Table of Contents

Overview

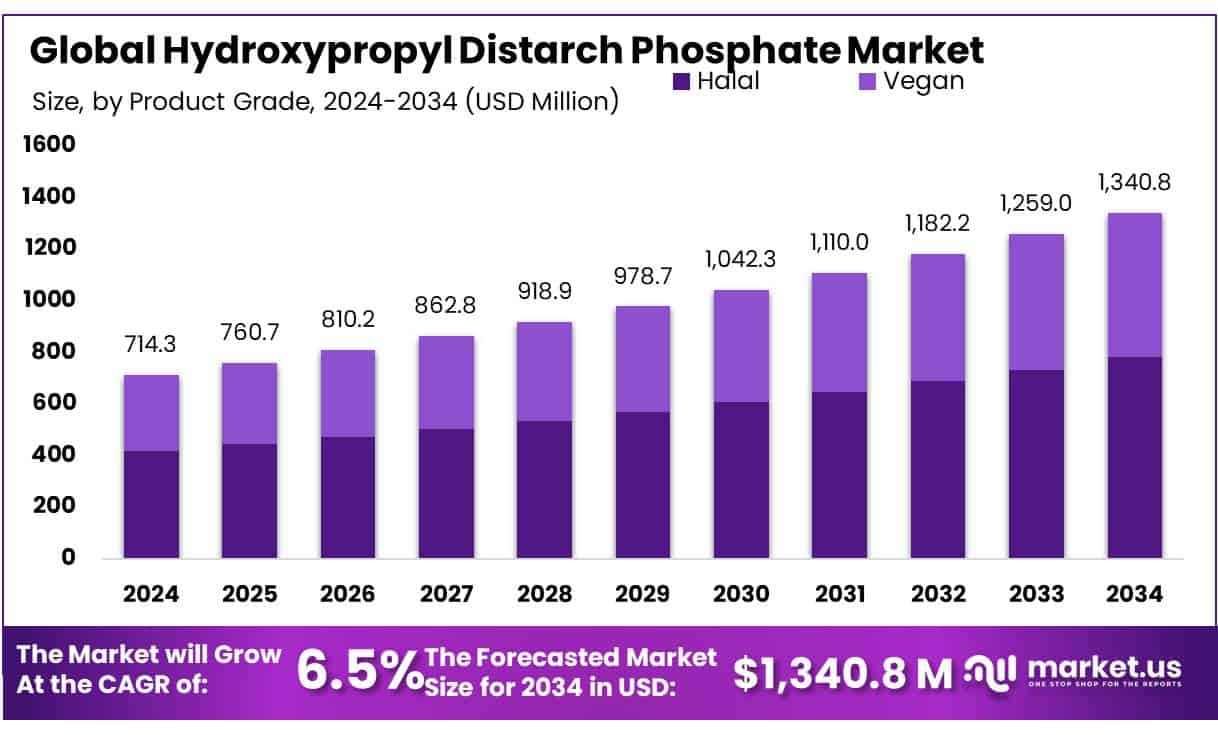

The global Hydroxypropyl Distarch Phosphate market is projected to grow from USD 714.3 million in 2024 to approximately USD 1,340.8 million by 2034, reflecting a compound annual growth rate (CAGR) of 6.5% over the forecast period (2025–2034). In 2024, North America led the market, accounting for over 48.2% of the total share, with revenue reaching around USD 344.2 million.

Hydroxypropyl Distarch Phosphate (INS 1442) is a chemically modified resistant starch created through both hydroxypropylation and phosphorylation processes. It is approved for use as a thickener, stabilizer, and texturizer in various regions including the European Union, the United States, Australia, New Zealand, Taiwan, and under Codex Alimentarius guidelines.

In the EU, HPDP is permitted across a broad range of food categories such as dairy, fruit-based products, soups, sauces, and processed meats. It follows the “quantum satis” rule, which allows its use in just the amount needed to achieve the desired effect, as long as safety limits are not exceeded. Regulation (EU) No. 231/2012 caps residual phosphorus content at 0.14% for potato or wheat starch sources and 0.04% for other starches.

In the U.S., the Food and Drug Administration (FDA) has classified HPDP as a safe food additive under 21 CFR 172.892 and 175.105. It is commonly used in products like bread, cereals, and cereal bars for its thickening and texture-enhancing properties. The ingredient also holds GRAS (Generally Recognized as Safe) status based on scientific review, in line with guidelines set out in 21 C.F.R. § 170.30(b).

Regulatory support is key to HPDP’s application in foods. In the EU, Regulation (EU) No. 1130/2011 confirms its safe usage under “quantum satis” conditions. In the U.S., FDA recognition ensures it meets safety standards for inclusion in a variety of processed food items.

Key Takeaways

- The Hydroxypropyl Distarch Phosphate (HDP) market is projected to grow from USD 714.3 million in 2024 to approximately USD 1,340.8 million by 2034, registering a CAGR of 6.5% during the forecast period.

- Products with Halal certification dominated the market in 2024, accounting for over 58.3% of the total HDP market share.

- The thickener segment led the functional application category, making up more than 33.6% of the global HDP market.

- The food and beverages segment was the primary end-use industry, holding a commanding 63.9% share of the global market.

- North America emerged as the leading regional market for HDP, contributing around 48.2% of global revenue, which amounted to approximately USD 344.2 million in 2024.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-hydroxypropyl-distarch-phosphate-market/free-sample/

Report Scope

| Market Value (2024) | USD 714.3 Mn |

| Forecast Revenue (2034) | USD 1340.8 Mn |

| CAGR (2025-2034) | 6.5% |

| Segments Covered | By Product Grade (Halal, Vegan), By Function (Thickener, Anticaking Agent, Emulsifier, Stabilizer, Binder, Others), By End-Use (Food and Beverages, Cosmetics, Pharmaceuticals, Personal Care, Others) |

| Competitive Landscape | Roquette Frères, AGRANA, Cargill, Tate & Lyle, Avebe, BENEO, Grain Processing Corporation, Chemstar Products Company, Shandong Fuyang Biotechnology Co. Ltd., Sinofi Ingredients |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=152828

Key Market Segments

By Product Grade Analysis: Halal Grade Leads with 58.3% Market Share Due to Rising Compliance Demand

As of 2024, Halal-grade Hydroxypropyl Distarch Phosphate (HDP) accounted for over 58.3% of the global market. This dominance stems from increasing demand for Halal-certified ingredients across industries like food, cosmetics, and pharmaceuticals especially in regions with large Muslim populations such as the Middle East, Southeast Asia, and parts of Africa. Manufacturers are increasingly aligning their processes with Halal standards to meet both religious and ethical consumer expectations, boosting the adoption of Halal-grade HDP globally.

By Function Analysis: Thickener Function Leads with 33.6% Share Due to Versatility in Food Applications

In 2024, the thickener segment secured a dominant 33.6% share of the global HDP market based on function. This is largely due to its vital role in enhancing the texture and consistency of processed foods such as sauces, soups, dairy products, and baked goods. As the demand for shelf-stable and convenience food rises, HDP has become a preferred thickening agent due to its resistance to heat, acid, and mechanical stress during production.

By End-Use Analysis: Food & Beverages Dominate with 63.9% Share Owing to Broad Utility

The food and beverages sector led the HDP market in 2024, holding over 63.9% of the total share. This strong presence reflects the ingredient’s extensive use as a stabilizer, thickener, and emulsifier in a wide array of products such as processed meals, dairy, baked goods, and sauces. Rising global consumption of convenience foods and the need for ingredients that support product stability and longer shelf life are key factors driving this segment’s growth.

Regional Analysis

North America Leads with 48.2% Market Share, Valued at USD 344.2 Million

As of 2024, North America dominates the Hydroxypropyl Distarch Phosphate (HDP) market, accounting for 48.2% of total revenue, which translates to about USD 344.2 million. This leading position is supported by a strong food processing industry, growing demand for clean-label and convenient foods, and well-established food safety regulations enforced by the U.S. FDA and Canada’s CFIA. HDP is widely used across the region in bakery goods, ready-to-eat meals, and frozen foods due to its excellent thickening, stabilizing, and freeze-thaw-resistant characteristics.

Market growth is further driven by active innovation from private companies and government interest in sustainable food production. Initiatives by the USDA and FDA that promote plant-based and stable food ingredients have contributed to the expanding use of HDP. Additionally, partnerships between research institutions and ingredient manufacturers are enhancing HDP’s effectiveness in food texture and stability applications.

Top Use Cases

1. Thickening Sauces & Gravies:

HDP is widely used to thicken sauces, gravies, and pie fillings without the need for heating. It forms smooth, shiny pastes resistant to heat and freeze-thaw cycles, improving mouthfeel and visual appeal. Its neutral flavor ensures ingredients like herbs and spices blend evenly into the final product.

2. Enhancing Dairy Texture:

In dairy items like yogurt, ice cream, and drinking creams, HDP boosts creaminess, reduces whey separation, and improves stability during pasteurization and cold storage. It preserves texture and prevents syneresis all while offering a cost-effective alternative to costly fat or gum additions, helping maintain a consistent, appealing product.

3. Fat Replacement in Low-Fat Meats:

When used in low-fat meat products like sausages and processed meats, HDP replaces up to 50% of fat while preserving texture and mouthfeel. It boosts moisture retention, viscosity, and emulsion stability, providing a leaner product with reduced calories that still satisfies consumer expectations.

4. Freezing Protection in Prepared Foods:

HDP is added to frozen meals, vegetables, doughs, and desserts to maintain structure and color through freeze-thaw cycles. It prevents water separation, retains shape, and keeps appearance and texture consistent, which enhances shelf life and consumer appeal in chilled or frozen convenience foods.

5. Stabilizing Beverages & Dressings:

In emulsified products like salad dressings, sauces, and flavored drinks, HDP stabilizes water-oil mixtures, preventing separation and sedimentation. Its freeze-thaw resilience and ability to hold particulates make it invaluable for beverages and dressings requiring long shelf life and even ingredient distribution.

6. Cosmetic & Pharmaceutical Formulations:

Beyond food, HDP serves as a stabilizer in creams, lotions, and pharmaceutical suspensions. It thickens formulations, improves spreadability, prevents ingredient separation, and controls release rates in topical and oral products enhancing quality and consistency in cosmetic and medicinal applications.

Recent Developments

Roquette Frères: Roquette continues to support pharmaceutical innovation through its Pharma Virtual Lab, offering excipients like pea starch and sorbitol that enhance hydrogen peroxide-based drug formulations for improved solubility, stability, and controlled release. This development reflects increasing demand for advanced, H₂O₂-compatible excipients in pharmaceutical manufacturing.

AGRANA: AGRANA integrates modified starches into industrial processes, though no direct hydrogen peroxide updates were found. Its product portfolio now supports technical applications such as adhesives and paper suggesting potential synergy with peroxide-based bleaching or oxidation processes.

Cargill: Cargill filed a Food Additive Petition with the FDA (Aug 30, 2022), proposing hydrogen peroxide as a safe antimicrobial, oxidizing, and bleaching agent potentially replacing sulfur dioxide in food processing. The petition (FAP 2A4833) is currently under environmental review.

Tate & Lyle: Tate & Lyle shared a new guide titled “Ingredient Innovation for a Sustainable Future,” showcasing plant-based cleaning ingredients areas where hydrogen peroxide is often used in synergy. While not peroxide-focused, this initiative confirms their push toward eco-friendly cleaning solutions where H₂O₂ might play a role.

Avebe: Avebe holds patents (via Justia) demonstrating the use of hydrogen peroxide with metal catalysts like copper for oxidizing starch (e.g. potato starch), improving viscosity and stability. This highlights Avebe’s focus on peroxide-based starch modification techniques.

BENEO: No direct hydrogen peroxide updates were found. However, BENEO continues to offer functional ingredients used in pharma and food where peroxide may be applied in processing, reflecting industry overlap even if unspecified.

Grain Processing Corporation:No specific H₂O₂ developments surfaced via public sources. GPC remains focused on starches, maltodextrins, and syrup solids for food and industrial uses, which could involve peroxide in bleaching/processing internally.

Chemstar Products Company: Chemstar (Ecolab’s subsidiary) market products containing hydrogen peroxide at 1-5% for cleaning applications such as glass cleaners and teat dips. Label info indicates peroxide presence and compliance with U.S. reporting standards (SARA 302/313).

Conclusion

Regulatory approvals under frameworks such as EU’s “quantum satis” and the FDA’s GRAS guidelines combined with widespread consumer preference for texture-stable, clean-label products, are supporting market momentum and innovation. Looking ahead, HDP’s essential role as a multifunctional ingredient in thickeners, stabilizers, and emulsifiers positions it for ongoing expansion, particularly as global food and beverage industries continue to prioritize convenience, plant-based trends, and shelf-life enhancement.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)