Table of Contents

Overview

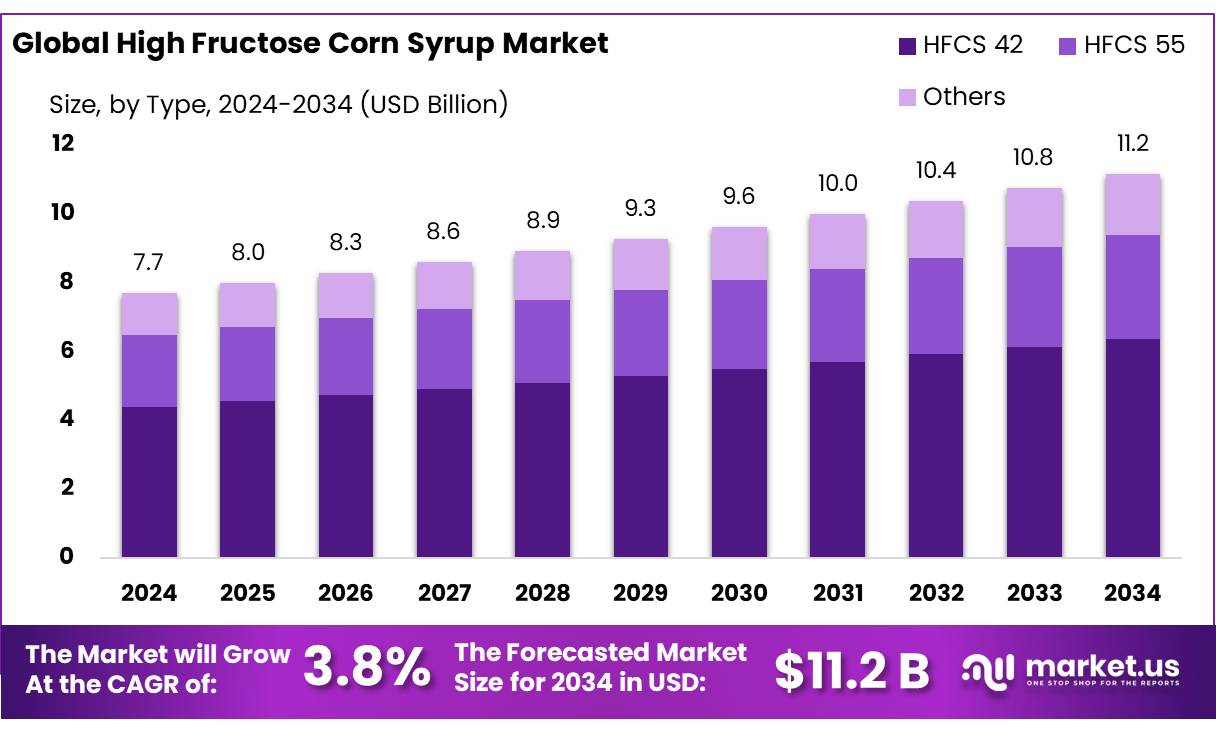

New York, NY – August 01, 2025 – The Global High Fructose Corn Syrup (HFCS) Market is projected to grow from USD 7.7 billion in 2024 to USD 11.2 billion by 2034, achieving a CAGR of 3.8% during the forecast period (2025–2034). In 2024, North America led the market, accounting for a 41.8% share and generating USD 3.2 billion in revenue.

High Fructose Corn Syrup is a liquid sweetener derived from corn starch through enzymatic conversion of glucose into fructose. Introduced in the 1970s, HFCS has become a staple in North America due to its affordability, ease of transportation in liquid form, and versatility in applications such as acidic beverages, baked goods, and processed foods. Variants such as HFCS-42 and HFCS-55, containing 42% and 55% fructose, respectively, allow manufacturers to tailor sweetness and product stability.

The HFCS market benefits from significant U.S. federal support, with approximately USD 4.9 billion in annual corn subsidies, alongside tariffs and quotas on imported cane and beet sugar. These policies make HFCS 10%–30% cheaper than sugar in the U.S., driving its use in soft drinks and processed foods. Advances in wet milling and enzymatic conversion technologies have further lowered production costs and improved quality, reinforcing HFCS’s competitive edge.

U.S. per capita HFCS consumption has declined from a high of 65.9 lb/year in 1999 to about 39.5 lb/year in 2021, reflecting shifting consumer preferences and public health concerns. Total U.S. HFCS production dropped by 0.8% in 2014/15 to 7.2 million short tons, continuing a two-decade decline. Globally, however, demand remains steady, fueled by rising processed food consumption in emerging markets.

Government policies, including U.S. corn subsidy reforms and reviews of HFCS in SNAP and school lunch programs, may curb domestic use but are spurring innovation in concentrated formulations like HFCS-65 and HFCS-70 for specialized applications in confectionery and pharmaceuticals.

Key Takeaways

- The High Fructose Corn Syrup Market size is expected to be worth around USD 11.2 billion by 2034, from USD 7.7 billion in 2024, growing at a CAGR of 3.8%.

- HFCS 42 held a dominant market position, capturing more than a 57.2% share in the High Fructose Corn Syrup market.

- Food & Beverages held a dominant market position, capturing more than a 68.8% share in the High Fructose Corn Syrup (HFCS) market.

- Offline held a dominant market position, capturing more than an 89.3% share in the High Fructose Corn Syrup (HFCS) market.

- North America held a leading position in the global high fructose corn syrup (HFCS) market, accounting for a significant 41.8% share, with an estimated market value of USD 3.2 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-high-fructose-corn-syrup-market/request-sample/

Report Scope

| Market Value (2024) | USD 7.7 Billion |

| Forecast Revenue (2034) | USD 11.2 Billion |

| CAGR (2025-2034) | 3.8% |

| Segments Covered | By Type (HFCS 42, HFCS 55, Others), By Application (Food and Beverages, Household Seasonings, Daily Chemicals, Pharmaceutical, Others), By Distribution Channel (Offline, Online) |

| Competitive Landscape | AGRANA Beteilgungs AG, Archer Daniels Midland Company, Cargill, Incorporated, COFCO, DAESANG Corporation, Global Sweeteners Holdings Limited, HUNGRANA KFT., Ingredion Incorporated, Japan Corn Starch Co., Ltd., Kasyap, Kerry Group Plc., Roquette Frères, Showa Sangyo, Sinofi Ingredients, Tate & Lyle PLC |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=152693

Key Market Segments

By Type Analysis

HFCS 42 leads the market with a 57.2% share in 2024, driven by its widespread use in processed foods and beverages. Its moderate sweetness, cost-effectiveness, and liquid form make it ideal for soft drinks, baked goods, sauces, and dairy products. The versatility and extended shelf life of HFCS 42 fuel its high adoption, particularly in North America and Asia-Pacific, where demand for convenient, packaged foods continues to grow.

By Application Analysis

The Food & Beverages sector commands a 68.8% share of the HFCS market in 2024, propelled by strong demand for sweeteners in ready-to-eat meals, soft drinks, fruit juices, confectionery, and baked goods. HFCS is favored for its affordability, ease of blending in liquid form, and stability across various temperatures and pH levels, making it a staple in mass-produced food and beverage products. The beverage industry, especially in the U.S., China, and Mexico, drives significant consumption.

By Distribution Channel Analysis

Offline channels dominate with an 89.3% share in 2024, reflecting the preference of food and beverage manufacturers for direct transactions with suppliers. Bulk purchasing, favorable pricing, and long-term supply agreements bolster offline distribution. This channel ensures reliable quality control, timely delivery, and robust after-sales support, critical for industrial buyers in regions with strong logistics infrastructure.

Regional Analysis

North America holds a 41.8% share of the global HFCS market in 2024, valued at USD 3.2 billion, led by the U.S. due to its robust processed food and beverage industry. HFCS is widely used in soft drinks, baked goods, sauces, dairy, and frozen foods, supported by an extensive corn supply chain and wet milling infrastructure.

Canada and Mexico also contribute, particularly in beverages, where HFCS’s blending ease and shelf life are valued. U.S. corn subsidies, totaling USD 3.2 billion in 2024, keep HFCS competitively priced despite growing health concerns. U.S. per capita HFCS consumption remains significant at 39.5 pounds annually, underscoring its entrenched role in the food industry. North America’s manufacturing strength, agricultural policies, and distribution networks ensure its market leadership.

Top Use Cases

- Soft Drinks Sweetener: HFCS, especially HFCS 55, is widely used in soft drinks due to its high sweetness and liquid form, which blends easily. It’s cheaper than sugar, helping manufacturers keep costs low while maintaining taste. Its stability in acidic beverages ensures consistent flavor, making it a top choice for cola and fruit-flavored drinks.

- Processed Food Sweetener: HFCS 42 is common in processed foods like cereals, snacks, and sauces. Its moderate sweetness enhances the taste without overpowering. The liquid form simplifies mixing, and it extends shelf life, reducing spoilage. This makes it ideal for mass-produced foods, keeping products affordable and fresh.

- Baked Goods Enhancer: HFCS is used in baked goods like bread, cookies, and cakes to add sweetness and improve texture. It retains moisture, keeping products soft and fresh longer. HFCS 42’s ability to brown surfaces enhances visual appeal, making it a go-to ingredient for commercial bakeries aiming for quality and cost savings.

- Dairy Product Sweetener: HFCS sweetens dairy items like yogurt, flavored milk, and ice cream. Its liquid form blends smoothly, ensuring even sweetness. It’s cost-effective compared to sugar and helps maintain product stability. HFCS 42 is preferred for its balanced sweetness, meeting consumer demand for tasty, affordable dairy products.

- Confectionery Ingredient: HFCS is used in candies and chocolates to provide sweetness and prevent crystallization. Its smooth texture improves product consistency, while its affordability supports large-scale production. HFCS 42 and 55 are chosen based on desired sweetness levels, helping manufacturers create appealing, cost-competitive confectionery products.

Recent Developments

1. AGRANA Beteiligungs AG

AGRANA has been focusing on reducing sugar content in food products, including HFCS alternatives, due to rising health concerns. The company is investing in natural sweeteners and clean-label solutions. AGRANA’s fruit-based sweeteners are gaining traction as healthier substitutes for HFCS in beverages and processed foods.

2. Archer Daniels Midland Company (ADM)

ADM has expanded its sweetener portfolio, including HFCS, while also developing low-calorie and plant-based alternatives. The company is leveraging fermentation technology to produce sustainable sweeteners, responding to consumer demand for reduced sugar intake.

3. Cargill, Incorporated

Cargill continues to produce HFCS but is shifting toward non-GMO and organic sweeteners. The company introduced EverSweet, a stevia-based sweetener, as an HFCS alternative. Cargill is also working on sustainable corn sourcing to address environmental concerns linked to HFCS production.

4. COFCO

As China’s largest food processor, COFCO has been adjusting its HFCS production due to government policies promoting sugar reduction. The company is investing in starch-based sweeteners and diversifying into healthier alternatives to meet changing consumer preferences.

5. DAESANG Corporation

DAESANG has been innovating in the HFCS market with enzyme technology to improve production efficiency. The company is also exploring allulose and other low-glycemic sweeteners as potential HFCS replacements in response to health-conscious trends.

Conclusion

High Fructose Corn Syrup remains a key sweetener in the food and beverage industry due to its affordability, versatility, and functional benefits like stability and shelf-life extension. Despite health concerns driving some consumer shifts toward natural sweeteners, HFCS’s cost-effectiveness ensures its continued dominance in soft drinks, processed foods, and other applications. Its market is expected to grow steadily, supported by demand for convenient, low-cost products.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)