Table of Contents

Overview

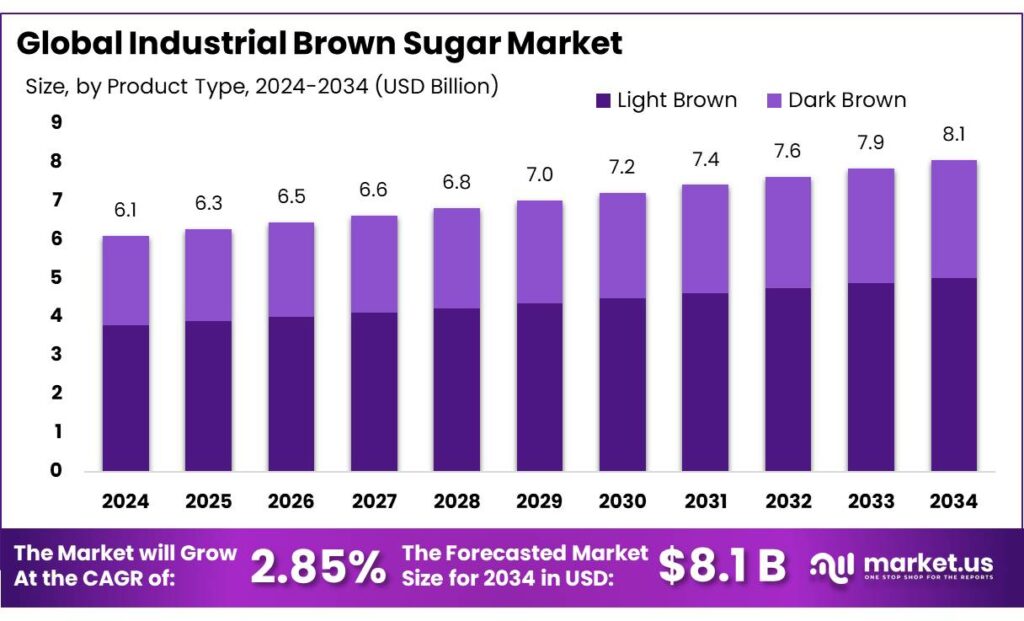

New York, NY – September 25, 2025 – The Global Industrial Brown Sugar Market is projected to reach USD 8.1 billion by 2034, rising from USD 6.1 billion in 2024, at a CAGR of 2.8% between 2025 and 2034. In 2024, Asia-Pacific emerged as the leading region, capturing 43.6% of the market share and generating revenues of USD 10.4 billion.

Industrial brown sugar refers to bulk-packaged brown sugar intended for food processing and manufacturing applications, rather than direct consumer retail. Produced by coating refined white sugar crystals with molasses, it carries a distinct flavor, darker color, and richer aroma. These qualities make it an essential ingredient in bakery products, confectionery, beverages, and nutraceuticals, where it enhances taste and appearance.

The market’s primary growth driver is the increasing demand for bakery and confectionery items, alongside its broader adoption in food and beverage processing. The growing trend of flavored brown sugar is expected to support market expansion over the coming years. However, the sector faces competitive pressure from healthier sugar alternatives, which are gaining preference among health-conscious consumers.

According to the World Health Organization (WHO), adults should limit their daily sugar intake to no more than 25 grams (approximately 5.75 teaspoons) to maintain better health outcomes, highlighting the challenges facing traditional sugar products in today’s evolving food landscape.

Key Takeaways

- The Global Industrial Brown Sugar Market was valued at USD 6.1 billion in 2024.

- The global industrial brown sugar market is projected to grow at a CAGR of 2.8% and is estimated to reach USD 8.1 billion by 2034.

- Among the product types, industrial light brown sugar dominated the market, valued at around USD 14.7 billion in 2024.

- On the basis of applications, the industrial brown sugar market was dominated by bakery goods with a market share of 24.3% in 2024.

- In 2024, the Asia Pacific was the biggest market for industrial brown sugar, constituting around 43.6% of the total market share, valued at approximately USD 10.4 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/industrial-brown-sugar-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 6.1 Billion |

| Forecast Revenue (2034) | USD 8.1 Billion |

| CAGR (2025-2034) | 5.8% |

| Segments Covered | By Product Type (Light Brown and Dark Brown), By Applications (Bakery Goods, Confectionery Products, Sauces/Marinades, Beverages, Dairy Products, and Other Applications) |

| Competitive Landscape | ASR Group, Cargill, Incorporated, Amalgamated Sugar Company, Taikoo Sugar Limited, Südzucker AG, Louis Dreyfus Company, Agrana Beteiligungs-AG, Tereos (Whitworths), Associated British Foods plc, Other Key Players. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=157175

Key Market Segments

Product Type Analysis

Light Brown Sugar Leads Market with Subtle Flavor Appeal

The industrial brown sugar market is divided into light brown and dark brown segments. In 2024, light brown sugar commanded a leading 62% share of the global market, driven by its subtle caramel flavor, making it a versatile substitute for white granulated sugar in various recipes without overwhelming the taste. Light brown sugar, with approximately 3.5% molasses content, contrasts with dark brown sugar’s 6.5% molasses, which can dominate dishes with its robust flavor. When recipes simply call for “brown sugar” without specifying, light brown sugar is typically assumed as the default choice.

Application Analysis

Bakery Goods Drive Demand for Industrial Brown Sugar

The industrial brown sugar market is segmented by application into bakery goods, confectionery, sauces/marinades, beverages, dairy products, and others. In 2024, bakery goods led the market, capturing a 24.3% share. Brown sugar’s rich flavor enhances baked goods like chocolate chip cookies and banana bread, while its hygroscopic properties contribute to the soft, moist, and chewy textures prized in cakes, cookies, and quick breads.

In contrast, confectionery products like hard candies and delicate caramel often favor white sugar for its purity and faster caramelization, which helps achieve desired textures and avoids burning risks from molasses. Similarly, beverages typically use white or superfine sugar for faster dissolution and a less dominant flavor, allowing other ingredients to stand out.

Regional Analysis

Asia Pacific Dominates Global Industrial Brown Sugar Market

In 2024, the Asia Pacific region held a commanding 43.6% share of the global industrial brown sugar market, valued at roughly USD 2.66 billion. This dominance stems from the region’s large population, deep-rooted sugar consumption traditions, and thriving food and beverage industry. Major producers and consumers like India, China, Thailand, and Indonesia heavily utilize brown sugar in traditional sweets, beverages, sauces, and baked goods.

Thailand stands out as both a key exporter and consumer, particularly for palm sugar-based brown varieties. The region’s tropical climate and robust agricultural infrastructure support extensive sugarcane production, providing a competitive edge. Additionally, the strong food processing sectors in countries like Japan and South Korea further boost demand for brown sugar as a sweetener and flavor enhancer.

Top Use Cases

- Bakery Goods Enhancement: Industrial brown sugar adds a warm caramel note and keeps baked items soft and chewy, thanks to its natural moisture from molasses. Factories use it in cookies, cakes, and breads to create that perfect tender texture without extra steps. This makes it a go-to for large-scale production where flavor and consistency matter most, boosting appeal in everyday treats.

- Confectionery Flavor Boost: In candy making, industrial brown sugar brings depth to caramels and chocolates, blending smoothly for rich, gooey results. Its molasses content helps control browning during cooking, avoiding burnt tastes in hard candies or fudges. Producers love it for crafting premium sweets that stand out on shelves with authentic, indulgent vibes.

- Sauce and Marinade Sweetener: Food makers mix industrial brown sugar into barbecue sauces and glazes for a subtle sweet-tangy balance that clings to meats. The molasses enhances caramelization on grills, locking in smoky flavors. It’s ideal for bulk processing in ready-to-eat meals, giving everyday condiments a homemade feel without overpowering spices.

- Beverage Sweetening Agent: Brewers and bottlers add industrial brown sugar to sodas, teas, and cocktails for a smooth dissolve and hint of toffee. It tempers bitterness in dark beers or adds warmth to iced drinks, making them more refreshing. In mass production, it ensures even flavor distribution for consistent sips every time.

- Dairy Product Enricher: Creameries blend industrial brown sugar into yogurts, ice creams, and cheeses for a creamy, nuanced sweetness that pairs with fruits or nuts. Its hygroscopic nature prevents ice crystals in frozen treats, keeping them scoopable. This elevates simple dairy lines into gourmet options for health-focused shoppers.

Recent Developments

1. ASR Group

ASR Group is focusing on sustainable sugarcane production through its subsidiary, Florida Crystals. Recent developments highlight their investment in regenerative agricultural practices to improve soil health and reduce the environmental footprint of their sugar production. This includes cover cropping and reduced tillage, directly impacting the supply chain for their industrial brown sugar products by promoting long-term sustainability and appealing to eco-conscious business customers.

2. Cargill, Incorporated

Cargill has recently expanded its commitment to sustainable sourcing and traceability in its sugar supply chain. For industrial brown sugar, this means leveraging technology to provide customers with greater transparency from farm to factory. They are also responding to demand for clean-label ingredients, ensuring their industrial brown sugar offerings meet specific non-GMO or organic standards for food and beverage manufacturers seeking simpler, traceable ingredient lists.

3. Amalgamated Sugar Company

Amalgamated Sugar continues to invest significantly in operational efficiency and product quality. A key recent development is the ongoing modernization of its factories, which enhances the consistency and purity of its sugar products, including industrial brown sugars. These capital investments aim to increase yield and reduce waste, ensuring a reliable supply of high-quality sugar for their industrial food manufacturing partners across the United States.

4. Taikoo Sugar Limited

Taikoo Sugar, part of the Swire Group, emphasizes its Pure & Natural branding. A recent development is their focus on leveraging this brand promise for their industrial brown sugar segments, targeting premium food and beverage manufacturers. They highlight responsible sourcing and minimal processing to meet the growing demand in Asia for high-quality, natural ingredients, positioning their brown sugar as a superior choice for industrial clients producing premium consumer goods.

5. Südzucker AG

Südzucker is strategically navigating the European market’s shift towards sugar alternatives. While a major sugar producer, their recent developments involve diversifying their product portfolio. For industrial customers, this includes offering a range of sugar products, including brown sugar, alongside plant-based sweeteners. This approach allows them to cater to diverse formulation needs, from traditional recipes to products with reduced sugar content, ensuring they remain a comprehensive partner for the food industry.

Conclusion

Brown Sugar is a versatile powerhouse in the food world, quietly shaping flavors and textures across countless products. Its natural molasses edge gives it an authentic charm that white sugar can’t match, drawing in makers who chase that cozy, homemade taste in everything from quick bites to fancy drinks. With folks craving real, clean ingredients amid busy lives, this sugar steps up as a smart pick for brands aiming to delight.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)