Table of Contents

Overview

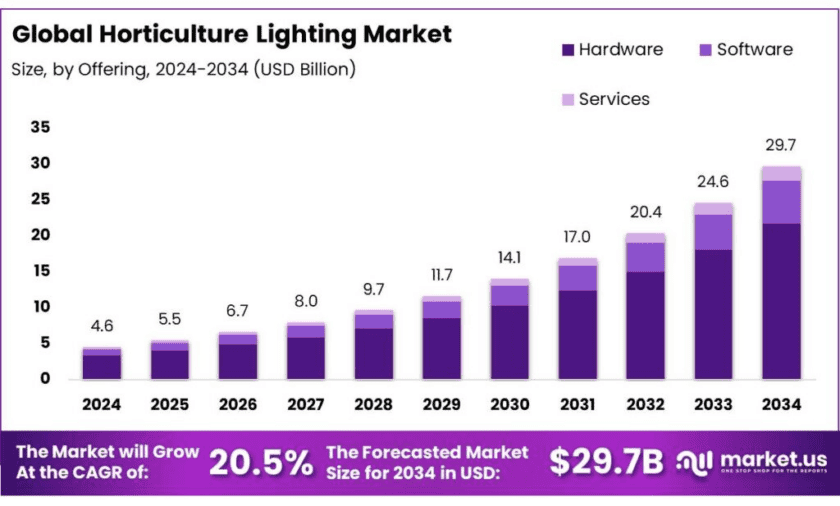

New York, NY – Nov 06, 2025 – The global horticulture lighting market is projected to reach USD 29.7 billion by 2034, rising from USD 4.6 billion in 2024, and is expected to grow at a strong CAGR of 20.5% between 2025 and 2034. In 2024, North America led the global market, capturing a 43.8% share, equivalent to approximately USD 2 billion in revenue. The industry has witnessed rapid growth due to the increasing adoption of indoor and vertical farming, as well as controlled-environment agriculture (CEA) systems that depend on artificial lighting to enhance plant productivity.

In India, government support has become a key catalyst for the adoption of horticulture lighting and sustainable farming technologies. The Clean Plant Programme (CPP), launched by the Ministry of Agriculture & Farmers Welfare, aims to boost horticultural output by supplying disease-free planting material. The program includes the creation of nine Clean Plant Centres nationwide—with three centres in Maharashtra (Pune for grapes, Nagpur for oranges, and Solapur for pomegranates)—and an investment of ₹300 crore.

State-level programs further reinforce sustainable development. For instance, in Karnataka, the horticulture department offers a 50% subsidy on solar-powered irrigation pumps for farmers in Mysuru and Chamarajanagar districts. Under this scheme, farmers receive ₹1 lakh for a 3 HP pump and ₹3 lakh for a 5 HP pump, helping to cut irrigation costs and promote eco-friendly farming.

Key Takeaways

- Horticulture Lighting Market size is expected to be worth around USD 29.7 Billion by 2034, from USD 4.6 Billion in 2024, growing at a CAGR of 20.5%.

- Hardware held a dominant market position, capturing more than a 73.4% share of the horticulture lighting market.

- LED (Light Emitting Diode) held a dominant market position, capturing more than a 69.3% share of the horticulture lighting market.

- Toplighting held a dominant market position, capturing more than a 56.9% share of the horticulture lighting market.

- New Installations held a dominant market position, capturing more than a 67.2% share of the horticulture lighting market.

- Greenhouses held a dominant market position, capturing more than a 51.7% share of the horticulture lighting market.

- North America held a dominant position in the horticulture lighting market, capturing more than 43.8% of the total market share, valued at approximately USD 2 billion.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/horticulture-lighting-market/free-sample/

Report Scope

| Market Value (2024) | USD 4.6 Bn |

| Forecast Revenue (2034) | USD 29.7 Bn |

| CAGR (2025-2034) | 20.5% |

| Segments Covered | By Offering (Hardware, Software, Services), By Technology (LED (Light Emitting Diode), High-Intensity Discharge (HID), Fluorescent, Others), By Lighting Type (Toplighting, Interlighting, Supplemental Lighting), By Installation Type (New Installations, Retrofit Installations), By End Use (Greenhouses, Vertical Farms, Indoor Farms, Research and Tissue Culture, Others) |

| Competitive Landscape | Signify Holding B.V., Heliospectra AB, Gavita International B.V., Hortilux Schreder B.V., Valoya Oy, OSRAM GmbH, California LightWorks, Inc., Kroptek Ltd., SANANBIO Co., Ltd., Agnetix, Inc. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=159528

Key Market Segments

By Offering Analysis – Hardware Leads the Horticulture Lighting Market with 73.4% Share in 2024

In 2024, the hardware segment dominated the global horticulture lighting market, accounting for a significant 73.4% share. This dominance stems from the crucial role of hardware components—such as LED fixtures, drivers, reflectors, and cooling systems—in ensuring optimal performance of horticultural lighting setups. These components form the backbone of lighting systems used in indoor and vertical farming applications, directly influencing energy efficiency and crop productivity. The growing adoption of LED-based systems, known for their reliability, low energy consumption, and long lifespan, continues to propel hardware demand. As of 2025, the hardware segment is expected to maintain a leading position, driven by ongoing advancements in smart and precision lighting technologies for agriculture.

By Technology Analysis – LED Technology Dominates with 69.3% Share in 2024

The LED (Light Emitting Diode) segment held a commanding 69.3% share of the horticulture lighting market in 2024, reflecting its technological superiority and efficiency. LEDs are widely preferred for their energy savings, durability, and spectral flexibility, which allow growers to customize light wavelengths for different crop types and growth stages. Compared to conventional lighting systems such as fluorescent and HID lamps, LEDs consume significantly less power and reduce long-term operational costs. The global agricultural shift toward sustainability and precision farming continues to reinforce LED dominance. Looking ahead, the segment is projected to see modest share growth in 2025, supported by innovations in smart LEDs with automated spectrum control and integration with data-driven farming systems.

By Lighting Type Analysis – Toplighting Dominates with 56.9% Share in 2024

In 2024, toplighting emerged as the most widely adopted lighting type, securing 56.9% of the market share. Toplighting systems are mounted above plant canopies, delivering uniform illumination across large crop areas, which makes them ideal for greenhouses and commercial-scale indoor farms. These systems help optimize photosynthesis and crop growth while maintaining excellent energy efficiency. The integration of LED-based toplighting solutions has enhanced precision in light distribution and reduced electricity costs. Despite growing interest in interlighting and hybrid setups, toplighting is expected to retain its leading position in 2025, driven by its scalability, cost-effectiveness, and compatibility with diverse horticultural operations.

By Installation Type Analysis – New Installations Hold 67.2% Share in 2024

The new installations segment dominated the horticulture lighting market in 2024, accounting for 67.2% of total share. This growth is fueled by the expansion of indoor and vertical farming ventures and the increasing establishment of modern greenhouses equipped with advanced lighting technologies. Farmers and agribusinesses are investing in new lighting systems to maximize crop yield and resource efficiency, particularly in regions with limited natural sunlight. The rising adoption of controlled-environment agriculture (CEA) and demand for locally grown produce are accelerating system installations. In 2025, this segment is expected to maintain its strong momentum as more growers modernize their infrastructure with energy-efficient, LED-based lighting systems.

By End Use Analysis – Greenhouses Dominate with 51.7% Share in 2024

In 2024, greenhouses accounted for 51.7% of the horticulture lighting market, establishing themselves as the largest end-use segment. Greenhouses enable year-round cultivation by providing a controlled environment that optimizes plant growth and productivity, especially in regions with low sunlight levels. The adoption of advanced LED lighting in greenhouses enhances crop yield, quality, and energy efficiency while supporting sustainable farming practices. Increasing global demand for locally grown, pesticide-free produce has further driven the use of greenhouse-based systems. Moving into 2025, the segment is projected to sustain its market leadership as growers increasingly integrate smart lighting controls and renewable energy solutions to achieve higher efficiency and environmental sustainability.

List of Segments

By Offering

- Hardware

- Software

- Services

By Technology

- LED (Light Emitting Diode)

- High-Intensity Discharge (HID)

- Fluorescent

- Others

By Lighting Type

- Toplighting

- Interlighting

- Supplemental Lighting

By Installation Type

- New Installations

- Retrofit Installations

By End Use

- Greenhouses

- Vertical Farms

- Indoor Farms

- Research and Tissue Culture

- Others

Regional Analysis

In 2024, North America dominated the global horticulture lighting market, accounting for a substantial 43.8% share, valued at approximately USD 2 billion. This regional leadership is primarily driven by the growing adoption of controlled-environment agriculture (CEA), vertical farming, and urban farming, where precision lighting plays a vital role in improving crop yield, quality, and year-round production. The region’s advanced agricultural infrastructure, coupled with a strong commitment to sustainability and technology integration, has accelerated the use of energy-efficient LED horticulture lighting systems across both commercial and indoor farming setups.

Government support has been another key factor behind this growth. Several U.S. states, including California and New York, have introduced programs encouraging energy-efficient and sustainable farming practices, promoting innovation in agricultural lighting technology. Furthermore, increasing R&D investments by lighting manufacturers and agricultural tech firms have driven the development of smart horticulture lighting solutions that optimize energy use and plant growth conditions. Rising consumer demand for locally grown and organic produce has also spurred the expansion of greenhouses and indoor farms, solidifying North America’s position as the global hub for modern horticultural lighting innovation and adoption.

Top Use Cases

Greenhouse yield lift with supplemental LEDs: Adding LEDs above sunlight increases productivity and quality in tomatoes—meta-analysis across 31 studies / 100 observations shows supplemental LED lighting improves yield and fruit traits versus non-LED controls. In building-integrated trials, LED-treated plants produced ~7.2% more fruits and ~9.3% heavier tomatoes, with +35% more red (ripe) proximal fruit. These gains translate directly into higher saleable output in light-limited seasons.

Lower electricity bills through spectrum control And smarter DLI: LEDs enable precise spectra and dynamic scheduling. Research shows growers can carry light across days and reduce next-day DLI by ~5.25 mol·m⁻²·d⁻¹ after a sunny period without hurting lettuce growth—cutting kWh while meeting crop targets. Greenhouse energy analyses further document material savings when transitioning from HPS to LEDs through higher efficacy and better control.

Vertical farms: design for energy—lighting is the big lever: In vertical farms, lighting is the dominant load. U.S. DOE estimates ~17.4 W/ft² lighting power density for LED-lit vertical farms (about 24% lower per-area energy vs. legacy approaches), and recent benchmarks show outcomes hinge on fixture efficacy (reported ranges ~1.3 µmol/J and up). Selecting higher-efficacy fixtures and optimizing PPFD/DLI scheduling are the fastest payback moves.

Policy tailwinds for indoor/urban agriculture: In the U.S., USDA Urban Agriculture & Innovative Production programs offer technical and financial assistance to rooftop, indoor, and vertical farms; 2024 notices invited grant applications supporting infrastructure and training. These programs de-risk capex for LED systems and controls, helping new entrants reach commercial scale in cities.

Energy risk management in European greenhouses: EU greenhouse reviews highlight that energy is a major operating cost (often fossil-dependent). LEDs reduce electricity use relative to HPS and cut radiant heat, improving climate control and lowering total energy intensity—especially valuable in Northern Europe’s high-energy houses.

Quality steering: morphology & ripening outcomes: LEDs deliver narrowband red/blue/far-red, growers steer plant height, leaf area, and ripening. In Mediterranean tomato trials, LEDs accelerated ripening (+35% red fruit area) and improved fruit number/weight—useful for meeting retail windows and uniformity specs without chemical ripeners.

Recent Developments

In 2024, Signify reported full-year sales of EUR 6,143 million, with LED-based revenues representing 93% of total sales. While the company does not break out horticulture lighting by segment in its public data, commentary in its quarterly release notes growth in its horticulture business in Q3 2024. I observe that Signify’s global reach, strong LED portfolio and focus on connected lighting systems position it well to expand in the horticulture lighting space—leveraging scale, efficiency and existing infrastructure to serve indoor-ag and controlled-environment farms.

For the fiscal year 2024, Heliospectra reported net sales of SEK 32,411 thousand, slightly down from SEK 35,311 thousand in 2023. I note that although Heliospectra remains small, its specialise focus on smart LED grow-light systems for greenhouse and vertical farm applications gives it a niche position within the horticulture lighting sector. Its pipeline and recent contracts suggest potential growth as growers adopt precision-lighting technologies.

In 2024, Gavita International expanded its horticulture lighting portfolio with its “CT 2000e LED” toplight fixture and “Clone Bar LED 120-270V” bar fixture, aimed at greenhouse and vertical-farm operations. I view Gavita as a specialist in high-performance LED grow lighting—leveraging precise spectra and modular systems to serve large-scale controlled-environment agriculture. Given the broader market’s expected growth from hardware dominance and LED share, Gavita’s technology and focus position it well for growth in the horticulture lighting sector.

Hortilux Schréder, based in the Netherlands, continues to innovate in LED, HPS and hybrid grow lights for greenhouse horticulture; in 2024 it emphasized its HORTILED® full-LED system claiming improved uniformity and energy savings for growers. From an analyst’s perspective, Hortilux’s four-decade heritage and large international greenhouse footprint make it a strong contender in the global horticulture lighting market—especially given rising demand for energy-efficient toplighting and LED retrofits in commercial greenhouses.

In 2024, Valoya Oy continued to expand its precision horticulture lighting business, serving vertical farms, greenhouses, and crop-science labs across 30+ countries with patented LED spectrum solutions. As a market-research analyst, I note that Valoya’s focus on high-end, energy-efficient LED grow lights and its deep crop-biology R&D give it a solid niche position in the growing horticulture lighting market—especially as growers shift from generic lighting to spectrum-optimized systems in CEA (controlled environment agriculture).

In 2024, the parent group ams‑OSRAM AG reported revenues of €3.4 billion, reflecting broad lighting and sensor system operations. While OSRAM’s exact horticulture lighting revenues aren’t separately disclosed, its global LED and lighting systems capacity positions it well to service horticulture lighting demand. From a market-research perspective, OSRAM’s scale, breadth of light-engine tech and established brand give it the capability to capture growth in horticulture lighting as LED adoption and smart lighting for agriculture accelerate.

In 2023-24, California LightWorks reported continued innovation in horticulture lighting, with its commercial MegaDrive® systems achieving up to 3.93 µmol/J efficacy and over 2,100 µmol/s output in the 600 W version. I see California LightWorks positioning itself strongly in the high-end LED grow-light segment, serving commercial greenhouses, indoor farms and vertical farms in North America. Their U.S.-based manufacturing, spectrum control technology and performance metrics align with rising demand for energy-efficient, precision lighting in controlled-environment agriculture.

In 2024, Kroptek Ltd. emphasised its LED grow-lights and full controlled-environment agriculture (CEA) solutions for vertical farms, indoor farms and greenhouses globally, highlighting 40-60% energy savings versus HPS lighting. As an analyst, I view Kroptek as a strong specialist in customised LED lighting and CEA consultancy, well placed in the horticulture lighting market’s growth phase. Its own manufacturing and emphasis on year-round, sustainable crop systems position it to serve growers focused on plant quality, yield predictability and operational efficiency.

In 2024, SANANBIO, a subsidiary of LED-chip giant Sanan Optoelectronics which produces about 19.72% of global LED chips, expanded its horticulture lighting portfolio to include over 80 light-spectra options tailored for indoor farms, greenhouses, and research facilities. I see SANANBIO positioning itself strongly in the global horticulture lighting market by leveraging deep LED-chip manufacturing scale, offering spectrum-customised solutions, and targeting both commercial and research segments — which aligns well with grower demand for precision lighting in controlled-environment agriculture.

In 2024, Agnetix introduced its ZENITH water-cooled LED horticulture fixture boasting up to 3.34 µmol /J efficacy, integrated sensors and networking (USB and PoE) for data capture and crop monitoring. From a market research analyst’s perspective, Agnetix stands out in the high-end niche of smart lighting systems for indoor and greenhouse grows, combining energy-efficient hardware with IoT/data layers — exactly the type of advanced solution the rapidly growing horticulture lighting market is increasingly demanding.

Conclusion

In conclusion, horticulture lighting is emerging as a foundational element of the future agricultural ecosystem rather than just an operational input. The rise of controlled-environment agriculture (CEA)—including greenhouses, vertical farms and indoor cultivation—combined with the shift to LED‐based systems for energy efficiency, spectrum control and year-round crop production is driving momentum.

The key opportunities lie in the integration of smart lighting, sensor networks, and crop-specific light recipes. Growing regulatory emphasis on sustainability and the demand for locally produced, high-quality crops mean that horticulture lighting has moved from a supporting technology to a strategic investment in the future of farming.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)