Table of Contents

Introduction

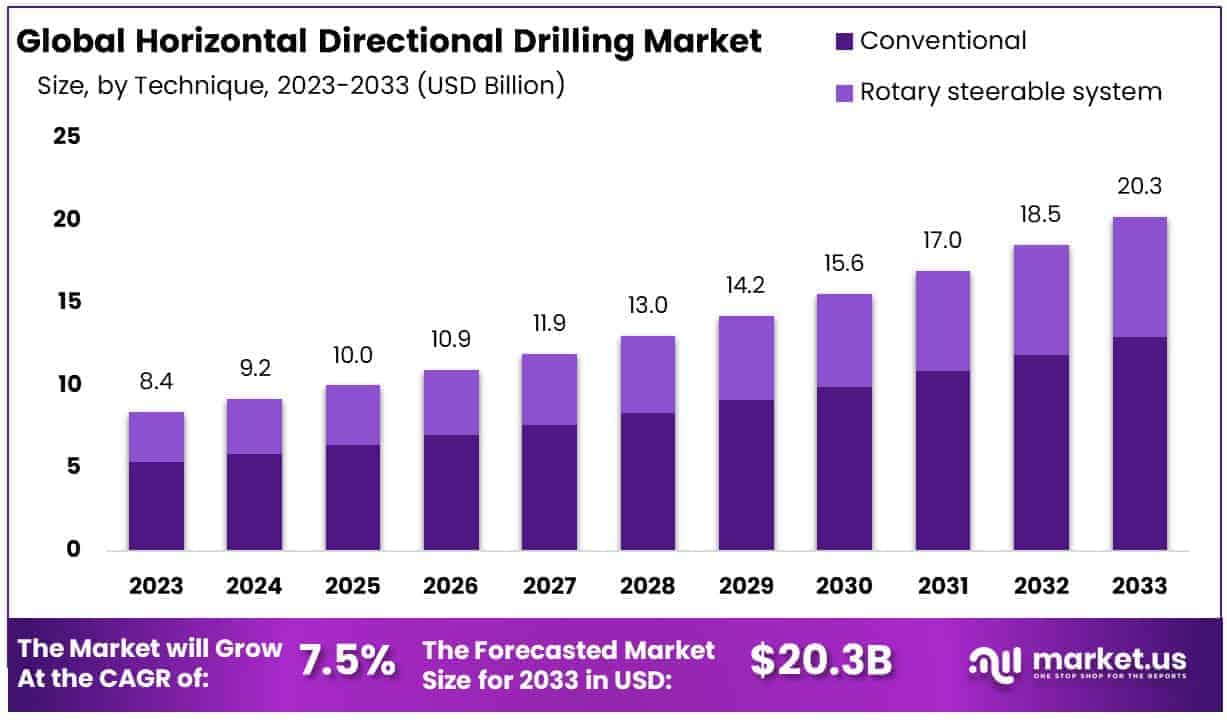

The Global Horizontal Directional Drilling Market is projected to grow from USD 8.4 Billion in 2023 to approximately USD 20.3 Billion by 2033, expanding at a compound annual growth rate (CAGR) of 7.50% from 2024 to 2033.

Horizontal Directional Drilling (HDD) is a trenchless construction method used to install underground pipelines, conduits, and cables with minimal surface disturbance. This technique is employed in various applications including water and sewer lines, gas and oil pipelines, and telecommunication installations. The HDD market capitalizes on the demand for efficient, minimally invasive infrastructure development. Factors driving the growth of the HDD market include urbanization, increased spending on infrastructure, and the growing emphasis on environmental conservation which compels the adoption of less disruptive construction techniques.

Additionally, technological advancements in drilling equipment and techniques are expanding the capability of HDD to handle complex installations, thereby broadening the market’s scope. Opportunities in the HDD market are substantial, particularly in emerging economies where infrastructure development is rapid, and in developed regions where aging infrastructure requires precision upgrading without extensive surface disruption.

Key Takeaways

- The Horizontal Directional Drilling Market is projected to grow significantly, from USD 8.4 billion in 2023 to approximately USD 20.3 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 7.50% during the 2024-2033 forecast period.

- The Rotary Steerable System (RSS) holds the largest market share at 56%, due to its superior precision in directional drilling.

- Rigs are essential for HDD projects, commanding a 32% share of the market.

- Onshore drilling is the predominant environment, holding a 58.1% market share, fueled by increasing infrastructure and urban development.

- The oil & gas excavation sector is a significant market driver, with a 44% share, underscoring HDD’s vital role in energy resource exploration and development.

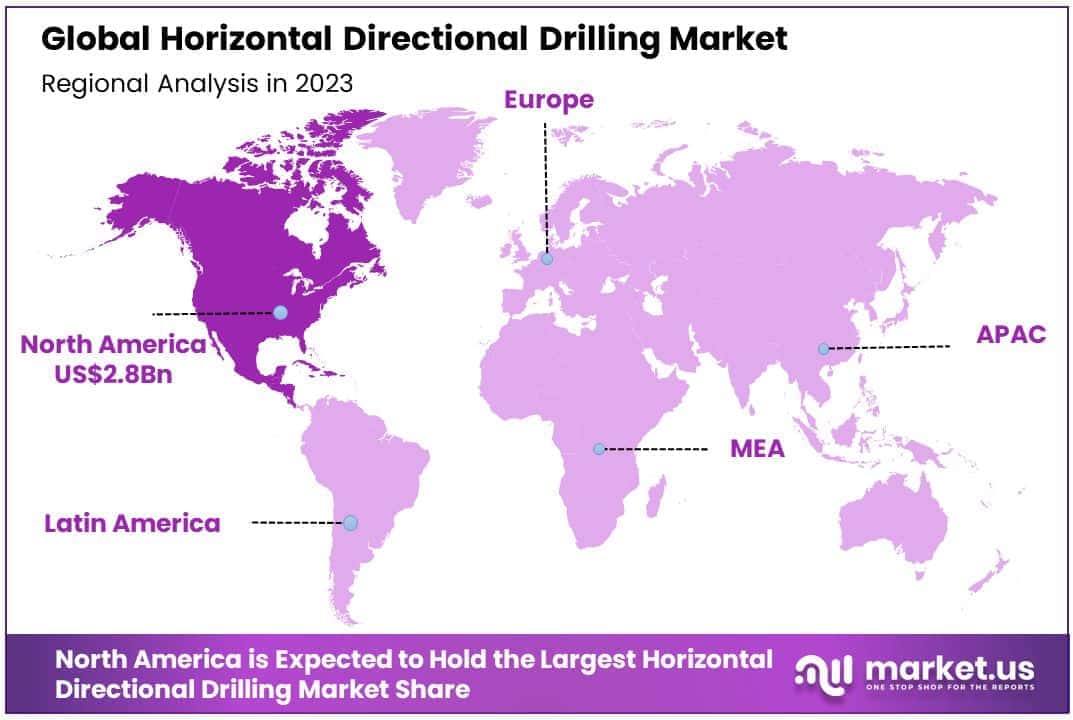

- North America leads the market with a 34.5% share. Europe, Asia Pacific, Latin America, and the Middle East & Africa follow, each influenced by regional infrastructure projects, regulatory frameworks, and technological progress.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 8.4 Billion |

| Forecast Revenue (2033) | USD 20.3 Billion |

| CAGR (2024-2033) | 7.50% |

| Segments Covered | By Technique (Conventional, Rotary steerable system), By Parts (Pipes, Rigs, Reamers, Bits), By Application (Onshore, Offshore), By End-User (Telecommunication, Oil & Gas Excavation, Utility, Other End-Users) |

| Competitive Landscape | Nabors Industries Ltd., American Augers, Inc., Nawtek GmbH, Barbco, Inc., Ellingson Companies, Prime Drilling GmbH, Ferguson Michiana Inc., Herrenknecht AG, National Oilwell Varco, Inc., The Toro Company, Other Key Players |

Emerging Trends

- Infrastructure Investment: The HDD market is seeing a robust phase, fueled by significant investments in infrastructure. This surge in demand spans multiple sectors, including telecommunications and power distribution, where government and private funding are contributing to rapid market growth.

- Technological Advancements: HDD technology continues to evolve, with improvements in precision and efficiency. New drilling technologies allow for more accurate positioning of the drill head, which is particularly useful in urban environments with complex underground utilities.

- Electric and Hybrid Systems: There’s a noticeable trend towards the adoption of electric and hybrid HDD systems. These systems are designed to reduce environmental impact and operational noise, aligning with global sustainability goals.

- Data Integration: Modern HDD operations are increasingly data-driven. Contractors use detailed data collection and analysis to improve the accuracy of drilling operations and manage site efficiency, which helps in reducing costs and enhancing project delivery.

- Diversification into New Markets: HDD techniques are being applied in new markets such as geothermal, solar, and offshore wind energy installations. The ability to lay infrastructure with minimal environmental disruption is particularly valuable in these sectors.

Top Use Cases

- Telecommunications: The expansion of fiber-optic networks is a primary driver for HDD, as it allows for minimal disruption in densely populated urban areas.

- Utility Installations: HDD is critical for the installation of gas, water, and electrical systems, especially in areas where traditional trenching is impractical or too disruptive.

- Environmental Remediation: HDD techniques are employed to install remediation systems without disturbing contaminated sites, which is crucial for maintaining site integrity and safety.

- Underwater Installations: HDD is utilized for laying pipes and cables under rivers and water bodies, avoiding the need for expensive and disruptive dredging operations.

- Renewable Energy Projects: As the demand for renewable energy grows, HDD is increasingly used for laying the groundwork necessary for solar and wind farms, particularly in remote or environmentally sensitive areas.

Major Challenges

- Complex Subsurface Conditions: Navigating varied and unpredictable ground conditions can complicate drilling operations, requiring advanced planning and technological support.

- High Equipment Costs: The initial capital investment for HDD equipment is substantial, which can be a barrier for smaller operators or those new to the industry.

- Workforce Shortages: There is a significant shortage of skilled labor in the HDD industry, exacerbated by the increasing complexity of HDD projects which demand specialized expertise.

- Regulatory Challenges: Navigating the complex local, state, and federal regulations can delay or restrict HDD projects, particularly in environmentally sensitive areas.

- Maintenance and Downtime: HDD equipment is subject to intense wear and tear, leading to maintenance challenges and potential downtime, which can delay projects and increase costs.

Top Opportunities

- Expansion into New Geographical Markets: Emerging markets, especially in developing countries, present significant growth opportunities for HDD due to increased infrastructure development.

- Partnerships with Governments: Collaborations on public infrastructure projects can provide steady work and revenue streams, as governments look to upgrade or expand utilities with minimal surface disruption.

- Innovations in Drilling Technology: Continued advancements in HDD technology can open up new applications and improve efficiency, allowing operators to tackle more challenging projects.

- Integration of Sustainable Practices: As global focus on sustainability intensifies, HDD operators who adopt greener practices and technologies can gain a competitive edge and meet the regulatory requirements.

- Training and Development Programs: Investing in training programs to combat the skill shortages in the HDD sector can create a more capable workforce, ready to handle the complexities of modern drilling projects.

Key Player Analysis

- Nabors Industries Ltd. – This company is prominent in the market due to its advanced drilling solutions. In collaboration with SLB, Nabors has worked on automated drilling solutions to enhance well construction efficiency, which showcases its commitment to technological innovation and leadership in HDD operations.

- Herrenknecht AG – Known for its tunnelling technology, Herrenknecht AG provides specialized machinery for the HDD market. It offers unique solutions that facilitate efficient drilling, even under challenging conditions, supporting the infrastructure needs of multiple regions.

- Ellingson Companies – A key player in North America, Ellingson focuses on providing comprehensive water management and infrastructure solutions. Their use of HDD technology emphasizes minimal environmental disruption, particularly important in urban and sensitive areas.

- American Augers, Inc. – This company has made a mark in the HDD market with its robust equipment that is known for reliability and high performance. American Augers continues to support large-scale and technically complex projects, reflecting its strong position in the market.

- Prime Drilling GmbH – Based in Germany, Prime Drilling specializes in the manufacture of high-performance HDD rigs. Their equipment is known for precision and durability, which are critical for the successful completion of extensive drilling projects.

Regional Analysis

Asia-Pacific Leads Horizontal Directional Drilling Market with Largest Market Share of 34.5%

The Asia-Pacific region holds a commanding position in the horizontal directional drilling market, representing 34.5% of the global market share in 2023. This region’s market valuation reached approximately USD 2.8 billion, reflecting its pivotal role in the industry’s growth. Factors contributing to this dominance include rapid urbanization, extensive infrastructural developments, and increasing investments in telecommunication and energy sectors.

The continuous demand for better utilities and communication services, coupled with the adoption of technologically advanced drilling solutions in countries like China, India, and Japan, fuels the market expansion. Furthermore, government initiatives aimed at improving infrastructure, along with policies supporting environmental sustainability, have significantly propelled the adoption of horizontal directional drilling methods, making Asia-Pacific a leading region in this field.

Recent Developments

- In 2024, DTI successfully acquired SDP for $32.2 million, blending DTI’s robust sales framework with SDP’s production expertise to strengthen their combined market position and operational synergies. This strategic move is expected to accelerate growth and foster innovation across their integrated networks.

- In 2024, SLB partnered with Nabors Industries to streamline the integration of drilling automation technologies and rig operating systems, enhancing well construction efficiency for their clients. This collaboration marks a significant advancement in drilling technology services.

- On September 22, 2023, Legacy Directional Drilling, LLC absorbed Renegade Oil Tools, LLC, merging Renegade’s cutting-edge drilling motor designs with Legacy’s comprehensive directional drilling operations across several U.S. states. This acquisition enhances Legacy’s service offerings and supports Renegade’s ongoing commitment to high-quality manufacturing.

- In 2024, Numaligarh Refinery Limited undertook one of the longest Horizontal Directional Drillings across the Subansiri River to facilitate a major crude oil pipeline project aimed at connecting Lakhimpur to Majuli in Assam. This initiative is part of a larger expansion project to increase the refinery’s capacity significantly.

- On March 4, 2024, PATTERSON-UTI ENERGY reported maintaining an average of 122 drilling rigs operational in the United States as of February 2024, demonstrating consistent performance in their drilling operations.

Conclusion

The Horizontal Directional Drilling (HDD) market is experiencing a significant upward trajectory, anticipated to more than double in value over the next decade. This growth is driven by the global push towards infrastructural development with minimal environmental impact, harnessing HDD’s capability for installing underground utilities without major surface disruptions. Urbanization and technological advancements are key factors propelling this market, as cities worldwide adapt to more efficient and less invasive construction methods to meet the needs of growing populations and evolving industries. Moreover, the expansion of telecommunications and renewable energy sectors further bolsters the demand for HDD, offering substantial opportunities for growth in various regions. As the industry continues to evolve, incorporating more sustainable practices and advanced technologies will likely remain central to overcoming challenges such as high equipment costs and skilled labor shortages, ensuring the HDD market’s robust expansion in the years ahead.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)