Table of Contents

Introduction

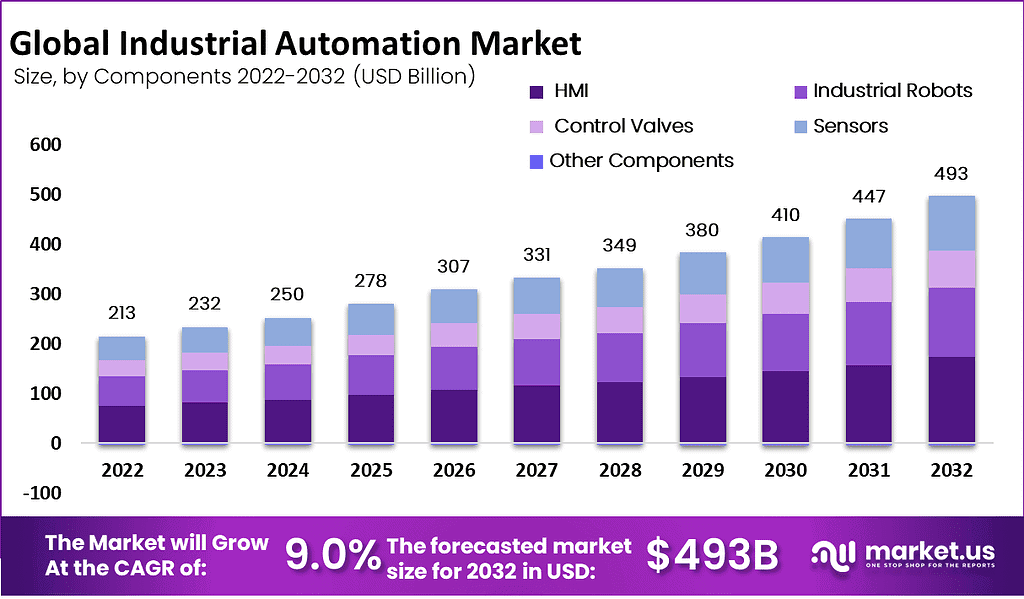

The Global Industrial Automation Market is projected to increase from USD 232.0 billion in 2023 to approximately USD 493.0 billion by 2032, expanding at a compound annual growth rate (CAGR) of 9.0% from 2022 to 2032.

Industrial Automation refers to the use of control systems, such as computers and robots, and information technologies for handling different processes and machineries in an industry to replace a human being. It is step beyond mechanization in the scope of industrialization. The Industrial Automation Market encompasses the systems, solutions, and devices that enable automated operations in various industries, improving efficiency and productivity while reducing human error and operational costs.

The growth of the Industrial Automation Market can be attributed to several factors. Increasing demand for precision and control in manufacturing processes has driven the adoption of automation technologies. As industries strive for operational excellence and optimal resource utilization, the integration of automation systems has become crucial. Technological advancements in artificial intelligence, machine learning, and robotics have further propelled the market forward by enhancing the capabilities of automation systems.

Demand within the Industrial Automation Market is primarily fueled by industries such as automotive, electronics, pharmaceuticals, and food and beverage. These sectors require stringent quality control and flexibility in manufacturing processes, which automation can provide. Additionally, the push towards sustainable manufacturing practices and the need to comply with international safety regulations encourage the adoption of industrial automation.

Opportunities in the Industrial Automation Market are vast and varied. The ongoing trend towards smart factories and Industry 4.0 presents significant potential for growth. There is also a growing emphasis on data analytics and Internet of Things (IoT) technologies, which are expected to play pivotal roles in the future landscape of industrial automation by enabling more efficient and connected operations. As businesses continue to recognize the benefits of automation, the market is likely to witness sustained growth, driven by technological innovation and increasing industrial demand.

Key Takeaways

- The Industrial Automation Systems Market is anticipated to reach approximately USD 493 Billion by 2032, from USD 212.6 Billion in 2023, with a CAGR of 9.0%.

- Industrial robots are the predominant component within the market, primarily due to their role in enhancing operational efficiency in manufacturing.

- Distributed Control Systems (DCS) accounted for a 34% share of the control systems market in 2022, supported by the increasing integration of the Industrial Internet of Things (IIoT).

- The manufacturing sector emerges as the principal end-user, with automation being increasingly deployed to boost productivity and minimize errors.

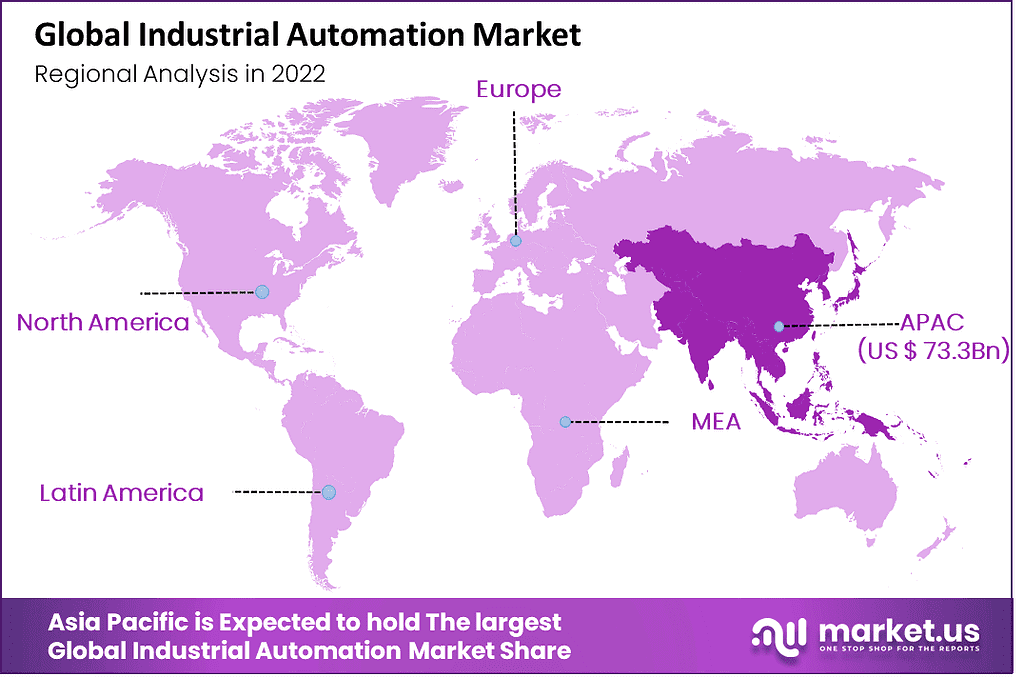

- Asia-Pacific leads with a 34.5% share in the market, propelled by significant automation initiatives within key industries such as automotive and electronics.

Industrial Automation Statistics

- In the United States, 70% of routine physical and cognitive tasks are at risk from automation.

- Around 24% of US jobs needing a bachelor’s degree face potential automation.

- Jobs requiring less than a bachelor’s degree have a 55% automation potential.

- Young workers aged 16 to 24 have the highest automation risk at 49%.

- Men face higher automation risk (24%) compared to women (17%).

- In England, 1.5 million jobs, or 7.4%, risk becoming obsolete due to automation.

- By 2030, 44% of workers with low education levels may face technological unemployment.

- Approximately 37% of people worry about automation replacing their jobs.

- Over 70% of individuals would consider brain and body enhancements to boost job prospects.

- About 56% of people feel governments should protect jobs against automation impacts.

- Nearly 70% of workers see automation as an opportunity to qualify for higher-skilled roles.

- Employers (57%) plan to use automation to enhance human performance and productivity.

- About 24% of businesses intend to use automation to lower operating costs.

- Currently, half of all work activities can be automated.

- Almost all workers (94%) report performing repetitive tasks in their roles.

- Among knowledge workers, 90% say automation improves workplace quality of life.

- Automation reduces stress for 65% of knowledge workers by minimizing manual tasks.

Emerging Trends

- Collaborative Robotics: The shift towards collaborative robots (cobots) is enhancing efficiency and safety. These cobots work alongside human operators to perform tasks such as assembly and quality control, adapting to changing circumstances.

- AI and Machine Learning Integration: Artificial intelligence is increasingly embedded in industrial processes to optimize production, predict equipment failures, and improve decision-making. This trend is advancing the precision and operational efficiency of robots and drones.

- Digital Twin Technology: The adoption of digital twin technology is growing, providing a virtual model of physical systems to simulate and monitor real-time operations, thereby improving decision-making and operational efficiency.

- Edge Computing: This technology brings data processing closer to the source of data generation, reducing latency and improving real-time data handling, which is crucial for industrial automation systems.

- Generative AI Applications: There’s a noticeable increase in the use of generative AI for various applications within industrial settings, such as coding, support, and operational analytics, driven by major cloud and AI service providers.

Top Use Cases

- Real-Time Monitoring and Control: IoT technologies enable the real-time monitoring and control of industrial processes, allowing for immediate response to any operational deviations.

- Predictive Maintenance: By analyzing data collected from machinery, predictive maintenance can be scheduled before failures occur, optimizing maintenance costs and extending equipment lifespan.

- Smart Factories: IoT-driven smart factories integrate various systems to enhance communication and operational efficiency, supporting real-time inventory tracking and production optimization.

- Enhanced Supply Chain Management: IoT devices provide real-time visibility and traceability of goods throughout the supply chain, improving logistics and inventory management.

- Safety and Security Enhancements: Advanced monitoring and security systems in industrial automation help in detecting hazardous conditions and managing safety risks more effectively.

Major Challenges

- Cybersecurity Risks: As automation technologies become more interconnected, the risk of cyberattacks increases, necessitating robust cybersecurity measures to protect sensitive data and operational integrity.

- Integration Complexity: Integrating new technologies with existing systems poses significant challenges, requiring substantial investment in time and resources to ensure compatibility and optimal performance.

- Skilled Worker Shortage: Despite automation’s growth, there is still a critical need for skilled workers capable of managing and maintaining advanced automation systems.

- Regulatory Compliance: Keeping up with evolving regulations and standards, especially in cybersecurity, is a continuous challenge for industry stakeholders.

- Technological Obsolescence: Rapid technological advancements can render existing systems obsolete, compelling companies to continuously invest in newer technologies to stay competitive

Top Opportunities

- Increased Productivity: Automation technologies significantly enhance productivity by enabling faster and more precise manufacturing processes.

- Cost Reduction: Over time, automation leads to reduced labor costs and operational expenses by minimizing waste and improving energy efficiency.

- Market Expansion: Automation opens up new markets by enhancing the capabilities of manufacturers to meet diverse and changing consumer demands more efficiently.

- Improved Worker Safety: By reducing the need for human presence in hazardous areas, automation improves overall workplace safety.

- Sustainability: Automated systems often consume less energy and resources than traditional methods, supporting broader sustainability goals within the industry

Key Player Analysis

In 2024, key players such as ABB Ltd., Siemens AG, and Schneider Electric SE will significantly drive the global industrial automation market. ABB Ltd. is expected to leverage its robust portfolio in robotics and digital solutions to capture substantial market share, particularly in automotive and electronics industries. Siemens AG will likely strengthen its position through continuous innovation in Industrial IoT and digital twin technologies, reinforcing its industry leadership.

Emerson Electric Co. and Rockwell Automation, Inc. are poised for growth through strategic partnerships and enhanced automation software offerings, emphasizing operational efficiency. Honeywell International, Inc. and Yokogawa Electric Corporation could expand their influence in process industries, driven by increasing demand for automated control systems. Meanwhile, Mitsubishi Electric Corporation and OMRON Corporation are positioned to benefit from strong capabilities in robotics and smart factory solutions. Fuji Electric Co., Ltd. and Kawasaki Heavy Industries, Ltd. will likely maintain steady market growth through niche specialization and targeted technological advancements.

Top Key Players in the Market

- ABB Ltd.

- Emerson Electric Co.

- Honeywell International, Inc.

- Kawasaki Heavy Industries, Ltd.

- Mitsubishi Electric Corporation

- OMRON Corporation

- Rockwell Automation, Inc.

- Schneider Electric SE

- Siemens AG

- Yokogawa Electric Corporation

- Fuji Electric Co., Ltd.

- Other Key Players

Regional Analysis

Asia Pacific Dominates Industrial Automation Market with Largest Market Share of 34.5%

The Asia Pacific region holds a dominant position in the industrial automation market, accounting for a substantial market share of approximately 34.5% in 2024, valued at USD 73.3 billion. The region’s significant growth can be attributed to rapid industrialization, increased investment in advanced manufacturing technologies, and the robust expansion of key sectors such as automotive, electronics, and manufacturing.

Countries including China, Japan, India, and South Korea have emerged as prominent contributors to regional demand, driven by government initiatives aimed at boosting manufacturing efficiency and reducing labor costs through automation. Furthermore, supportive regulatory policies and extensive adoption of robotics and Industry 4.0 technologies continue to bolster the region’s market leadership position.

Recent Developments

- In 2023, Rockwell Automation partnered with Microsoft to boost industrial automation development by incorporating generative AI technology. Microsoft’s Azure OpenAI Service will be integrated into Rockwell’s FactoryTalk Design Studio, speeding up product launches for industrial automation customers.

- In 2024, Siemens expanded its electric vehicle charging business by acquiring Heliox, a specialist in fast-charging technologies for electric buses and trucks. This acquisition broadens Siemens’ charging solutions and enhances its presence in Europe and North America.

- In 2024, Altair agreed to be acquired by Siemens for around $10.6 billion, offering shareholders $113 per share in cash. This deal represents a significant premium over Altair’s recent stock prices, enhancing Siemens’ technology offerings in various industries.

- In 2025, Legrand announced the acquisition of Australian Plastic Profiles (APP), significantly growing Legrand’s electrical infrastructure presence in Australia. APP, known for PVC conduit solutions, generated nearly AU$170 million in sales during fiscal year 2024.

- In 2024, ABB finalized the acquisition of Real Tech, a Canadian firm specializing in optical sensors for water monitoring. This acquisition will help ABB strengthen its position in smart water technology by adding advanced real-time monitoring capabilities.

- In 2025, Honeywell announced plans to acquire Sundyne from Warburg Pincus for $2.16 billion. Sundyne specializes in high-performance pumps and compressors, which will enhance Honeywell’s energy solutions segment and address global energy security.

- In 2025, Symbotic Inc. agreed to purchase Walmart’s Advanced Systems and Robotics business, expanding an existing partnership aimed at creating fully automated supply chain solutions.

- In 2025, TE Connectivity announced its intention to acquire Richards Manufacturing from Oaktree Capital and the Bier family. The acquisition will reinforce TE Connectivity’s presence in the North American electrical utility market, especially in underground infrastructure.

Conclusion

The Industrial Automation Market is expected to continue its strong growth, driven by increased adoption across manufacturing industries and advancements in technology such as artificial intelligence and robotics. Rising demand for efficiency, quality control, and cost savings will further accelerate automation’s role in industry. The Asia-Pacific region will remain a key growth area, benefiting from rapid industrialization and strong government support for advanced manufacturing solutions. Overall, the future of industrial automation looks promising, with ongoing innovation shaping the manufacturing landscape globally.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)