Table of Contents

Overview

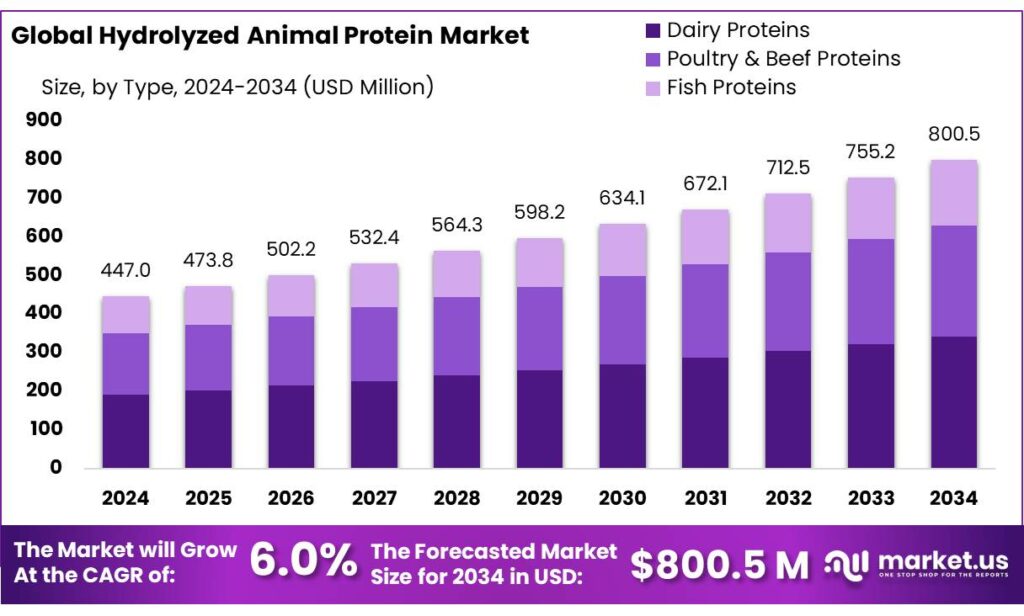

New York, NY – September 16, 2025 – The Global Hydrolyzed Animal Protein Market is projected to reach USD 800.5 million by 2034, up from USD 447.0 million in 2024, with a CAGR of 6.0% over the forecast period (2025–2034). In 2024, the Asia-Pacific region led the market, holding a 42.9% share and generating USD 33.1 billion in revenue.

Hydrolyzed animal proteins (HAP) are produced by breaking down animal-derived proteins, such as those from dairy, meat, fish, or poultry, into peptides and amino acids through enzymatic or chemical hydrolysis. This process enhances digestibility, solubility, and bioavailability, making HAP a valuable ingredient in functional foods, dietary supplements, infant and clinical nutrition, pet food, and specialized feed applications.

The clean-label, hypoallergenic, and fast-absorbing properties of HAP drive its strong demand across these industries. In India, the National Biomanufacturing Policy, the Department of Biotechnology under the Ministry of Science and Technology, promotes alternative proteins, including HAP, to bolster employment, economic growth, and environmental sustainability. Additionally, the Department of Science and Technology has launched a funding initiative to advance millet-based plant protein development. One approved project, focused on plant-based egg alternatives derived from millet, received funding of ₹8,930,000 for two years.

Key Takeaways

- The Global Hydrolyzed Animal Protein Market size is expected to be worth around USD 800.5 Million by 2034, from USD 447.0 Million in 2024, growing at a CAGR of 6.0%.

- Dairy Proteins held a dominant market position, capturing more than a 42.7% share in the Hydrolyzed Animal Protein Market.

- Powder held a dominant market position, capturing more than a 72.6% share in the Hydrolyzed Animal Protein Market.

- Food held a dominant market position, capturing more than a 39.2% share in the Hydrolyzed Animal Protein Market.

- North America held a dominant market position, capturing more than a 49.3% share worth USD 220.3 million.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/hydrolyzed-animal-protein-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 447.0 Million |

| Forecast Revenue (2034) | USD 800.5 Million |

| CAGR (2025-2034) | 6.0% |

| Segments Covered | By Type (Dairy Proteins, Poultry and Beef Proteins, Fish Proteins), By Form (Powder, Liquid), By Application (Food, Pharmaceuticals and Nutraceuticals, Cosmetics and Personal Care, Feed, Others) |

| Competitive Landscape | Arla Foods Ingredients Group P/S, BRF S.A., Cargill, Inc., Fonterra Co-operative Group, GELITA, Kemin Industries, Inc., Kerry, Inc., Lactalis Ingredients, Novozymes A/S |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=156442

Key Market Segments

By Type Analysis

Dairy Proteins Lead with 42.7% Market Share in 2024

In 2024, dairy proteins commanded a leading 42.7% share of the Hydrolyzed Animal Protein Market, driven by their extensive use in infant formulas, sports nutrition, and medical nutrition products. Hydrolyzed whey and casein proteins are prized for their superior amino acid profiles, high digestibility, and proven benefits for muscle growth and recovery, making them a top choice for athletes and individuals with specialized dietary needs.

Dairy proteins are poised to maintain their dominance, fueled by advancements in hydrolysis technology that improve solubility and reduce allergenicity. The growing demand for protein-enriched beverages, clinical nutrition, and functional foods further solidifies their market position. Manufacturers are increasingly promoting hydrolyzed dairy proteins as “highly digestible” and “clinically validated,” enhancing their appeal to health-conscious consumers.

By Form Analysis

Powder Dominates with 72.6% Market Share in 2024

In 2024, powdered hydrolyzed proteins held a commanding 72.6% share of the Hydrolyzed Animal Protein Market. Their popularity stems from a long shelf life, ease of transport, and versatility in applications across food, beverages, dietary supplements, and clinical nutrition. Powdered forms are easily incorporated into products like infant formulas, protein shakes, baked goods, and medical foods, offering manufacturers unmatched flexibility and commercial viability.

Powders are expected to retain their market leadership, driven by rising global demand for protein-rich and functional foods. Their ease of dosing, storage, and integration into large-scale food processing systems ensures cost-effectiveness and formulation versatility. With the surge in popularity of sports nutrition and health supplements, powdered hydrolyzed proteins will continue to drive innovation and market growth, solidifying their position as the foundation of the hydrolyzed animal protein market.

By Application Analysis

Food Segment Leads with 39.2% Market Share in 2024

In 2024, the food segment captured a leading 39.2% share of the Hydrolyzed Animal Protein Market, driven by its widespread use in baked goods, soups, sauces, and ready-to-eat meals. Hydrolyzed proteins serve as natural flavor enhancers and functional ingredients, improving taste, texture, and nutritional value while meeting consumer demand for protein-rich, clean-label products.

The food segment is expected to maintain its dominance as global dietary preferences shift toward higher protein consumption. Increased awareness of hydrolyzed proteins’ digestibility and their role in health-focused products, such as fortified snacks and functional beverages, further boosts their adoption. The trend toward reducing artificial additives has also spurred manufacturers to use hydrolyzed proteins as natural alternatives for flavor and nutrition.

Regional Analysis

In 2024, North America led the Hydrolyzed Animal Protein market, securing over 49.3% of the market share, valued at USD 220.3 million. This dominance stems from a well-established food and beverage sector that leverages hydrolyzed proteins for enhanced flavor, improved texture, and fast digestibility in products like soups, sauces, ready meals, snacks, and fortified bakery goods. The sports and active-lifestyle segment significantly boosts demand, with fast-absorbing hydrolyzed proteins used in powders, ready-to-drink beverages, and performance snacks to aid rapid recovery.

Additionally, the clinical and medical nutrition industries utilize hydrolysates for their digestibility and precise amino acid delivery in specialized formulas. Clear regulations and robust quality systems in the U.S. and Canada accelerate commercialization, supported by well-defined specifications, validated HACCP programs, and reliable traceability, ensuring a low-risk supply chain for major buyers.

Top Use Cases

- Infant Nutrition Formulas: Hydrolyzed animal proteins, like whey and casein, are key in baby formulas to make them easy to digest and reduce allergy risks. They provide essential amino acids for healthy growth without upsetting tiny tummies. Parents love them for supporting strong development in sensitive little ones, making formulas a go-to choice in early feeding.

- Sports and Fitness Supplements: Athletes use hydrolyzed animal proteins in shakes and bars for quick muscle repair and growth after workouts. Their high digestibility means faster energy and less bloating, helping folks hit fitness goals. With more people chasing active lifestyles, these proteins boost performance in gyms worldwide.

- Pet Food for Sensitive Animals: In dog and cat kibble, hydrolyzed proteins from chicken or fish cut allergy triggers while keeping meals tasty and nutritious. They improve gut health and coat shine, easing digestion for picky or sensitive pets. Pet owners rely on them for happier, healthier furry friends

- Animal Feed for Livestock: Farmers add hydrolyzed animal proteins to pig, chicken, and fish feeds to speed up growth and strengthen immunity. Sourced from by-products, they offer balanced nutrition at low cost, cutting waste and boosting farm yields. This keeps animals thriving in busy production setups.

- Functional Foods and Beverages: Bakers and drink makers mix hydrolyzed proteins into soups, snacks, and protein waters to amp up nutrition and flavor naturally. They enhance texture without fake additives, appealing to health fans seeking clean eats. This trend helps create yummy, protein-packed options for daily diets.

Recent Developments

1. Arla Foods Ingredients Group P/S

Arla Foods Ingredients is focusing on bioactive peptides from milk, specifically for medical nutrition. Their recent development is the launch of a new whey protein hydrolysate, Lacprodan HYDRO.365, designed to support muscle maintenance in healthy aging. This product addresses sarcopenia by offering a high-quality, easily absorbed protein source tailored for senior nutrition.

2. BRF S.A.

BRF S.A., through its subsidiary Sadia, is innovating in value-added product segments. A key development is expanding its line of processed meats, including turkey-based hydrolyzed proteins. These ingredients are used to enhance flavor and nutritional profiles in soups, stocks, and ready-to-eat meals, catering to the Brazilian market’s demand for convenience and taste without compromising on protein content.

3. Cargill, Inc.

Cargill is investing in sustainable and clean-label protein solutions. Their recent development includes expanding production capabilities for their hydrolyzed collagen peptides at their Campo Grande, Brazil, facility. This expansion significantly increases their output of Verisol and Gelita brands, meeting the growing global demand for collagen-based supplements that support skin, bone, and joint health.

4. Fonterra Co-operative Group

Fonterra is advancing its research into dairy-derived bioactive peptides. A recent development is their studies on specific milk protein hydrolysates that demonstrate cognitive health benefits. This research focuses on peptides that may help manage stress and improve sleep quality, positioning their ingredients for the growing wellness and functional food markets beyond basic nutrition.

5. GELITA AG

GELITA, a global leader in collagen peptides, recently launched a new product, BODYBALANCED. This specific hydrolyzed collagen is clinically shown to prevent the loss of bone density in postmenopausal women. This innovation directly targets the health and wellness sector, providing a scientifically-backed, protein-based solution for managing osteoporosis and supporting long-term musculoskeletal health.

Conclusion

Hydrolyzed Animal Protein is fueled by health trends like high-protein diets and clean labels; it’s a star in sports drinks, pet treats, and farm feeds. Innovations in gentle processing make it more versatile and sustainable, turning waste into wellness gold. Challenges like vegan shifts exist, but demand for easy-digest options keeps it strong, expecting even bigger roles in everyday nutrition as folks prioritize fitness and eco-friendly eats. Overall, it’s a smart bet for steady, feel-good growth.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)