Table of Contents

Overview

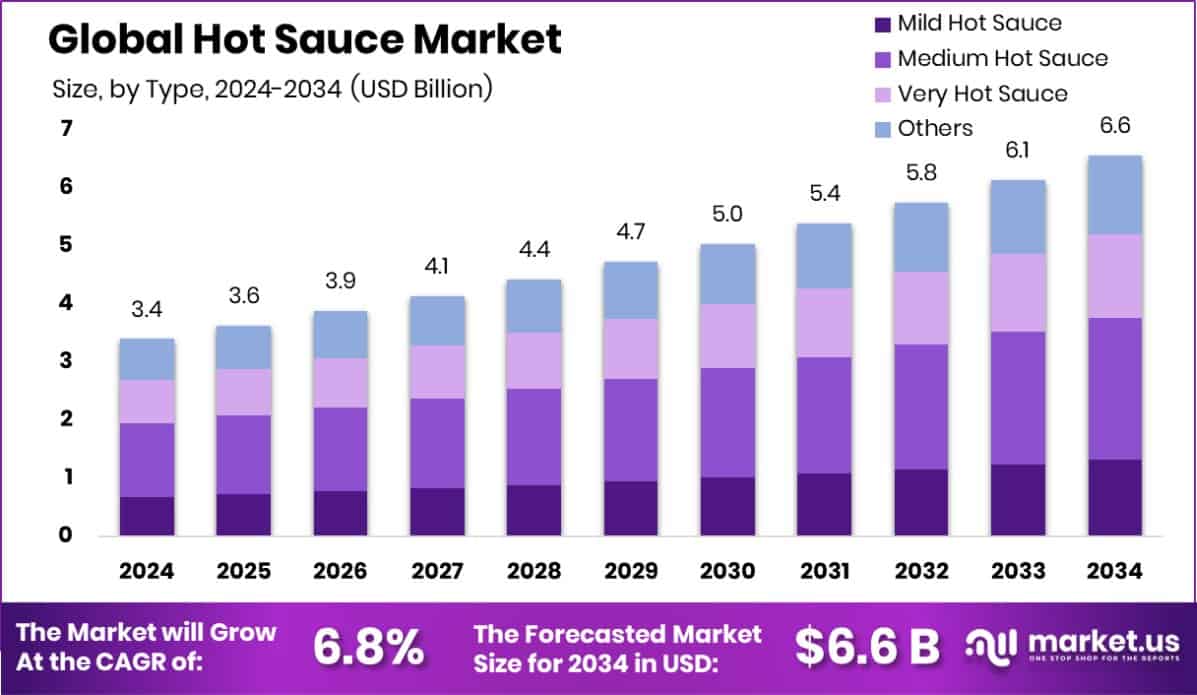

New York, NY – Oct 17, 2025 – The global Hot Sauce Market is projected to reach approximately USD 6.6 billion by 2034, rising from USD 3.4 billion in 2024, with a CAGR of 6.8% between 2025 and 2034. North America is expected to account for about USD 1.5 billion of the market value, representing 46.30% of total global sales.

Hot sauce is a spicy condiment primarily made from chili peppers, combined with ingredients such as vinegar, salt, and sometimes fruits or vegetables to enhance flavor. Its heat level and taste profile can range from mild to extremely hot, appealing to various culinary preferences worldwide. It is widely used to add spice and depth to dishes across global cuisines.

The hot sauce market encompasses the production, distribution, and sale of diverse sauce varieties, catering to consumers seeking to elevate meals with heat and bold flavors. Its growth is fueled by the rising popularity of ethnic cuisines, where hot sauce is a staple, and by increasing consumer appetite for adventurous and spicy tastes.

Expanding culinary exploration and a growing interest in gourmet dining experiences have boosted demand for unique hot sauces. Fast-casual dining venues often featuring spicy condiments, the rise of home cooking, and interest in the health benefits of capsaicin such as metabolism enhancement are further driving market growth.

Opportunities lie in the increasing demand for natural and organic products. Producers can capitalize by offering sauces made from organically grown ingredients without artificial additives and by introducing regional and global chili varieties for consumers seeking authentic, novel flavors.

In August 2024, Sauce.vc closed its third fund at INR 365 crore (~USD 43.6 million), surpassing its INR 250 crore target. Primarily backed by domestic investors, the fund aims to invest INR 5 crore in 12-15 companies initially, reserving 75% for follow-on investments in high-performing ventures.

Key Takeaways

- The global hot sauce market is projected to reach approximately USD 6.6 billion by 2034, rising from USD 3.4 billion in 2024, with a CAGR of 6.8% between 2025 and 2034.

- Medium hot sauce leads the category, accounting for 37.30% of the market.

- Tabasco Pepper Sauce is the top product type, holding a 28.30% market share.

- Bottled packaging remains the most popular, representing 73.40% of sales.

- Cooking sauce applications dominate, capturing 59.30% of the market segment.

- North America leads globally with a 46.30% market share, valued at USD 1.5 billion.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-hot-sauce-market/free-sample/

Report Scope

| Market Value (2024) | USD 3.4 Billion |

| Forecast Revenue (2034) | USD 6.6 Billion |

| CAGR (2025-2034) | 6.8% |

| Segments Covered | By Type (Mild Hot Sauce, Medium Hot Sauce, Very Hot Sauce, Others), By Product Type (Tabasco Pepper Sauce, Habanero Pepper Sauce, Jalapeno Sauce, Sweet and Spicy Sauce, Peanut Butter Hot Sauce, Chipotle Hot Sauce, Asian-Style Hot Sauce, Others), By Packaging (Jars, Bottles, Others), By Application (Cooking Sauce, Table Sauce, Others) |

| Competitive Landscape | Baumer Foods Inc., Campbell Soup Company, Conagra Brands Inc., Hormel Foods Corporation, McCormick & Company, Inc., McIlhenny Company, Southeastern Mills, Inc., T.W. Garner Food Company, The Kraft Heinz Company, Unilever PLC |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=145107

Key Market Segments

By Type Analysis

Medium Hot Sauce leads the market with a 37.30% share.

In 2024, Medium Hot Sauce dominated the “By Type” segment of the Hot Sauce Market, accounting for 37.30% of sales. Its popularity stems from a balanced flavor profile that delivers satisfying heat without overpowering a dish’s original taste. This moderate spiciness appeals to a wide consumer base, making it a favorite in both households and restaurants. It is especially popular in regions where people prefer a moderate heat level yet enjoy the nuanced flavors these sauces bring to different cuisines. The segment’s strong performance reflects a growing market trend consumers seeking flavorful complexity with manageable heat, expanding its culinary versatility and broadening overall appeal.

By Product Type Analysis

Tabasco Pepper Sauce dominates product types with a 28.30% share.

In 2024, Tabasco Pepper Sauce held the top position in the “By Product Type” segment, securing 28.30% of the market. Known for its distinctive flavor and moderate heat, it remains a global favorite. Its versatility across cuisines from breakfast dishes to cocktails along with a trusted brand reputation, has sustained its strong market presence. Tabasco’s strategy of introducing new flavor variations while preserving its iconic original recipe has expanded its customer base. Widely used in homes and commercial kitchens alike, its consistent quality and adaptability showcase consumer loyalty to established brands that successfully blend tradition with innovation.

By Packaging Analysis

Bottles are the preferred packaging, representing 73.40% of the market.

In 2024, bottled packaging dominated the “By Packaging” segment with a 73.40% share. Favored for their durability, practicality, and ability to preserve flavor, bottles made from glass or plastic remain the top choice for both producers and consumers. Transparent packaging enhances product visibility, influencing purchasing decisions. Easy-to-use caps or droppers provide controlled dispensing, minimizing waste and mess key benefits in both household and commercial settings. Glass bottles, often viewed as premium and eco-friendly, also align with growing sustainability trends, further boosting consumer preference for bottled hot sauce packaging.

By Application Analysis

Cooking Sauce leads with a 59.30% share.

In 2024, Cooking Sauce dominated the “By Application” segment, capturing 59.30% of the market. Its popularity highlights the increasing use of hot sauce as a cooking ingredient rather than just a tabletop condiment. Home cooks and professional chefs are integrating hot sauce into marinades, stir-fries, stews, and baked dishes for added heat, tang, and complexity. This trend reflects a shift toward bold flavors in everyday meals and supports higher repeat purchases, as consumers often opt for larger packaging sizes for cooking purposes. The category’s strength underscores its role as a kitchen essential in global cuisines that embrace spice.

Regional Analysis

North America leads the hot sauce market, holding a 46.30% share valued at USD 1.5 billion.

The global hot sauce market is divided into five major regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. North America dominates, driven by a strong preference for spicy foods and a culturally diverse population that has integrated hot sauce into everyday cooking.

In Europe, growth is fueled by the rising popularity of ethnic cuisines, with hot sauces increasingly used to enhance traditional recipes. The Asia Pacific region shows significant potential, supported by rapid urbanization and the widespread use of spicy condiments in local dishes. In the Middle East & Africa, adoption is gradually increasing as global trade and culinary exchange introduce more diverse condiment options.

Latin America, with its deep-rooted tradition of chili-based sauces, continues to innovate with new flavors and varieties, further strengthening its market presence. Regional culinary preferences and demographic trends collectively shape the market’s dynamic and diverse landscape.

Top Use Cases

- Brand Collaboration and Cross-Promotion:

Hot sauce brands partner with complementary food and beverage companies like snack makers or craft breweries for limited-edition co-branded products. These collaborations spark buzz, expand brand visibility, and tap into established customer bases, creating marketing momentum and driving incremental sales.

2. Convenient Packaging Formats for Modern Lifestyles:

Innovative packaging such as single-serve packets, spray bottles, and sachets meet the demands of today’s on-the-go consumers. These formats offer controlled application and portability, enhancing consumer convenience and supporting use cases like portion control, travel-friendly options, and efficient dispensing in varied dining situations.

3. Data-Driven E-Commerce & Subscription Models:

Leveraging online platforms, hot sauce brands sell directly to consumers with rich descriptions, honest ingredient transparency, and personalized recommendations. Subscription services like “Sauce of the Month” kits foster recurring purchases, deepen brand engagement, and provide customer insights for better product positioning and retention strategies.

4. Product Innovation and Flavor Diversification:

Brands develop unique blends combining fruits, exotic ingredients, or crossover flavors to attract adventurous eaters. Whether inspired by artisanal techniques or exotic regional tastes, innovation in flavors helps differentiate products in a crowded market and appeals to niche and premium-seeking consumers.

5. Cooking Ingredient Integration:

Hot sauce increasingly serves not just as a table condiment but as a cooking ingredient. Consumers incorporate it into marinades, stir-fries, soups, and baked dishes to add heat and depth. This trend supports larger packaging sizes, repeat purchases, and positions hot sauce as an essential kitchen staple.

6. Health and Functional Benefits Positioning:

With rising interest in capsaicin’s metabolism-boosting and antioxidant effects, hot sauce marketers emphasize functional health benefits. Positioning hot sauce as a flavorful yet health-aligned ingredient appeals to wellness-oriented consumers and supports dietary applications beyond traditional spicy enjoyment.

Recent Developments

1. Baumer Foods Inc.

- Family-owned Baumer Foods continues to produce its signature Crystal Hot Sauce, now shipping around 3 million gallons annually to over 75 countries. After Hurricane Katrina, they relocated their operations to Reserve, Louisiana, and recreated the iconic lighted chef sign atop a new building on the original factory site. The brand remains renowned for its medium heat and pronounced dark chile flavor.

2. McIlhenny Company

- McIlhenny introduced its first Mexican-style hot sauce, Tabasco Salsa Picante a thicker, milder sauce with paprika, oregano, and cumin joining the permanent lineup. The company continues product modernization, including high-speed packaging upgrades and global collaboration efforts such as TABASCO-flavored snacks for the Gulf market.

3. McCormick & Company, Inc.

- McCormick, owner of Cholula hot sauce, forecasts modest sales and profit growth due to soft demand especially in China and rising marketing costs. The company is reformulating products to remove artificial colors and reduce sodium to align with recent FDA regulations banning carcinogenic dyes.

4. The Kraft Heinz Company

- Kraft Heinz partnered with musician Ed Sheeran to create “Tingly Ted’s,” a new spicy sauce under their Taste Elevation platform. This aligns with their broader push to innovate and rejuvenate their condiment portfolio.

Conclusion

The hot sauce market is evolving rapidly, driven by shifting consumer preferences toward bold flavors, diverse heat profiles, and innovative product offerings. Leading companies are focusing on expanding flavor portfolios, introducing culturally inspired variants, and adopting convenient packaging to meet modern lifestyle demands. Strategic collaborations, brand partnerships, and targeted marketing are helping brands enhance visibility and connect with broader audiences. While established players maintain strong brand loyalty through heritage products, newer entrants are leveraging unique ingredients and regional chili varieties to stand out.

The growing popularity of ethnic cuisines, health-conscious formulations, and e-commerce distribution channels is creating new growth opportunities. Regional markets continue to shape the competitive landscape, with North America holding a dominant share due to ingrained culinary habits and global brand presence, while Asia Pacific shows high growth potential. Overall, the sector’s dynamic mix of tradition, innovation, and cross-cultural influence ensures continued expansion in the coming years.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)