Table of Contents

Introduction

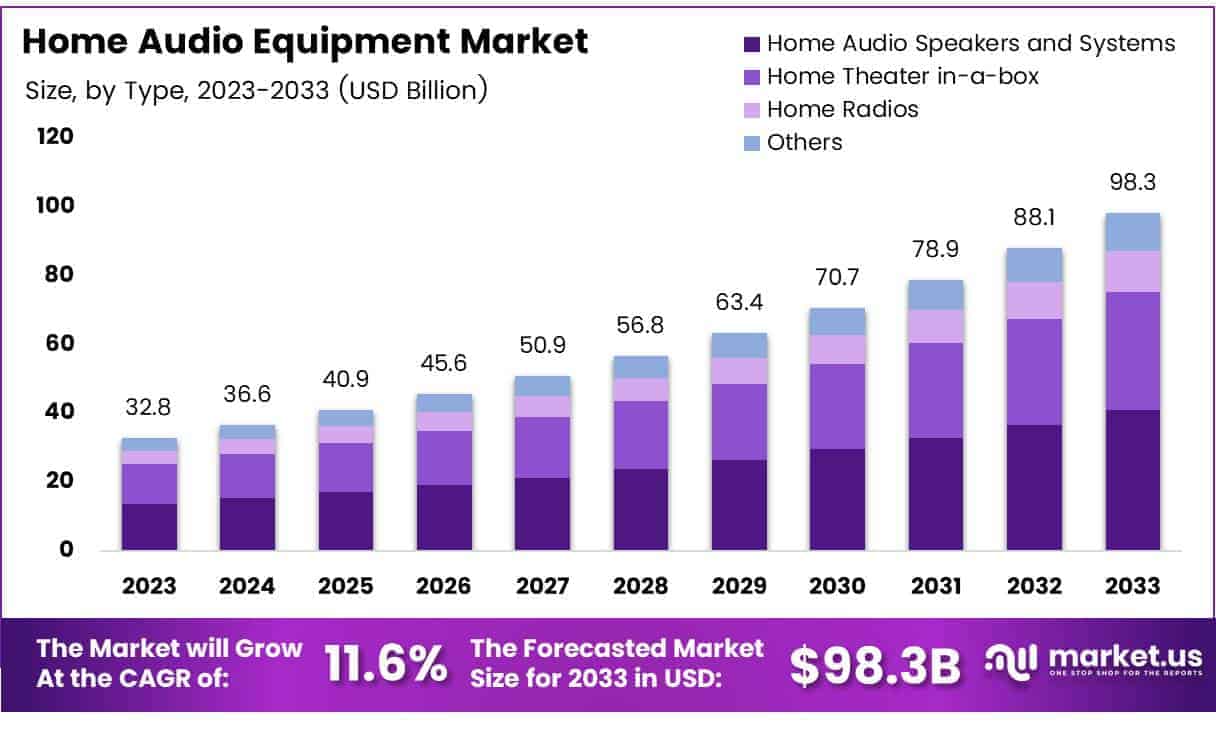

New York, NY – March 25 , 2025 – The Global Home Audio Equipment Market is projected to reach a value of approximately USD 98.3 billion by 2033, up from USD 32.8 billion in 2023. This represents a compound annual growth rate (CAGR) of 11.6% from 2024 to 2033

Home Audio Equipment refers to devices designed for use within the home environment to reproduce audio from various sources such as television, radio, or streaming devices. These systems range from simple setups like portable Bluetooth speakers to complex multi-channel surround sound systems that enhance the overall listening experience. The Home Audio Equipment Market encompasses the global sales and distribution of these devices, addressing the needs of consumers seeking enhanced audio quality for entertainment and communication purposes.

Growth in the Home Audio Equipment Market can be attributed to several factors. Increasing consumer demand for premium audio experiences, driven by the proliferation of digital media and streaming services, plays a crucial role. As households continue to invest in home entertainment setups, particularly in light of increased home-bound activities stemming from global shifts like remote work trends, the market has seen substantial growth. Technological advancements in wireless technology and audio quality, including developments in connectivity such as Bluetooth and Wi-Fi, further stimulate this demand.

Opportunities within the market are expanding, notably through the integration of smart home technology. Audio equipment that offers compatibility with digital assistants and can be integrated into broader smart home systems is increasingly preferred. This integration allows for more personalized and convenient user experiences, which is a significant selling point for tech-savvy consumers.

Additionally, the shift towards high-resolution audio devices that offer superior sound quality is creating a niche market segment, promising higher profit margins for manufacturers and retailers focusing on premium product offerings. The continued innovation and enhancement of audio equipment thus remain central to capitalizing on these emerging market opportunities.

Key Takeaways

- The global home audio equipment market is forecasted to expand significantly, reaching an estimated value of USD 98.3 billion by 2033. This represents a robust compound annual growth rate (CAGR) of 11.6% from its 2023 valuation of USD 32.8 billion.

- In 2023, Home Audio Speakers and Systems were the most prominent product segment, capturing a 34.9% market share.

- Wireless technology emerged as the preferred choice in the home audio equipment market in 2023, driven by consumer demand for convenience and flexibility in their audio devices.

- Online sales channels led the distribution of home audio equipment in 2023, accounting for a significant portion of the market’s transactions.

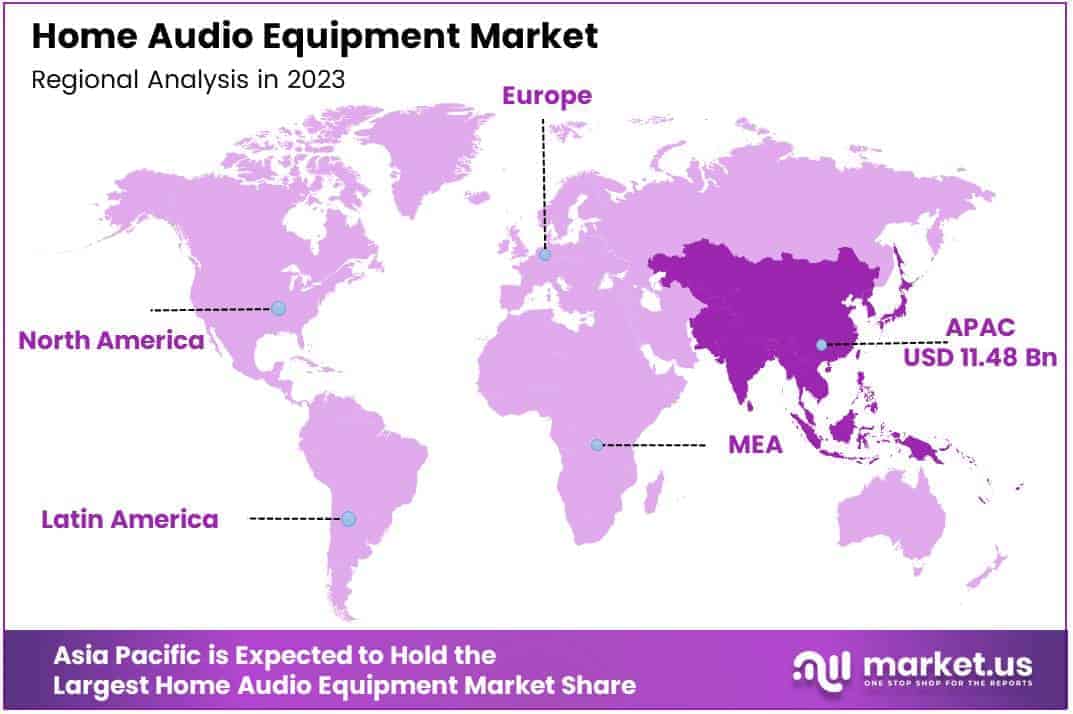

- Asia Pacific was the leading region in the home audio equipment market in 2023, holding a 35.8% share, equivalent to approximately USD 11.48 billion.

Request a Sample Copy of This Report at https://market.us/report/home-audio-equipment-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 32.8 Billion |

| Forecast Revenue (2033) | USD 98.3 Billion |

| CAGR (2024-2033) | 11.6% |

| Segments Covered | By Type (Home Theater in-a-box, Home Audio Speakers and Systems, Home Radios, Others), By Technology (Wired, Wireless), By Distribution Channel (Online, Offline) |

| Competitive Landscape | SAMSUNG, HARMAN International, Intex Technologies, JVCKENWOOD Corporation, Akai (inMusic, Inc.), Audio Partnership Plc, Vistron (Dong Guan) Audio Equipment Co., Ltd., LG Electronics, Nakamichi Corporation, Nice North America, Panasonic Holdings Corporation, Bose Corporation, Dolby Laboratories, Inc., XPERI INC, Koninklijke Philips N.V., SHARP CORPORATION |

Emerging Trends

- Wireless Connectivity: Dominance of wireless technology continues as consumer preference shifts towards more flexible and convenient audio solutions. The integration of wireless technologies such as Bluetooth and Wi-Fi enhances user experience by providing seamless connectivity with smart home devices.

- Smart Home Integration: The proliferation of smart homes is significantly influencing home audio equipment, with users increasingly favoring systems that integrate smoothly with other smart home technologies, offering features like voice control and multi-room audio capabilities.

- High-Resolution Audio: Consumers are showing a heightened interest in high-resolution audio systems that deliver superior sound quality. This trend is driving demand for advanced audio components capable of supporting high-definition audio formats.

- Compact and Aesthetic Designs: There is a growing demand for home audio systems that blend well with home decor while providing high-quality sound. This has led to innovations in compact designs and aesthetically pleasing audio equipment that complement modern home interiors.

- Eco-friendly Products: Environmental concerns are prompting manufacturers to develop eco-friendly audio products. This includes the use of sustainable materials and energy-efficient technologies, catering to the environmentally conscious consumer.

Top Use Cases

- Home Theaters: Consumers are investing in home theater systems to recreate a cinema-like audio experience in the comfort of their own homes, driven by the desire for high-quality sound and visual setups.

- Streaming Music: Wireless audio systems are increasingly used for streaming music, leveraging platforms like Spotify and Apple Music. This use case is supported by the ease of connectivity and control offered by smart audio systems.

- Gaming: Enhanced audio systems are becoming essential for gaming setups, providing immersive sound that enhances gameplay experience. Gamers are particularly interested in multi-channel systems that offer spatial audio effects.

- Virtual Meetings: With the rise of remote work, home audio equipment is being used to improve audio quality in virtual meetings and conferences, ensuring clearer communication.

- Personalized Listening Experiences: Advances in audio technology allow users to customize their listening experiences based on personal preferences, such as adjusting sound levels and equalization settings directly through smart apps.

Major Challenges

- Market Saturation: The market is becoming increasingly saturated with numerous brands and products, making it challenging for new entrants to differentiate themselves and gain market share.

- High Development Costs: The cost of developing new audio technologies and products can be prohibitively high, potentially limiting innovation and the introduction of new products into the market.

- Complex Integration with Other Technologies: As home audio systems become more integrated with other smart home technologies, the complexity of ensuring compatibility and maintaining performance across different platforms increases.

- Consumer Privacy Concerns: With the increased connectivity of home audio devices, concerns about data privacy and security are becoming more prominent. Consumers are cautious about devices that may collect and transmit personal data.

- Economic Fluctuations: Economic downturns and fluctuations can impact consumer spending on non-essential goods like home audio equipment, affecting overall market growth.

Top Opportunities

- Emerging Markets: Developing countries present significant opportunities for growth, thanks to rising disposable incomes and increasing interest in high-quality home entertainment systems.

- Innovative Product Features: There is ample opportunity for differentiation through innovative features, such as advanced sound customization, integration with virtual assistants, and enhanced connectivity options.

- Partnerships and Collaborations: Companies can expand their market reach and enhance product offerings through strategic partnerships and collaborations with technology providers and content creators.

- Health and Wellness Applications: Audio equipment that supports wellness and relaxation, such as systems that can play therapeutic sounds or integrate with wellness apps, could tap into the growing health-conscious consumer base.

- Enhanced Online Retail Strategies: Strengthening online sales channels and digital marketing strategies can capitalize on the shift towards online shopping, offering detailed product information, comparisons, and enhanced customer engagement.

Key Player Analysis

In the Global Home Audio Equipment Market of 2024, significant contributions come from various key players, each bringing unique strengths and strategic initiatives. Samsung, leading with its advanced technology, offers a wide range of products appealing to both premium and budget-conscious segments. Harman International continues to impress with its high-quality systems and strong R&D, broadening its market through automotive and consumer audio integrations. Intex Technologies captures the mid-tier segment with its cost-effective solutions, particularly in emerging markets, boosting its visibility and market share.

JVCKENWOOD Corporation attracts a youthful demographic with its blend of stylish design and innovative technology, while also focusing on sustainability. Akai, under inMusic, Inc., caters to both professional and amateur audiophiles with its high-quality traditional and digital audio equipment. Audio Partnership Plc distinguishes itself in the luxury market with bespoke, high-end audio solutions that emphasize craftsmanship and superior sound quality. Vistron from Dong Guan excels in providing customizable OEM and ODM services, responding swiftly to client needs and market shifts. LG Electronics enhances user experience through innovative user interfaces and seamless product integration, whereas Nakamichi upholds its legacy in high-fidelity audio, expanding into more affordable ranges.

Nice North America leverages the growing demand for integrated home automation systems, including smart audio solutions. Panasonic Holdings Corporation continues to innovate in sound technology while emphasizing sustainable practices. Bose Corporation dominates with its pioneering noise-cancelling technology, focusing on delivering exceptional sound and user experience. Dolby Laboratories leads with cutting-edge audio technologies that elevate multimedia entertainment across various platforms.

XPERI INC uniquely positions itself with technology licensing, influencing audio processing advancements across consumer electronics. Koninklijke Philips N.V. integrates its audio products with health technology, appealing to health-conscious consumers. Lastly, Sharp Corporation enhances consumer loyalty through cross-device compatibility and integration of its audio products with its broader electronics range. Each company strategically navigates the market, driving innovation and capturing consumer interest in a competitive landscape.

Top Key Players

- SAMSUNG

- HARMAN International

- Intex Technologies

- JVCKENWOOD Corporation

- Akai (inMusic, Inc.)

- Audio Partnership Plc

- Vistron (Dong Guan) Audio Equipment Co., Ltd.

- LG Electronics

- Nakamichi Corporation

- Nice North America

- Panasonic Holdings Corporation

- Bose Corporation

- Dolby Laboratories, Inc.

- XPERI INC

- Koninklijke Philips N.V.

- SHARP CORPORATION

Purchase the Full Report Now at https://market.us/purchase-report/?report_id=133802

Regional Analysis

Asia Pacific Leads Home Audio Equipment Market with Largest Market Share of 35.8%

In 2024, the Home Audio Equipment Market in Asia Pacific is projected to dominate the global landscape with a substantial market share of 35.8%, valued at approximately USD 11.48 billion. This region’s prominence in the market can be attributed to several key factors that drive demand for home audio systems. Firstly, rapid urbanization across major Asian economies has resulted in increased disposable incomes and a higher standard of living, contributing to greater consumer expenditure on home entertainment solutions.

Furthermore, Asia Pacific benefits from the presence of several key industry players who are significantly investing in technological advancements and innovation. These companies are not only enhancing the quality and connectivity features of home audio systems but are also making them more integrated and user-friendly, appealing to a tech-savvy consumer base.

Moreover, the increasing penetration of internet services and smart devices in this region supports the growth of connected home audio devices, which are becoming an integral part of the modern ‘smart home’. The consumer preference in Asia Pacific is shifting towards compact and aesthetically pleasing audio systems due to urban space constraints, which is another pivotal factor fueling the market growth. Additionally, promotional activities and aggressive marketing strategies by manufacturers, along with the availability of a wide range of products across different price points, have made high-quality audio systems more accessible to a broader audience in this region, thereby reinforcing its leading position in the global market.

Recent Developments

- In 2023, Skyball unveiled its innovative line of home audio products, marking the company’s foray into the consumer electronics sector. Skyball’s introduction of high-performance audio equipment is tailored specifically for audiophiles looking to enhance their listening experiences. These products blend advanced technology with user-centric design to meet the increasing demands for superior sound quality in home entertainment.

- In 2024, Focusrite plc expanded its portfolio in the audio technology industry by acquiring Innovate Audio, a pioneer in spatial audio solutions based in the UK. This acquisition is part of Focusrite’s broader strategy to dominate the immersive audio market, following their earlier purchase of TiMax. The move signifies Focusrite’s commitment to enhancing its technological capabilities and offering cutting-edge audio solutions.

- On October 24, 2024, Acuity Brands, Inc. announced a significant expansion by agreeing to acquire QSC, LLC for $1.215 billion. This acquisition, factoring in net tax benefits, is valued at approximately 14 times QSC’s recent EBITDA, promising to boost Acuity’s earnings per share in fiscal 2025. This strategic move aims to strengthen Acuity’s position in the industrial technology sector and enhance shareholder value through financial and operational synergies.

- On May 27, 2024, Sony India introduced its ULT POWER SOUND® series, a new collection of wireless speakers and noise-cancelling headphones designed to deliver an immersive audio experience akin to being front-row at a live concert. The series includes several models, such as ULT TOWER 10, ULT FIELD 7, and ULT FIELD 1 speakers, along with ULT WEAR headphones, all equipped with the unique ULT button to enhance audio quality with distinct sound modes. This launch caters to the desires of music enthusiasts for powerful, life-like sound in portable formats.

Conclusion

The Global Home Audio Equipment Market is set for substantial growth, driven by evolving consumer preferences and technological advancements. As people increasingly seek enhanced audio experiences at home, the demand for sophisticated systems that integrate seamlessly with smart home technologies is rising. Innovations in wireless and high-resolution audio are catering to desires for both convenience and superior sound quality. With significant opportunities in developing regions and through innovative product features, the market is well-positioned to expand. Strategic collaborations and a focus on eco-friendly and aesthetically pleasing designs are likely to shape future trends. Overall, the home audio equipment industry is navigating through a dynamic phase, poised to meet the growing demand for immersive and personalized audio solutions.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)