Table of Contents

Overview

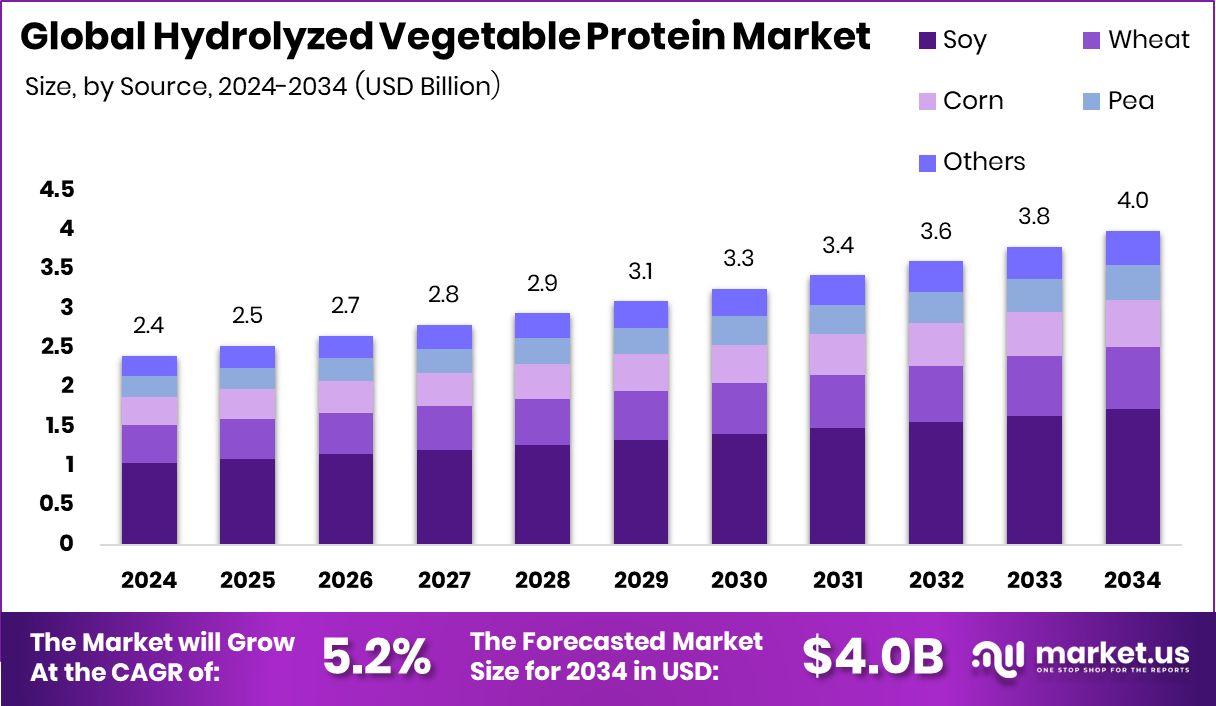

New York, NY – Nov 19, 2025 – The Global Hydrolyzed Vegetable Protein (HVP) Market is set to reach USD 4.0 billion by 2034 from USD 2.4 billion in 2024, supported by a steady 5.2% CAGR and North America’s strong 44.70% leadership.

HVP, produced by hydrolyzing vegetable proteins such as soy, corn, or wheat, delivers natural glutamates that create a clean umami taste. With consumers seeking plant-based, clean-label, and natural flavor ingredients, HVP has become essential in soups, sauces, snacks, and ready meals.

Growing interest in healthier, plant-forward eating is a major driver. This shift is reinforced by activity in the bakery and food innovation space, including Bakingo securing $16 million to scale its presence in India, signaling increased demand for ingredients that elevate taste naturally.

Sustainability-oriented flavor innovation is also rising, reflected in French fermentation startups raising $6 million to develop upcycled cocoa alternatives that align with HVP’s eco-friendly positioning.

Opportunities continue to expand across global markets and new product formats. Japan’s Umami United, raising $2 million to take plant-based egg solutions to the US and Europe, highlights the international appetite for natural umami enhancers. Likewise, The Baker’s Dozen, attracting $5 million, underscores confidence in clean-label bakery growth. Even discussions around the $3.6 million political allocation show how broader funding climates can subtly influence food innovation ecosystems.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-hydrolyzed-vegetable-protein-market/request-sample/

Key Takeaways

- The Global Hydrolyzed Vegetable Protein Market is expected to be worth around USD 4.0 billion by 2034, up from USD 2.4 billion in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034.

- Soy-based hydrolyzed vegetable protein dominates with 43.2%, offering rich umami flavor and strong plant-protein stability.

- Flavoring agents hold a 69.9% share, as HVP enhances savory depth in packaged and convenience foods.

- Processed food applications account for 39.1% due to extensive HVP use in instant meals and snacks.

- The North American market value reached approximately USD 1.0 billion, driven by strong food innovation.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=165231

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 2.4 Billion |

| Forecast Revenue (2034) | USD 4.0 Billion |

| CAGR (2025-2034) | 5.2% |

| Segments Covered | By Source (Soy, Wheat, Corn, Pea, Others), By Function (Flavoring Agent, Emulsifying Agent, Others), By Application (Bakery and Confectionery, Processed Food Products, Meat Substitutes, Beverages, Others) |

| Competitive Landscape | Ajinomoto Co., Inc., Kerry Group Plc., Aipu Food Industry, Titan Biotech, Cargill Inc., Roquette Frères, DSM, Tate & Lyle, Griffith Foods, MGP |

Key Market Segments

By Source Analysis

In 2024, soy led the hydrolyzed vegetable protein market’s by-source segment with a 43.2% share, reflecting its strong functional and economic advantages. Its rich amino acid profile, affordability, and adaptability across soups, sauces, seasonings, and ready-to-eat foods make soy-based HVP the most reliable option for delivering clean, natural umami.

Food manufacturers prefer soy due to its wide availability, consistent quality, and ability to enhance flavor without synthetic additives. As the industry continues shifting toward natural, plant-based, and sustainable protein ingredients, soy’s established supply chain and nutritional strengths further support its dominance.

Its versatility in both traditional and modern formulations, along with its balanced savory taste, ensures that soy remains the top choice for global food processors. These combined factors cement its leadership and reinforce why it continues to outperform other HVP sources in diverse processed and convenience food categories.

By Function Analysis

In 2024, Flavoring Agent dominated the Hydrolyzed Vegetable Protein Market’s By Function segment with a notable 69.9% share, driven by its essential role in boosting umami and savory depth across soups, sauces, snacks, and ready-to-eat meals. Food manufacturers increasingly turned to HVP as a clean-label, plant-based replacement for synthetic enhancers, aligning with consumer preferences for natural flavor solutions.

The segment’s leadership was strengthened by rising interest in healthier diets and the demand for authentic, full-bodied taste profiles. As brands focused on removing artificial additives, HVP-based flavoring agents became a preferred choice for delivering natural, consistent taste improvement.

Their broad application range and ability to elevate flavor without compromising product transparency made this segment the primary growth engine within the market.

By Application Analysis

In 2024, Processed Food Products led the Hydrolyzed Vegetable Protein Market’s By Application segment with a 39.1% share, supported by the rising dependence on ready-to-eat and convenience foods in rapidly urbanizing regions. HVP plays a key role in these products by enhancing flavor, improving mouthfeel, and delivering a natural umami boost without relying on artificial additives.

As consumers look for quick yet wholesome meal options, demand for plant-based and clean-label ingredients has surged. This has encouraged manufacturers to incorporate HVP into soups, sauces, instant noodles, and snack formulations to achieve richer, more authentic taste profiles.

The growing packaged food sector and continued interest in healthier, flavor-forward processed foods further reinforce the segment’s leadership, ensuring that HVP remains a preferred ingredient in modern convenience food development.

Regional Analysis

In 2024, North America led the Hydrolyzed Vegetable Protein Market with a 44.70% share, valued at USD 1.0 billion, driven by strong demand for plant-based ingredients and clean-label flavor solutions across the U.S. and Canada. Consumers’ preference for natural, protein-rich foods has pushed HVP usage in soups, sauces, and convenience meals.

Europe continued to expand steadily, supported by interest in sustainable food sources and the growing appeal of vegan and vegetarian diets. In the Asia Pacific, a rising population, rapid urbanization, and a strengthening food processing sector created significant growth potential.

Regions such as the Middle East & Africa and Latin America saw gradual adoption as modern eating habits and packaged food consumption increased. With continuous innovation and heightened consumer awareness around healthy ingredients, North America is expected to retain its leadership, while Asia Pacific remains one of the fastest-growing markets due to wider product availability and expanding local manufacturing of plant-based components.

Top Use Cases

- Flavor enhancer in soups and sauces: HVP is widely used in instant soups, sauce mixes, and gravy powders to give a strong umami taste and boost savory flavor.

- Processed meat and snack applications: It helps meat products, snack foods, and canned meals by improving taste, masking off-flavors, and reducing cost by enabling lower real-meat usage.

- Plant-based/vegan meat substitutes: HVP supports cleaner, plant-derived savoury flavour in vegetarian/vegan products, helping mimic meat taste using soy/corn/wheat proteins

- Cosmetic & hair-care ingredient: Beyond food, HVP is used in skin & hair care—e.g., as a moisturizer, humectant, film-former, and conditioning agent in hair treatments.

- Hydration and skin conditioning: In personal care formulations, HVP (plant-based amino acids/peptides) offers water-binding, skin-conditioning, and elastic-support benefits.

- Hair strengthening & anti-static applications: On hair, HVP penetrates the shaft to boost moisture, improve elasticity, reduce breakage, and act as an anti-static film on strands.

Recent Developments

- In June 2025, Ajinomoto Health & Nutrition North America, a subsidiary of Ajinomoto Co., launched two new ingredient platforms: “Salt Answer” and “Palate Perfect.” These are designed to help food manufacturers reduce sodium by up to ~30% and improve taste enhancement using umami/kokumi technologies. The relevance to HVP is that such flavor-enhancer platforms often involve amino acid or protein-derived ingredients, aligned with Ajinomoto’s HVP business.

- In November 2024, Kerry Group announced it had entered into an agreement to sell its dairy and consumer-ingredients arm, Kerry Dairy Ireland, for approximately €500 million. This shift is intended to make Kerry a “pure play” taste & nutrition company, enabling greater focus on plant-based, protein hydrolysate, and flavor-enhancing solutions.

Conclusion

The Hydrolyzed Vegetable Protein market continues to grow as food makers look for natural ways to boost flavor and improve the taste of everyday products. Its clean-label profile, plant-based origin, and ability to deliver rich umami make it a preferred choice across snacks, soups, sauces, and ready meals.

Rising interest in healthier and simpler ingredients is encouraging wider adoption, especially as consumers move away from artificial enhancers. With expanding food innovation, stronger demand for vegan and natural flavors, and steady improvements in processing technologies, HVP is set to remain an important ingredient in both traditional and modern food applications.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)