered | By Product (Acrylic, Alkyd, Polyurethane, Epoxy, Polyesters, Others), By Technology (Solvent Borne, Water Borne, Powder Based, Others), By End-use (Automotive, Marine, Electronics, Aerospace, Oil and Gas, Mining, Power Generation, Others) |

| Competitive Landscape | Akzo Nobel N.V., Axalta Coating Systems, BASF SE, Diamond Paints, Hempel A/S, Industrial Coatings Ltd., Jotun, Kansai Paint Co., Ltd., Nippon Paint Holdings Co., Ltd., PPG Industries, Inc., RPM International Inc., The Chemours Company FC, LLC.. The Sherwin-Williams Company |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153521

Key Market Segments

By Product Analysis

Acrylic coatings led the industrial coatings market in 2024, commanding a 34.6% share. Their dominance stems from versatility, rapid drying, and cost-effectiveness, making them ideal for diverse industrial uses. Acrylics excel in weather resistance and color retention, particularly for exterior metal structures, machinery, and equipment in variable climates. Their compatibility with waterborne and solvent-borne systems supports industries shifting toward eco-friendly solutions.

By Technology Analysis

Solvent-borne coatings held a leading 48.7% share of the industrial coatings market in 2024, driven by their reliability and superior performance in challenging industrial environments. Known for excellent adhesion, smooth finishes, and durability on surfaces like metal and concrete, they thrive in high-humidity or low-temperature conditions. Their resistance to abrasion, corrosion, and chemicals makes them a go-to choice for industries prioritizing robust protection, such as infrastructure, machinery, and transportation.

By End-use Analysis

The automotive sector led the end-use segment in 2024, capturing a 28.9% share of the industrial coatings market. Coatings are vital for vehicle durability, aesthetics, and corrosion resistance, applied extensively in OEM and aftermarket components like chassis, body panels, and engine parts. High production volumes and stringent performance standards drive demand for coatings that protect against weather, chemicals, and wear. Advances in coating formulations enhance vehicle longevity and low-maintenance needs, reinforcing the sector’s reliance on high-performance solutions.

Regional Analysis

In 2024, Asia-Pacific dominated the industrial coatings market with a 45.7% share, valued at USD 52.8 billion. This leadership is fueled by robust manufacturing, rapid urbanization, and extensive infrastructure projects in countries like China, India, and Southeast Asia. The automotive, construction, and heavy machinery sectors drive strong demand for durable coatings.

North America and Europe saw steady growth due to established industries and infrastructure maintenance, while the Middle East & Africa and Latin America showed gradual growth from rising construction and industrial activities. Asia-Pacific’s position as the largest and fastest-growing region underscores its pivotal role in global market dynamics.

Top Use Cases

- Automotive Protection and Aesthetics: Industrial coatings enhance vehicle durability and appearance, protecting chassis, body panels, and engine parts from corrosion, scratches, and UV damage. They ensure long-lasting finishes for both OEM and aftermarket applications, meeting high production demands and aesthetic standards while improving resistance to harsh weather and chemicals.

- Infrastructure Durability: Coatings safeguard bridges, buildings, and other structures from corrosion, abrasion, and weathering. Applied to steel and concrete, they extend lifespan and reduce maintenance costs. Their weather-resistant and durable properties make them ideal for harsh environments, supporting infrastructure growth in urbanizing regions.

- Machinery and Equipment Protection: Industrial coatings shield heavy machinery and equipment from wear, corrosion, and chemical exposure. Used in manufacturing and construction, they ensure operational efficiency and longevity. Fast-drying and durable coatings minimize downtime, making them essential for industries prioritizing reliable, low-maintenance equipment.

- Marine and Offshore Applications: Coatings protect ships, offshore platforms, and marine equipment from saltwater corrosion and harsh conditions. They provide durability and resistance to abrasion, ensuring long-term performance. These coatings are critical for marine engineering, reducing maintenance costs and supporting safety in challenging environments.

- Aerospace Component Longevity: Industrial coatings are used on aircraft components to resist extreme temperatures, corrosion, and wear. They protect critical parts like wings and fuselages, ensuring safety and performance. High-performance coatings meet strict industry standards, supporting the aerospace sector’s demand for reliability and durability.

Recent Developments

1. Akzo Nobel N.V.

- Akzo Nobel has been focusing on sustainable coatings, launching Interpon D1036 Low-E, a powder coating that reduces energy consumption in curing. They also acquired Lankwitzer Lackfabrik GmbH to expand their liquid coatings portfolio. Additionally, Akzo Nobel introduced digital color-matching tools to enhance efficiency for industrial customers.

2. Axalta Coating Systems

- Axalta launched Alesta AM Powder Coatings, designed for additive manufacturing (3D printing). They also expanded their Voltatex 4222 electrical insulation coating for e-mobility. Axalta partnered with BYD to supply coatings for electric buses, emphasizing sustainability.

3. BASF SE

- BASF introduced Innovalit 3100, a high-performance coating for automotive and industrial applications. They also developed bio-based hardeners for epoxy coatings to reduce the carbon footprint. BASF’s ColorWorks team launched new pigment solutions for industrial durability.

4. Diamond Paints

- Diamond Paints expanded its Diamond Shield line with anti-corrosive coatings for heavy machinery. They introduced fast-curing industrial coatings to reduce downtime. The company also enhanced UV-resistant coatings for extreme weather conditions.

5. Hempel A/S

- Hempel launched Hempablade Edge 170, a leading-edge protection coating for wind turbines. They also introduced Hempadur Avantguard, an innovative anti-corrosive solution. Hempel committed to doubling its sustainability efforts, focusing on low-VOC coatings.

Conclusion

The Industrial Coatings Market is thriving due to its critical role in protecting and enhancing surfaces across automotive, infrastructure, marine, aerospace, energy, and general industrial sectors. With growing demand for durable, eco-friendly, and high-performance coatings, the market is driven by rapid industrialization, urbanization, and sustainability trends. Innovations like low-VOC and powder coatings ensure continued growth, meeting diverse industry needs effectively.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)