Table of Contents

Overview

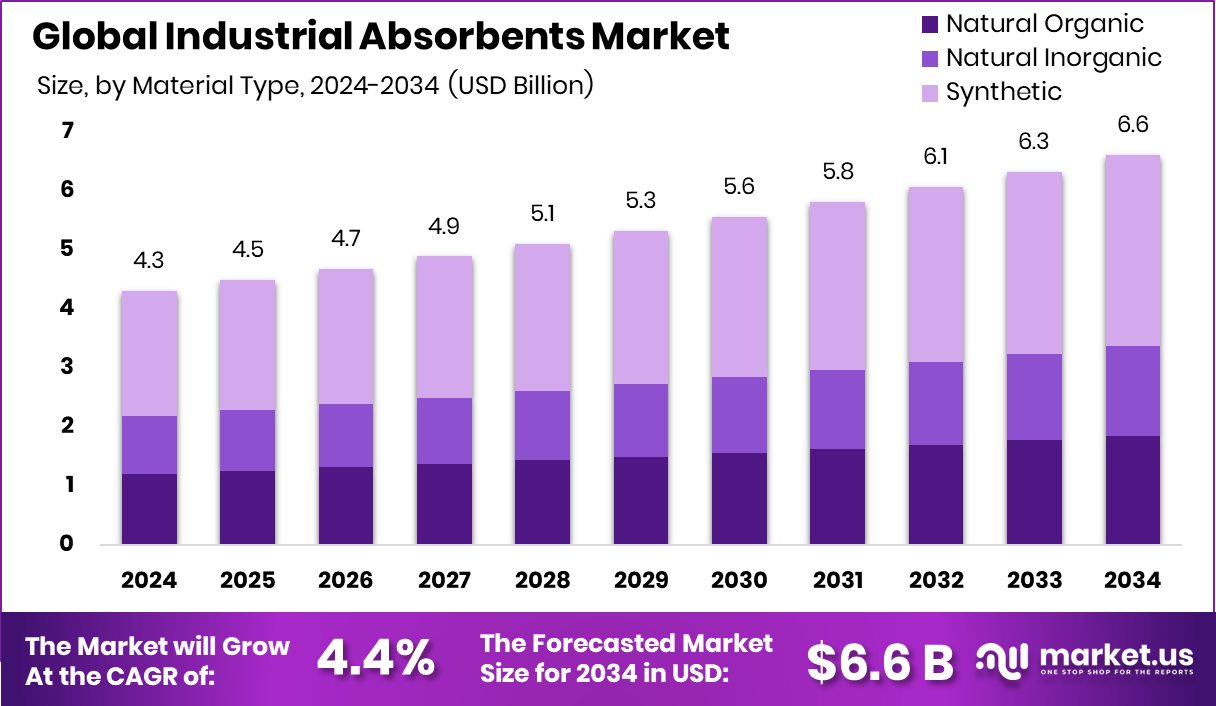

New York, NY – August 04, 2025 – The Global Industrial Absorbents Market is projected to reach USD 6.6 billion by 2034, growing from USD 4.3 billion in 2024 at a CAGR of 4.4% from 2025 to 2034. North America holds a dominant 48.7% market share, driven by stringent industrial safety regulations.

Industrial absorbents are specialized materials designed to absorb or contain liquids like oils, chemicals, solvents, and water in industrial settings. Available in forms such as pads, rolls, granules, and socks, they are vital for spill management, workplace safety, and regulatory compliance across industries like manufacturing, transportation, oil & gas, and chemicals.

The industrial absorbents market encompasses the global production, distribution, and use of these materials for spill control, leak management, and environmental protection. It is driven by strict safety and environmental regulations, increasing demand for workplace risk management, and heightened environmental awareness.

Stringent regulations are a key growth driver, compelling industries to adopt absorbents to minimize environmental impact and comply with containment standards set by environmental agencies. The expansion of industries such as manufacturing, automotive, and energy further fuels demand for spill control solutions, as larger operations handle greater volumes of fluids, necessitating effective absorbent products.

Routine spills in maintenance and operational activities also sustain consistent demand. Growing focus on sustainability is shaping the market, with innovations like EF Polymer’s organic super absorbent polymer gaining traction. EF Polymer recently raised 1 billion yen in Series B funding and an additional $6.6 million to advance eco-friendly absorbent technologies for industrial and agricultural applications.

Key Takeaways

- The Global Industrial Absorbents Market is expected to be worth around USD 6.6 billion by 2034, up from USD 4.3 billion in 2024, and is projected to grow at a CAGR of 4.4% from 2025 to 2034.

- In 2024, synthetic materials led the Industrial Absorbents Market with a 48.4% usage share globally.

- Pads accounted for 31.8% of product demand in the Industrial Absorbents Market due to easy application.

- Oil-only absorbents dominated with a 48.6% share, driven by rising spill control needs in industrial operations.

- The oil and gas sector led end-use demand in 2024, capturing a 42.7% share of the market.

- North America reached a market value of USD 2.0 billion in 2024.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/industrial-absorbents-market/request-sample/

Report Scope

| Market Value (2024) | USD 4.3 Billion |

| Forecast Revenue (2034) | USD 6.6 Billion |

| CAGR (2025-2034) | 4.4% |

| Segments Covered | By Material Type (Natural Organic, Natural Inorganic, Synthetic), By Product (Pads, Rolls, Pillows, Granules, Booms and Socks, Sheets and Mats, Others), By Type (Universal, Oil-Only, HAZMAT/Chemical), By End-use (Oil and Gas, Chemical, Food Processing, Healthcare, Others) |

| Competitive Landscape | 3M Company, ANSELL LTD, Brady Worldwide Inc., Johnson Matthey Inc., Kimberly-Clark Worldwide Inc., Meltblown Technologies Inc., Monarch Green Inc., Tolsa SA, DecorUS Europe Ltd., Asa Environmental Products Inc. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153575

Key Market Segments

By Material Type Analysis

Synthetic materials lead the Industrial Absorbents Market, holding a 48.4% share in 2024. Their dominance stems from high absorption capacity, durability, and chemical resistance, making them ideal for managing oil-based and hazardous chemical spills. Made from materials like polypropylene, synthetic absorbents are lightweight, versatile (available as pads, booms, and rolls), and excel in demanding industrial environments.

By Product Analysis

Absorbent pads dominate the product segment with a 31.8% share in 2024, driven by their convenience, high absorption efficiency, and ease of use in industrial settings. Widely applied in maintenance, clean-ups, and emergency spill response across factories and warehouses, pads offer versatility in absorbing oils, coolants, solvents, and other liquids. Their flat, disposable design ensures rapid deployment and minimal waste, enhancing operational efficiency.

By Type Analysis

Oil-only absorbents command the largest share at 48.6% in 2024, favored for their ability to selectively absorb hydrocarbons while repelling water. This makes them highly effective for oil spill management in industries like marine, automotive, and heavy manufacturing, particularly in outdoor or offshore settings.

Available in forms like pads, booms, and pillows, oil-only absorbents are critical for spill response kits. Their dominance is fueled by the need for quick, compliant cleanup to minimize environmental damage and meet regulatory requirements.

By End-use Analysis

The oil and gas sector leads with a 42.7% share in 2024, driven by the frequent handling of petroleum-based products in drilling, refining, and storage operations. Industrial absorbents are essential for rapid spill containment and cleanup, especially in high-risk settings like offshore platforms and pipelines. Their use reduces downtime, supports emergency preparedness, and ensures compliance with strict environmental regulations, addressing the sector’s significant safety and ecological challenges.

Regional Analysis

North America dominates the Industrial Absorbents Market with a 48.7% share in 2024, valued at USD 2.0 billion. This leadership is driven by stringent safety regulations and high environmental compliance awareness in industries like oil & gas, manufacturing, and chemicals, particularly in the U.S. and Canada.

Robust spill prevention and response protocols sustain demand for absorbents. While Europe, Asia Pacific, Latin America, and the Middle East & Africa show growth due to expanding industrial activities and stricter spill management norms, North America’s mature infrastructure and regulatory enforcement maintain its market lead.

Top Use Cases

- Oil Spill Cleanup in Oil & Gas Industry: Industrial absorbents, like oil-only pads and booms, quickly soak up oil spills during drilling or refining. They repel water, making them ideal for offshore or rainy conditions. Used in refineries and pipelines, they ensure fast cleanup, reduce environmental damage, and meet strict regulations, minimizing financial and reputational risks for companies.

- Chemical Spill Management in Manufacturing: Factories handling hazardous chemicals use absorbents like HAZMAT pads to contain spills. These absorbents are chemically inert, safely managing corrosive or toxic liquids. They help prevent workplace accidents, protect workers, and ensure compliance with safety standards, reducing downtime and maintaining operational efficiency in manufacturing plants.

- Maintenance and Repair in the Automotive Sector: Automotive workshops use absorbent pads and rolls for routine maintenance tasks like oil changes or coolant leaks. These products quickly absorb fluids, keeping work areas clean and safe. Their ease of use and disposal reduces cleanup time, enhances worker safety, and supports a tidy, efficient workspace for mechanics.

- Healthcare Facility Spill Control: Hospitals and clinics use absorbents to manage spills of blood, bodily fluids, or chemicals during medical procedures. Absorbent pads and mats prevent slips and contamination, ensuring a safe environment. Their high absorbency and disposability support hygiene standards, making them essential for maintaining safety in healthcare settings.

Recent Developments

1. 3M Company

3M has expanded its absorbent solutions with advanced oil and chemical absorbents for industrial spills. Their 3M Universal Absorbent Socks now feature improved durability and absorption rates. The company is also focusing on sustainability, with recycled materials in some absorbent products.

2. ANSELL LTD

Ansell has introduced high-performance absorbent gloves and PPE for hazardous chemical handling. Their MICROFLEX 93-260 gloves combine chemical resistance with absorbency, reducing contamination risks in industrial settings.

3. Brady Worldwide Inc.

Brady launched Brady Absorbent Pads for oil and chemical spills, designed for quick deployment in industrial facilities. Their Spill Cleanup Kits now include eco-friendly absorbents with higher efficiency.

4. Johnson Matthey Inc

Johnson Matthey is innovating in specialty absorbents for chemical processing, including catalytic absorbent materials that neutralize hazardous spills while enabling recovery of valuable chemicals.

5. Kimberly-Clark Worldwide Inc.

Kimberly-Clark’s KLEENGUARD Absorbent Wipes now feature biodegradable materials for industrial spill control. Their WYPALL X absorbents are being used in automotive and manufacturing sectors for oil and coolant spills.

Conclusion

The Industrial Absorbents Market is thriving due to growing industrial activities, strict environmental regulations, and increased focus on workplace safety. These versatile materials are essential across sectors like oil & gas, manufacturing, healthcare, and transportation, effectively managing spills and ensuring compliance. With rising demand for eco-friendly solutions, innovations in sustainable absorbents are driving market growth, promising a robust future.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)