Table of Contents

Overview

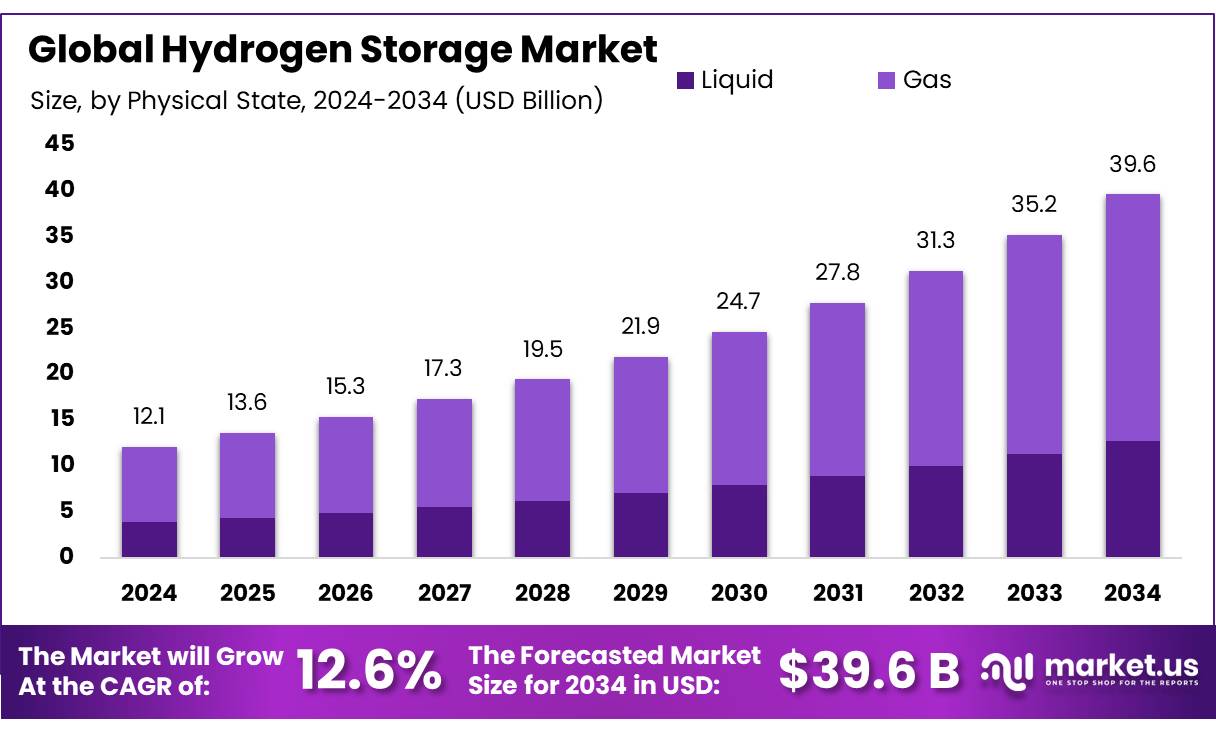

New York, NY – August 06, 2025 – The Global Hydrogen Storage Market is projected to reach USD 39.6 billion by 2034, up from USD 12.1 billion in 2024, with a CAGR of 12.6% over the 2025–2034 period. In 2024, the Asia-Pacific region led the market, holding a 38.6% share and generating USD 4.6 billion in revenue.

Hydrogen storage is crucial for advancing a low-carbon energy future, enabling efficient hydrogen use and transport in sectors like energy, transportation, and industry. Storage technologies include compressed gas, liquid hydrogen, and advanced material-based systems, each addressing specific needs for energy density, safety, and cost. In India, hydrogen storage infrastructure is expanding, supported by government policies and private investments.

India’s National Green Hydrogen Mission, launched in January 2023, aims to position the country as a global leader in green hydrogen production and use. Key measures include waiving interstate transmission charges for renewable energy used in hydrogen production and funding Hydrogen Valleys in cities like Pune, Jodhpur, Bhubaneswar, and Kerala, each allocated USD 50 crore to develop regional hubs for production, storage, and utilization.

Globally, the U.S. and Australia are also advancing hydrogen storage. The U.S. National Hydrogen Strategy and Roadmap emphasizes large-scale hydrogen production and application in transportation and industry. Australia’s National Hydrogen Strategy targets up to USD 300 billion in investments to establish the country as a major global hydrogen market player.

Key Takeaways

- The Hydrogen Storage Market is projected to reach USD 39.6 billion by 2034, growing from USD 12.1 billion in 2024, at a CAGR of 12.6%.

- By physical state, gas held the leading position in 2024, capturing more than 67.9% of the market share.

- By type, cylinder-based storage dominated the market in 2024 with a share exceeding 42.2%.

- By technology, compression was the most widely adopted method in 2024, holding over 58.3% of the market share.

- By application, the chemicals segment accounted for the largest portion in 2024, securing more than 34.8% of the total market.

- Asia-Pacific (APAC) emerged as the leading regional market in 2024, contributing 38.6% of global share and generating approximately USD 4.6 billion in revenue.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-hydrogen-storage-market/request-sample/

Report Scope

| Market Value (2024) | USD 12.1 Billion |

| Forecast Revenue (2034) | USD 39.6 Billion |

| CAGR (2025-2034) | 12.6% |

| Segments Covered | By Physical State (Liquid, Gas), By Type (Cylinder, Merchant/Bulk, On-site, On-board), By Technology (Compression, Liquefaction, Material Based), By Application (Chemicals, Oil Refineries, Metalworking, Automotive and Transportation, Others) |

| Competitive Landscape | Air Liquide, Air Products Inc., Cummins Inc., Engie, ITM Power, Iwatani Corporation, Linde plc, Nedstack Fuel Cell Technology BV, Nel ASA, Steelhead Composites Inc. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153470

Key Market Segments

By Physical State Analysis

In 2024, gaseous hydrogen storage dominated the market, holding a 67.9% share due to the widespread use of compressed hydrogen systems and their compatibility with existing production and transport infrastructure. Gas storage is favored for its simplicity, scalability, and proven technology, making it ideal for industrial, mobility, and energy storage applications.

High-pressure tanks enable flexible storage for both stationary and mobile systems. Compared to liquid or solid-state storage, gaseous hydrogen’s cost-effectiveness and ease of handling solidify its market leadership. As hydrogen demand grows in transportation, power, and refining, gas storage’s minimal infrastructure requirements and rapid deployment ensure its dominance in developed and emerging markets.

By Type Analysis

In 2024, cylinders captured a 42.2% share of the hydrogen storage market, driven by their practicality and proven performance across diverse applications. Used for storing compressed hydrogen at 200–700 bar, cylinders are ideal for stationary setups, fuel cell vehicles, and backup power systems.

Their ease of use, reusability, and compliance with established standards make them a preferred choice in laboratories, industrial sites, and pilot hydrogen projects. Cylinders’ adaptability supports small- and medium-scale hydrogen distribution, sustaining demand amid growing hydrogen use in transportation and decentralized energy systems in 2024.

By Technology Analysis

In 2024, compression technology led the hydrogen storage market with a 58.3% share, attributed to its reliability, simplicity, and affordability. Storing hydrogen at 350–700 bar, compression is well-suited for fuel cell vehicles, industrial applications, and backup energy systems.

Its widespread use in refueling stations and storage hubs, supported by established supply chains, lowers installation and operational costs. As decarbonization efforts intensify and hydrogen’s role in energy transitions expands, compression’s accessibility and scalability ensure its market leadership in 2024.

By Application Analysis

In 2024, the chemical sector held a 34.8% share of the hydrogen storage market, driven by hydrogen’s critical role as a feedstock in ammonia production, methanol synthesis, and refining. The growing push for cleaner production methods increases demand for reliable storage to ensure a steady hydrogen supply, especially with variable renewable energy inputs.

The shift toward low-emission and green hydrogen in chemical facilities further emphasizes the need for efficient storage systems. As global decarbonization priorities strengthen, the chemical industry’s reliance on hydrogen sustains its leading position in storage applications in 2024.

Regional Analysis

Asia-Pacific (APAC) led the hydrogen storage market in 2024, capturing a 38.6% share and generating USD 4.6 billion in revenue. This dominance stems from industrial growth, strong government support, and significant investments in hydrogen infrastructure. APAC leads in adopting compressed and solid-state storage technologies, enhanced by safety and scalability.

Government incentives and funding for compression and liquefaction facilities lower adoption barriers. The region’s push to electrify industries and heavy-duty transportation, coupled with hydrogen’s role in replacing fossil fuels, drives demand for storage solutions. APAC’s leadership is set to continue beyond 2024, supported by robust policies, infrastructure development, and growing demand across industrial, mobility, and energy sectors.

Top Use Cases

- Fuel Cell Vehicles: Hydrogen storage powers fuel cell electric vehicles (FCEVs), using high-pressure tanks to store compressed hydrogen. It enables zero-emission transport, offering quick refueling and long ranges. Ideal for heavy-duty vehicles like buses and trucks, it supports the automotive sector’s shift to clean energy, reducing reliance on fossil fuels.

- Renewable Energy Storage: Hydrogen storage captures excess energy from solar or wind through electrolysis, storing it as gas or liquid. It ensures a steady energy supply during low production periods, enhancing grid stability. This use case supports renewable integration, making it vital for sustainable energy systems and decarbonization goals.

- Industrial Applications: Hydrogen storage supports chemical industries, like ammonia and methanol production, by providing a reliable feedstock. Stored hydrogen ensures a continuous supply for industrial processes, even with variable renewable energy inputs. It aids decarbonization in heavy industries, reducing emissions while maintaining operational efficiency.

- Power Generation: Hydrogen storage enables clean power generation via fuel cells or turbines, especially for backup power. It stores energy for use when grid power is unavailable, supporting sectors like telecom, healthcare, and data centers. This ensures reliable, low-emission electricity for critical infrastructure and remote locations.

- Portable Power Systems: Hydrogen storage powers portable devices, such as generators for remote sites or emergency response. Compact storage solutions, like cylinders, deliver clean energy for construction, disaster relief, or military use. This flexibility supports off-grid applications, reducing reliance on diesel generators.

Recent Developments

1. Air Liquide

Air Liquide has invested in large-scale liquid hydrogen storage solutions, notably for heavy mobility and industrial applications. The company recently commissioned a new liquid hydrogen storage facility in Nevada, USA, to support fuel cell electric vehicles (FCEVs). They are also exploring advanced cryogenic storage technologies to improve efficiency.

2. Air Products Inc.

Air Products is developing green hydrogen projects with integrated storage solutions, such as their NEOM project in Saudi Arabia, which includes large-scale hydrogen storage. They also partnered with the U.S. DOE to demonstrate advanced liquid hydrogen storage for transportation.

3. Cummins Inc.

Cummins, through its Accelera brand, is advancing hydrogen storage for fuel cell applications. They are working on high-pressure storage tanks (700 bar) for trucks and buses, collaborating with vehicle manufacturers to enhance storage safety and capacity.

4. Engie

Engie is focusing on underground hydrogen storage in salt caverns, particularly in Europe. Their HyPSTER project in France aims to demonstrate large-scale renewable hydrogen storage, supporting grid stability and industrial decarbonization.

5. ITM Power

ITM Power is integrating hydrogen storage with electrolysis solutions, offering pressurized storage systems for refueling stations. Their recent projects include collaborations with Shell and other energy firms to optimize storage for green hydrogen production.

Conclusion

The Hydrogen Storage Market is poised for strong growth, driven by its critical role in clean energy transitions. Applications in transportation, power generation, and industry highlight its versatility. Advancements in compression, liquid, and solid-state storage technologies are enhancing efficiency and safety, while government support and infrastructure investments fuel adoption. As demand for sustainable energy rises, hydrogen storage will be key to achieving global decarbonization goals.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)