Table of Contents

Overview

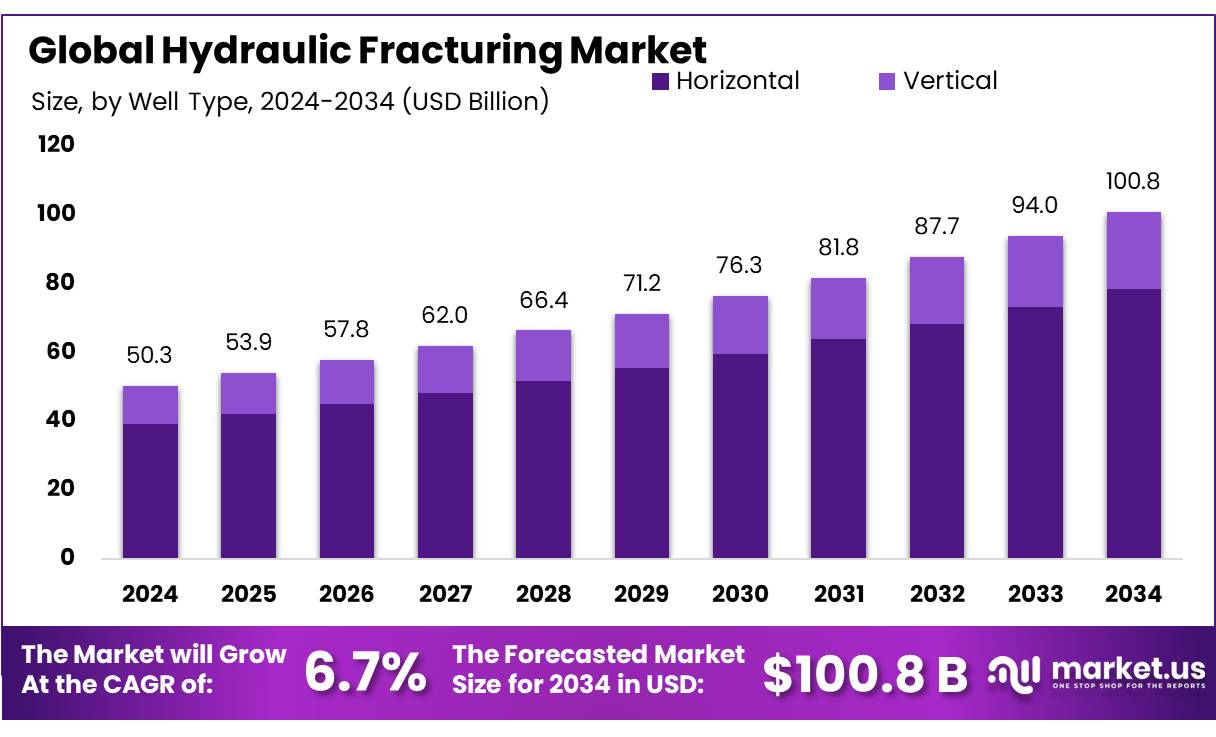

New York, NY – August 08, 2025 – The Global Hydraulic Fracturing Market is projected to grow from USD 50.3 billion in 2024 to approximately USD 100.8 billion by 2034, achieving a CAGR of 6.7% during the forecast period from 2025 to 2034. In 2024, North America led the market, accounting for a 42.8% share, equivalent to USD 21.5 billion in revenue.

Hydraulic fracturing concentrates are specialized chemical additives and proppants combined with water to form a high-pressure fluid used to stimulate tight oil and gas reservoirs. These concentrates typically include proppants, such as silica sand or ceramic beads, and chemical additives like surfactants, biocides, scale inhibitors, friction reducers, and anti-corrosion agents. Their primary function is to create and maintain fractures in shale or tight rock formations, enabling the flow of hydrocarbons.

The U.S. Energy Information Administration, hydraulic fracturing wells produced over 4.3 million barrels per day by 2015, representing about 50% of total U.S. crude oil production. In contrast, in 2000, approximately 23,000 fracked wells produced just 102,000 barrels per day, accounting for less than 2% of U.S. oil output. The Independent Petroleum Association of America reports that over 1.7 million U.S. wells have been completed using hydraulic fracturing, yielding a cumulative total of more than seven billion barrels of oil and 600 trillion cubic feet of natural gas.

Regulatory requirements, such as the U.S. Environmental Protection Agency’s FracFocus Chemical Disclosure Registry, have driven demand for standardized chemical formulations. By March 2013, the registry recorded over 38,000 well disclosures, providing chemical composition data for more than 37,000 wells. Government initiatives, including the EPA’s state-of-the-science study on hydraulic fracturing under the Safe Drinking Water Act, promote transparency and enforce stricter standards for fluid composition and wastewater management.

Key Takeaways

- The Global Hydraulic Fracturing Market is projected to reach USD 100.8 billion by 2034, up from USD 50.3 billion in 2024, registering a CAGR of 6.7% during the forecast period.

- In 2024, horizontal wells accounted for a 78.2% share, reflecting their widespread adoption in shale formations for higher recovery efficiency.

- Plug & Perf emerged as the leading fracturing technology in 2024, capturing over 69.8% of the market share due to its operational flexibility and cost-effectiveness.

- Slick water-based fluids dominated the fluid segment with a 56.1% share in 2024, driven by their low viscosity and reduced friction in horizontal well operations.

- Shale gas applications led the market in 2024, holding a 58.3% share, supported by the expansion of shale resource development globally.

- North America was the leading regional market in 2024, accounting for a 42.8% share and generating around USD 21.5 billion in revenue, driven by strong shale drilling activity in the U.S. and Canada.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-hydraulic-fracturing-market/request-sample/

Report Scope

| Market Value (2024) | USD 50.3 Billion |

| Forecast Revenue (2034) | USD 100.8 Billion |

| CAGR (2025-2034) | 6.7% |

| Segments Covered | By Well Type (Horizontal, Vertical), By Technology (Plug and Perf, Sliding Sleeve), By Fluid Type (Slick Water-based Fluid, Foam-based Fluid, Gelled Oil-based Fluid, Others), By Application (Shale Gas, Tight Oil, Tight Gas) |

| Competitive Landscape | AFG Holdings, Inc., Baker Hughes, Calfrac Well Services Ltd., GD Energy Products, LLC, Halliburton, Liberty Oilfield Services LLC, National Energy Services Reunited Corp., NexTier Oilfield Solutions, Patterson-UTI Energy, Inc., Petro Welt Technologies AG, ProPetro Holding Corp., Schlumberger, STEP Energy Services, TechnipFMC plc, Trican, Weatherford |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153737

Key Market Segments

By Well Type Analysis

Horizontal wells led the global hydraulic fracturing market in 2024, commanding a 78.2% share due to their superior efficiency in shale formations. Their dominance stems from widespread adoption in major U.S. shale plays, such as the Permian Basin and Marcellus Shale, where they access larger rock surfaces for enhanced oil and gas extraction from tight formations. The ability to perform multiple fracturing stages in a single wellbore reduces the need for additional vertical wells, lowering operational costs.

By Technology Analysis

In 2024, Plug & Perf technology held a 69.8% share of the hydraulic fracturing market, favored for its flexibility and proven performance, particularly in horizontal well completions. This method’s operational simplicity allows operators to isolate and perforate multiple zones in stages, offering precise control over the fracturing process. Its adaptability across diverse geological conditions, such as the Bakken and Permian fields, has solidified its preference among oilfield service providers.

By Fluid Type Analysis

Slick Water-based Fluid captured a 56.1% share of the hydraulic fracturing market in 2024, driven by its cost-efficiency and low viscosity. Composed primarily of water and friction reducers, this fluid effectively carries proppants deep into fractures, making it ideal for shale formations. Its low viscosity enables high pumping rates, critical for horizontal fracturing operations.

By Application Analysis

Shale Gas accounted for a 58.3% share of the hydraulic fracturing market in 2024, fueled by extensive shale development in North America, particularly in the Marcellus, Eagle Ford, and Permian basins. Hydraulic fracturing is the primary method for extracting gas from tight shale formations, supporting the global shift toward natural gas as a cleaner energy alternative to coal.

Regional Analysis

North America held a 42.8% share of the global hydraulic fracturing market in 2024, generating approximately USD 21.5 billion in revenue. This dominance is driven by the extensive shale formations in the U.S. and Canada, supported by advanced infrastructure and industry expertise. In Canada, formations like Duvernay, Montney, and Horn River have facilitated over 170,000 fractured wells, with unconventional gas reserves estimated at up to 1.3 quadrillion cubic feet. Regulatory frameworks, such as the U.S. EPA’s FracFocus registry and Canadian tax incentives, enhance transparency and encourage investment, sustaining North America’s market leadership.

Top Use Cases

- Shale Gas Extraction: Hydraulic fracturing unlocks natural gas trapped in shale formations, boosting production in regions like the Marcellus and Permian basins. It uses high-pressure fluid to create fractures, allowing gas to flow freely. This method supports energy demands, reduces reliance on coal, and enhances energy security with cleaner-burning fuel.

- Tight Oil Recovery: Fracking enables the extraction of oil from tight rock formations, like those in the Bakken shale. By injecting water, sand, and chemicals, it creates pathways for oil to flow. This increases output from unconventional reserves, meeting global oil demand while optimizing production in low-permeability reservoirs.

- Enhanced Well Productivity: Hydraulic fracturing improves well efficiency by creating multiple fractures in a single wellbore. Techniques like plug and perf allow precise targeting of hydrocarbon-rich zones. This maximizes output, reduces the need for additional wells, and lowers operational costs, especially in horizontal drilling projects.

- Water Management Solutions: Fracking operations increasingly use treated and recycled produced water to reduce freshwater use. In regions like Pennsylvania, wastewater is reused, minimizing environmental impact. This practice supports sustainable operations, aligns with regulations, and creates opportunities for water treatment innovations in the industry.

- Energy Transition Support: Hydraulic fracturing aids the shift to cleaner energy by increasing natural gas production, a lower-emission alternative to coal. It supports power generation and industrial needs while renewable energy scales up. This transitional role ensures energy stability in developing economies like India and China.

Recent Developments

1. AFG Holdings, Inc

AFG Holdings, a subsidiary of American Fabrication Group, has been focusing on advanced manufacturing solutions for hydraulic fracturing equipment. Recently, they expanded their production capabilities to support high-pressure pumping systems used in fracking operations. Their innovations aim to improve durability and efficiency in harsh drilling environments. AFG continues to collaborate with major oilfield service providers to enhance equipment performance.

2. Baker Hughes

Baker Hughes has been advancing low-carbon fracking technologies, including electric frac pumps and emissions-reduction systems. Their NuVista frac fleet integrates AI-driven analytics to optimize well performance. Recently, they partnered with Chesapeake Energy to deploy next-gen fracturing solutions that reduce methane emissions. Baker Hughes is also investing in water recycling technologies to minimize environmental impact.

3. Calfrac Well Services Ltd.

Calfrac has been expanding its sustainable fracturing services, including CO₂-based fracking to reduce water usage. They recently secured contracts in the Permian Basin for high-efficiency multi-well pad operations. Calfrac is also testing bio-based fracturing fluids to lower environmental impact. Their focus remains on cost-effective, eco-friendly solutions for shale producers.

4. GD Energy Products, LLC

GD Energy Products (GDEP) has introduced Titan Frac pumps, designed for higher pressure and longer lifespan in fracking operations. They recently partnered with a major E&P company to deploy electric frac fleets, reducing diesel consumption. GDEP is also innovating in real-time frac monitoring systems to enhance operational efficiency.

5. Halliburton

Halliburton continues to lead in digital fracking with their SmartFleet automated fracturing system. Their recent CleanStim eco-friendly fluid technology reduces chemical usage. Additionally, Halliburton is working on carbon-neutral fracking initiatives, including partnerships for geothermal and CCS (Carbon Capture & Storage) integration.

Conclusion

Hydraulic Fracturing is a key driver in meeting global energy demands, particularly through shale gas and tight oil extraction. Its applications extend beyond traditional oil and gas, supporting geothermal energy and carbon capture initiatives. Despite environmental challenges, advancements in water recycling and eco-friendly technologies enhance sustainability. The market is poised for growth, driven by energy needs and technological innovation, especially in North America and emerging economies.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)